Get More Information on Container Security Market - Request Sample Report

Container Security Market Size was valued at USD 1.92 Billion in 2023 and is expected to reach USD 13.10 Billion by 2032, growing at a CAGR of 23.81% over the forecast period 2024-2032.

The adoption of container applications among enterprises helps to drive the growth of container security market for security models and methods, along with cloud computing across additional sectors. Serverless technologies are on the rise, and solutions like Customer Identity Management (CIAM) offer advanced security to protect company and user data. The shift towards cloud-based platforms such as Zoom and Salesforce, and the success of public cloud providers like AWS, Microsoft Azure, and Google Cloud, further fuel this growth. Enterprise customers demand application portability between clouds with Containers and Docker/Kubernetes simplifying development and reducing Time to Market for Application Development. Such as the purchase by Docker of Tilt in 2022 which adds to Kubernetes development, providing reproducible environments and live updates, helping container adoption. The U.S. Department of Defence (DoD) in 2023 issued an update to its Cybersecurity Maturity Model Certification (CMMC), requiring all defence contractors subject to Level 3 and above certifications be compliant with container security guidelines by 2024. A 47% of IT decision makers in North America are accelerating their deployment of container security solutions as part of cyber defence strategies, according to a 2023 survey by Global Tech Outlook that showed the number was driven largely by rising cyber-attacks against vulnerable containers.

Containerization supports the DevOps model and can help deliver software at scale, which is often required for large-scale IoT systems. Benefit like flexibility, cost effectiveness; Scaling services easily. The trend for businesses becoming more digital is already causing automation and cloud transitions at a faster rate. DevOps is key to this transformation by bringing operations into software and quality practices, making business much agile and adaptive with DevOps. The growth in the container security market is likely to result from these trends. In a study by the National Institute of Standards and Technology (NIST), they found that nearly 30% of all vulnerabilities reported in container environments were around misconfigurations which is stated as most common security issue in this field. The UK National Cyber Security Centre (NCSC) as it stated in its latest annual review that container environments were implicated in 18% of all cybersecurity breaches this year, making the case for better security practices around these.

Market Dynamics

Drivers

The rise in microservices architecture and the adoption of containerized applications have significantly increased the demand for container security solutions to protect these environments.

The increasing frequency and sophistication of cyberattacks targeting container environments have driven the need for robust security measures to safeguard containerized applications.

The growing use of DevOps practices and CI/CD pipelines necessitates container security to ensure secure code deployment and infrastructure management.

The shift towards cloud-native technologies and digital transformation initiatives by enterprises are driving the adoption of container security solutions to protect cloud workloads.

The increasing adoption of containerized applications which is impacting the growth of Container Security Market. Containers provide a lightweight and efficient way to deploy applications, which is why they have been more commonly adopted across industry. Containers have a number of advantages ranging from quicker deployment, to better scaling and resource efficiency on top. It has also increased the attack surface for cyber threats due to this wide use of containers. In fact, over the last year alone about 50% of organizations using containerized applications experienced a security breach, 2023 recent report. This certainly increases the need for powerful container security solutions to protect this threat.

Additionally, as the industry matures and enterprise organizations rapidly adopt microservices architecture, the managing containers and securing containerized applications increase in complexity. The variety of tools available points to the need for specialized security solutions that can work in harmony with DevOps practices and CI/CD pipelines, providing confidence in secure application deployment and operation. The increasing adoption of containers and hybrid cloud architectures, combined with the growing threat landscape is driving the need for holistic container security solutions to protect critical business applications.

Restraints

The complexity involved in deploying and integrating container security solutions with existing IT infrastructure can hinder adoption, especially for smaller organizations.

The shortage of skilled professionals with expertise in container security can be a significant barrier to the implementation and management of these solutions.

As organizations adopt container security solutions, they face challenges integrating these solutions with existing IT infrastructures. According to a 2023 report some IT professionals said that the majority of them (53%) specified integration complexity as an important restriction limiting their capability to implement container security effectively. That complexity is often due to the need for different cloud platform compatibility, as well as with their respective legacy system support that can amount in extensive customization/configuration. A 47% percent of organizations experience frequent deployment time delays related to integration challenges, and that have compromised their security posture overall. These are barriers to integrating container security solutions, which may slow the benefits and discourage some organizations from fully embracing deployment.

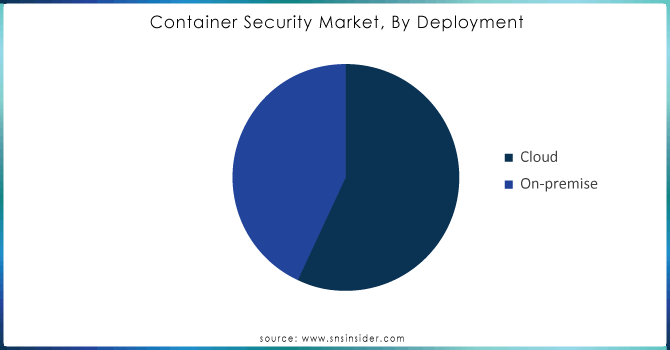

By Deployment

The cloud-based deployment segment accounted for more than 53% share of market in 2023. Even with the rise of cloud computing, security issues still make networks a weak technology for protection from cyber threat and data breaches. Because personal security measures off-premises are too expensive, companies often turn to computer security software pools which offer similar results of discovery and prevention. This provides a massive opportunity for the sector, as it means that Software as a Service (SaaS) platforms are increasingly accessible to more corporations, and enhancements driven by Artificial Intelligence (AI) can now be used great data resources good security practices proficient services The compelling cost savings associated with cloud-based platforms are encouraging commercial enterprises and government bodies to transition towards the adoption of cloud storage & services which is in turn, propelling demand for cloud-based container security solutions throughout the forecast period.

On-premise segment expected to grow at a significant CAGR over the forecast period. Various companies prefer on-premise solutions as it gives full control business data will be the only place held and upgrades became easy which in turn increases security level to its maximum. On-prem deployments decrease reliance on third party providers since customers can directly monitor and control data. For example, Qualys container security provides visibility and continuous bastion for on-premise containers along with vulnerability scanning that is highly accurate leaving the job of remediating to Security teams. The importance placed on keeping data in house will drive sales of 'on premise' solutions for the during forecast period.

Need any customization research on Container Security Market - Enquiry Now

By Organization size

The large enterprise segment dominated the market with a share of over 54% in 2023, As they are typically managing lots of applications and services for various distributed environments, large enterprises need to constantly update them in order to fulfil business requirements. This includes security, productivity gains and cost savings. These firms are increasingly putting their money in DevOps solutions with an aim to write error-prone code, release high-quality software products and carry out consistent customer interactions. Improved collaboration between development and operational teams due to DevOps leads to better product delivery, encouraging large enterprises in the adoption of container security solutions.

Small & Medium Enterprises (SMEs) segment is projected to grow at the highest CAGR during the forecast period. They also find new ways to increase speed of delivery without creating new mistakes or delays. The SMEs are enabled to absolutely overcome all problems related with service delivery through integration of DevOps tools such as software development, quality assurance and infrastructure operations in a composite automated framework. DevOps leads to smoother processes, reduced delivery time and bottlenecks while increasing speed of production, which in turn enhances overall productivity response towards business needs.

By End User

The IT and telecom segment accounted the highest market share over 20.8% in 2023. The COVID-19 pandemic drove IT and telecom providers to quickly embrace the use of cloud applications/services, so top workers could replicate traditional office-based work experiences from anywhere (remotely), while they traverse legacy network security perimeters. These companies to shift their focus towards developing in-house cloud network security solutions which helped them sustain the market growth. IT and telecom companies are particularly attractive targets due to the sensitive personal data they store, including names, addresses or financial details. The need of the hour for telecom companies is to protect this data and avoid any instances of breaches, which often leads them towards increasing their investments on security solutions. Furthermore, with the growing complexity of global regulatory environments present day telecom companies are also having to evolve and increase their compliance efforts warranting further growth in such sectors.

BFSI segment is projected to exhibit with a significant CAGR. Container technology is imperative for financial institutions to remain competitive against fintech rivals. This is leading many banks to rethink and refresh their IT processes and technologies, thus increasing application portability in this era of heightened operational resilience. Containers Make It Easier for Banks to Implement Microservices, Helping Them Modernize IT at Their Own Pace The innovations are likely to fuel adoption of container security solutions in the BFSI industry over the upcoming years.

Regional analysis

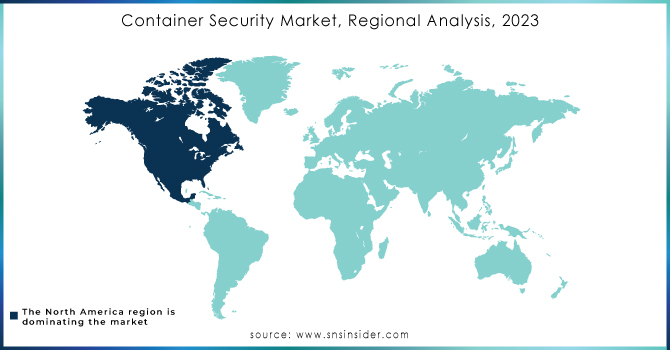

North America dominated the container security market and held largest share more than 32% in 2023. The growth of this region can be attributed to the reliance on emerging technologies by small and medium-sized businesses (SMBs), despite growing microservices demand, as well as a drive towards digital transformation among enterprises. Rapid adoption of cloud solutions by the SMEs is contributing to further business. Intensified way. For instance, Docker (a U.S.-based software provider) purchased Atomist in June 2022 to further equip it's the company secure software supply chain within businesses. With this acquisition, client organizations can now see and govern their software supply chains without adding friction to existing workflows and tools. These factors are anticipated to propel the demand of container security solutions in North America throughout the forecast period.

APAC region is growing with a significant CAGR during forecast period. This growth is driven by the rising load of organizational data, increasing number of SMEs and vulnerability management applications being extensively used for tackling cyberattacks. According to Red Hat’s 2022 survey, a majority of IT executives in Asia Pacific are employing open-source code for DevOps teams overseeing infrastructure updates. Furthermore, leading IT solutions in the region seek for superior software development practices followed by advanced technologies backed with professional endorsements; which has consequently created traction for container security solution offerings across enterprise scale businesses within Asia Pacific during the forecast timeline.

The key market players are NeuVector, enSilo, VMware, IBP Corporation, McAfee Corporation, Palo Alto Networks, Aqua Security, Juniper Networks, CrowdStrike Holdings, Fidelis Cybersecurity, Tenable Inc, Check Point Software Technologies, Aqua Security, Cisco System, Inc., Sonatype, and others.

The Kaspersky released a complete solution for container environments, called Kaspersky Container Security (KCS), in October 2023. The intention of the product is to secure container applications from development to production. KCS is production-ready, low-cost and modular for easy customization and deployment within a company's IT ecosystem.

The same month in 2023, Net Feasa revealed a patent-pending update on its IoTPASS smart container tracking system that would be further secure. It is the secure link between a shipping container and its locking bar, It utilizes Net Feasa's context-aware AI to intelligently detect security breaches and anomalies.

Palo Alto Networks purchased Cider Security in November 2022, a company that specializes software supply chain and application security (AppSec). The purchase is in support of Palo Alto's Prisma Cloud strategy to secure the full stack of application security through its lifecycle.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.92 Bn |

| Market Size by 2032 | USD 13.10 Bn |

| CAGR | CAGR of 23.81% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Components (Products, Services) • By Organizational Size (Small & Medium Enterprises, Large Enterprises) • By Deployment (Cloud, On-premises) • By End User (BFSI, Retail & Consumer Goods, Healthcare & Life Science, Manufacturing, IT & Telecommunication, Government & Public Sector, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | NeuVector, enSilo, VMware, IBP Corporation, McAfee Corporation, Palo Alto Networks, Aqua Security, Juniper Networks, CrowdStrike Holdings, Fidelis Cybersecurity, Tenable Inc, Check Point Software Technologies, Aqua Security, Cisco System, Inc., Sonatype |

| Key Drivers | • Popularity of microservices and digital transformation are consistently Increasing across enterprises. • Containers are being used by businesses to optimize their application operations increasingly |

| Market Restraints | • Absence of awareness and facing challenges in operations about operational technology. • Insufficient financial stability for small and medium-sized businesses. |

Ans: Yes, you can ask for the customization as pas per your business requirement.

Ans: The Container Security Market size was valued at USD 1.92 Bn in 2023.

Ans. • Popularity of microservices and digital transformation are consistently Increasing across enterprises.

• Containers are being used by businesses to optimize their application operations increasingly.

Ans: The Container Security Market is to grow at a CAGR of 23.81% Over the Forecast Period 2024-2032.

Ans. The major key players in the Container Security Market are IBM, Fidelis Cybersecurity, VMware, McAfee Corporation, Palo Alto Networks, and others in final report.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, By Region

5.3 Cybersecurity Incidents, By Region (2020-2023)

5.4 Cloud Services Usage, By Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Container Security Market Segmentation, by component

7.1 Chapter Overview

7.2 Products

7.2.1 Products Market Trends Analysis (2020-2032)

7.2.2 Products Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Million)

8. Container Security Market Segmentation, By Organizational Size

8.1 Chapter Overview

8.2 Small & Medium Enterprises

8.2.1 Small & Medium Enterprises Market Trends Analysis (2020-2032)

8.2.2 Small & Medium Enterprises Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Large Enterprises

8.3.1 Large Enterprises Market Trends Analysis (2020-2032)

8.3.2 Large Enterprises Market Size Estimates and Forecasts to 2032 (USD Million)

9. Container Security Market Segmentation, by Deployment

9.1 Chapter Overview

9.2 Cloud

9.2.1 Cloud Market Trends Analysis (2020-2032)

9.2.2 Cloud Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 On-premises

9.3.1 On-premises Market Trends Analysis (2020-2032)

9.3.2 On-premises Market Size Estimates and Forecasts to 2032 (USD Million)

10. Container Security Market Segmentation, by end user

10.1 Chapter Overview

10.2 Retail & Consumer Goods

10.2.1 Retail & Consumer Goods Market Trends Analysis (2020-2032)

10.2.2 Retail & Consumer Goods Market Size Estimates and Forecasts to 2032 (USD Million)

10.3 BFSI

10.3.1 BFSI Market Trends Analysis (2020-2032)

10.3.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Million)

10.4 Healthcare & Life Science

10.4.1 Healthcare & Life Science Market Trends Analysis (2020-2032)

10.4.2 Healthcare & Life Science Market Size Estimates and Forecasts to 2032 (USD Million)

10.5 IT & Telecommunication

10.5.1 IT & Telecommunication Market Trends Analysis (2020-2032)

10.5.2 IT & Telecommunication Market Size Estimates and Forecasts to 2032 (USD Million)

10.6 Manufacturing

10.6.1 Manufacturing Market Trends Analysis (2020-2032)

10.6.2 Manufacturing Market Size Estimates and Forecasts to 2032 (USD Million)

10.6 Government & Public Sector

10.6.1 Government & Public Sector Market Trends Analysis (2020-2032)

10.6.2 Government & Public Sector Market Size Estimates and Forecasts to 2032 (USD Million)

10.7 Others

10.7.1 Others Market Trends Analysis (2020-2032)

10.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Container Security Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.2.3 North America Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.2.4 North America Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.2.5 North America Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.2.6 North America Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.2.7 USA

11.2.7.1 USA Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.2.7.2 USA Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.2.7.3 USA Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.2.7.4 USA Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.2.7 Canada

11.2.7.1 Canada Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.2.7.2 Canada Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.2.7.3 Canada Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.2.7.3 Canada Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.2.8 Mexico

11.2.8.1 Mexico Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.2.8.2 Mexico Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.2.8.3 Mexico Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.2.8.3 Mexico Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Container Security Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.1.3 Eastern Europe Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.3.1.4 Eastern Europe Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.3.1.5 Eastern Europe Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.1.5 Eastern Europe Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.1.6 Poland

11.3.1.6.1 Poland Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.3.1.6.2 Poland Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.3.1.6.3 Poland Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.1.6.3 Poland Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.1.7 Romania

11.3.1.7.1 Romania Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.3.1.7.2 Romania Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.3.1.7.3 Romania Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.1.7.3 Romania Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.1.8 Hungary

11.3.1.8.1 Hungary Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.3.1.8.2 Hungary Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.3.1.8.3 Hungary Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.1.8.3 Hungary Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.1.9 Turkey

11.3.1.9.1 Turkey Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.3.1.9.2 Turkey Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.3.1.9.3 Turkey Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.1.9.3 Turkey Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.3.1.11.2 Rest of Eastern Europe Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.3.1.11.3 Rest of Eastern Europe Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.1.11.3 Rest of Eastern Europe Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Container Security Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.2.3 Western Europe Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.3.2.4 Western Europe Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.3.2.5 Western Europe Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.5 Western Europe Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2.6 Germany

11.3.2.6.1 Germany Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.3.2.6.2 Germany Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.3.2.6.3 Germany Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.6.3 Germany Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2.7 France

11.3.2.7.1 France Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.3.2.7.2 France Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.3.2.7.3 France Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.7.3 France Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2.8 UK

11.3.2.8.1 UK Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.3.2.8.2 UK Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.3.2.8.3 UK Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.8.3 UK Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2.9 Italy

11.3.2.9.1 Italy Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.3.2.9.2 Italy Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.3.2.9.3 Italy Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.9.3 Italy Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2.11 Spain

11.3.2.11.1 Spain Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.3.2.11.2 Spain Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.3.2.11.3 Spain Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.11.3 Spain Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2.11 Netherlands

11.3.2.11.1 Netherlands Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.3.2.11.2 Netherlands Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.3.2.11.3 Netherlands Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.11.3 Netherlands Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2.12 Switzerland

11.3.2.12.1 Switzerland Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.3.2.12.2 Switzerland Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.3.2.12.3 Switzerland Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.12.3 Switzerland Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2.13 Austria

11.3.2.13.1 Austria Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.3.2.13.2 Austria Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.3.2.13.3 Austria Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.13.3 Austria Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.3.2.14 Rest of Western Europe

11.3.2.14.1 Rest of Western Europe Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.3.2.14.2 Rest of Western Europe Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.3.2.14.3 Rest of Western Europe Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.14.3 Rest of Western Europe Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Container Security Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.4.3 Asia Pacific Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.4.4 Asia Pacific Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.4.5 Asia Pacific Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.5 Asia Pacific Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.4.6 China

11.4.6.1 China Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.4.6.2 China Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.4.6.3 China Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.6.3 China Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.4.7 India

11.4.7.1 India Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.4.7.2 India Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.4.7.3 India Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.7.3 India Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.4.8 Japan

11.4.8.1 Japan Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.4.8.2 Japan Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.4.8.3 Japan Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.8.3 Japan Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.4.9 South Korea

11.4.9.1 South Korea Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.4.9.2 South Korea Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.4.9.3 South Korea Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.9.3 South Korea Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.4.11 Vietnam

11.4.11.1 Vietnam Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.4.11.2 Vietnam Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.4.11.3 Vietnam Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.11.3 Vietnam Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.4.11 Singapore

11.4.11.1 Singapore Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.4.11.2 Singapore Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.4.11.3 Singapore Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.11.3 Singapore Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.4.12 Australia

11.4.12.1 Australia Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.4.12.2 Australia Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.4.12.3 Australia Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.12.3 Australia Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.4.13 Rest of Asia Pacific

11.4.13.1 Rest of Asia Pacific Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.4.13.2 Rest of Asia Pacific Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.4.13.3 Rest of Asia Pacific Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.13.3 Rest of Asia Pacific Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Container Security Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.1.3 Middle East Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.5.1.4 Middle East Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.5.1.5 Middle East Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.1.5 Middle East Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5.1.6 UAE

11.5.1.6.1 UAE Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.5.1.6.2 UAE Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.5.1.6.3 UAE Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.1.6.3 UAE Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5.1.7 Egypt

11.5.1.7.1 Egypt Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.5.1.7.2 Egypt Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.5.1.7.3 Egypt Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.1.7.3 Egypt Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5.1.8 Saudi Arabia

11.5.1.8.1 Saudi Arabia Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.5.1.8.2 Saudi Arabia Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.5.1.8.3 Saudi Arabia Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.1.8.3 Saudi Arabia Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5.1.9 Qatar

11.5.1.9.1 Qatar Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.5.1.9.2 Qatar Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.5.1.9.3 Qatar Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.1.9.3 Qatar Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.5.1.11.2 Rest of Middle East Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.5.1.11.3 Rest of Middle East Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.1.11.3 Rest of Middle East Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Container Security Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.2.3 Africa Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.5.2.4 Africa Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.5.2.5 Africa Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.2.8.3 Africa Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5.2.6 South Africa

11.5.2.6.1 South Africa Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.5.2.6.2 South Africa Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.5.2.6.3 South Africa Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.2.8.3 South Africa Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5.2.7 Nigeria

11.5.2.7.1 Nigeria Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.5.2.7.2 Nigeria Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.5.2.7.3 Nigeria Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.2.8.3 Nigeria Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.5.2.8 Rest of Africa

11.5.2.8.1 Rest of Africa Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.5.2.8.2 Rest of Africa Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.5.2.8.3 Rest of Africa Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.2.8.3 Rest of Africa Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Container Security Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.6.3 Latin America Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.6.4 Latin America Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.6.5 Latin America Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.6.5 Latin America Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.6.6 Brazil

11.6.6.1 Brazil Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.6.6.2 Brazil Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.6.6.3 Brazil Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.6.6.3 Brazil Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.6.7 Argentina

11.6.7.1 Argentina Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.6.7.2 Argentina Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.6.7.3 Argentina Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.6.7.3 Argentina Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.6.8 Colombia

11.6.8.1 Colombia Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.6.8.2 Colombia Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.6.8.3 Colombia Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.6.8.3 Colombia Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

11.6.9 Rest of Latin America

11.6.9.1 Rest of Latin America Container Security Market Estimates and Forecasts, by component (2020-2032) (USD Million)

11.6.9.2 Rest of Latin America Container Security Market Estimates and Forecasts, By Organizational Size (2020-2032) (USD Million)

11.6.9.3 Rest of Latin America Container Security Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.6.9.3 Rest of Latin America Container Security Market Estimates and Forecasts, By end user (2020-2032) (USD Million)

12. Company Profiles

12.1 NeuVector

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 enSilo

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 VMware

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 IBP Corporation

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 McAfee Corporation

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Palo Alto Networks

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Aqua Security

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Juniper Networks

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 CrowdStrike Holdings

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Fidelis Cybersecurity

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Components

Products

Services

By Organizational Size

Small & Medium Enterprises

Large Enterprises

By Deployment

Cloud

On-premises

By End User

BFSI

Retail & Consumer Goods

Healthcare & Life Science

Manufacturing

IT & Telecommunication

Government & Public Sector

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Online Banking Market Size was valued at USD 4.4 billion in 2023 and is expected to reach USD 6.0 billion by 2032 and grow at a CAGR of 3.6% by 2024-2032.

In-Store Analytics Market was valued at USD 3.8 billion in 2023 and is expected to reach USD 25.9 billion by 2032, growing at a CAGR of 23.8% over 2024-2032.

The Virtual Prototype Market was valued at USD 597.76 million in 2023 and will reach USD 1975.27 million by 2032, growing at a CAGR of 17.31% by 2032.

The Image Recognition Market Size was valued at USD 45.6 Billion in 2023 and will reach USD 165.2 Billion by 2032, growing at a CAGR of 15.4% by 2032.

The Mobile Virtual Network Operator Market was valued at USD 83.2 billion in 2023 and will reach USD 155.8 billion and CAGR of 7.24% by 2032.

Customer Experience Monitoring Market was valued at USD 2.45 billion in 2023 and is expected to reach USD 18.35 billion by 2032, growing at a CAGR of 25.11% from 2024-2032.

Hi! Click one of our member below to chat on Phone