Get More Information on Continuous Glucose Monitoring Market - Request Sample Report

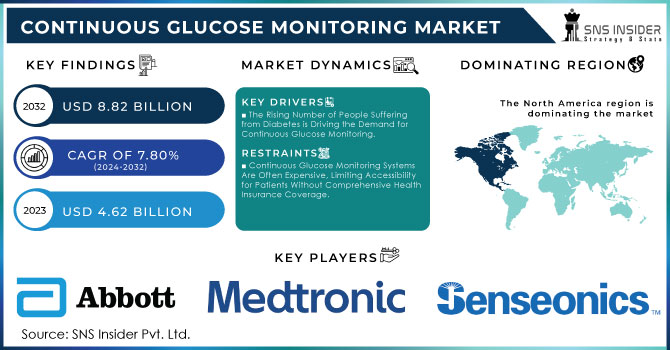

The Continuous Glucose Monitoring Market Size was valued at USD 4.62 Billion in 2023, and is expected to reach USD 8.82 Billion by 2032, and grow at a CAGR of 7.80%.

The increase in the prevalence of diabetes owing to aging, obesity, and unhealthy lifestyles is fueling the demand for continuous glucose monitoring. Obesity is the main cause of diabetes. According to WHO, the number of obese people across the globe exceeded 1 billion by 2022. Of these, 650 million are adults, 340 million are adolescents, and the remaining 39 million are children. Also, WHO has projected that in 2025, 167 million people including both children and adults will have poor health owing to weight issues & poor lifestyle which will drive the demand for continous glucose monitoring devices during forecast period. Additionally, diabetes is becoming more and more prevalent across the globe. According to the International Diabetes Federation,there would be 642 million suffering from diabetes in 2040. The statsitics further indicates that the prevalence of diabetes is increasing worldwide, with the highest increase witnessed in low and middle-income countries. All these factors will drive the demand for continous glucose monitoring boosting the market growth.

| Country | Prevalence of diabetes (%) |

| Pakistan | 30.8 |

| French Polynesia | 25.2 |

| Kuwait | 24.9 |

| New Caledonia | 23.4 |

| Northern Mariana Islands | 23.4 |

| Nauru | 23.4 |

| The Marshall Islands | 23 |

| Mauritius | 22.6 |

| Kiribati | 22.1 |

| Egypt | 20.9 |

Note : The following table shows the top 10 countries or territories with the highest estimated prevalence of diabetes in adults aged 20–79 in 2021.

The CGM devices are minimally invasive and thus provide a simple and effective way of managing diabetes. In addition, they can detect sudden and abnormal blood glucose concentrations, thus preventing hypoglycaemic implications. The appliances allow for the analysis of blood glucose changes at different intervals using a given sensor. The resultant data are wirelessly transmitted from the sensor to a diabetes management system. These outputs help the patients to understand the disease better, thus managing it effectively. The common risk factors associated with diabetic disorders comprise smoking, obesity, physical inactivity, high blood pressure, and high cholesterol.

Key Drivers:

The Rising Number of People Suffering from Diabetes is Driving the Demand for Continuous Glucose Monitoring.

The Unhealthy Lifestyle Is Leading to The Rise of People Suffering from Diabetes.

The Rising Demand for Continuously Tracking the Body's Glucose Levels Fueling the Market Growth

Restraints:

Continuous Glucose Monitoring Systems Are Often Expensive, Limiting Accessibility for Patients Without Comprehensive Health Insurance Coverage.

Some CGM Devices Require Frequent Calibration with Blood Glucose Meters, And Users Must Manage Sensor Replacements, Which Can Be Cumbersome.

Opportunity:

Ongoing Innovations in CGM Technology, Such as Fully Implantable Systems, Improved Sensor Accuracy, And Integration With AI, Can Enhance User Experience and Reliability.

With The Increasing Adoption of Telemedicine, CGM Data Can Be Seamlessly Shared with Healthcare Providers, Allowing for Real-Time Monitoring and Adjustments to Diabetes Management, Potentially Expanding the Market for CGM Devices.

By Component

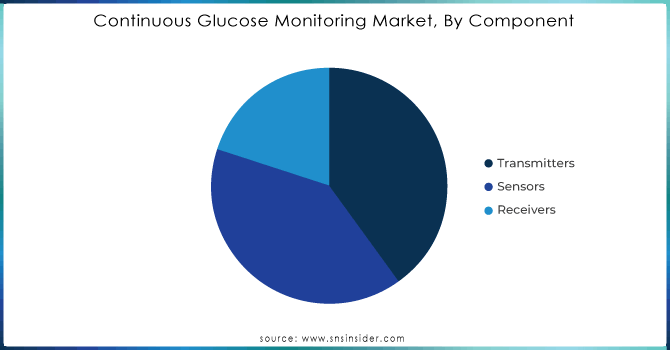

The sensors segment dominated the market in terms of revenue holding 41% of share in 2023. Additionally, the high growth of the segment can be attributed to the technological advancements to improve sensor accuracy during the forecast period. Sensors are an integral part of continuous glucose monitoring devices. Subcutaneous sensors measure glucose levels in the surrounding region using a small filament that is inserted below the skin. The filament, which is thinner than a strand of hair, is held in place by adhesive tape placed at the edge of the sensor. CGM monitors use a chemical called glucose oxidase to monitor blood glucose levels. Glucose oxidase produces hydrogen peroxide from glucose.

In addition, the platinum which is attached to the filament produces an electrical signal. The sensor is also constructed from chemical layers that cover the glucose oxidation, which ensures that the sensor survives in the body when it is at its worst pressure. I expect the transmitters segment to report the highest CAGR during the forecast period, as it is expected to grow at a CAGR of 7.85%. Transmitters are attached to the skin and communicate wirelessly with a sensor that is inserted into the skin. The sensor measures the amount of glucose in the interstitial fluid. Then, the transmitter signals a receiver or a smartphone app to send data to the device, where the user can monitor glucose levels and receive a warning of low or elevated blood sugar levels. Radio waves are used in the transmitter, which is also used in CGM devices that are easy to fold. In addition, the data will be sent from the sensor to the receiver or smartphone app. Also, Near-field Communication sensors and Bluetooth sensors are used.

Need any customization research on Continuous Glucose Monitoring Market - Enquiry Now

By Connectivity

Based on the connectivity, in 2023, the Bluetooth segment led the market with the largest revenue share of 60%. CGM sensors consist of Bluetooth chips in themselves. As the patient hovers over the recording device over the sensor, all the detailed information takes place transferring the blood glucose levels through the Bluetooth in the device. Further, the information is displayed in the reading device. The data may or may not transfer through a 4G network to be saved in the monitor center database. These chips are mainly outsourced by the other CGM manufacturers to provide precise and accurate data capture from the sensor. These chips are being out-sourced by, Nordic Semiconductors, Renesas Electronic, Onsemi, and many others, that develop chips for CGM devices. The lifespan of the chip is 14 days, as the sensors need to be changed. The 4G network segment is expected to witness a CAGR of 7.78% during the forecast period.

The 4G network includes data transfer from the receiving unit to the CGM central monitor database to the service provider database and numerous data points storage through specific CGM mobile applications as well. Such data transfer is considered utmost crucial for the determination of treatment fairways, monitoring alerts, and insulin delivery. There are numerous apps available today to perform such functions and save patient data, that help them to comprehend glucose fluctuation. Apps like Glucose Buddy, Diabetes Connect, My Sugar, Fooducate, My Fitness Pal, and many more are purchased at a rate of approximately $2 – 20 per month or $ 30 – 80 per year. Several other apps or top on the playstore also as Sugarsense or BlueStar Diabeties are available for free download.

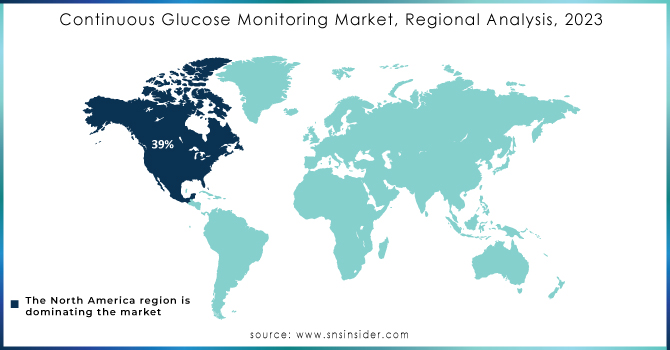

The North American region captured the largest market share of 39% in 2023. The increasing prevalence of diabetes, rising adoption of CGM devices, technological advancement, and the presence of key companies are some of the factors propelling the market growth. In addition, the efforts taken by the federal government to manage the disease at a bigger scale are driving the market growth. The Asia Pacific region is expected to witness the highest CAGR of 8.72 % during the forecast period. According to the Asian Diabetes Prevention Initiative 2018, almost 60% of the world’s diabetic population is in the Asia Pacific region. The high incidence of disease in developing countries like India and China is driving the market growth in the region. In addition, the increasing healthcare expenditure in developing countries increasing investment by companies, and favorable regulatory policies are also positively affecting the market growth in this region.

The players operating in the continuous glucose monitoring market are the following:

Abbott Laboratories: Freestyle Libre 1, Freestyle Libre 3, Freestyle Libre 3 Pro

Dexcom: Dexcom G6, Dexcom G7

Medtronic: Enlite sensor, MiniMed 670G system

Tandem Diabetes Care: t: slim X2 pump

Senseonics Holdings: Eversense XL

Nipro Corporation: Nipro Cosmos system

Roche Diagnostics: Accu-Chek Aviva Plus CGM system

F. Hoffmann-La Roche Ltd: (Parent company of Roche Diagnostics)

Ypsomed: YpsoPump, YpsoDiab system

Insulet Corporation: Omnipod system

Medtrum Technologies: MiaoMiao 2, MiaoMiao 3

FreeStyle Libre: Freestyle Libre 2, Freestyle Libre 3

LifeScan: OneTouch Reveal system

Ascensia Diabetes Care: Contour Next Flash, Contour Next One

B. Braun: Melsungen CGM system

Terumo Corporation: Terumo CGM system

Sanofi: Freestyle Libre 3

ARKRAY: GlucoCard Nexus system

Prodigy Diabetes Care: Prodigy AutoScan system

ACON Laboratories: ACON CGM system

RECENT DEVELOPMENTS

In October 2023, Dexcom, Inc. expanded its presence in Canada with the launch of the Dexcom G7. In September 2023, Senseonics Holdings, Inc. announced the completion of the ENHANCE Pivotal Clinical Study. It showed that Eversense should be used to help effective and sustainable management of diabetes as it demonstrated the proper and secure monitoring for an accurate and safe diabetes management function.

In April 2023, Medtronic Inc. announced the U.S. FDA approval for its MiniMed 780G system with the Guardian 4 sensor.

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.62 Billion |

| Market Size by 2032 | US$ 8.82 Billion |

| CAGR | CAGR of 7.80% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Sensors, Transmitters, Receivers) •By End Use Outlook (Hospitals, Home Care, Others) •By Connectivity Outlook (Bluetooth, 4G) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, Dexcom, Medtronic, Tandem Diabetes Care, Senseonics Holdings, Nipro Corporation, Roche Diagnostics, F. Hoffmann-La Roche Ltd, Ypsomed, and Insulet Corporation & Other players |

| Key Drivers | •The Rising Number of People Suffering from Diabetes is Driving the Demand for Continuous Glucose Monitoring. •The Unhealthy Lifestyle Is Leading to The Rise of People Suffering from Diabetes. •The Rising Demand for Continuously Tracking the Body's Glucose Levels Fueling the Market Growth |

| RESTRAINTS | •Continuous Glucose Monitoring Systems Are Often Expensive, Limiting Accessibility for Patients Without Comprehensive Health Insurance Coverage. •Some CGM Devices Require Frequent Calibration with Blood Glucose Meters, And Users Must Manage Sensor Replacements, Which Can Be Cumbersome. |

Ans : The Continuous Glucose Monitoring Market size was valued at USD 4.62 Bn in 2023.

Ans : The Continuous Glucose Monitoring Market is to grow at aa CAGR of 7.80% over the forecast period 2024-2032.

Ans : The uncertainty related to the accuracy of the glucose levels.

Ans; The U.S. FDA has cleared a reader for its FreeStyle Libre 3 integrated continuous glucose monitoring. Also, the company is working to get this system added to Medicare’s list of covered systems.

Ans : People suffering from Type 1 Type 2 diabetes can actually use this system

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Device Volume: Device usage volumes of pharmaceuticals.

5.4 Healthcare Spending: Expenditure data by government, insurers, and out-of-pocket by patients

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Component Benchmarking

6.3.1 Component specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Component launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Continuous Glucose Monitoring Market Segmentation, by Component

7.1 Chapter Overview

7.2 Transmitters

7.2.1 Transmitters Market Trends Analysis (2020-2032)

7.2.2 Transmitters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Sensors

7.3.1 Sensors Market Trends Analysis (2020-2032)

7.3.2 Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Receivers

7.4.1 Receivers Trends Analysis (2020-2032)

7.4.2 Receivers Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Continuous Glucose Monitoring Market Segmentation, by Connectivity

8.1 Chapter Overview

8.2 Bluetooth

8.2.1 Bluetooth Market Trends Analysis (2020-2032)

8.2.2 Bluetooth Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 4G

8.3.1 4G Market Trends Analysis (2020-2032)

8.3.2 4G Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Continuous Glucose Monitoring Market Segmentation, by End Use

9.1 Chapter Overview

9.2 Hospitals

9.2.1 Hospitals Market Trends Analysis (2020-2032)

9.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Homecare Settings

9.3.1 Homecare Settings Market Trends Analysis (2020-2032)

9.3.2 Homecare Settings Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Others

9.4.1 Others Market Trends Analysis (2020-2032)

9.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Continuous Glucose Monitoring Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.4 North America Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.2.5 North America Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.6.2 USA Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.2.6.3 USA Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.7.2 Canada Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.2.7.3 Canada Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.2.8.2 Mexico Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.2.8.3 Mexico Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Continuous Glucose Monitoring Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.6.2 Poland Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.3.1.6.3 Poland Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.7.2 Romania Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.3.1.7.3 Romania Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Continuous Glucose Monitoring Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.4 Western Europe Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.3.2.5 Western Europe Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.6.2 Germany Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.3.2.6.3 Germany Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.7.2 France Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.3.2.7.3 France Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.8.2 UK Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.3.2.8.3 UK Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.9.2 Italy Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.3.2.9.3 Italy Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.10.2 Spain Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.3.2.10.3 Spain Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.13.2 Austria Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.3.2.13.3 Austria Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Continuous Glucose Monitoring Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.4 Asia Pacific Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.4.5 Asia Pacific Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.6.2 China Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.4.6.3 China Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.7.2 India Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.4.7.3 India Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.8.2 Japan Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.4.8.3 Japan Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.9.2 South Korea Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.4.9.3 South Korea Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.10.2 Vietnam Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.4.10.3 Vietnam Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.11.2 Singapore Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.4.11.3 Singapore Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.12.2 Australia Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.4.12.3 Australia Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Continuous Glucose Monitoring Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.4 Middle East Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.5.1.5 Middle East Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.6.2 UAE Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.5.1.6.3 UAE Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Continuous Glucose Monitoring Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.4 Africa Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.5.2.5 Africa Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Continuous Glucose Monitoring Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.4 Latin America Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.6.5 Latin America Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.6.2 Brazil Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.6.6.3 Brazil Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.7.2 Argentina Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.6.7.3 Argentina Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.8.2 Colombia Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.6.8.3 Colombia Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Continuous Glucose Monitoring Market Estimates and Forecasts, by Component (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Continuous Glucose Monitoring Market Estimates and Forecasts, by Connectivity (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Continuous Glucose Monitoring Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11. Company Profiles

11.1 Insulet Corporation

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Component/ Services Offered

11.1.4 SWOT Analysis

11.2 Abbott Laboratories

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Component/ Services Offered

11.2.4 SWOT Analysis

11.3 Dexcom

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Component/ Services Offered

11.3.4 SWOT Analysis

11.4 Medtronic

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Component/ Services Offered

11.4.4 SWOT Analysis

11.5 Tandem Diabetes Care

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Component/ Services Offered

11.5.4 SWOT Analysis

11.6 Senseonics Holdings

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Component/ Services Offered

11.6.4 SWOT Analysis

11.7 Nipro Corporation

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Component/ Services Offered

11.7.4 SWOT Analysis

11.8 Roche Diagnostics

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Component/ Services Offered

11.8.4 SWOT Analysis

11.9 F. Hoffmann-La Roche Ltd

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Component/ Services Offered

11.9.4 SWOT Analysis

11.10 Ypsomed

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Component/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Component

Transmitters

Sensors

Receivers

By Connectivity

Bluetooth

4G

By End Use

Hospitals

Homecare Settings

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Robotic Nurse Assistant Market Size was USD 1.27 Billion in 2023 and will reach USD 4.55 Billion by 2032 and grow at a CAGR of 15.27% by 2024-2032

The Plasma Fractionation Market Size was valued at USD 29.0 Billion in 2023, and is expected to reach USD 48.58 Billion by 2032, and grow at a CAGR of 6.16% over the forecast period 2024-2032.

Pathology Laboratories Market was valued at USD 355.56 billion in 2023 and is expected to reach USD 720.60 billion by 2032, growing at a CAGR of 8.13% from 2024-2032.

The Inflammatory Bowel Disease Drugs Market size was valued at USD 21.15 Billion in 2023 and is expected to reach USD 27.65 Billion By 2031 and grow at a CAGR of 3.47% over the forecast period of 2024-2031.

Pet Funeral Services Market Size was valued at USD 2.32 billion in 2023 and is expected to reach USD 3.43 billion by 2032, growing at a CAGR of 4.44% over the forecast period 2024-2032.

The Ambulance Equipment Market was valued at USD 5.13 billion in 2023 and is expected to reach USD 7.23 billion by 2032, growing at a CAGR of 3.89% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone