Global Consumer Genomics Market Size and Overview:

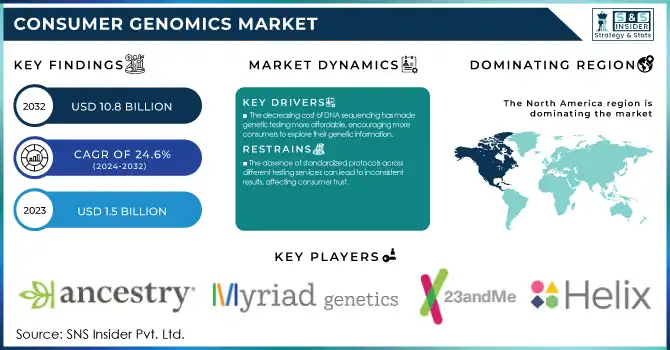

The Consumer Genomics Market Size was valued at USD 1.5 Billion in 2023 and is expected to reach USD 10.8 Billion by 2032, growing at a CAGR of 24.6% over the forecast period 2024-2032.

Get More Information on Consumer Genomics Market - Request Sample Report

The consumer genomics market is booming, with growing interest from the public in the direct consumer market for personalized health care and genetic insights. Increased awareness about genetic susceptibility to diseases and the possibility of prophylactic measures contribute to this growth. An expansion in genetic testing has started, with more than 75,000 genetic tests now available for more than 5,000 conditions, according to the National Institutes of Health (NIH) in 2023. Approximately 1 in 31 babies born in the United States is affected by a genetic, chromosomal, or inherited condition, according to the U.S. Centers for Disease Control and Prevention (CDC), highlighting the need for genetic screening. Furthermore, the National Human Genome Research Institute (NHGRI) states that the cost of sequencing a human genome has dramatically decreased from $100 million in 2001 to less than $1,000 in 2023, making genetic testing more accessible to consumers. As a result, many companies have begun offering direct-to-consumer genetic testing: The U.S. Federal Drug Administration (FDA) has approved several at-home genetic tests for common health conditions. Demand for genetic testing has also increased during the COVID-19 pandemic, with the CDC enumerating over 1.4 million SARS-CoV-2 genomes sequenced in the United States by 2023 and highlighting the importance of genomics in public health.

Furthermore, about 10% of all cancers are found as inherited genetic mutations, according to the National Cancer Institute (NCI), supporting the rise in consumer genomics and cancer risk assessment. Recent advances in genome data analysis using artificial intelligence and machine learning are helping to make genetic interpretations more accurate and faster the NIH's All of Us Research Program will sequence one million genomes by 2025. The increased consumer and physician interest in direct-to-consumer genomic kits as the latter become more affordable and convenient to purchase and do not require a direct prescription from a doctor. This factor is more about the accessibility of tests, but it also illustrates a broader trend when a larger number of people become interested in their personal, customized genomics, which may encompass health, ancestry, and other traits. One of the catalysts for this change is the rapid technological advancements, which allow for more precise and various genetic analyses. Such technological evolution facilitates a permanent technological base that enables more applications of the various tests for consumer genomics in addition to ancestry identification health risks, and other traits, which can also be tested for, such as personalized nutrition. As a result of this effect, there are many more and increasingly sophisticated DTC tests, catered to meet specific needs, such as sports performance, or those to support ongoing research.

Consumer Genomics Market dynamics

Drivers

-

The decreasing cost of DNA sequencing has made genetic testing more affordable, encouraging more consumers to explore their genetic information.

-

Advancements in genetic testing technologies, such as next-generation sequencing (NGS) and CRISPR, have enhanced the accuracy, affordability, and accessibility of genetic tests for the general public.

The genetic testing technologies and the way it has been practiced have been revolutionized by technological advancements. Modern methods have made genetic testing more accurate, affordable, and accessible. The first innovation that has changed genetics is sequencing. Next-generation sequencing has transformed the process of mutation identification using a comprehensive assessment of the human genome. NGS allows improved proficiency and costs only a portion of the cost of traditional testing. Thanks to NGS, scientists and experts can identify a higher number of genetic mutations. To correct genetic mutations and explore gene functions, scientists and specialists can use CRISPR, a recent development in the area of genome editing. This technology has numerous therapeutic implications, and it has also contributed to an improvement in the peerless. It has helped to reduce the costs of all genetic testing procedures. As a result of the application of innovative technologies, such as NGS, CRISPR, and others, genetic testing has become more accurate and less costly, which has allowed the opening of multiple clinics that offer public affordable and accurate genetic testing. In the future, these technologies will develop even further and help humanity to reach new milestones.

-

Growing consumer awareness and health consciousness, fueled by a desire to understand genetic predispositions and make informed lifestyle choices, is driving higher demand for consumer genomics services.

Growing consumer awareness and health consciousness are significantly boosting the demand for consumer genomics services. Consumers are increasingly motivated by a desire to gain information about their genetic predispositions, which helps them make informed lifestyle and health decisions. This heightened interest is driven by a growing awareness of how genetics can influence various aspects of health, from susceptibility to chronic diseases to responses to different diets and exercise regimens. Consumers are seeking personalized solutions that go beyond traditional health and wellness approaches, aiming for a deeper understanding of their genetic makeup to tailor preventive measures and optimize their well-being. This shift is also supported by advancements in genomic technologies and decreasing costs, making genetic testing more accessible and appealing. The rise of direct-to-consumer genetic testing companies has further fueled this trend, providing consumers with convenient and user-friendly tools to explore their genetic information. As a result, there is a burgeoning market for services that offer genetic insights and personalized health recommendations, reflecting a broader trend towards individualized health management and proactive lifestyle choices.

Restraints

-

The absence of standardized protocols across different testing services can lead to inconsistent results, affecting consumer trust.

-

Due to fears of misuse or unauthorized access, privacy and data security concerns surrounding the collection and storage of genetic data can hinder the growth of the consumer genomics market.

Privacy and data security concerns pose significant barriers to the growth of the consumer genomics market. As genetic data becomes increasingly accessible through various consumer services, there is heightened anxiety about how this sensitive information is collected, stored, and utilized. Consumers fear misuse of their genetic data, including unauthorized access or potential exploitation by third parties, such as insurance companies or employers. This trepidation can lead to reluctance to share personal genetic information, thereby stifling market expansion. Ensuring robust data protection measures and clear privacy policies is crucial for alleviating these concerns and fostering consumer trust. Without addressing these issues, the consumer genomics market may face slower adoption rates and restricted growth, as individuals prioritize their privacy over potential benefits.

Consumer Genomics Market Segment Analysis

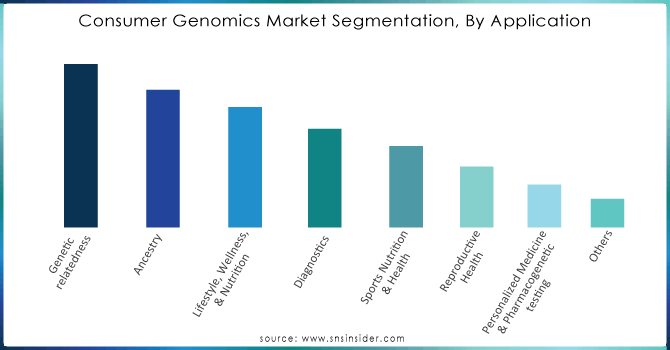

By application

In 2023, the genetic-relatedness segment accounted for the highest revenue share 21%. The dominance of the genetic-relatedness segment is expected due to an increase in interest in ancestry and heritage discovery. U.S. Census Bureau data shows that the share of Americans describing themselves as multiracial grew to nearly 9% by 2020, up from just 2.9% in 2010, suggesting a growing interest in exploring genetic background. As a result of this, there has been an increase in genetic testing services focused on ancestry. In 2023, the at-home ancestry segment is to demonstrate its prowess with over 26 million people taking at-home ancestry tests, according to the National Institutes of Health (NIH).

Conversely, the lifestyle, wellness & nutrition segment is projected to grow at a faster CAGR in the forecast period. A rapidly growing lifestyle, wellness & nutrition segment is fuelled by the demand for personalized health and preventive care. According to the CDC, 6 in 10 US adults have a chronic disease, and 4 in 10 have two or more chronic diseases. The widespread nature of chronic conditions has contributed to the desire to utilize genetic findings within disease prevention and management. Personalized nutrition by genetic info can reduce chronic disease risk by 30% at least, as reported by the U.S. Dept. of Health and Human Services. In fact, since 2020, the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) has spent more than $150 million on research related to spending in the field of nutrigenomics and personalized nutrition, indicating a shift in the relevance of research in this area. Several nutrigenetic tests approved for direct-to-consumer use by the FDA have also aided segmentation growth, as they provide the public with personalized nutrition recommendations.

Need any customization research on Consumer Genomics Market - Enquiry Now

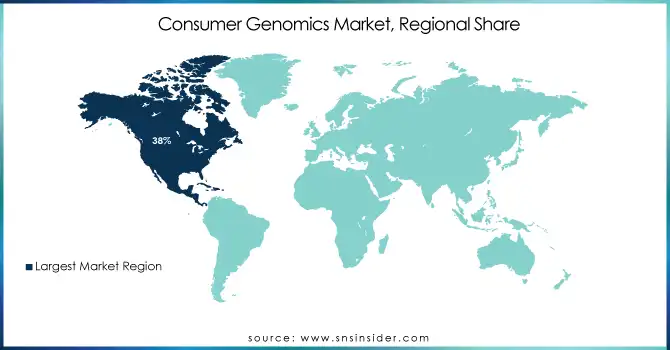

Regional Analysis

In 2023, North America accounted for the largest consumer genomics market share of 38%, the dominance can be attributed to developed healthcare infrastructure, high consumer awareness, and huge investments in genomic research, North America is anticipated to observe high growth in the revenue of consumer genomics market over the forecast period. For context, the U.S. National Institutes of Health (NIH) spent $546 million on genomics research in fiscal year 2023, showing that SEF remains committed to the genomics science in the region. The U.S. Food and Drug Administration (FDA) has given the green light to many direct-to-consumer genetic tests which provides favorable conditions for market development. It shows how far the market is penetrated in the region, based on the report of the Centers for Disease Control and Prevention (CDC) about 1 in 25 Americans have access to their genetic information through direct-to-consumer testing.

On the other hand, Asia Pacific is witnessing rapid growth due to increasing healthcare expenditure, growing awareness regarding genetic testing, and supporting initiatives for genomic research by Governments. For example, in 2021, the Ministry of Science and Technology of China launched the 'National Key Research and Development Program of China' which includes extensive funding for precision medicine and genomics research. Japan corresponds to the "Genomic Medicine Implementation Policy" set by the government, which proposes that more than 100,000 citizens have their genomes sequenced by 2025, driving growth in the market. India's Department of Biotechnology has been a significant catalyst for regional market growth by investing over $65 million in genomics research and infrastructure improvements since 2020. The Asia Pacific region's large population base and increasing prevalence of genetic disorders also contribute to its rapid growth, with the World Health Organization (WHO) estimating that genetic and congenital disorders affect 2-5% of all live births in the region.

Key Players

Service Providers / Manufacturers

-

23andMe, Inc. (Ancestry Service, Health + Ancestry Service)

-

Ancestry.com LLC (AncestryDNA, Traits + All Access Package)

-

Illumina, Inc. (iSeq 100, MiSeq)

-

Thermo Fisher Scientific, Inc. (Ion Torrent, Applied Biosystems Genetic Analyzer)

-

Myriad Genetics, Inc. (myRisk Hereditary Cancer, Prequel Prenatal Screen)

-

Gene by Gene, Ltd. (Family Tree DNA, myDNA Wellness)

-

Color Genomics, Inc. (Color Test, Hereditary Cancer Test)

-

Helix OpCo LLC (DNA Kit, DNA Discovery Kit)

-

Fulgent Genetics, Inc. (Comprehensive Cancer Panel, Carrier Screening Test)

-

Veritas Genetics, Inc. (myGenome, Whole Genome Sequencing Service)

Key Users:

-

Pfizer Inc.

-

GlaxoSmithKline plc (GSK)

-

Novartis International AG

-

Merck & Co., Inc.

-

AstraZeneca plc

-

Roche Holding AG

-

Johnson & Johnson

-

Sanofi S.A.

-

AbbVie Inc.

-

Amgen Inc.

Recent developments:

-

In November 2023: 23 and Me launched 23 and Me+ Total Health, their cutting-edge health membership focused on prevention. This membership offers clinical-grade exome sequencing, biannual blood testing, and unparalleled access to genetics-driven clinical services.

-

Genetic Technologies Limited, a leading provider of genomics-based testing for serious disease and wellness, announced in May 2023 the acquisition of AffinityDNA's direct-to-consumer eCommerce business and distribution rights. It is a strategic move to increase the market share of Genetic Technologies in consumer genomics products.

-

In September 2023: Ancestry launched an update to the 2023 Ethnicity Estimate. This update featured a revised algorithm and reference panels, and it utilized a greater quantity of DNA samples to develop the reference panels compared to previous results.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.5 Billion |

| Market Size by 2032 | USD 10.8 Billion |

| CAGR | CAGR of 24.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Genetic relatedness, Ancestry, Lifestyle, Wellness, & Nutrition, Diagnostics, Sports Nutrition & Health, Reproductive Health, Personalized Medicine & Pharmacogenetic testing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

23andMe, Inc., Ancestry.com LLC, Illumina, Inc., Thermo Fisher Scientific, Inc., Myriad Genetics, Inc., Gene by Gene, Ltd., Color Genomics, Inc., Helix OpCo LLC, Fulgent Genetics, Inc., Veritas Genetics, Inc. |

| Key Drivers |

• The decreasing cost of DNA sequencing has made genetic testing more affordable, encouraging more consumers to explore their genetic information. |

| RESTRAINTS | • The absence of standardized protocols across different testing services can lead to inconsistent results, affecting consumer trust. • Due to fears of misuse or unauthorized access, privacy and data security concerns surrounding the collection and storage of genetic data can hinder the growth of the consumer genomics market. |