To get more information on Construction Equipment Market - Request Free Sample Report

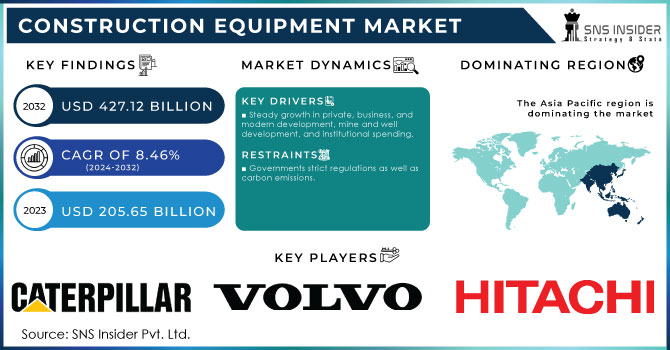

The Construction Equipment Market Size was estimated at USD 179.37 billion in 2023 and is expected to arrive at USD 345.08 billion by 2032 with a growing CAGR of 7.54% over the forecast period 2024-2032. This report provides a unique perspective on the Construction Equipment Market by analyzing regional output trends and utilization rates, offering insights into operational efficiency. It highlights maintenance and downtime metrics, addressing cost implications and fleet reliability. The study also examines technological adoption rates, such as AI-driven diagnostics and electrification trends, across key regions. Additionally, export/import data uncovers shifting trade dynamics. To enhance the analysis, the report includes automation in construction equipment, rental market penetration, and supply chain disruptions, providing a well-rounded view of the industry's evolving landscape.

Drivers

Rising infrastructure investments in roads, bridges, railways, and smart cities are driving demand for advanced, efficient, and technology-driven construction equipment.

The rising investments in infrastructure development, including roads, bridges, railways, and smart cities, are significantly boosting the demand for construction equipment. Across the world, especially in developing economies, governments are earmarking significant budgets to large infrastructure projects that are being pursued for better connectivity and urbanization. This tendency is fuelling the utilization of sophisticated construction equipment, like excavators, loaders, and cranes, in order to enhance the performance and decrease the duration of the projects. Furthermore, as the push towards developing smart cities continues, demand for technologically driven equipment such as IoT smart equipment and other autonomous machinery is on the rise. The construction equipment industry is experiencing consistent growth in demand across the world, driven by an increase in public-private partnerships and foreign direct investments into infrastructure. Several key trends are shaping the industry, including the adoption of electric/hybrid equipment, sustainability-driven innovations, and innovating construction processes through digitalization. The rise in infrastructure projects across the globe would market growth in forecasted period owing to high power output along with fuel efficient as well as automated construction equipment will drive market.

Restraint

High initial investment costs limit the adoption of advanced construction equipment, especially for small and mid-sized firms, due to financial constraints and additional operational expenses.

The high initial investment cost of advanced construction equipment poses a significant barrier to adoption, especially for small and mid-sized construction firms. Excavators, bulldozers, and cranes are all heavy machinery that is expensive and can put a shock to cash flow when purchasing them outright. Moreover, advanced equipment with automation, telematics and green engines compound upfront costs. Many smaller companies have difficulty making such investments because of intermittent project demands and inconsistent construction activity. In addition, financing options are available but often impose high interest rates and as such, ownership becomes more challenging. Thus, a lot of companies decide for rent or lease parts of equipment rather than buying, restricting general market development. On top of this financial burden are the added costs of maintenance, insurance and operator training. Small businesses struggle to compete with better-capitalized players in the industry, but large construction firms can swallow these costs.

Opportunities

The integration of IoT and telematics in construction equipment enhances efficiency, reduces downtime, lowers costs, and optimizes fleet management through real-time monitoring and predictive maintenance.

The integration of IoT and telematics in construction equipment is revolutionizing the industry by enhancing efficiency, safety, and cost-effectiveness. Smart or connected machinery, on the other hand, allows real-time monitoring of equipment performance, fuel consumption, and operational data for predictive maintenance and reduced downtime. Telematics solutions enable monitoring of equipment location, usage patterns, and wear-and-tear, optimizing fleet management and enhancing productivity. By avoiding costly surprise failures and reducing maintenance costs (both timeframe and expense), such technologies increase equipment longevity and reduce overall ownership costs. Moreover, automation powered by IoT improves remote diagnostics and operational control, enabling informed decisions and efficient resource utilization. Smart construction equipment is gaining traction and drawing lucrative investments due to the high demand to enhance efficiency and adhere to stringent regulatory standards. Furthermore, data analytics originating from IoT powered systems assist in preemptive planning, decreasing inefficiencies and promoting profitability. With digital transformation ti, the need for IoT-integrated construction equipment is likely to increase and drive innovation in the sector.

Challenges

Economic uncertainties, including inflation, geopolitical tensions, and market fluctuations, impact infrastructure investments, equipment demand, and overall industry growth.

Economic uncertainties pose a significant challenge to the construction equipment market, as fluctuations in global and regional economies directly impact infrastructure investments. Inflation is increasing the prices of raw materials, fuel and labor; all contributing to a higher cost for construction projects and reducing budget allocations for buying new equipment. And rising interest rates have made it more expensive to finance construction projects and heavy machinery, also putting demand on a tighter leash. Geopolitical tensions, trade restrictions, and supply chain disruptions introduce earnings volatility into equipment availability and pricing, exerting upward pressure on capital and operating costs for manufacturers and end-users alike. Movements in the market, such as economic downturns or declines in key industries like real estate and mining, can cause capital spending to decrease on large-scale construction projects. Cuts in government funding or delays with infrastructure programs because of economic instability further fuel market uncertainty. Hence, construction equipment manufacturers need to implement flexible strategies, such as cost optimization and diversification, to mitigate such economic challenges efficiently.

By Product

The Material handling machinery segment dominated with a market share of over 38% in 2023. This segment comprises the cranes and the forklifts used in lifting, transporting, and placing heavy material at the construction sites. With the rise in the infrastructure development, rapid urbanization, and expanding commercial & industrial projects globally, the demand for material handling machinery is increasing. Equipment efficiency is aided by advancements in automation and smart technologies, in turn enabling adoption. Moreover, government investments in largescale construction projects, logistics, and warehousing have propelled the segment's dominance, firmly establishing it as a key driver of growth in the construction equipment market.

By Equipment Type

The Heavy Construction Equipment segment dominated with a market share of over 62% in 2023, due to its crucial role in large-scale infrastructure projects, mining operations, and commercial construction. From excavators to bulldozers and loaders, these machines are heavy-duty workhorses that are essential for applications such as earthmoving, material handling, and demolition. The demand for heavy equipment is further fueled by poll governments, investing in infrastructure development. Moreover, continuous technological developments like automation and telematics have further increased the efficiency and productivity of this segment leading to its continued dominance. The saga of prominent manufacturers makes it easier to proceed it and the increasing demand for durable, high-performance machinery fuels continuous growth. With construction activities worldwide, the heavy construction equipment segment is projected to continue its dominant position in the market.

By Propulsion Type

The ICE (Internal Combustion Engine) segment dominated with a market share of over 52% in 2023, due to its high-power output, durability, and ability to operate in demanding conditions. Diesel equipment is still the industry standard, offering higher efficiency, longer runtimes and the ability to perform heavy-duty applications in remote and off-grid locations. Its charging infrastructure is also widely implemented. ICE-powered machinery remains the preferred choice due to its reliability and cost-effectiveness even as environmental concerns rise. However, as stricter emissions regulations come into effect and alternative technologies advance, slowly-filling electric and hybrid construction equipment are projected to be on the rise over the following years.

By Power

The <100 HP segment dominated with a market share of over 34% in 2023, due to its extensive use in compact and highly versatile machinery such as mini excavators, skid-steer loaders, and backhoe loaders. These machines are found among urban construction, landscaping and small-scale infrastructure projects where their superior maneuverability is the requirement due to space constraints. Their lower fuel consumption and operational efficiency make them an ideal choice for contractors and businesses to cost-effective. Moreover, rising investments in smart cities and residential developments boost the demand for compact construction equipment. Moreover, the increasing trend towards electrification in this segment also makes it more attractive, as electric and hybrid models have lower emissions and lower operating costs, which appeals to global sustainability goals and stricter emissions regulations.

By Engine Capacity

The 250-500 HP segment holds a significant share due to its versatility and widespread application across key construction activities. This segment comprises formidable construction equipment, including excavators, bulldozers, loaders, and graders, which are crucial for large-scale infrastructure development, road construction, and material handling. The market for these machines is fueled by rising urbanization, government expenditure in infrastructure, and developing commercial and residential construction. And with new technologies such as better fuel economy, automation, and telematics integration only adding to the desirability of this segment. To improve the balance of power and efficiency at a solid 250-500 HP, this tier of machines continues to be the go-to for contractors needing dependable, well-engineered equipment for rugged construction operations.

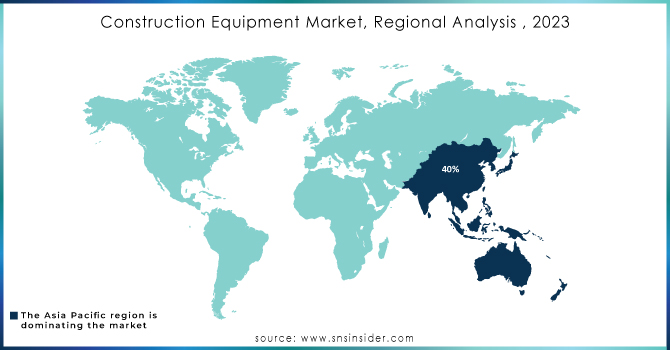

Asia-Pacific region dominated with a market share of over 44% in 2023, due to rapid urbanization, large-scale infrastructure projects, and increasing investments in the construction sector. Even countries like China, India, and Japan lead this segment as they fuel the growing demand for advanced machinery. The development of China's Belt and Road Initiative (BRI) and India's Smart Cities Mission has also played a crucial role in driving construction activities, thus further accelerating the growth of the market. Moreover, the domination of the region is due to initiatives taken by the government, the increasing foreign direct investments (FDI), and the developments in the real estate sector. Adoption of automation, intelligent construction technologies, and environmentally friendly equipment is growing, as well. As populations grow, urban housing needs expand and mega infrastructure projects are under construction, Asia-Pacific is once again the global leader in construction equipment.

North America is the fastest-growing region in the construction equipment market, driven by rising demand for advanced machinery and smart construction technologies. Adoption of automation, telematics, and electric powered equipment is growing across the region to promote efficiency and sustainability. Government initiatives, like the U.S. Infrastructure Investment and Jobs Act, are also spurring large-scale construction projects, from highways and bridges to smart cities. Moreover, emphasis on lowering carbon emissions is boosting the need for energy-efficient and eco-friendly devices. Moreover, the continuous technological progress and increasing presence of prominent industry participants further propel the growth of the market. North America is already in a position to see such booming expansion due to increased investments in residential, commercial, and industrial infrastructure across the region.

Need any customization research on Construction Equipment Market - Enquiry Now

Hitachi Ltd.(Excavators, Loaders, Cranes)

AB Volvo (Wheel Loaders, Articulated Haulers, Excavators)

Caterpillar Inc. (Dozers, Excavators, Loaders, Motor Graders)

CNH Industrial N.V. (Backhoe Loaders, Skid Steer Loaders, Excavators)

Deere And Company (Excavators, Loaders, Scrapers, Backhoes)

Hyundai Doosan Infracore Co. Ltd. (Excavators, Wheel Loaders, Dump Trucks)

J C Bamford Excavators. Ltd (JCB) (Backhoe Loaders, Telehandlers, Excavators)

Komatsu Ltd. (Bulldozers, Dump Trucks, Hydraulic Excavators)

Liebherr-International Ag, (Tower Cranes, Loaders, Mining Trucks)

XCMG Group (Excavators, Road Rollers, Cranes)

Sany Group (Concrete Machinery, Piling Machinery, Cranes)

Terex Corporation (Aerial Work Platforms, Cranes, Material Handlers)

Zoomlion Heavy Industry Science & Technology Co. Ltd. (Excavators, Concrete Machinery, Cranes)

Manitou Group (Telehandlers, Forklifts, Aerial Work Platforms)

Kubota Corporation (Mini Excavators, Tractors, Compact Loaders)

Wirtgen Group (A John Deere Company) (Road Pavers, Cold Milling Machines, Compactors)

Tadano Ltd. (Mobile Cranes, Aerial Work Platforms)

Atlas Copco (Drilling Equipment, Compressors, Power Tools)

Schwing Stetter (Concrete Mixers, Batching Plants, Concrete Pumps)

Mahindra Construction Equipment (Backhoe Loaders, Earthmovers, Road Equipment)

Caterpillar (USA)

Komatsu (Japan)

John Deere (USA)

XCMG (China)

Sany (China)

Liebherr (Germany)

Volvo Construction Equipment (Sweden)

Hitachi Construction Machinery (Japan)

JCB (United Kingdom)

Doosan Bobcat (South Korea)

In May 2024: Volvo CE introduced the EC230, its largest electric excavator, at the Japan CSPI-Expo. This marked the first commercial launch of the EC230 Electric in Asia, with subsequent introductions planned for North America and select European markets.

In February 2024: Deere & Company (US) unveiled the 9RX tractor models, featuring an 830 HP option. The lineup includes three high-horsepower four-track models: 9RX 710, 9RX 770, and 9RX 830.

In November 2023: Komatsu Ltd., through its subsidiary Komatsu America Corp., announced the acquisition of American Battery Solutions, Inc., a U.S.-based battery manufacturer. This acquisition enables Komatsu Ltd. to develop and manufacture its own battery-powered mining and construction equipment by integrating advanced battery technology with its existing expertise.

In May 2023: Caterpillar Inc. introduced the upgraded Cat D10 Dozer, engineered for demanding construction environments and challenging job sites. The new model features load-sensing hydraulics and a stator clutch torque converter to enhance power transmission efficiency.

| Report Attributes | Details |

| Market Size in 2023 | USD 179.37 Billion |

| Market Size by 2032 | USD 345.08 Billion |

| CAGR | CAGR of 7.54% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Products (Earth Moving Machinery (Excavators, Loaders, Dump Trucks, Moto Graders, Dozers), Material Handling Machinery (Crawler Cranes, Trailer Mounted Cranes, Truck Mounted Cranes, Forklift), Concrete and Road Construction Machinery (Concrete Mixer & Pavers, Construction Pumps, Others) • By Equipment Type (Heavy Construction Equipment, Compact Construction Equipment) • By Propulsion Type (ICE, Electric, CNG/LNG) • By Power (<100 HP, 101-200 HP, 201-400 HP, >401 HP) • By Engine Capacity (Up to 250 HP, 250-500 HP, More than 500 HP) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hitachi Ltd., AB Volvo, Caterpillar Inc., CNH Industrial N.V., Deere & Company, Hyundai Doosan Infracore Co. Ltd., J C Bamford Excavators Ltd. (JCB), Komatsu Ltd., Liebherr-International AG, XCMG Group, Sany Group, Terex Corporation, Zoomlion Heavy Industry Science & Technology Co. Ltd., Manitou Group, Kubota Corporation, Wirtgen Group (A John Deere Company), Tadano Ltd., Atlas Copco, Schwing Stetter, Mahindra Construction Equipment. |

Ans: The Construction Equipment Market is expected to grow at a CAGR of 7.54% during 2024-2032.

Ans: The Construction Equipment Market was USD 179.37 billion in 2023 and is expected to reach USD 345.08 billion by 2032.

Ans: Rising infrastructure investments in roads, bridges, railways, and smart cities are driving demand for advanced, efficient, and technology-driven construction equipment.

Ans: The “Material handling machinery” segment dominated the Construction Equipment Market.

Ans: Asia-Pacific dominated the Construction Equipment Market in 2023

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Construction Equipment Market Output, by Region (2020-2023)

5.2 Utilization Rates of Construction Equipment, by Region (2020-2023)

5.3 Maintenance and Downtime Metrics for Construction Equipment

5.4 Technological Adoption Rates in Construction Equipment, by Region

5.5 Export/Import Data for Construction Equipment, by Region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Construction Equipment Market Segmentation, By Product

7.1 Chapter Overview

7.2 Earth Moving Machinery

7.2.1 Earth Moving Machinery Market Trends Analysis (2020-2032)

7.2.2 Earth Moving Machinery Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Excavators

7.2.3.1 Excavators Market Trends Analysis (2020-2032)

7.2.3.2 Excavators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Loaders

7.2.4.1 Loaders Market Trends Analysis (2020-2032)

7.2.4.2 Loaders Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Dump Trucks

7.2.5.1 Dump Trucks Market Trends Analysis (2020-2032)

7.2.5.2 Dump Trucks Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6 Moto Graders

7.2.6.1 Moto Graders Market Trends Analysis (2020-2032)

7.2.6.2 Moto Graders Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.7 Dozers

7.2.7.1 Dozers Market Trends Analysis (2020-2032)

7.2.7.2 Dozers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Material Handling Machinery

7.3.1 Material Handling Machinery Market Trends Analysis (2020-2032)

7.3.2 Material Handling Machinery Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Crawler Cranes

7.3.3.1 Crawler Cranes Market Trends Analysis (2020-2032)

7.3.3.2 Crawler Cranes Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Trailer Mounted Cranes

7.3.4.1 Trailer Mounted Cranes Market Trends Analysis (2020-2032)

7.3.4.2 Trailer Mounted Cranes Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 Truck Mounted Cranes

7.3.5.1 Truck Mounted Cranes Market Trends Analysis (2020-2032)

7.3.5.2 Truck Mounted Cranes Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.6 Forklift

7.3.6.1 Forklift Market Trends Analysis (2020-2032)

7.3.6.2 Forklift Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Concrete and Road Construction Machinery

7.4.1 Temperature Sensors Market Trends Analysis (2020-2032)

7.4.2 Temperature Sensors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.3 Concrete Mixer & Pavers

7.4.3.1 Concrete Mixer & Pavers Market Trends Analysis (2020-2032)

7.4.3.2 Concrete Mixer & Pavers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.4 Construction Pumps

7.4.4.1 Construction Pumps Market Trends Analysis (2020-2032)

7.4.4.2 Construction Pumps Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.5 Others

7.4.5.1 Others Market Trends Analysis (2020-2032)

7.4.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Construction Equipment Market Segmentation, By Equipment Type

