Get More Information on Cosmetic Packaging Market - Request Sample Report

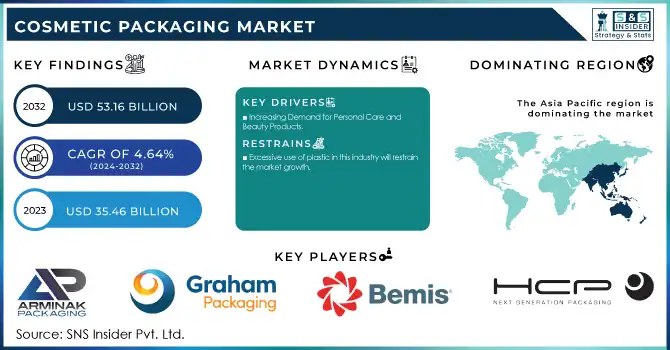

The Cosmetic Packaging Market was valued at USD 35.46 billion in 2023 and is projected to reach USD 53.16 billion by 2032, growing at a CAGR of 4.64% during the forecast period.

The market is projected to grow over the forecast period due to an increase in demand for cosmetic products owing to changes in packaging types, innovative designs of containers, and a growing youth population.

Moreover, the market is expected to show strong growth over the forecast period due to increased demand for cosmetics on account of changing attitudes towards care between men and women. For the marketing of cosmetic products, producers are using large-scale advertising in a variety of media. The innovation of packaging will play a key role in attracting consumers over the coming years and is likely to have an impact on the growth of the entire packaging sector.

Moreover, the growth opportunities of the cosmetics sector have been greatly expanded in developing countries like China and Japan as a result of increasing consumer spending and changing lifestyles. Consequently, as the demand for cosmetic products rises globally over the forecast period, it will have a direct impact on this sector's market and increase its global growth. Product and packaging innovation is being driven by a growing number of new entrants to the cosmetics sector, who are seeking competitive advantage. The cosmetic packaging market is projected to experience growth in the coming years, driven by these factors.

Demand for cosmetic products has also been influenced by the increasing penetration of eCommerce and online shopping in both rural and city areas. For example, there are 97% of total US sales made on the internet by Glossier Inc. Businesses are also switching their sales to online platforms as a result of an increase in internet usage. Therefore, the growth of the packaging industry has been affected by a general increase in demand for beauty products.

In addition, companies are beginning to target a specific segment of consumers called the Middle Class. This has resulted in the packaging industry's demand being affected so companies are adopting products with less packaging capacity. By adopting new packaging techniques, the introduction of environmental and Green Packaging is having a strong impact on the development of the entire industry. In addition, the growth of this sector is aided by new innovations in its product lines.

However, the most commonly used packaging material in this industry is plastic, most of which ends up in landfills. According to the Environmental Protection Agency, nearly 70% of plastic waste from the cosmetics industry is not recycled and ends up in landfills. Additionally, the majority of the packaging is made of single-use plastic paper, a significant portion of which is multi-layered to give it a more premium look, contributing to the excessive use of plastic. Excessive use of plastics is expected to hamper the market growth due to increased public awareness and government initiatives.

KEY DRIVERS:

Increasing Demand for Personal Care and Beauty Products

The expansion of the beauty and personal care industry is a major factor driving the cosmetic packaging market. There has also been a growing demand for innovative packaging solutions to differentiate products and provide consumers with choices, in view of the continued growth of market demand for cosmetics worldwide.

The rise of the online market has had a positive impact on cosmetic packaging markets

RESTRAIN:

Excessive use of plastic in this industry will restrain the market growth.

OPPORTUNITY:

Emerging markets like the Asia Pacific, Latin America, and the Middle East are showing a marked increase in demand for cosmetics.

Such areas offer cosmetic packaging producers an opportunity for expansion and to tap into a new consumer base. Success can be achieved through adapting packaging designs, materials and marketing strategies in response to the preferences and cultural characteristics of these markets.

The introduction of customized packaging options that enable product differentiation by consumers is a way for cosmetics manufacturers to capitalize on this trend.

CHALLENGES:

Reducing waste from packaging and increasing recycling packaging rates are key challenges.

The effects of the Ukraine war are on the global cosmetics industry, with producers using a variety of things such as alcohol made from grain and beets to make perfumes and sunflower oil for cosmetic purposes. At the same time, the price of glass and paper has risen as a result of the energy crisis caused by the war, and the new containment in China has made it impossible for companies to obtain packaging for their luxury cosmetic products.

As Russia's invasion of Ukraine adds further disruption to the supply chain for beauty products, which leads to higher prices due to robust demand, European perfume and cosmetic manufacturers face a shortage of paper, glass, or some key oils and alcohol.

The $ 550 billion global cosmetics sector is grappling with the fallout from the war because producers use alcohol derived from grains and organic beets to make perfumes, and sunflower-seed oils to be used in cosmetics from all the main crops of Ukraine. In Russia, several top beauty brands and retail outlets have suspended their operations due to the ongoing conflict in Ukraine according to an expert who says that these actions are aligned with a widespread consumer sentiment and growing difficulties for doing business there.

The invasion by Russia hit the Ukrainian cosmetics sector hard, forcing many manufacturers to temporarily stop production and close their shops. The market for Personal Care Products in this country is expected to generate sales of US$ 2.9 billion by 2022. However, Russia’s invasion has halted activity in this fast-growing domestic industry. According to United Nations estimates, Ukraine's GDP would fall by 10%, forcing many national producers out of business.

In the beauty industry, lipstick effectiveness, also known as the lipstick index, is regarded as the leading economic indicator in the field. The concept is that during times of recession or other financial stress, women make self-initiated purchases that lift their emotions without going over their budget. The lipstick is just right.

The effect of lipstick may not have had a major impact on the traditional business world, but new data from global market tracking firm NPD Group shows that sales of lipsticks and other lip makeup in the first quarter were down year-on-year. It increased by 50 % and is growing more than twice as fast as before.

In 2022, roughly $430 billion worth of revenues were generated by the beauty market, which covers skincare, fragrance, makeup and hair care. In 2022, the United States' prestige beauty products sales increased by 16 %. Even after recession it is expected that beauty products and cosmetics market will grow by 2.5% in US.

By Material

Plastic

Paper

Glass

Metal

Others

The market for cosmetic packaging is segmented according to material types, namely plastic, paper, metal and glass. The largest market share was held by the plastic segment, which is expected to grow significantly in the near future. The manufacturers have a strong preference for Rigid Plastic Packaging, because of its wide use and low costs. Companies prefer plastic for packaging purposes so that they can package the product in smaller units, which is contributing to segment growth.

By Product Type

Tubes

Bottles

Jars & Containers

Tins & Cans

Blister & Strip Packs

Others

By Application

Skin Care

Hair Care

Nail Care

Makeup

Perfumes

Others

The makeup segment is expected to show the highest growth amongst other segments, with a 5.7% compound annual growth rate during the forecast period. The growth of the market has been affected to a large extent by an increasing number of working women in recent years and one of the major factors underpinning this segment's growth.

The Asia Pacific region leads with a share of 45.0%, and is expected to grow significantly over the next few years. The majority of this share is held by Japan, which is expected to grow at the rate of 5.5% per annum over the forecast period for Asia Pacific. The market in this region is being driven by the introduction of new product varieties, as well as increasing consumer acceptance due to growing awareness about various benefits such as sun protection.

During the forecast period, Middle East & Africa is projected to register a 5.3% compound annual growth rate. Muslim-majority countries such as Saudi Arabia and the UAE are expected to see increased demand for cosmetics in the near future. Rising demand for halal cosmetics is boosting the market in the region. Therefore, increased demand from the cosmetics industry leads to increased demand from the packaging industry.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Some major key players in the Cosmetic Packaging market are AREMIX Packaging, Graham Packaging Company, Bemis Company Inc, HCP Packaging, Silgan Holdings, Albea, Libo Cosmetics, RPC Group Plc, AptarGroup Inc, DS Smith and other players.

Baralan is showing off innovative glass packaging techniques at Luxe Pack New York. In addition to its newest jars, bottles and accessories, the company specializing in primary packaging of cosmetics and beauty products introduced a selection of solutions that focus on airless glass containers.

Geka, The all new, patented shadow printing service has just begun to be offered by the Geka Beauty brand of medmix.

An Italian company, Minelli, specializing in the manufacture of custom and standard wooden parts, has launched its new low carbon premium packaging product “mPackting” that is targeted at the beauty industry.

| Report Attributes | Details |

| Market Size in 2023 | US$ 37.95 Bn |

| Market Size by 2031 | US$ 55.35 Bn |

| CAGR | CAGR of 4.8% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Plastic, Paper, Glass, Metal, Others) • By Product Type (Tubes, Bottles, Jars & Containers, Tins & Cans, Blister & Strip Packs, Others) • By Application (Skin Care, Hair Care, Nail Care, Makeup, Perfumes, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | AREMIX Packaging, Graham Packaging Company, Bemis Company Inc, HCP Packaging, Silgan Holdings, Albea, Libo Cosmetics, RPC Group Plc, AptarGroup Inc, DS Smith |

| Key Drivers | • Increasing Demand for Personal Care and Beauty Products • The rise of the online market has had a positive impact on cosmetic packaging markets |

| Market Restraints | • Excessive use of plastic in this industry will restrain the market growth. |

Ans: The Cosmetic Packaging Market is expected to grow at a CAGR of 4.5 %.

Ans: The Cosmetic Packaging Market size was USD 36.21 billion in 2022 and is expected to Reach USD 51.49 billion by 2030.

Ans: Increasing Demand for Personal Care and Beauty Products.

Ans: Excessive use of plastic in this industry will restrain market growth.

Ans: The Asia Pacific region leads with a share of 45.0%, and is expected to grow over the forecast period.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of Russia-Ukraine war

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

4.3 Supply Demand Gap Analysis

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Cosmetic Packaging Market Segmentation, By Material

8.1 Plastic

8.2 Paper

8.3 Glass

8.4 Metal

8.5 Others

9. Cosmetic Packaging Market Segmentation, By Product Type

9.1 Tubes

9.2 Bottles

9.3 Jars & Containers

9.4 Tins & Cans

9.5 Blister & Strip Packs

9.6 Others

10. Cosmetic Packaging Market Segmentation, By Application

10.1 Skin Care

10.2 Hair Care

10.3 Nail Care

10.4 Makeup

10.5 Perfumes

10.6 Others

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 North America Cosmetic Packaging Market by Country

11.2.2North America Cosmetic Packaging Market by Material

11.2.3 North America Cosmetic Packaging Market by Product Type

11.2.4 North America Cosmetic Packaging Market by Application

11.2.5 USA

11.2.5.1 USA Cosmetic Packaging Market by Material

11.2.5.2 USA Cosmetic Packaging Market by Product Type

11.2.5.3 USA Cosmetic Packaging Market by Application

11.2.6 Canada

11.2.6.1 Canada Cosmetic Packaging Market by Material

11.2.6.2 Canada Cosmetic Packaging Market by Product Type

11.2.6.3 Canada Cosmetic Packaging Market by Application

11.2.7 Mexico

11.2.7.1 Mexico Cosmetic Packaging Market by Material

11.2.7.2 Mexico Cosmetic Packaging Market by Product Type

11.2.7.3 Mexico Cosmetic Packaging Market by Application

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Eastern Europe Cosmetic Packaging Market by Country

11.3.1.2 Eastern Europe Cosmetic Packaging Market by Material

11.3.1.3 Eastern Europe Cosmetic Packaging Market by Product Type

11.3.1.4 Eastern Europe Cosmetic Packaging Market by Application

11.3.1.5 Poland

11.3.1.5.1 Poland Cosmetic Packaging Market by Material

11.3.1.5.2 Poland Cosmetic Packaging Market by Product Type

11.3.1.5.3 Poland Cosmetic Packaging Market by Application

11.3.1.6 Romania

11.3.1.6.1 Romania Cosmetic Packaging Market by Material

11.3.1.6.2 Romania Cosmetic Packaging Market by Product Type

11.3.1.6.4 Romania Cosmetic Packaging Market by Application

11.3.1.7 Turkey

11.3.1.7.1 Turkey Cosmetic Packaging Market by Material

11.3.1.7.2 Turkey Cosmetic Packaging Market by Product Type

11.3.1.7.3 Turkey Cosmetic Packaging Market by Application

11.3.1.8 Rest of Eastern Europe

11.3.1.8.1 Rest of Eastern Europe Cosmetic Packaging Market by Material

11.3.1.8.2 Rest of Eastern Europe Cosmetic Packaging Market by Product Type

11.3.1.8.3 Rest of Eastern Europe Cosmetic Packaging Market by Application

11.3.2 Western Europe

11.3.2.1 Western Europe Cosmetic Packaging Market by Country

11.3.2.2 Western Europe Cosmetic Packaging Market by Material

11.3.2.3 Western Europe Cosmetic Packaging Market by Product Type

11.3.2.4 Western Europe Cosmetic Packaging Market by Application

11.3.2.5 Germany

11.3.2.5.1 Germany Cosmetic Packaging Market by Material

11.3.2.5.2 Germany Cosmetic Packaging Market by Product Type

11.3.2.5.3 Germany Cosmetic Packaging Market by Application

11.3.2.6 France

11.3.2.6.1 France Cosmetic Packaging Market by Material

11.3.2.6.2 France Cosmetic Packaging Market by Product Type

11.3.2.6.3 France Cosmetic Packaging Market by Application

11.3.2.7 UK

11.3.2.7.1 UK Cosmetic Packaging Market by Material

11.3.2.7.2 UK Cosmetic Packaging Market by Product Type

11.3.2.7.3 UK Cosmetic Packaging Market by Application

11.3.2.8 Italy

11.3.2.8.1 Italy Cosmetic Packaging Market by Material

11.3.2.8.2 Italy Cosmetic Packaging Market by Product Type

11.3.2.8.3 Italy Cosmetic Packaging Market by Application

11.3.2.9 Spain

11.3.2.9.1 Spain Cosmetic Packaging Market by Material

11.3.2.9.2 Spain Cosmetic Packaging Market by Product Type

11.3.2.9.3 Spain Cosmetic Packaging Market by Application

11.3.2.10 Netherlands

11.3.2.10.1 Netherlands Cosmetic Packaging Market by Material

11.3.2.10.2 Netherlands Cosmetic Packaging Market by Product Type

11.3.2.10.3 Netherlands Cosmetic Packaging Market by Application

11.3.2.11 Switzerland

11.3.2.11.1 Switzerland Cosmetic Packaging Market by Material

11.3.2.11.2 Switzerland Cosmetic Packaging Market by Product Type

11.3.2.11.3 Switzerland Cosmetic Packaging Market by Application

11.3.2.1.12 Austria

11.3.2.12.1 Austria Cosmetic Packaging Market by Material

11.3.2.12.2 Austria Cosmetic Packaging Market by Product Type

11.3.2.12.3 Austria Cosmetic Packaging Market by Application

11.3.2.13 Rest of Western Europe

11.3.2.13.1 Rest of Western Europe Cosmetic Packaging Market by Material

11.3.2.13.2 Rest of Western Europe Cosmetic Packaging Market by Product Type

11.3.2.13.3 Rest of Western Europe Cosmetic Packaging Market by Application

11.4 Asia-Pacific

11.4.1 Asia-Pacific Cosmetic Packaging Market by Country

11.4.2 Asia-Pacific Cosmetic Packaging Market by Material

11.4.3 Asia-Pacific Cosmetic Packaging Market by Product Type

11.4.4 Asia-Pacific Cosmetic Packaging Market by Application

11.4.5 China

11.4.5.1 China Cosmetic Packaging Market by Material

11.4.5.2 China Cosmetic Packaging Market by Product Type

11.4.5.3 China Cosmetic Packaging Market by Application

11.4.6 India

11.4.6.1 India Cosmetic Packaging Market by Material

11.4.6.2 India Cosmetic Packaging Market by Product Type

11.4.6.3 India Cosmetic Packaging Market by Application

11.4.7 Japan

11.4.7.1 Japan Cosmetic Packaging Market by Material

11.4.7.2 Japan Cosmetic Packaging Market by Product Type

11.4.7.3 Japan Cosmetic Packaging Market by Application

11.4.8 South Korea

11.4.8.1 South Korea Cosmetic Packaging Market by Material

11.4.8.2 South Korea Cosmetic Packaging Market by Product Type

11.4.8.3 South Korea Cosmetic Packaging Market by Application

11.4.9 Vietnam

11.4.9.1 Vietnam Cosmetic Packaging Market by Material

11.4.9.2 Vietnam Cosmetic Packaging Market by Product Type

11.4.9.3 Vietnam Cosmetic Packaging Market by Application

11.4.10 Singapore

11.4.10.1 Singapore Cosmetic Packaging Market by Material

11.4.10.2 Singapore Cosmetic Packaging Market by Product Type

11.4.10.3 Singapore Cosmetic Packaging Market by Application

11.4.11 Australia

11.4.11.1 Australia Cosmetic Packaging Market by Material

11.4.11.2 Australia Cosmetic Packaging Market by Product Type

11.4.11.3 Australia Cosmetic Packaging Market by Application

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Cosmetic Packaging Market by Material

11.4.12.2 Rest of Asia-Pacific Cosmetic Packaging Market by Product Type

11.4.12.3 Rest of Asia-Pacific Cosmetic Packaging Market by Application

11.5 Middle East & Africa

11.5.1 Middle East

11.5.1.1 Middle East Cosmetic Packaging Market by Country

11.5.1.2 Middle East Cosmetic Packaging Market by Material

11.5.1.3 Middle East Cosmetic Packaging Market by Product Type

11.5.1.4 Middle East Cosmetic Packaging Market by Application

11.5.1.5 UAE

11.5.1.5.1 UAE Cosmetic Packaging Market by Material

11.5.1.5.2 UAE Cosmetic Packaging Market by Product Type

11.5.1.5.3 UAE Cosmetic Packaging Market by Application

11.5.1.6 Egypt

11.5.1.6.1 Egypt Cosmetic Packaging Market by Material

11.5.1.6.2 Egypt Cosmetic Packaging Market by Product Type

11.5.1.6.3 Egypt Cosmetic Packaging Market by Application

11.5.1.7 Saudi Arabia

11.5.1.7.1 Saudi Arabia Cosmetic Packaging Market by Material

11.5.1.7.2 Saudi Arabia Cosmetic Packaging Market by Product Type

11.5.1.7.3 Saudi Arabia Cosmetic Packaging Market by Application

11.5.1.8 Qatar

11.5.1.8.1 Qatar Cosmetic Packaging Market by Material

11.5.1.8.2 Qatar Cosmetic Packaging Market by Product Type

11.5.1.8.3 Qatar Cosmetic Packaging Market by Application

11.5.1.9 Rest of Middle East

11.5.1.9.1 Rest of Middle East Cosmetic Packaging Market by Material

11.5.1.9.2 Rest of Middle East Cosmetic Packaging Market by Product Type

11.5.1.9.3 Rest of Middle East Cosmetic Packaging Market by Application

11.5.2 Africa

11.5.2.1 Africa Transfusion Diagnostics Market by Country

11.5.2.2 Africa Cosmetic Packaging Market by Material

11.5.2.3 Africa Cosmetic Packaging Market by Product Type

11.5.2.4 Africa Cosmetic Packaging Market by Application

11.5.2.5 Nigeria

11.5.2.5.1 Nigeria Cosmetic Packaging Market by Material

11.5.2.5.2 Nigeria Cosmetic Packaging Market by Product Type

11.5.2.5.3 Nigeria Cosmetic Packaging Market by Application

11.5.2.6 South Africa

11.5.2.6.1 South Africa Cosmetic Packaging Market by Material

11.5.2.6.2 South Africa Cosmetic Packaging Market by Product Type

11.5.2.6.3 South Africa Cosmetic Packaging Market by Application

11.5.2.7 Rest of Africa

11.5.2.7.1 Rest of Africa Cosmetic Packaging Market by Material

11.5.2.7.2 Rest of Africa Cosmetic Packaging Market by Product Type

11.5.2.7.3 Rest of Africa Cosmetic Packaging Market by Application

11.6 Latin America

11.6.1 Latin America Cosmetic Packaging Market by Country

11.6.2 Latin America Cosmetic Packaging Market by Material

11.6.3 Latin America Cosmetic Packaging Market by Product Type

11.6.4 Latin America Cosmetic Packaging Market by Application

11.6.5 Brazil

11.6.5.1 Brazil America Cosmetic Packaging by Material

11.6.5.2 Brazil America Cosmetic Packaging by Product Type

11.6.5.3 Brazil America Cosmetic Packaging by Application

11.6.6 Argentina

11.6.6.1 Argentina America Cosmetic Packaging by Material

11.6.6.2 Argentina America Cosmetic Packaging by Product Type

11.6.6.3 Argentina America Cosmetic Packaging by Application

11.6.7 Colombia

11.6.7.1 Colombia America Cosmetic Packaging by Material

11.6.7.2 Colombia America Cosmetic Packaging by Product Type

11.6.7.3 Colombia America Cosmetic Packaging by Application

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Cosmetic Packaging by Material

11.6.8.2 Rest of Latin America Cosmetic Packaging by Product Type

11.6.8.3 Rest of Latin America Cosmetic Packaging by Application

12 Company profile

12.1 AREMIX Packaging

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 Graham Packaging Company

12.2.1 Company Overview

12.2.2 Financials

12.2.3 Product/Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 Bemis Company Inc

12.3.1 Company Overview

12.3.2 Financials

12.3.3 Product/Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 HCP Packaging

12.4.1 Company Overview

12.4.2 Financials

12.4.3 Product/Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Silgan Holdings

12.5.1 Company Overview

12.5.2 Financials

12.5.3 Product/Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 Albea

12.6.1 Company Overview

12.6.2 Financials

12.6.3 Product/Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Libo Cosmetics

12.7.1 Company Overview

12.7.2 Financials

12.7.3 Product/Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 RPC Group Plc

12.8.1 Company Overview

12.8.2 Financials

12.8.3 Product/Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 AptarGroup Inc

12.9.1 Company Overview

12.9.2 Financials

12.9.3 Product/Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 DS Smith

12.10.1 Company Overview

12.10.2 Financials

12.10.3 Product/Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

13. Competitive Landscape

13.1 Competitive Bench marking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Packaging Laminates Market Size was valued at USD 6.4 billion in 2023 and is expected to reach USD 9.03 billion by 2031 and grow at a CAGR of 4.4% over the forecast period 2024-2031.

The Modular Container Market size projected to reach at USD 52.05 billion by 2032 & was valued at USD 28.05 billion in 2023 with CAGR of 7.8% by 2024-2032.

The Folding Carton Packaging Market size was valued at USD 167.01 billion in 2023 and is expected to increase to USD 239.33 billion in 2031, growing at a compound annual growth rate of 4.6% Over the Forecast Period of 2024-2031.

The Molded Pulp Packaging Market size was valued at USD 6.02 billion in 2023 and is expected to reach USD 10.97 billion by 2032, registering a CAGR of 6.9% over the forecast period 2024-2032.

The Adjustable Boxes Market size was valued at USD 42.70 billion in 2023 and will Reach USD 69.17 billion by 2032 and grow at a CAGR of 5.54% by 2024-2032.

The Returnable Packaging Market size was valued at USD 111.40 billion in 2023 and is expected to Reach USD 185.04 billion by 2032 and grow at a CAGR of 5.8 % over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone