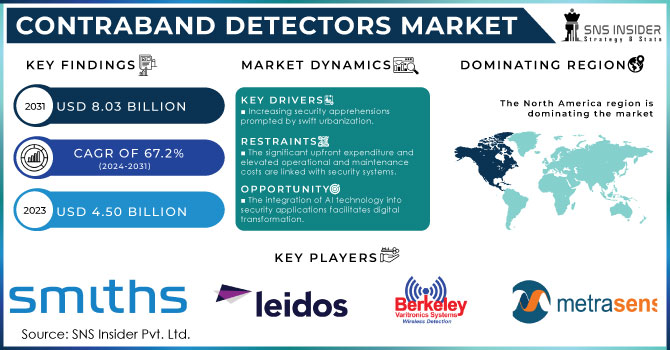

The Contraband Detectors Market Size was valued at USD 4.55 Billion in 2023 and is expected to reach USD 8.51 Billion by 2032 and grow at a CAGR of 7.22% over the forecast period 2024-2032.

The Contraband Detectors Market has grown enormously over the last few years, especially in the context of rising security threats and policy shifts by the governments to effectively deter illegal trading and smuggling practices. As of 2023, the US, China, and India, among others, are focusing significantly on the deployment of sophisticated technologies related to contraband detection, with an increasing budget being allotted by governments for strengthening airport security, seaport security, and border crossings.

Get more information on Contraband Detectors Market - Request Sample Report

For instance, the U.S. Department of Homeland Security provided with an increased budget for the detection systems in 2023. India, too, undertook policies that transformed its customs. It issued handheld detectors to all its checkpoints to check the increasing trend of smuggling. In a major move to improve security in correctional facilities, the Hubbard County Sheriff’s Office has adopted the innovative CLEARPASS® C.i. partial body scanner, created by LINEV Systems® in Conroe, Texas, to thwart the smuggling of illegal items like drugs and firearms into their jail.

Advancements in technology have contributed the most in determining the Contraband Detectors Market. The addition of AI into the contraband detectors has maximized their performance and accuracy. Real-time scanning of images using AI-powered systems helps reduce false positives by as much as 15%, according to the leading industry experts. The new portable X-ray scanners and trace detection systems now come with IoT capabilities that can be monitored and data shared from a distance, which is useful in big operations. One of the development highlights in 2023 was a new sophisticated handheld detector featuring advanced deep-learning algorithms in its detection for uncovering concealed items by a U.S.-based company.

The future holds great opportunities for the Contraband Detectors Market, due to the growth in demand for non-invasive detection technologies, as well as the need for rapid and efficient screening systems in dense population areas. Governments and private organizations are combining their efforts to improve R&D, which allows for innovative solutions to be adapted to specific security challenges. Another initiative is that of public-private partnerships and funding programs, that make advanced detection technologies more available in emerging economies.

Data from different government agencies such as the U.S. Department of Homeland Security and the European Border and Coast Guard Agency has pointed out that the use of contraband detectors is becoming increasingly essential to counter the smuggling activities. This aspect, along with others, explains why the market for contraband detectors is expected to remain on the growth trajectory in the near future.

Key Drivers:

Global Efforts to Combat Smuggling through Strengthened Security and Advanced Detection Technologies for Public Safety

Governments worldwide have strengthened security protocols, especially at borders, airports, and seaports, in response to rising smuggling activities. According to the U.S. Department of Homeland Security, 2023 saw increase in investment towards contraband detection systems, with border control agencies prioritizing mobile X-ray units and advanced scanners. These policies highlight the importance of contraband detectors in public safety and the reduction of risks associated with illegal trade.

Growing Demand for AI-Powered Detection Systems Enhancing Accuracy and Efficiency in Smuggling Prevention

The demand is significantly driven by cutting-edge innovations, such as AI-powered detection algorithms and portable devices. For example, industry research indicate that X-ray imaging systems with machine learning witnessed a 30% increase in adoption in 2023. Real-time analytics and remote monitoring capabilities have improved operational efficiency, reducing false alarms by 15% compared to conventional systems. This trend indicates the market's preference for smart, user-friendly solutions that optimize detection accuracy and performance.

Restrain:

Challenges of High-Cost Contraband Detection Equipment in Small Enterprises and Developing Countries

The price of contraband detection equipment, especially ones with more complex features such as AI and IoT, is highly prohibitive to small enterprises and developing countries. For example, portable X-ray machines can be as expensive as $20,000 to $50,000, thus are not very accessible.

Furthermore, the maintenance and operational expenses add to the burden of organizations, especially in low-income regions. Governments in emerging economies such as Africa and Southeast Asia are addressing this issue by offering subsidies and initiating public-private partnerships to reduce financial constraints. However, the overall adoption rate remains slower in cost-sensitive markets, which impacts the global expansion of the contraband detectors industry.

By Deployment Type

The portable segment dominated in 2023, holding 58% of the market share. Portable contraband detectors offer unparalleled flexibility, enabling swift and efficient deployment across diverse environments such as airports, ports, and high-traffic public spaces. These devices are lightweight, easy to operate, and equipped with cutting-edge technologies like AI-driven analytics, making them indispensable for on-the-go security checks.

Battery technology advancement and device miniaturization is fast, and at the same time, the portable segment is expected to grow with the fastest CAGR of 7.38% during the forecast period from 2024 to 2032. Government initiatives for enhancing border security and curbing illegal activities in regions such as Asia-Pacific and the Middle East fuel the increasing adoption of portable detectors. With mobility forming the backbone of organizations and striving to reduce costs, the portable segment is bound to grow aggressively in comparison to the fixed one.

By Technology

In 2023, the X-ray imaging emerged with the highest market share of 51%. The systems have a good reputation for high accuracy in detection of concealed items, making them preferred in the applications of airports, customs, and military. Further advancement in the technology of dual-energy and 3D X-ray systems is capable of cutting scanning time down to 25%.

The X-ray imaging segment is expected to grow at the fastest CAGR of 7.33% between 2024 and 2032, driven by the integration of AI and machine learning algorithms. These advancements enable real-time anomaly detection, significantly improving operational efficiency. Further, governments in nations like the U.S. and Germany are pushing mandatory installations of next-generation X-ray scanners into significant infrastructure areas expected to make it even stronger within the region within the years ahead.

North America led the Contraband Detectors Market in 2023, capturing 39% of the market share, with strong security policies and huge investments in R&D. The U.S. increased funding for contraband detection by 15% in 2023, according to Homeland Security.

Meanwhile, the Asia-Pacific region is expected to be the fastest-growing region, with a CAGR of 7.74% during the forecast period from 2024 to 2032. This growth is driven by the increasing cross-border trade activities, rising smuggling incidents, and government efforts to improve security infrastructure. China is also a major contributor, with innovations in portable and AI-integrated technologies driving market expansion across the continent.

Get Customized Report as per your Business Requirement - Request For Customized Report

Some of the Major Players in the Contraband Detectors Market Are

Smiths Detection (HI-SCAN 6040aTiX, HI-SCAN 100100T-2is)

OSI Systems, Inc. (Rapiscan 620DV, Rapiscan 920CT)

Leidos (Soter RS, Soter X)

Nuctech Company Limited (MVT-1000, MVT-2000)

Metrasens (Ferromagnetic Detection System, M-Vision)

ADANI (ADANI X-ray Inspection System, ADANI Cargo Inspection System)

CEIA S.p.A. (THS/21, THS/21M)

Berkeley Varitronics Systems, Inc. (BVS-01, BVS-02)

Godrej Security Solutions (G-Secure, G-Safe)

Campbell/Harris Security Equipment Company (HDS-100, HDS-200)

Garrett Metal Detectors (PD 6500i, MZ 6100)

PKI Electronic Intelligence GmbH (PKI 6800, PKI 6800i)

Vidisco Ltd. (Eagle, Eagle X)

Astrophysics Inc. (XIS-1800, XIS-1000)

Autoclear LLC (ACX 100, ACX 200)

Gilardoni S.p.A. (G-Scan 100, G-Scan 200)

Aventura Technologies, Inc. (AVT-1000, AVT-2000)

Ranger Security Detectors (RSD-100, RSD-200)

Global Security Solutions, Inc. (GSS-1000, GSS-2000)

L3Harris Technologies (HI-SCAN 6040aTiX, HI-SCAN 100100T-2is)

3M Company

Honeywell International Inc.

General Electric Company

Siemens AG

Schneider Electric SE

ABB Ltd.

Rockwell Automation, Inc.

Emerson Electric Co.

Mitsubishi Electric Corporation

Panasonic Corporation

April 2024: Smiths Detection, a worldwide frontrunner in security screening and threat detection technologies, and a division of Smiths Group plc, today unveils its innovative X-ray Diffraction (XRD) technology scanner, the SDX 10060 XDi. Designed for deployment in numerous high-traffic global airports, express forwarding stations, and customs checkpoints, Smiths Detection’s latest scanner is a groundbreaking solution that is set to be a vital player in the ongoing rapid battle against illegal drugs and other forms of contraband.

January 2025: OSI Systems, based in the US, has announced an order worth around USD27 million to deliver checkpoint and hold baggage screening solutions to a confidential airport client.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 4.55 Billion |

|

Market Size by 2032 |

USD 8.51 Billion |

|

CAGR |

CAGR of 7.22% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

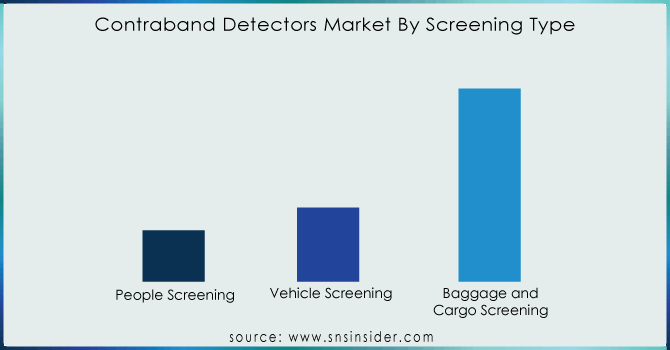

• By Screening Type (People Screening, Vehicle Screening, Baggage and Cargo Screening) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Smiths Detection, OSI Systems, Inc., Leidos, Nuctech Company Limited, Metrasens, ADANI, CEIA S.p.A., Berkeley Varitronics Systems, Inc., Godrej Security Solutions, Campbell/Harris Security Equipment Company, Garrett Metal Detectors, PKI Electronic Intelligence GmbH, Vidisco Ltd., Astrophysics Inc., Autoclear LLC, Gilardoni S.p.A., Aventura Technologies, Inc., Ranger Security Detectors, Global Security Solutions, Inc., L3Harris Technologies. |

|

Key Drivers |

• Global Efforts to Combat Smuggling through Strengthened Security and Advanced Detection Technologies for Public Safety. |

|

Restraints |

• Challenges of High-Cost Contraband Detection Equipment in Small Enterprises and Developing Countries. |

Ans: Contraband Detectors Market size was USD 4.55 Billion in 2023 and is expected to Reach USD 8.51 Billion by 2032.

Ans: The Contraband Detectors Market is expected to grow at a CAGR of 7.22% during 2024-2032.

Ans: The major growth factors of the Contraband Detectors Market are Efforts to Combat Smuggling and Growing Demand for AI-Powered Detection Systems.

Ans: The portable segment dominated the Contraband Detector Market.

Ans: North America dominated the Contraband Detectors Market in 2023.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Key Vendors and Feature Analysis, 2023

5.2 Performance Benchmarks, 2023

5.3 Integration Capabilities

5.4 Usage Statistics, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Contraband Detectors Market Segmentation, By Screening Type

7.1 Chapter Overview

7.2 People Screening

7.2.1 People Screening Market Trends Analysis (2020-2032)

7.2.2 People Screening Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Vehicle Screening

7.3.1 Vehicle Screening Market Trends Analysis (2020-2032)

7.3.2 Vehicle Screening Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Baggage and Cargo Screening

7.4.1 Baggage and Cargo Screening Market Trends Analysis (2020-2032)

7.4.2 Baggage and Cargo Screening Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Contraband Detectors Market Segmentation, by Application

8.1 Chapter Overview

8.2 Government

8.2.1 Government Market Trends Analysis (2020-2032)

8.2.2 Government Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Industrial

8.3.1 Industrial Market Trends Analysis (2020-2032)

8.3.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Retail

8.4.1 Retail Market Trends Analysis (2020-2032)

8.4.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Hospitality

8.5.1 Hospitality Market Trends Analysis (2020-2032)

8.5.2 Hospitality Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Commercial

8.6.1 Commercial Market Trends Analysis (2020-2032)

8.6.2 Commercial Market Size Estimates And Forecasts To 2032 (USD Billion)

8.7 Coated

8.7.1 Coated Market Trends Analysis (2020-2032)

8.7.2 Coated Market Size Estimates And Forecasts To 2032 (USD Billion)

8.8 Education

8.8.1 Education Market Trends Analysis (2020-2032)

8.8.2 Education Market Size Estimates And Forecasts To 2032 (USD Billion)

9. Contraband Detectors Market Segmentation, By Deployment Type

9.1 Chapter Overview

9.2 Portable

9.2.1 Portable Market Trends Analysis (2020-2032)

9.2.2 Portable Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Fixed

9.3.1 Fixed Market Trends Analysis (2020-2032)

9.3.2 Fixed Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Contraband Detectors Market Segmentation, By Technology

10.1 Chapter Overview

10.2 X-Ray Imaging

10.2.1 X-Ray Imaging Market Trends Analysis (2020-2032)

10.2.2 X-Ray Imaging Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Spectroscopy/Spectrometry

10.3.1 Spectroscopy/Spectrometry Market Trends Analysis (2020-2032)

10.3.2 Spectroscopy/Spectrometry Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Metal Detection

10.4.1 Metal Detection Market Trends Analysis (2020-2032)

10.4.2 Metal Detection Market Size Estimates And Forecasts To 2032 (USD Billion)

10.5 Other

10.5.1 Other Market Trends Analysis (2020-2032)

10.5.2 Other Market Size Estimates And Forecasts To 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Contraband Detectors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.2.4 North America Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.5 North America Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.2.6 North America Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.2.7.2 USA Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.7.3 USA Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.2.7.4 USA Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.2.8.2 Canada Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.8.3 Canada Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.2.8.4 Canada Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.2.9.2 Mexico Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.9.3 Mexico Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.2.9.4 Mexico Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Contraband Detectors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.7.3 Poland Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.3.1.7.4 Poland Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.8.3 Romania Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.3.1.8.4 Romania Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Contraband Detectors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.5 Western Europe Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.3.2.6 Western Europe Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.7.3 Germany Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.3.2.7.4 Germany Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.3.2.8.2 France Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.8.3 France Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.3.2.8.4 France Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.3.2.9.2 UK Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.9.3 UK Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.3.2.9.4 UK Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.10.3 Italy Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.3.2.10.4 Italy Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.11.3 Spain Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.3.2.11.4 Spain Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.14.3 Austria Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.3.2.14.4 Austria Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Contraband Detectors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.4.4 Asia Pacific Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.5 Asia Pacific Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.4.6 Asia Pacific Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.4.7.2 China Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.7.3 China Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.4.7.4 China Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.4.8.2 India Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.8.3 India Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.4.8.4 India Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.4.9.2 Japan Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.9.3 Japan Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.4.9.4 Japan Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.4.10.2 South Korea Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.10.3 South Korea Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.4.10.4 South Korea Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.11.3 Vietnam Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.4.11.4 Vietnam Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.4.12.2 Singapore Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.12.3 Singapore Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.4.12.4 Singapore Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.4.13.2 Australia Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.13.3 Australia Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.4.13.4 Australia Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Contraband Detectors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.5.1.4 Middle East Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.5 Middle East Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.5.1.6 Middle East Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.7.3 UAE Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.5.1.7.4 UAE Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Contraband Detectors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.5.2.4 Africa Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.5 Africa Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.5.2.6 Africa Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Contraband Detectors Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.6.4 Latin America Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.5 Latin America Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.6.6 Latin America Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.6.7.2 Brazil Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.7.3 Brazil Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.6.7.4 Brazil Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.6.8.2 Argentina Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.8.3 Argentina Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.6.8.4 Argentina Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.6.9.2 Colombia Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.9.3 Colombia Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.6.9.4 Colombia Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Contraband Detectors Market Estimates and Forecasts, By Screening Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Contraband Detectors Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Contraband Detectors Market Estimates and Forecasts, By Deployment Type (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Contraband Detectors Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

12. Company Profiles

12.1 Smiths Detection

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 OSI Systems

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Leidos

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Nuctech Company Limited

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Metrasens

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 ADANI

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 CEIA S.p.A.

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Berkeley Varitronics Systems

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Godrej Security Solutions

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Campbell/Harris Security Equipment Company

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Screening Type

People Screening

Vehicle Screening

Baggage and Cargo Screening

By Deployment Type

Portable

Fixed

By Technology

X-Ray Imaging

Spectroscopy/Spectrometry

Metal Detection

Other

By Application

Government

Industrial

Retail

Hospitality

Commercial

Education

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Reed Sensor Market Size was valued at USD 1.74 Billion in 2023 and is expected to reach USD 3.04 Billion by 2032 and grow at a CAGR of 6.5% over the forecast period 2024-2032.

The Ambient Lighting Market size was valued at USD 70.26 billion in 2023 and is expected to reach USD 155.11 billion by 2032 and grow at a CAGR of 9.20% over the forecast period 2024-2032.

The Circuit Protection Market Size was valued at USD 49.28 Billion in 2023 and is expected to grow at a CAGR of 5.79% to reach USD 81.52 Billion by 2032.

The Occupancy Sensor Market Size was valued at USD 2.76 billion in 2023 and is expected to grow at a CAGR of 10.87% to reach USD 6.96 billion by 2032.

The Crop Monitoring Market Size was valued at USD 3.05 billion in 2023 and is expected to grow at a CAGR of 15.04% to reach USD 10.71 billion by 2032.

The Flexible Display Market Size was valued at USD 36.78 billion in 2023 and is expected to reach USD 255.29 billion by 2032 and grow at a CAGR of 24.02% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone