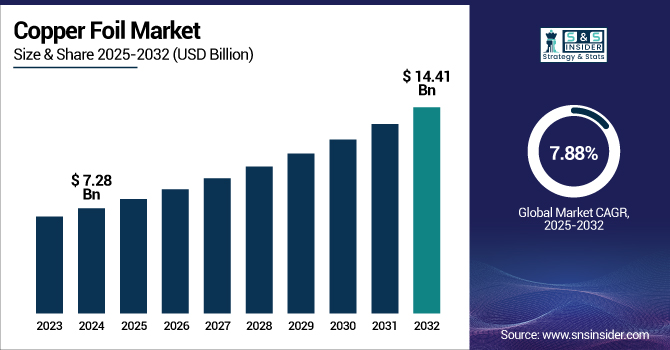

The Copper Foil Market size was valued at USD 7.28 billion in 2024 and is expected to reach USD 14.41 billion by 2032 expanding at a CAGR of 7.88% over the forecast period.

To Get more information on Copper Foil Market - Request Free Sample Report

The growing expansion of 5G infrastructure is driving the market growth. This 5G infrastructure expansion is driven by the increase in 5G base solution, tablets, smartphones, and other devices that require copper foil. Moreover, the production of printed circuit boards (PCBs) and other crucial parts required for 5G devices depends heavily on copper foils. Owing to their remarkable conductivity, which is essential for enabling the high-speed and low-latency data transmission needed by 5G networks, these materials are highly sought after. The need for copper foils in a variety of applications has increased as 5G technology spreads, especially in fields including consumer electronics, servers, and base stations.

For instance, in 2025, Copper Innovation Technologies (CIT) launched the Dolphin ultra-flat transparent antenna, operating up to 20 GHz with a copper foil just 10 nm thick. This innovation offers superior signal transmission and a surface roughness below 1 nm, ideal for smart transportation systems.

Drivers:

Increasing Demand for Consumer Electronics Drives Market Growth

The copper foil market is expanding due to the growing demand for consumer electronics, which necessitates the use of miniaturized circuit designs and high-density interconnects (HDI). Copper foils are crucial components for printed wiring boards (PWBs), where microvias, required for small and powerful electronics, such as laptops, tablets, smartphones, and wearables, can be created using precision technologies including laser drilling. Ultra-thin, premium copper foils are in high demand as a result of the trend toward devices that are lighter, more compact, and more powerful.

Moreover, laser drilling methods increase production accuracy and efficiency while satisfying the demanding specifications of contemporary electronics. Thus, the copper foil market continues to grow rapidly as customer demand for smarter and more connected gadgets increases internationally.

For instance, Furukawa Electric Co., Ltd. is an electronics and electrical equipment producer. The company's primary end-use sectors include electronics, construction, telecommunications, and autos. The business sells its goods across North America, China, Japan, and the rest of Asia Pacific. Japan holds over 50.0% of the company's total sales. Its main goal is to continue investing in R&D for maintaining its dominant position in the business of copper foils globally.

Restraints:

High Manufacturing Costs Hampers Market Expansion

The high costs for manufacturing act as a major restraining factor hampering the copper foil market expansion globally. High-end copper foils, particularly those used in high-speed mobile devices, are produced using technology-intensive processes, such as electroplating, laser drilling, and precision manufacturing processes; and these are all capital-intensive processes. The high operating costs of these technologies are due to the significant investments in specialized equipment and facilities. Furthermore, cost pressure arises from the availability of raw materials, especially copper, and fluctuations in prices on the global market. This can be a cost, which can be too expensive for smaller manufacturers and those in developing regions, further preventing them from competing. This in turn may hinder manufacturers’ ability to maintain margins, therefore straining their capability to scale supply to meet increased demand for copper foil in consumer electronics, electric and autonomous vehicles, and other applications.

Trends:

Surged Advancement in Battery Technologies are Trends Aiding Market Expansion

The increased innovation in battery technology, such as the rising high-performance lithium batteries’ development, is driving the need for specialized copper foils. This new technological advancement is increasing energy density and charging speeds propelling the market growth. Moreover, the companies are focused on the trend and have done some innovation in their battery lineup, and have launched new innovative battery products.

For instance, in 2024, StarPlus Energy, a joint venture formed between Samsung SDI and Stellantis, has awarded Lotte Energy Materials an exclusive copper foil supply contract for their first battery plant in the U.S. Lotte Energy, previously Iljin Materials, underwent a year-long process to achieve quality certification.

By Product

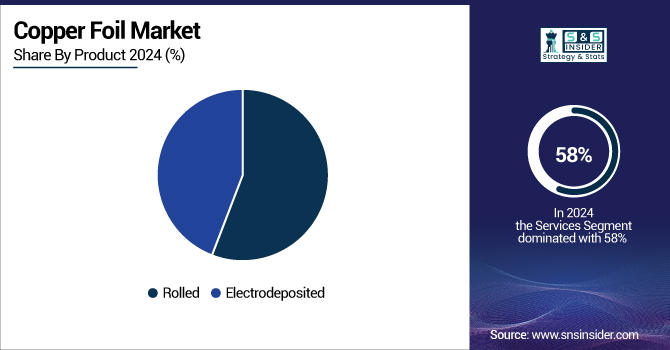

In 2024, the rolled segment held the largest market share of 58%. The segment is anticipated to grow at a lucrative pace due to the high demand from applications including solar PV panels, IoT-enabled services, and lithium-ion batteries, along with high durability and reliability. Rolled copper foil is used in key industries, such as flexible printed circuit boards (FPCBs), batteries, and high-frequency electronic devices (due to continuous bending under high-frequency signals), where the copper foil can withstand repeated bending without cracking, which electrodeposited (ED) copper cannot typically do. The increasing consumer electronics, electric vehicles, and 5G products has also boosted the demand for rolled copper foil due to the need for high-performance conductive materials in these sectors. Furthermore, the growing preference for designs of lightweight and compact devices has resulted in the surging utilization of rolled copper foil across advanced applications, which further consolidates its foothold in the copper foil market.

Electrodeposited segment held a significant market share in 2024 as these foils are cost-effective and well-suited for high-volume manufacturing, such as for printed circuit boards (PCBs) and lithium-ion batteries. Unlike other conventional copper foils, ED copper foil not only provides high conductivity, but it is also defect-free with a small amount of thickness, and can bond firmly with traditional metals. This makes it a practically marketable option for large output electric devices and energy storage systems.

By Application

Circuit boards dominated the market in terms of share of approximately 45% in 2024. The rapid growth of mobile phones, laptop computers, automotive electronics, and industrial applications is driving up the demand for high-end PCBs. Copper foil is essential for such applications, as it provides a high level of conductivity, reliability, and durability. The need for more advanced circuit boards have been compounded by the introduction of 5G technology and Internet of Things (IoT) devices, which have solidified their status as a leader above other alternative.

Batteries held a substantial market share and is expected to be the fastest-growing segment in the market during the forecast period. Its use in batteries reduces the amount of bending, fracturing, wrinkling, and deformation, which occurs during high-pressure cell manufacturing process. Additionally, as batteries need to be small and light, ultra-thin copper foil is advantageous.

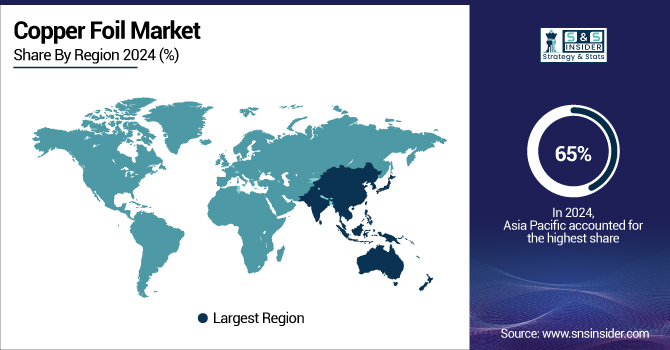

Asia Pacific held the largest market share of around 65% in 2024. A key role in the global supply chain for clean technology and essential minerals is played by Asia Pacific, and the market in the region is dominated by China and the Republic of Korea. China dominated the production of batteries and electric vehicles in 2023, accounting for 38% of the global investment in the energy transition. Therefore, the usage of copper foil in batteries and electric devices is high, further driving the market growth in the region.

For instance, in 2022, A USD 547 million copper foil manufacturing facility was set up by subsidiary SK Nexilis as part of SK Group’s EV supply chain. This expansion helped Malaysia to increase its production and provide more products in the market, which drives the copper foil market growth.

North America is expected to be the fastest growing region in the market growing with the highest CAGR during the forecast period. The growth is attributed to the increasing demand for electric vehicles (EVs) and energy storage space in the region. Recent supply chain bottlenecks have spurred the U.S. government into action with large investments, such as the Bipartisan Infrastructure Law that provides over USD 7.5 billion for EV infrastructure, thereby promoting the production of EV batteries, where copper foil constitutes as a critical raw material. North America offers a rich consumer electronics market and substantial development in 5G telecommunications, both of which need high-performance copper foils for printed circuit boards (PCBs).

Europe also held a significant copper foil market share due to the strong position of the region in the electric vehicles (EVs) and renewable energy industry. With German, French, and the U.K. spending on EVs and solar expensive past the news, both EVs and PCB soldering demand batteries, requiring high-performance copper foils.

For instance, Europe gained a large market share potential for copper applications in components, partly due to over 20% share of global EV sales in 2023, as per European Automobile Manufacturers Association (ACEA) data.

Moreover, stringent carbon emission rules and the European Green Deal are pushing industries to shift to advanced energy storage systems, which will drive the adoption of copper foils globally. Europe remains one of the key markets for copper foil applications as it houses major hubs for battery manufacturing and government-initiated programs for clean energy transition.

Get Customized Report as per Your Business Requirement - Enquiry Now

The market is growing the and key players are focused on innovation to drive the market growth, and the report provides the copper foil companies' name, copper foil market share, copper foil market analysis. The leading players in the market include Showa Denko Materials Co., Ltd., Furukawa Electric Co., Ltd., SKC, Mitsui Mining & Smelting Co., Ltd., Doosan Corporation, JX Nippon Mining & Metals Corporation, Circuit Foil Luxembourg, Carl Schlenk AG, Nan Ya Plastics Corporation, and Co-Tech Copper Foil Corporation.

In February 2024, Addionics opened its first U.S. manufacturing facility in Massachusetts as part of a USD 400 million investment to ramp domestic EV battery production. They are developing an advanced 3D manufacturing process at the facility to manufacture next-generation smart 3D electrodes based on their unique copper foil technology to improve EV battery performance.

In December 2024, JX Nippon Mining & Metals USA’s facility in Arizona is shutting down operations. The closure marks the end of domestic copper foil production for printed circuit boards (PCBs) in the region. This development could impact North America's supply chain for critical electronics manufacturing.

In September 2024, Hindalco Industries began copper foil manufacturing, particularly for electric vehicle (EV) batteries at its new plant in India. The facility focuses on producing high-performance, ultra-thin copper foils essential for lithium-ion batteries.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 7.85 Billion |

| Market Size by 2032 | USD 14.41 Billion |

| CAGR | CAGR of 7.88% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Electrodeposited, Rolled) • By Application (Circuit Boards, Batteries, Electrical Appliances, Solar & Alternative Energy, Medical, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Showa Denko Materials Co., Ltd., Furukawa Electric Co., Ltd., SKC, Mitsui Mining & Smelting Co., Ltd., Doosan Corporation, JX Nippon Mining & Metals Corporation, Circuit Foil Luxembourg, Carl Schlenk AG, LYCT, CCP, Nan Ya Plastics Corporation, Oak-Mitsui Technologies, Co-Tech Copper Foil Corporation, Global Brass and Copper Holdings, Inc., Iljin Materials, Solus Advanced Materials, Kingboard Copper Foil Holdings Ltd., Guangdong Jiayuan Technology, Suzhou Fukuda Metal Co., Ltd., HuiZhou United Copper Foil Electronic Material Co., Ltd. |

Ans: The Copper Foil Market was valued at USD 7.85 billion in 2024.

Ans: The expected CAGR of the global Copper Foil Market during the forecast period is 7.88%.

Ans: The rolled segment is expected to grow rapidly in the Copper Foil Market during 2025 to 2032.

Ans: Increasing demand for consumer electronics drives the market growth.

Ans: Asia Pacific led the Copper Foil Market in the region with the highest revenue share in 2024.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization by Country, By Type, 2024

5.2 Feedstock Prices by Country, and Type, 2024

5.3 Regulatory Impact by Country and By Product 2024.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives by Region

5.5 Innovation and R&D, Type, 2024

6. Competitive Landscape

6.1 List of Major Companies By Region

6.2 Market Share Analysis By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion Plans and New Product Launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Copper Foil Market Segmentation By Product

7.1 Chapter Overview

7.2 Electrodeposited

7.2.1 Electrodeposited Trend Analysis (2021-2032)

7.2.2 Electrodeposited Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Rolled

7.3.1 Rolled Market Trends Analysis (2021-2032)

7.3.2 Rolled Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Copper Foil Market Segmentation By End-Use Industry

8.1 Chapter Overview

8.2 Circuit Boards

8.2.1 Circuit Boards Market Trends Analysis (2021-2032)

8.2.2 Circuit Boards Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Batteries

8.3.1 Batteries Market Trends Analysis (2021-2032)

8.3.2 Batteries Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Electrical Appliances

8.4.1 Electrical Appliances Market Trends Analysis (2021-2032)

8.4.2 Electrical Appliances Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Solar & Alternative Energy

8.5.1 Solar & Alternative Energy Market Trends Analysis (2021-2032)

8.5.2 Solar & Alternative Energy Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Medical

8.6.1 Medical Market Trends Analysis (2021-2032)

8.6.2 Medical Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Others

8.7.1 Others Market Trends Analysis (2021-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Copper Foil Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.2.3 North America Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.2.4 North America Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.2.5.2 USA Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.2.6.2 Canada Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.2.7.2 Mexico Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.3 Europe

9.3.1 Trends Analysis

9.3.2 Europe Copper Foil Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.3.3 Europe Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.3.4 Europe Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.3.5 Germany

9.3.5.1 Germany Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.3.5.2 Germany Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.3.6 France

9.3.6.1 France Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.3.6.2 France Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.3.7 UK

9.3.7.1 UK Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.3.7.2 UK Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.3.8 Italy

9.3.8.1 Italy Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.3.8.2 Italy Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.3.9 Spain

9.3.9.1 Spain Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.3.9.2 Spain Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.3.10 Poland

9.3.10.1 Poland Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.3.10.2 Poland Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.3.11 Turkey

9.3.11.1 Turkey Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.3.11.2 Turkey Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.3.12 Rest of Europe

9.3.12.1 Rest of Europe Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.3.12.2 Rest of Europe Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Copper Foil Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.4.3 Asia Pacific Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.4.4 Asia Pacific Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.4.5.2 China Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.4.5.2 India Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.4.5.2 Japan Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.4.6.2 South Korea Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.4.7 Singapore

9.4.7.1 Singapore Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.4.7.2 Singapore Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

8.4.8 Australia

8.4.8.1 Australia Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

8.4.8.2 Australia Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.4.9 Rest of Asia Pacific

9.4.9.1 Rest of Asia Pacific Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.4.9.2 Rest of Asia Pacific Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.5 Middle East & Africa

9.5.1 Trends Analysis

9.5.2 Middle East & Africa Copper Foil Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.5.3 Middle East & Africa Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.5.4 Middle East & Africa Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.5.5 UAE

9.5.5.1 UAE Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.5.5.2 UAE Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.5.6 Saudi Arabia

9.5.6.1 Saudi Arabia Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.5.6.2 Saudi Arabia Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.5.7 Qatar

9.5.7.1 Qatar Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.5.7.2 Qatar Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.5.8 South Africa

9.5.8.1 South Africa Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.5.8.2 South Africa Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.5.9 Middle East & Africa

9.5.9.1 Middle East & Africa Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.5.9.2 Middle East & Africa Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Copper Foil Market Estimates and Forecasts, by Country (2021-2032) (USD Billion)

9.6.3 Latin America Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.6.4 Latin America Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.6.5.2 Brazil Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.6.6.2 Argentina Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

9.6.7 Rest of Latin America

9.6.7.1 Rest of Latin America Copper Foil Market Estimates and Forecasts, By Product (2021-2032) (USD Billion)

9.6.7.2 Rest of Latin America Copper Foil Market Estimates and Forecasts, By End-Use Industry (2021-2032) (USD Billion)

10. Company Profiles

10.1 Showa Denko Materials Co., Ltd.

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Product / Services Offered

10.1.4 SWOT Analysis

10.2 Furukawa Electric Co., Ltd.

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Product/ Services Offered

10.2.4 SWOT Analysis

10.3 SKC

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Product/ Services Offered

10.3.4 SWOT Analysis

10.4 Mitsui Mining & Smelting Co., Ltd.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Product/ Services Offered

10.4.4 SWOT Analysis

10.5 Doosan Corporation

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Product/ Services Offered

10.5.4 SWOT Analysis

10.6 JX Nippon Mining & Metals Corporation

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Product/ Services Offered

10.6.4 SWOT Analysis

10.7 Circuit Foil Luxembourg

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Product/ Services Offered

10.7.4 SWOT Analysis

10.8 Carl Schlenk AG

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Product/ Services Offered

10.8.4 SWOT Analysis

10.9 Nan Ya Plastics Corporation

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Product/ Services Offered

10.9.4 SWOT Analysis

10.10 Co-Tech Copper Foil Corporation

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Product/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Electrodeposited

Rolled

By Application

Circuit Boards

Batteries

Electrical Appliances

Solar & Alternative Energy

Medical

Other

Request for Segment Customization as per your Business Requirement: Segment Customization Request

North America

US

Canada

Mexico

Europe

Germany

France

UK

Italy

Spain

Poland

Turkey

Rest of Europe

Asia Pacific

China

India

Japan

South Korea

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

UAE

Saudi Arabia

Qatar

South Africa

Rest of Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

Scrap Metal Recycling Market Size was valued at USD 523.5 Billion in 2023 and will reach USD 856.2 Billion by 2032, growing at a CAGR of 5.7% by 2024-2032.

Optical Coating Market was valued at USD 15.63 Billion in 2023 and is expected to reach USD 26.90 Billion by 2032, growing at a CAGR of 6.22% from 2024-2032.

The Nitrile Gloves Market Size was valued at USD 10.0 billion in 2023, and will reach USD 16.2 billion by 2032, and grow at a CAGR of 5.5% by 2024-2032.

The Dimer Acid Market Size was valued at USD 3.0 billion in 2023, and is expected to reach USD 5.2 billion by 2032, and grow at a CAGR of 6.4% over the forecast period 2024-2032.

The Glass Manufacturing Market Size was USD 118.9 billion in 2023 and is expected to reach USD 210.1 billion by 2032 and grow at a CAGR of 6.5% by 2024-2032.

The Organosilicon Polymers Market was USD 1.8 billion in 2023 and is expected to reach USD 2.7 billion by 2032, growing at a CAGR of 4.3% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone