Contract Management Software Market Report Scope & Overview:

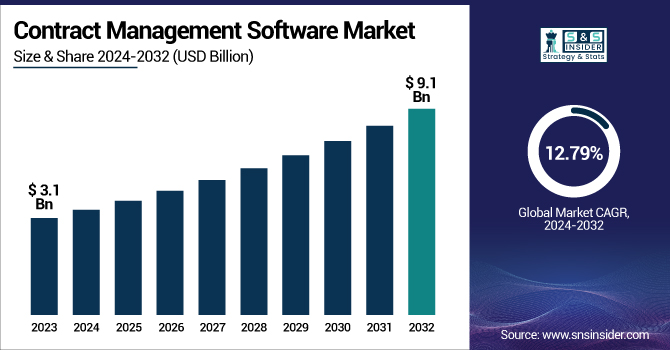

The Contract Management Software Market was valued at USD 3.1 billion in 2023 and is expected to reach USD 9.1 billion by 2032, growing at a CAGR of 12.79% from 2024-2032.

To Get more information on Contract Management Software Market - Request Free Sample Report

This report provides a detailed analysis of the Contract Management Software Market, presenting key statistical insights from 2023. It highlights how feature utilization patterns have evolved, with increasing adoption of AI-based contract analytics, automated approval workflows, and obligation tracking functionalities. The market continues to see strong uptake from end-user industries such as BFSI, healthcare, and IT, driven by rising regulatory demands, complex contract volumes, and the need for operational transparency. Integration capabilities with enterprise systems like ERP, CRM, and procurement platforms have also become a critical purchase criterion as businesses seek unified data visibility and process automation. Furthermore, the report notes a significant impact on contract cycle time and risk mitigation, with organizations reporting an average 30–40% reduction in contract turnaround time and noticeable improvements in risk detection and compliance management. In addition to these insights, the latest edition introduces emerging trends such as generative AI-powered contract drafting, predictive obligation management, and ESG clause monitoring tools, reflecting the market’s shift toward intelligent, context-aware contract lifecycle management solutions.

In 2023, the U.S. Contract Management Software market was valued at approximately USD 0.8 billion, and it is projected to reach USD 2.5 billion by 2032, growing at a CAGR of 12.51% during the forecast period. This growth is driven by increasing demand for process efficiency and automation, as well as rising investments in next-generation technologies

Contract Management Software Market Dynamics

Driver

-

Increasing demand for contract automation, compliance management, and AI-powered workflows is accelerating software adoption.

The increasing complexity of business contracts, along with the stringent regulatory requirements across industries such as BFSI, healthcare, and IT, is driving demand for advanced contract management solutions. Organizations are turning to software platforms that provide levels of automation to common contract processes, such as drafting, approval workflows, and renewal tracking. Growing levels of transactional data and the need for real-time compliance monitoring and risk assessment to mitigate financial and legal liabilities. Likewise, cloud-based deployment models and AI-enhanced analytics are becoming increasingly popular, providing scalability, accessibility, and intelligent insights. All of these trends are driving the adoption of contract management software in enterprises of all sizes.

Restraint

-

High implementation costs and complex integration with existing enterprise systems limit adoption, especially among SMEs.

Even with the operational benefits that come with applied Contract Management Software, the upfront costs associated with deploying CMM remain one of the biggest roadblocks for those organizations —especially SMEs. One of the greatest challenges of these solutions is that they are isolated from the enterprise, and integrating them with standard enterprise systems like ERP, CRM, and procurement platforms can be extremely difficult, requiring high IT resources and customization. However, data migration from legacy systems and ensuring data security during integration often require substantial work and investment. Some businesses also encounter opposition to change from in-house legal and procurement teams who are used to manual or semi-automated processes, which can hinder adoption rates and limit the underlying market’s full growth potential.

Opportunity

-

AI and predictive analytics are transforming contract lifecycle management with intelligent drafting, risk analysis, and compliance monitoring.

The integration of artificial intelligence and predictive analytics within contract management platforms presents a significant growth opportunity. AI-driven features such as automated contract drafting, intelligent clause extraction, risk flagging, and predictive obligation management, are revolutionizing how enterprises handle large volumes of contracts. These technologies not only enhance operational efficiency but also provide deeper insights into contract performance, potential risks, and compliance gaps. Additionally, AI-powered solutions can assist in ESG clause monitoring and regulatory reporting, adding strategic value to contract portfolios. This shift toward intelligent, automated contract management is expected to unlock new revenue streams and operational efficiencies for software vendors and enterprise users alike.

Challenge

-

Rising concerns over data security, privacy, and regulatory compliance risks are challenging cloud-based contract management platforms.

As contract management software increasingly relies on cloud infrastructure and centralized data repositories, concerns over data security, privacy, and regulatory compliance are intensifying. Sensitive business agreements containing financial terms, legal obligations, and personal information are prime targets for cyberattacks and data breaches. Ensuring that contract management platforms comply with global and regional data protection laws like GDPR, HIPAA, and CCPA adds further complexity. The risk of unauthorized access or accidental data leaks can undermine organizational trust and result in severe financial penalties. Consequently, vendors and enterprises must prioritize robust cybersecurity frameworks, encryption protocols, and compliance certifications to maintain data integrity and business continuity.

Contract Management Software Market Segmentation Analysis

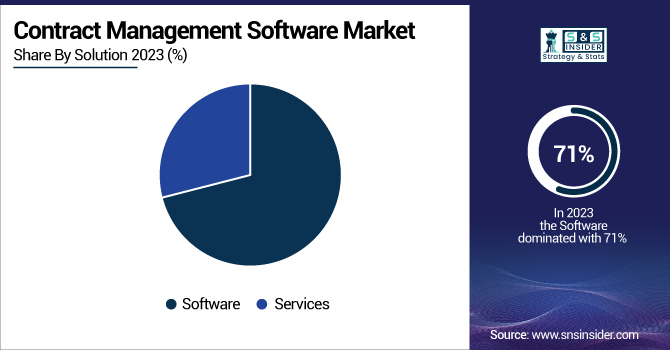

By Solution

In 2023, the software segment dominated the contract management software market and accounted for 71% of revenue share, owing to its ability to automate complex workflows, improve contract visibility, and minimize manual errors. The growing preference for AI-enhanced features such as automated clause extraction, risk flagging, and predictive obligation tracking has driven widespread adoption across the BFSI, healthcare, IT, and manufacturing sectors. Cloud-based and on-premise software offerings enable flexibility and scalability for large enterprises and SMEs alike. With rising regulatory compliance needs and digital transformation initiatives, this segment is projected to maintain its lead throughout the forecast period.

The services segment is expected to register the fastest CAGR during the forecast period, driven by the increasing demand for implementation, customization, integration, and support services. As businesses shift toward cloud-based contract management systems, professional services help ensure seamless system deployment, migration from legacy platforms, and secure data management. Additionally, the growing complexity of enterprise IT ecosystems and the need for continuous support and training are expanding managed services demand. The rise in ESG compliance services and AI-driven contract analytics consultancy is further accelerating growth, positioning services as a vital contributor to market expansion through 2032.

By Business Function

In 2023, the procurement segment dominated the contract management software market, driven by the need for efficient vendor management, automated contract approvals, and risk mitigation in supply chains. Increasingly globalized and complex supplier networks, combined with fluctuating material costs and regulatory scrutiny, have made procurement contract visibility and compliance critical. Contract management solutions help streamline vendor negotiations, renewal processes, and payment terms, reducing procurement cycle time and minimizing disputes. This segment is expected to retain its dominance as organizations prioritize cost control, supplier risk management, and ESG compliance in procurement operations.

The IT segment is projected to register the fastest CAGR over the forecast period due to the growing demand for managing technology service agreements, software licensing contracts, and SaaS subscriptions. As enterprises accelerate their digital transformation journeys, IT teams require robust tools for tracking service-level agreements, vendor contracts, and cybersecurity-related terms. Increasing integration of contract management solutions with enterprise IT ecosystems like ERP, CRM, and cloud management platforms is also fueling adoption. Future growth will be driven by AI-powered contract analytics, automated compliance monitoring, and the rising complexity of multi-vendor, multi-cloud technology environments.

By Enterprise Size

In 2023, large enterprises dominated the contract management software market and represented 65% of revenue share, due to their extensive contract volumes, complex global operations, and stringent compliance requirements. These organizations manage numerous vendor agreements, customer contracts, and regulatory documents, making automation, risk tracking, and real-time contract analytics essential. Large enterprises prioritize AI-powered, cloud-based solutions integrated with ERP, CRM, and procurement systems for enhanced visibility and operational efficiency. With ongoing investments in enterprise-wide digital transformation and contract risk mitigation, this segment is expected to maintain its leadership position through the forecast period.

The SMEs segment is expected to register the fastest CAGR during the forecast period, driven by growing awareness of the operational and financial risks posed by manual contract management. With rising regulatory scrutiny, SMEs are adopting affordable, cloud-based contract management solutions offering contract automation, compliance alerts, and template-based contract creation. Additionally, the availability of AI-enhanced, subscription-based tools tailored for SMEs’ needs is accelerating uptake. Future growth will be supported by increasing digitization initiatives, flexible deployment models, and the need for faster contract approvals, vendor negotiations, and obligation tracking among small and medium-sized businesses globally.

By Industry

In 2023, the services industry segment dominated the contract management software market, largely because service-based businesses like IT, legal, healthcare, and financial services heavily rely on client, vendor, and partnership agreements. These industries manage high volumes of recurring contracts, service-level agreements, and compliance-heavy documentation, making streamlined, automated, and analytics-driven contract management crucial. The services sector prioritizes digital solutions for risk mitigation, faster client onboarding, and real-time performance monitoring.

The public sector segment is projected to register the fastest CAGR during the forecast period due to the rising emphasis on regulatory compliance, transparency, and efficiency in managing government contracts, grants, and procurement processes. Public sector organizations require contract management software to handle complex documentation, budget controls, and multi-agency agreements. Increasing government investments in digital transformation, coupled with mandates for faster, compliant, and auditable contract processes, are accelerating software adoption.

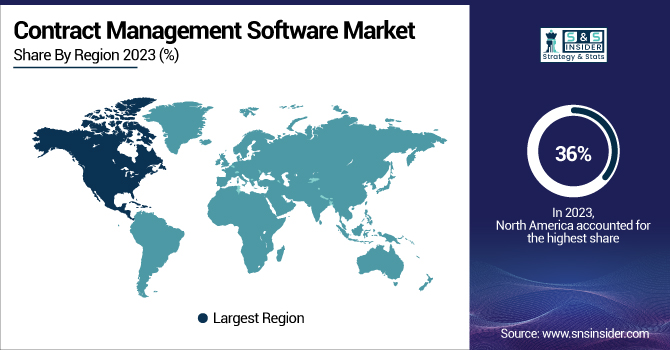

Regional Landscape

North America dominated the contract management software market in 2023 and represented 36% of revenue share, primarily driven by the U.S. as a key adopter. The region’s high adoption of advanced technologies, strict regulatory requirements, and well-established industries like BFSI, healthcare, and IT contribute significantly to its leadership. The widespread use of cloud-based and AI-driven solutions among large enterprises also fuels market growth in North America. The ongoing digital transformation and compliance demands across various sectors are expected to keep North America as the dominant region through the forecast period.

The Asia-Pacific region is expected to register the fastest growth in the contract management software market over the forecast period. This rapid growth is driven by the increasing adoption of digital solutions across emerging economies like China, India, and Southeast Asia. These regions are experiencing significant expansion in industries such as manufacturing, IT services, and government, which require efficient contract management tools.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

Atlassian – Jira Service Management

-

Pegasystems – Pega Case Management

-

ServiceNow – Customer Service Management

-

Salesforce – Service Cloud

-

OpenText – Core Case Management

-

InterSystems – TrakCare

-

CompuGroup Medical – CGM Clinical

-

Greenway Health – Intergy

-

Adobe Workfront – Workfront

-

TeleTracking – RTLS

-

IBM – Case Manager

-

Tyler Technologies – Odyssey Case Manager

-

Appian – Dynamic Case Management

-

Hyland Software – OnBase

-

OpenText (formerly Micro Focus) – Content Manager

Recent Developments

In May 2024, DocuSign acquired Lexion, an AI-powered agreement management company, for approximately $165 million. This acquisition aligns with DocuSign's strategy to enhance its Intelligent Agreement Management platform by integrating Lexion's AI capabilities, which include automated contract reviews and Q&A functionalities. Lexion's team will join DocuSign, with co-founders taking senior roles in product management and engineering.

In April 2024, Salesforce entered a partnership with Ironclad to provide a contract lifecycle management platform. This collaboration aims to reduce manual processes and enhance collaboration between legal and sales teams, streamlining contract workflows and improving efficiency.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 3.1 Billion |

|

Market Size by 2032 |

US$ 9.1 Billion |

|

CAGR |

CAGR of 12.79 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Solution (Software, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Atlassian, Pegasystems, ServiceNow, Salesforce, OpenText, InterSystems, CompuGroup Medical, Greenway Health, Adobe Workfront, TeleTracking, IBM, Tyler Technologies, Appian, Hyland Software, OpenText |