8.1 Chapter Overview

8.2 Heavy Construction Equipment

8.2.1 Heavy Construction Equipment Market Trends Analysis (2020-2032)

8.2.2 Heavy Construction Equipment Market Size Estimates and Forecasts To 2032 (USD Billion)

8.3 Compact Construction Equipment

8.3.1 Compact Construction Equipment Market Trends Analysis (2020-2032)

8.3.2 Compact Construction Equipment Market Size Estimates and Forecasts To 2032 (USD Billion)

9. Construction Equipment Market Segmentation, By Propulsion Type

9.1 Chapter Overview

9.2 ICE

9.2.1 ICE Market Trends Analysis (2020-2032)

9.2.2 ICE Market Size Estimates and Forecasts To 2032 (USD Billion)

9.3 Electric

9.3.1 Electric Market Trends Analysis (2020-2032)

9.3.2 Electric Market Size Estimates and Forecasts To 2032 (USD Billion)

9.4 CNG/LNG

9.4.1 CNG/LNG Market Trends Analysis (2020-2032)

9.4.2 CNG/LNG Market Size Estimates and Forecasts To 2032 (USD Billion)

10. Construction Equipment Market Segmentation, By Power

10.1 Chapter Overview

10.2 <100 HP

10.2.1 <100 HP Market Trends Analysis (2020-2032)

10.2.2 <100 HP Market Size Estimates and Forecasts To 2032 (USD Billion)

10.3 101-200 HP

10.3.1 101-200 HP Market Trends Analysis (2020-2032)

10.3.2 101-200 HP Market Size Estimates and Forecasts To 2032 (USD Billion)

10.4 201-400 HP

10.4.1 201-400 HP Market Trends Analysis (2020-2032)

10.4.2 201-400 HP Market Size Estimates and Forecasts To 2032 (USD Billion)

10.5 >401 HP

10.5.1 >401 HP Market Trends Analysis (2020-2032)

10.5.2 >401 HP Market Size Estimates and Forecasts To 2032 (USD Billion)

11. Construction Equipment Market Segmentation, By Engine Capacity

11.1 Chapter Overview

11.2 Up to 250 HP

11.2.1 Up to 250 HP Market Trends Analysis (2020-2032)

11.2.2 Up to 250 HP Market Size Estimates and Forecasts To 2032 (USD Billion)

11.3 250-500 HP

11.3.1 250-500 HP Market Trends Analysis (2020-2032)

11.3.2 250-500 HP Market Size Estimates and Forecasts To 2032 (USD Billion)

11.4 More than 500 HP

11.4.1 More than 500 HP Market Trends Analysis (2020-2032)

11.4.2 More than 500 HP Market Size Estimates and Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Construction Equipment Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.2.4 North America Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.5 North America Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.2.6 North America Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.2.7 North America Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.2.8.2 USA Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.8.3 USA Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.2.8.4 USA Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.2.8.5 USA Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.2.9.2 Canada Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.9.3 Canada Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.2.9.4 Canada Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.2.9.5 Canada Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.2.10.2 Mexico Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.10.3 Mexico Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.2.10.4 Mexico Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.2.10.5 Mexico Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Construction Equipment Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.3.1.8.2 Poland Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.8.3 Poland Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.1.8.4 Poland Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.8.5 Poland Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.3.1.9.2 Romania Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.9.3 Romania Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.1.9.4 Romania Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.9.5 Romania Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Construction Equipment Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.3.2.4 Western Europe Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.5 Western Europe Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.6 Western Europe Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.7 Western Europe Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.3.2.8.2 Germany Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.8.3 Germany Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.8.4 Germany Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.8.5 Germany Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.3.2.9.2 France Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.9.3 France Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.9.4 France Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.9.5 France Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.3.2.10.2 UK Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.10.3 UK Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.10.4 UK Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.10.5 UK Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.3.2.11.2 Italy Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.11.3 Italy Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.11.4 Italy Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.11.5 Italy Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.3.2.12.2 Spain Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.12.3 Spain Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.12.4 Spain Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.12.5 Spain Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.3.2.15.2 Austria Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.15.3 Austria Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.15.4 Austria Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.15.5 Austria Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Construction Equipment Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.4.4 Asia Pacific Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.5 Asia Pacific Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.4.6 Asia Pacific Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.4.7 Asia Pacific Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.4.8.2 China Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.8.3 China Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.4.8.4 China Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.4.8.5 China Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.4.9.2 India Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.9.3 India Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.4.9.4 India Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.4.9.5 India Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.4.10.2 Japan Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.10.3 Japan Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.4.10.4 Japan Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.4.10.5 Japan Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.4.11.2 South Korea Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.11.3 South Korea Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.4.11.4 South Korea Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.4.11.5 South Korea Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.4.12.2 Vietnam Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.12.3 Vietnam Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.4.12.4 Vietnam Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.4.12.5 Vietnam Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.4.13.2 Singapore Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.13.3 Singapore Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.4.13.4 Singapore Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.4.13.5 Singapore Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.4.14.2 Australia Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.14.3 Australia Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.4.14.4 Australia Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.4.14.5 Australia Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.5 Middle East and Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Construction Equipment Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.5.1.4 Middle East Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.5 Middle East Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.1.6 Middle East Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.7 Middle East Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.5.1.8.2 UAE Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.8.3 UAE Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.1.8.4 UAE Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.8.5 UAE Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Construction Equipment Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.5.2.4 Africa Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.5 Africa Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.2.6 Africa Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.7 Africa Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Construction Equipment Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.6.4 Latin America Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.5 Latin America Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.6.6 Latin America Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.6.7 Latin America Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.6.8.2 Brazil Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.8.3 Brazil Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.6.8.4 Brazil Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.6.8.5 Brazil Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.6.9.2 Argentina Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.9.3 Argentina Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.6.9.4 Argentina Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.6.9.5 Argentina Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.6.10.2 Colombia Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.10.3 Colombia Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.6.10.4 Colombia Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.6.10.5 Colombia Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Construction Equipment Market Estimates and Forecasts, By Sensor Type (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America Construction Equipment Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America Construction Equipment Market Estimates and Forecasts, By Sales Channel (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America Construction Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America Construction Equipment Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

13. Company Profiles

10.1 Hitachi Ltd.

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 AB Volvo

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Catterpillar Inc.

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 CNH Industrial N.V

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Deere And Company

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Hyundai Doosan Infracoe Co.Ltd

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 J C Bamford Excavators. Ltd.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Komatsu Ltd

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Liebherr-International Ag

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Xcmg Group

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Earth Moving Machinery

Excavators

Loaders

Dump Trucks

Moto Graders

Dozers

Material Handling Machinery

Crawler Cranes

Trailer Mounted Cranes

Truck Mounted Cranes

Forklift

Concrete and Road Construction Machinery

Concrete Mixer & Pavers

Construction Pumps

Others

By Equipment Type

Heavy Construction Equipment

Compact Construction Equipment

By Propulsion Type

ICE

Electric

CNG/LNG

By Power

<100 HP

101-200 HP

201-400 HP

>401 HP

By Engine Capacity

Up to 250 HP

250-500 HP

More than 500 HP

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Optical Measurement Market size was estimated at USD 5.15 billion in 2023 and is expected to reach USD 9.38 billion by 2032 at a CAGR of 6.89% during the forecast period of 2024-2032.

The Magnetic Separator Market size was valued at USD 1.28 Billion in 2023 and will reach USD 2.05 Billion by 2031, displaying a CAGR of 5.4% by 2024-2031.

The Waste Management Equipment Market was valued at USD 17.98 billion in 2023, and it is expected to reach USD 26.49 billion by 2032, registering a CAGR of 4.4% during the forecast period of 2024-2032.

Agrochemical Tank Market Size was valued at USD 1.42 Billion in 2023 and is expected to reach USD 2.09 Billion by 2032 and grow at a CAGR of 4.47% over the forecast period 2024-2032.

The Oil & Gas Drill Bit Market Size was valued at USD 10.67 billion in 2023 and is supposed to arrive at USD 5.99 billion by 2031 and develop at a CAGR of 7.48% over the forecast period 2024-2031.

Membrane Bioreactor Market size was $ 4.01 billion in 2023 and is anticipated to touch $ 5.46 billion by 2032 and develop at a CAGR of 10.5% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone