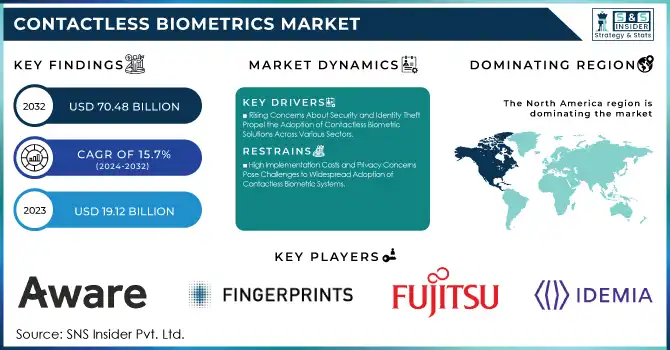

The Contactless Biometrics Market Size was valued at USD 19.12 Billion in 2023 and is expected to reach USD 70.48 Billion by 2032 and grow at a CAGR of 15.7% over the forecast period 2024-2032.

To Get More Information on Contactless Biometrics Market - Request Sample Report

The Contactless Biometrics Market has witnessed a significant transformation in recent years, spurred by advancements in technology, rising security concerns, and the demand for more efficient and non-invasive authentication solutions. Biometrics, such as fingerprint, facial recognition, iris scanning, and voice recognition, have become integral in providing secure access to digital devices, physical spaces, and financial transactions. As society becomes increasingly reliant on digital interactions, the need for reliable, user-friendly, and secure authentication methods is more pronounced. The contactless biometrics market is particularly appealing because it eliminates the need for physical contact, offering higher convenience and hygiene, especially in the post-pandemic era.

Traditional methods of security, such as passwords, PINs, and swipe cards, are increasingly being replaced due to their vulnerability to theft and fraud. Biometrics, on the other hand, offer a more reliable and secure alternative, as they are unique to each individual. This is especially critical in sectors such as banking and finance, where security breaches can lead to significant financial losses. The integration of contactless biometrics ensures that individuals are authenticated quickly and securely without having to physically touch a device, which is particularly important in public spaces or crowded environments.

Rising Concerns About Security and Identity Theft Propel the Adoption of Contactless Biometric Solutions Across Various Sectors

With the rise in identity theft, fraud, and cybercrime, there is an urgent need for more secure and robust methods of identity verification. Traditional authentication methods, such as passwords and PINs, have proven vulnerable to hacking and other forms of cyberattacks, driving businesses to seek alternatives. Contactless biometrics provide a highly secure and efficient solution by leveraging unique physical traits of individuals, such as fingerprints, facial features, and irises, making it almost impossible to forge or steal biometric data.

For instance, with facial recognition the technology has evolved to offer precise and fast identification, even in challenging environments, such as crowded public spaces or low-light conditions.

Governments, financial institutions, healthcare providers, and businesses are increasingly implementing contactless biometric systems to protect sensitive data and reduce fraud. The U.S. government, for example, has implemented biometric authentication in airports to ensure the secure boarding process for passengers. As cyber threats continue to evolve, the demand for contactless biometric solutions is expected to rise, offering an added layer of protection against increasingly sophisticated security breaches and identity theft.

Technological Advancements in AI and Machine Learning Drive Innovation and Efficiency in Contactless Biometric Systems

Artificial Intelligence (AI) and Machine Learning (ML) have revolutionized the contactless biometrics market by enhancing the accuracy, speed, and reliability of biometric systems. AI-powered algorithms allow biometric technologies to continuously improve, adapt to varying conditions, and provide more precise identification and authentication processes. Machine learning, specifically, enables biometric systems to “learn” from data and evolve over time, increasing the system’s ability to recognize subtle differences in facial features, voice patterns, or fingerprints, even when an individual’s appearance changes.

For example, AI-based facial recognition systems can now identify a person even if they change their hairstyle, wear glasses, or age over time. This ability to accurately recognize individuals in real-time, even under challenging circumstances, significantly boosts the market's appeal across sectors such as security, banking, and law enforcement. As more industries realize the benefits of integrating AI and ML into their biometric systems, market growth is expected to accelerate, with both accuracy and user-friendliness improving, leading to increased consumer adoption and industry-wide deployment of contactless biometrics.

High Implementation Costs and Privacy Concerns Pose Challenges to Widespread Adoption of Contactless Biometric Systems

While the potential benefits of contactless biometrics are evident, high implementation costs and privacy concerns remain significant barriers to widespread adoption. Deploying biometric systems, particularly those involving advanced technologies such as AI and facial recognition, can be expensive for businesses and governments, especially those that require large-scale infrastructure. These systems necessitate not only the purchase of high-tech devices but also the integration of backend software, training, and security measures to safeguard biometric data.

Additionally, the collection and storage of biometric data raise substantial privacy concerns. There is ongoing debate over the ethical implications of biometric data use, particularly regarding its potential misuse for surveillance, unauthorized access, or hacking. Public backlash over privacy issues has led to calls for stricter regulations and guidelines on biometric data handling. The potential risk of data breaches or misuse can deter both organizations and consumers from adopting contactless biometrics, making it a critical challenge for the industry. As privacy regulations and consumer confidence continue to evolve, companies must balance innovation with transparency to overcome these hurdles.

In 2023, the Facial Recognition segment dominated the contactless biometrics market, accounting for a substantial 42% revenue share. This technology’s popularity stems from its ability to provide secure and seamless identification without physical contact, making it ideal for a wide range of applications, from security to consumer electronics. Companies like Apple have integrated facial recognition into their smartphones, enhancing device security and user experience.

For example, NEC Corporation launched its NeoFace facial recognition system, which is designed for high-security applications, including in airports and financial institutions. As the demand for contactless, efficient authentication solutions continues to rise, facial recognition remains a frontrunner.

The Iris Recognition segment is emerging as the fastest-growing technology within the contactless biometrics market, with a projected CAGR of 18.21% during the forecast period. This technology offers an incredibly high level of accuracy due to the unique patterns of the human iris, which are stable over a lifetime. Companies such as Iris ID and EyeLock are driving the segment’s growth through product innovations.

For instance, Iris ID introduced the IrisAccess iCAM 7S, a contactless biometric authentication system that provides superior accuracy for access control in high-security environments. Similarly, EyeLock has developed its EyeLock Myris, a USB-powered iris recognition device, targeting both consumer and enterprise markets.

In 2023, the Access Control segment held the largest revenue share, accounting for 45% of the contactless biometrics market. The increasing demand for secure entry systems, especially in high-security environments such as corporate offices, government buildings, and data centers, has propelled the growth of this segment. Contactless biometrics, particularly facial recognition and fingerprint scanning offer enhanced security while reducing the friction and inconvenience of traditional access control methods, such as keycards or PINs.

For example, HID Global launched its HID Biometric Access Control Solutions, which integrates fingerprint and facial recognition technology to provide seamless and secure access for employees and visitors. Similarly, Suprema introduced its BioStation 3, a contactless biometric terminal that supports both face and fingerprint recognition for enhanced security and user convenience.

The Identity Verification segment is projected to experience the highest CAGR of 17.07% during the forecasted period within the contactless biometrics market. This surge is primarily driven by the increasing need for secure and frictionless authentication in online transactions, financial services, and identity management systems. With the growing threat of identity theft, fraud, and cybercrime, businesses and governments are turning to biometric solutions for more accurate and reliable verification.

For example, Jumio introduced its AI-powered identity verification solution, Netverify, which uses facial recognition, document verification, and liveness detection to ensure the authenticity of online users.

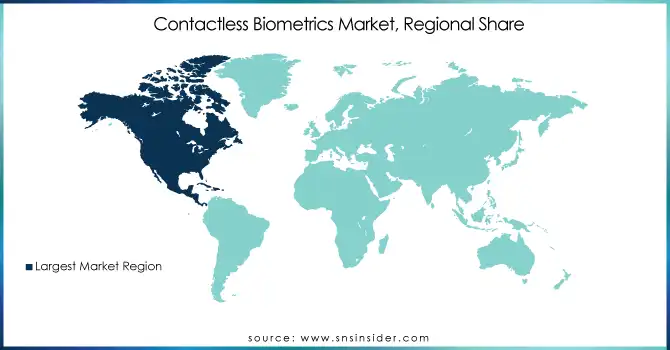

In 2023, North America held the dominant position in the contactless biometrics market, accounting for a significant market share. The region’s dominance can be attributed to several factors, including advanced technological infrastructure, strong adoption of biometric technologies across various industries, and robust government initiatives aimed at enhancing security measures. The U.S. has been a key driver in the growth of this market, with the integration of biometric systems into airports, government buildings, financial institutions, and consumer electronics.

For example, the U.S. Department of Homeland Security has deployed facial recognition systems at major airports for efficient and secure passenger processing, contributing to the growing market. In addition, companies such as Apple and Microsoft have integrated biometric systems like facial recognition and fingerprint scanning into their consumer products, enhancing security and user experience.

The Asia Pacific region is the fastest-growing market for contactless biometrics, with an estimated CAGR of 17.38% during the forecast period. Several factors are driving this rapid growth, including the rising adoption of advanced technologies, increasing security concerns, and expanding applications of biometrics in various industries. Countries such as China, India, Japan, and South Korea are at the forefront of this growth, where biometric systems are increasingly being used in sectors such as government, banking, healthcare, and retail.

For instance, India’s biometric identification program, Aadhaar, which uses fingerprint and iris scanning, is one of the largest biometric projects globally and has created significant demand for biometric solutions in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major players in the Contactless Biometrics Market are:

Aware (Biometric Software Suite, Facial Recognition Solutions)

Fingerprint Cards AB (Fingerprint Sensors, Smart Card Solutions)

Fujitsu (Palm Vein Authentication, Fingerprint Authentication)

HID Global (Biometric Access Control, Biometric Enrollment Station)

IDEMIA (Face Recognition Technology, Biometric Smart Cards)

M2SYS Technology (Biometric Identification Software, Face and Fingerprint Biometric Systems)

NEC Corporation (Facial Recognition Technology, Biometric Access Control Systems)

nVIAsoft (Face Recognition Solutions, Multi-Modal Biometric Solutions)

Touchless Biometric Systems (Touchless Fingerprint Scanner, Face Recognition Systems)

Thales (Biometric Passport Solutions, Biometric Identity Verification)

Veridium (Biometric Authentication Platform, Facial Recognition Solutions)

BioConnect (Face and Fingerprint Biometrics, Identity Management Software)

Innovatrics (Face Recognition Software, Fingerprint Matching Solutions)

Cognitec Systems (Face Recognition Systems, ID Document Authentication)

DERMALOG Identification Systems (Fingerprint and Face Recognition Systems, Biometric Passport Solutions)

SecuGen (Fingerprint Sensors, Biometric Authentication Solutions)

Neurotechnology (Face and Fingerprint Recognition Solutions, Biometrics SDK)

Shufti Pro (Facial Verification, Identity Verification Solutions)

Fidentity (Face Recognition Solutions, Identity Verification Systems)

In July 2024, Fingerprint Cards AB and IN Groupe, a leader in contactless and dual-interface cards, announced the launch of a secure component solution for contactless biometric payment cards through their SPS brand. This initiative aims to help global card manufacturers scale up production of next-generation payment cards.

In September 2023, HID, a global leader in trusted identity solutions, and CERTIFY Health, which provides modern solutions to enhance patient care and experience, announced a new collaboration focused on patient engagement and facial recognition. This offer aims to transform healthcare operations and improve patient service at every touchpoint.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 19.12 Billion |

| Market Size by 2032 | US$ 70.48 Billion |

| CAGR | CAGR of 15.7 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Contactless Fingerprint Recognition, Facial Recognition, Iris Recognition, Palm Vein Recognition, Voice Recognition, Contactless Cards) • By Component (Hardware, Software, Services) • By Application (Identity Verification, Payments & Transactions, Access Control) • By End-Use Industry (BFSI, Government & Law Enforcement, Healthcare, Military & Defense, Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aware, Fingerprint Cards AB, Fujitsu, HID Global, IDEMIA, M2SYS Technology, NEC Corporation, nVIAsoft, Touchless Biometric Systems, Thales, Veridium, BioConnect, Innovatrics, Cognitec Systems, DERMALOG Identification Systems, SecuGen, Neurotechnology, Shufti Pro, Fidentity |

| Key Drivers | • Rising Concerns About Security and Identity Theft Propel the Adoption of Contactless Biometric Solutions Across Various Sectors • Technological Advancements in AI and Machine Learning Drive Innovation and Efficiency in Contactless Biometric Systems |

| Restraints | • High Implementation Costs and Privacy Concerns Pose Challenges to Widespread Adoption of Contactless Biometric Systems |

Ans: The Contactless Biometrics Market is expected to grow at a CAGR of 15.7% during 2024-2032.

Ans: The Contactless Biometrics Market size was USD 19.12 billion in 2023 and is expected to Reach USD 70.48 billion by 2032.

Ans: The major growth factor of the Contactless Biometrics Market is the increasing demand for secure, convenient, and non-invasive authentication solutions across various industries.

Ans: The facial Recognition segment dominated the Contactless Biometrics Market.

Ans: North America dominated the Contactless Biometrics Market in 2023.

Table Of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Consumer Devices with Biometrics, 2023

5.2 Consumer Acceptance and Awareness

5.3 Technology Adoption by Region, 2023

5.4 Investment and Funding Trends

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Contactless Biometrics Market Segmentation, By Component

7.1 Chapter Overview

7.2 Hardware

7.2.1 Hardware Market Trends Analysis (2020-2032)

7.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Software

7.3.1 Software Market Trends Analysis (2020-2032)

7.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Services

7.4.1 Services Market Trends Analysis (2020-2032)

7.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Contactless Biometrics Market Segmentation, By End Use Industry

8.1 Chapter Overview

8.2 BFSI

8.2.1 BFSI Market Trends Analysis (2020-2032)

8.2.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Government & Law Enforcement

8.3.1 Government & Law Enforcement Market Trends Analysis (2020-2032)

8.3.2 Government & Law Enforcement Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Healthcare

8.4.1 Healthcare Market Trends Analysis (2020-2032)

8.4.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Military & Defense

8.5.1 Military & Defense Market Trends Analysis (2020-2032)

8.5.2 Military & Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Retail

8.6.1 Retail Market Trends Analysis (2020-2032)

8.6.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Contactless Biometrics Market Segmentation, By Application

9.1 Chapter Overview

9.2 Identity Verification

9.2.1 Identity Verification Market Trends Analysis (2020-2032)

9.2.2 Identity Verification Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Payments & Transactions

9.3.1 Payments & Transactions Market Trends Analysis (2020-2032)

9.3.2 Payments & Transactions Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Access Control

9.4.1 Access Control Market Trends Analysis (2020-2032)

9.4.2 Access Control Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Contactless Biometrics Market Segmentation, By Technology

