Consumer Healthcare Market Report Scope & Overview:

To Get More Information on Consumer Healthcare Market - Request Sample Report

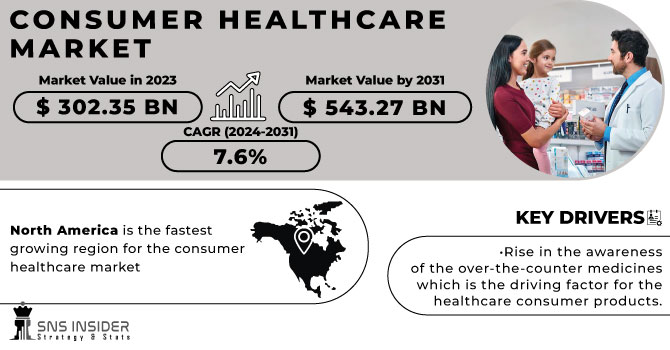

The Consumer Healthcare market was valued at USD 302.87 billion in 2023 and is expected to reach USD 588.68 billion by 2032 and grow at a CAGR of 7.68% over the forecast period of 2024-2032. This report includes an in-depth analysis of trends shaping the consumer healthcare industry. It provides valuable insights into the factors driving its future growth. The study highlights market expansion rates, evolving consumption patterns, and newly emerging products. Additionally, it examines demographic influences, such as the impact of rising health-conscious younger consumers and increasing disposable incomes on demand for healthcare products. The report explores shifting consumer preferences, emphasizing the growing inclination toward personalized wellness solutions, self-care products, and digital healthcare services. Furthermore, it assesses the role of e-commerce and omnichannel retailing in transforming product accessibility and distribution in the market.

Market Dynamics:

Drivers

-

The expansion of the consumer healthcare market, including an aging global population, rising health and wellness trends, increased use of digital health tools, the growth of personalized healthcare, and the rise of e-commerce.

Several key drivers are propelling the consumer healthcare market, and an aging global population is one of the major drivers. By 2050, there will be over 2.1 billion people aged 60 and above, accounting for 22% of the world's population. Such a demographic shift will increase the demand for products related to chronic disease management, such as diabetes, hypertension, and cardiovascular disease treatments. Along with this, the health and wellness trend has increased enormously. Consumers have now started taking time for themselves by focusing on self-care and preventive healthcare measures. The growth in the wellness industry is fast-paced, as interest in physical, mental, and emotional wellness through products increases. Digital health tools are being increasingly used and, therefore, are a great factor in growing the consumer healthcare market. The adoption of wearable devices, mobile health apps, and telemedicine has been significantly increased. Consumers can monitor and manage their health in real time. The increasing prevalence of personalized healthcare solutions is also adding momentum to the consumer healthcare market, as more consumers seek products tailored to their individual health needs. The rise of e-commerce also drives this, bringing healthcare products to a wider global reach, especially for populations underserved or living in remote areas, thereby increasing health-related products sold online.

Restraints

-

High healthcare costs remain a primary restraint, particularly in low-income and underserved regions where access to essential healthcare products and services is limited.

There are rising prices for medications, increasing health insurance premiums, and a rise in out-of-pocket spending in many countries, which will further reduce consumers' ability to buy necessary healthcare products. Regulation remains an ongoing challenge to the market. Regulatory requirements around over-the-counter (OTC) products and health devices can be highly heterogeneous across regions and therefore create a complex and very fragmented global marketplace. In some regions, lengthy approval processes or the lack of proper regulatory standards prevent companies from effectively bringing products to market. This inconsistency in regulation is especially evident in the market for supplements and wellness products, where there is a lack of oversight and standardization, leading to consumer mistrust. Another challenge is the spread of misinformation regarding healthcare products, particularly in the supplement and alternative medicine sectors. The spread of false information from various media and unbridled advertisements often continues to mislead consumers and make them skeptical, thus reducing their eagerness to invest in health-related products.

Opportunities

-

The consumer healthcare market presents numerous opportunities, especially in the realm of digital health technologies and personalized healthcare.

The digital health sector is continuing to grow rapidly. Wearable devices, mobile apps, and remote patient monitoring systems are gaining immense popularity in the personal tracking of health data and immediate feedback. The further innovations expected with advancements in technology in the digital health space will lead to opportunities for new products and services catering to consumer demand for convenience and control over their health. Gains are also noted in the trends for personalized care, including tailormade supplements, precision medicine, and personal wellness plans, where consumers have begun demanding the right product uniquely formulated to support their specific genetics, lifestyle, and health demands. Other prospects arise from rising consumer interest in natural and organic products within consumer healthcare, considering more and more people want those that are both sustainably sourced, chemical-free, and gentle on the planet. This shift toward organic, plant-based, and cruelty-free health products aligns with broader consumer trends in wellness and sustainability.

Challenges

-

A key challenge is the lack of standardization in the quality and efficacy of products, particularly in the digital health and wellness sectors.

With the growing number of wearable health devices and mobile health apps, there is a significant gap in terms of quality control, accuracy, and data privacy, which can reduce consumer trust. For example, consumers may be uncertain about the reliability of health data collected by unregulated devices or apps, which could impact their adoption. The lack of consistency in terms of regulations between regions makes the launch of healthcare products on an international level challenging. Varying levels of product approval criteria in different countries push back the launch dates and raise costs for companies trying to enter international markets. Trust with consumers is another critical challenge in the market, especially with a high variety of health-product-related supplements and alternative treatments available in the market. Misleading health claims and false advertising exacerbate the likelihood of consumer skepticism in the absence of strong regulations in certain sectors. In addition, widespread misinformation through digital channels, such as social media, or health forums often undermines confidence in new products and reduces consumer interest.

Segment Analysis:

By Product

OTC (Over-the-Counter) pharmaceuticals dominated the consumer healthcare market in 2023, accounting for 45% of the market share. Increasing consumer preference towards self-medication and the prevalent popularity of OTC drugs for common ailments such as colds, allergies, digestive issues, and pain relief were thus the factors creating this dominance. Furthermore, regulatory approvals for new OTC formulations and the increase in the availability of the aforementioned products through pharmacies, supermarkets, and convenience stores strengthened this base even further. Consumers prefer OTC pharmaceuticals because they cost less than prescription drugs and can easily use them to address minor health issues.

The dietary supplement market became the fastest-growing segment due to increased consumer awareness of preventive healthcare, nutrition, and wellness. The demand for vitamins, minerals, herbal supplements, and functional foods is surging with the increasing concerns regarding immunity, gut health, and chronic disease prevention. Consumers are shifting towards personalized nutrition solutions with growing interest in plant-based, organic, and clean-label supplements. The aging population has also fueled higher demand for bone health, cognitive support, and anti-aging supplements.

By Distribution Channel

The offline distribution channel, including pharmacies, supermarkets, and specialty stores, accounted for over 60% of the market share in 2023. The dominance was attributed to the trust of the consumers in brick-and-mortar retail stores, recommendations from pharmacists, and the opportunity to physically inspect products before buying them. Pharmacies and drugstores continue to be the first option for OTC pharmaceuticals and dietary supplements as they are perceived to be regulatory compliant, instantly available, and backed by the guidance of an expert.

The fastest-growing segment pertains to the online distribution channel, driven by increasing digital adoption, convenience, and access to a larger portion of healthcare products. Consumers are using e-commerce platforms for the direct purchase of OTC drugs and dietary supplements because of doorstep delivery, discounts, and recommendations for specific products that suit their requirements. AI-powered health advice subscription-based supplement services and online payment options have further catapulted consumer shifts towards online shopping.

Regional Analysis:

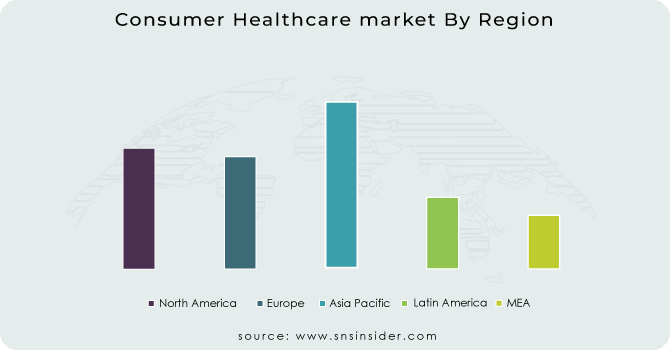

North America was the leading region in the consumer healthcare market, accounting for 42.5% of the market share, due to high consumer awareness, strong healthcare infrastructure, and wide availability of OTC pharmaceuticals and dietary supplements. The U.S. is the leading country, driven by the increasing self-care trend, an aging population, and increased adoption of digital health. Moreover, the region is home to key industry players and is witnessing rapid growth in e-commerce platforms.

Europe followed closely based on well-set healthcare regulations, growing demand for natural and organic supplements, and government initiatives in preventive healthcare. Major contributors among the countries involved are Germany, France, and the U.K. due to the robust pharmacy retail networks existing within these economies and the increased wellness-focused consumers.

Asia-Pacific is growing the fastest with rising disposable incomes, urbanization, and greater awareness about self-medication. Countries like China, India, and Japan see a strong surge in demand for OTC drugs and dietary supplements due to healthcare expenditure growth as well as because of the effect of digital health platforms. On the other hand, expansion in e-commerce, along with rising acceptance of traditional and herbal medicine, supports growth in the region.

Do You Need any Customization Research on Consumer Healthcare Market - Enquire Now

Key Players and Their Consumer Healthcare Products:

-

Teva Pharmaceutical Industries Limited (Advil, Cetirizine, Ratiopharm Vitamins)

-

Abbott Laboratories (Pedialyte, Ensure, Similac)

-

GlaxoSmithKline plc (GSK) (Panadol, Sensodyne, Centrum)

-

Sanofi S.A. (Allegra, Dulcolax, Enterogermina)

-

BASF SE (Newtrition, Dry n-3, Omega-3 Solutions)

-

Boehringer Ingelheim International GmbH (DulcoEase, Buscopan, Mucosolvan)

-

Amway Corp. (Nutrilite, XS Energy, Amway Protein Powder)

-

Pfizer Inc. (Centrum, Advil, Caltrate)

-

Bayer AG (Aspirin, Berocca, Redoxon)

-

Johnson & Johnson (Tylenol, Benadryl, Listerine)

-

Reckitt Benckiser Group plc (Nurofen, Strepsils, Gaviscon)

-

Nestlé Health Science (Garden of Life, Pure Encapsulations, Vital Proteins)

-

Procter & Gamble Co. (Metamucil, Vicks, Pepto-Bismol)

-

Unilever plc (Horlicks, Olly Vitamins, Vaseline)

-

Novartis AG (Theraflu, Excedrin, Voltaren)

-

Herbalife Nutrition Ltd. (Formula 1, Herbal Aloe, Liftoff)

-

DSM Nutritional Products (Quali-D, Maxavor, PeptoPro)

-

Himalaya Global Holdings Ltd. (Liv.52, Septilin, Cystone)

-

Perrigo Company plc (Nasonex, Prevacid, Good Sense Vitamins)

-

Merck KGaA (Seven Seas, Femibion, Nasivin)

Recent Developments:

In Oct 2024, Sanofi canceled its planned spin-off of its consumer healthcare business and is now in exclusive negotiations with U.S. private equity firm Clayton, Dubilier & Rice (CD&R) to transfer a controlling 50% stake in Opella. Opella, Sanofi’s consumer healthcare unit, includes well-known OTC brands like Allegra, Doliprane, and Dulcolax.

In Aug 2024, Strides Pharma Science, through its wholly owned subsidiary Strides Arcolab International (SAIL UK), announced plans to acquire the remaining stake in Strides Global Consumer Healthcare (Consumer UK) from its existing investor. This move aims to strengthen its consumer healthcare presence in the UK market.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 302.87 Billion |

|

Market Size by 2032 |

USD 588.68 Billion |

|

CAGR |

CAGR of 7.68% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product [OTC Pharmaceuticals, Personal Care Products, Dietary Supplements] |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Teva Pharmaceutical Industries Limited, Abbott Laboratories, GlaxoSmithKline plc (GSK), Sanofi S.A., BASF SE, Boehringer Ingelheim International GmbH, Amway Corp., Pfizer Inc., Bayer AG, Johnson & Johnson, Reckitt Benckiser Group plc, Nestlé Health Science, Procter & Gamble Co., Unilever plc, Novartis AG, Herbalife Nutrition Ltd., DSM Nutritional Products, Himalaya Global Holdings Ltd., Perrigo Company plc, Merck KGaA. |