10.1 Chapter Overview

10.2 Contactless Fingerprint Recognition

10.2.1 Contactless Fingerprint Recognition Market Trends Analysis (2020-2032)

10.2.2 Contactless Fingerprint Recognition Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Facial Recognition

10.3.1 Facial Recognition Market Trends Analysis (2020-2032)

10.3.2 Facial Recognition Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Iris Recognition

10.4.1 Iris Recognition Market Trends Analysis (2020-2032)

10.4.2 Iris Recognition Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Palm Vein Recognition

10.5.1 Palm Vein Recognition Market Trends Analysis (2020-2032)

10.5.2 Palm Vein Recognition Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Voice Recognition

10.6.1 Voice Recognition Market Trends Analysis (2020-2032)

10.6.2 Voice Recognition Market Size Estimates and Forecasts to 2032 (USD Billion)

10.7 Contactless Cards

10.7.1 Contactless Cards Market Trends Analysis (2020-2032)

10.7.2 Contactless Cards Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Contactless Biometrics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.4 North America Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.2.5 North America Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.6 North America Contactless Biometrics Market Estimates and Forecasts, By Technology(2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.7.2 USA Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.2.7.3 USA Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.7.4 USA Contactless Biometrics Market Estimates and Forecasts, By Technology(2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.8.2 Canada Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.2.8.3 Canada Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.8.4 Canada Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.9.2 Mexico Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.2.9.3 Mexico Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.9.4 Mexico Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Contactless Biometrics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Contactless Biometrics Market Estimates and Forecasts, By Technology(2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.7.2 Poland Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.3.1.7.3 Poland Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.7.4 Poland Contactless Biometrics Market Estimates and Forecasts, By Technology(2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.8.2 Romania Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.3.1.8.3 Romania Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.8.4 Romania Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Contactless Biometrics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.4 Western Europe Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.3.2.5 Western Europe Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.6 Western Europe Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.7.2 Germany Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.3.2.7.3 Germany Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.7.4 Germany Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.8.2 France Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.3.2.8.3 France Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.8.4 France Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.9.2 UK Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.3.2.9.3 UK Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.9.4 UK Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.10.2 Italy Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.3.2.10.3 Italy Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.10.4 Italy Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.11.2 Spain Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.3.2.11.3 Spain Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.11.4 Spain Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.14.2 Austria Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.3.2.14.3 Austria Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.14.4 Austria Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Contactless Biometrics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.4 Asia Pacific Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.4.5 Asia Pacific Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.6 Asia Pacific Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.7.2 China Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.4.7.3 China Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.7.4 China Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.8.2 India Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.4.8.3 India Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.8.4 India Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.9.2 Japan Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.4.9.3 Japan Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.9.4 Japan Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.10.2 South Korea Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.4.10.3 South Korea Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.10.4 South Korea Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.11.2 Vietnam Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.4.11.3 Vietnam Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.11.4 Vietnam Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.12.2 Singapore Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.4.12.3 Singapore Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.12.4 Singapore Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.13.2 Australia Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.4.13.3 Australia Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.13.4 Australia Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Contactless Biometrics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.4 Middle East Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.5.1.5 Middle East Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.6 Middle East Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.7.2 UAE Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.5.1.7.3 UAE Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.7.4 UAE Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Contactless Biometrics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.4 Africa Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.5.2.5 Africa Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.6 Africa Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Contactless Biometrics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.4 Latin America Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.6.5 Latin America Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.6 Latin America Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.7.2 Brazil Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.6.7.3 Brazil Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.7.4 Brazil Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.8.2 Argentina Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.6.8.3 Argentina Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.8.4 Argentina Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.9.2 Colombia Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.6.9.3 Colombia Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.9.4 Colombia Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Contactless Biometrics Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Contactless Biometrics Market Estimates and Forecasts, By End Use Industry (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Contactless Biometrics Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Contactless Biometrics Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

12. Company Profiles

12.1 Aware

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Fingerprint Cards AB

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Fujitsu

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 HID Global

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 IDEMIA

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 M2SYS Technology

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 NEC Corporation

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 nVIAsoft

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Touchless Biometric Systems

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Thales

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

MARKET SEGMENTATION

Contactless Fingerprint Recognition

Facial Recognition

Iris Recognition

Palm Vein Recognition

Voice Recognition

Contactless Cards

By Component:

Hardware

Software

Services

By Application:

Identity Verification

Payments & Transactions

Access Control

By End-Use Industry:

BFSI

Government & Law Enforcement

Healthcare

Military & Defense

Retail

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest Of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Gaming PC Market was valued at USD 57.21 billion in 2023 and is expected to reach USD 180.86 billion by 2032, growing at a CAGR of 13.68% from 2024-2032.

The Asset Management Market Size was valued at USD 484.74 Billion in 2023 and will reach USD 7287.15 Billion by 2032 and grow at a CAGR of 35.2% by 2032.

The Hybrid Model GCC Market Size was valued at USD 38.6 Billion in 2023 and is expected to reach USD 227.0 Billion by 2032 at a CAGR of 19.92% by 2024-2032.

The Esports Market was valued at USD 2.0 billion in 2023 and is expected to reach USD 13.7 billion by 2032, growing at a CAGR of 23.76% from 2024-2032.

The In-building Wireless Market size was valued at USD 18.3 billion in 2023 and is expected to reach USD 48.9 Billion by 2032, growing at a CAGR of 11.57% over the forecast period of 2024-2032.

Optical Character Recognition Market was valued at USD 11.84 billion in 2023 and is expected to reach USD 43.26 billion by 2032, growing at a CAGR of 15.52% by 2032

Hi! Click one of our member below to chat on Phone