Construction Elastomers Market Report Scope & Overview:

The Construction Elastomers Market size was valued at USD 5.7 Billion in 2023. It is expected to grow to USD 9.5 Billion by 2032 and grow at a CAGR of 5.8% over the forecast period of 2024-2032.

The automotive industry's demand for lightweight, versatile materials is driving the growth of the construction elastomers market. Thermoplastic elastomers (TPEs) are popular for their ease of use, design flexibility, and recyclability. Notably, 40% of global TPE consumption goes towards vehicle manufacturing. With the rising production of automobiles over 94 million units globally in 2023 and the growing electric vehicle market in China, the demand for elastomers is expected to surge. These lightweight materials enhance design freedom and contribute to fuel efficiency and reduced emissions, aligning perfectly with the auto industry's evolving priorities. These versatile elastomers are used throughout a car and many can even be recycled, aligning with the auto industry's growing environmental concerns. The rising electric vehicle (EV) market presents another exciting opportunity. Since EVs prioritize lightweight materials and noise dampening, they often require even more elastomers.

Get more information on Construction Elastomers Market - Request Sample Report

Rapidly increasing attention to sustainable and energy-efficient construction has become one of the primary driving forces contributing to the growing popularity of elastomers in green roofing systems. In particular, such materials as ethylene propylene diene monomer and styrene-butadiene-styrene have been extensively applied in the roofing industry. The popularity of elastomers in such contexts can be explained by their unparalleled durability, resistance to harsh weather, specifically, the sun and other UV sources, as well as extreme flexibility for low- and high-temperature applications. In this way, both EPDM and SBS can prolong the lifespan of roofs and reduce maintenance costs.

Furthermore, as the number of green and sustainable construction projects and the accompanying regulations continue to grow, the popularity of using elastomers widely in roofing applications is expected to keep increasing, thus directly driving the market growth in the construction industry. The U.S. Environmental Protection Agency (EPA) reports that green roofs can reduce building cooling costs by up to 50%, depending on the building’s location and design. This reduction is largely due to the enhanced insulation and heat reflection properties provided by materials like EPDM and SBS elastomers.

Drivers

-

Elastomers are increasingly popular in construction due to the combination of strength and flexibility.

Elastomers are resistance to abrasion, tearing, and harsh weather making them ideal for a wide range of applications. From essential building components like roofing membranes and weather stripping to carpeting, wall coverings, and even artificial turf, elastomers offer superior performance. The introduction of TPU and TPE elastomers further elevates construction possibilities. These advanced materials offer exceptional UV protection, enhanced mechanical performance, and increased durability, all while maintaining a visually appealing aesthetic. The ability to custom-color elastomers to match any building design adds another layer of versatility. Collaboration between raw material and elastomer manufacturers is leading to the development of even more specialized solutions for both interior and exterior applications. Ongoing research and development efforts focused on improving elastomer properties further enhance their potential in the ever-evolving construction landscape.

According to the U.S. Department of Commerce, the construction sector contributes approximately USD 1.8 trillion to the U.S. GDP annually, with a significant portion of this attributed to building materials that improve durability and performance. The growing demand for advanced materials like thermoplastic polyurethane (TPU) and thermoplastic elastomers (TPE) aligns with federal initiatives to promote resilience in infrastructure.

Restraint

-

Rising costs and competition challenge construction elastomer market growth

An increase in the prices for construction elastomers is a major challenge for consumers. The constant rise in crude oil and its derivatives, along with increasing labor and energy costs, pushes the price of elastomers upwards. Unlike some materials, elastomers can't use low-cost fillers to bring down the cost. Additionally, the specialized equipment needed for their production requires a high initial investment. This cost pressure, coupled with competition between different elastomer types, restricts market growth. Manufacturers are fighting back by researching cost-cutting production technologies and developing substitutes with less reliance on petrochemicals.

Opportunity

-

Emerging bio-based elastomers in the construction elastomers market.

Bio-based elastomers derived from renewable resources like vegetable oils and fatty acids, are emerging as a strong alternative to traditional materials. Not only do they offer equivalent or even superior properties for construction, electronics, and footwear applications, but their production boasts significant environmental benefits. Biobased elastomers are readily biodegradable, minimizing their environmental footprint compared to their non-renewable counterparts. This, coupled with continuous innovation and commercialization efforts, is creating exciting opportunities for manufacturers. Recognizing this shift, many synthetic elastomer producers are focusing on developing sustainable solutions. Companies like BASF and Lubrizol are leading the charge, offering biobased elastomers for a diverse range of industries, including construction, footwear, automotive, and electronics.

Market segmentation

By Type

The thermoset segment by type has dominated the construction industry and held a share of around 62% in 2023. Their exceptional weather resistance, thermal stability, and durability make them the go-to choice for various construction applications. These champions can withstand harsh environments while retaining their shape and resilience, ensuring superior performance in sealing, insulation, and structural elements. Their impressive chemical resistance adds to their versatility. As the demand for long-lasting building materials intensifies, thermoset elastomers are perfectly positioned to meet the industry's high-performance needs, propelling construction projects worldwide. In India Thermoset prioritizes customer satisfaction by rigorously testing every product against stringent industry standards. This commitment to quality ensures customers receive top-of-the-line kitchenware built to last.

By Chemistry

The styrene block copolymers (SBCs) segment by chemistry has dominated the construction elastomer market which held over 38% share in 2023. Their dominance can be attributed to their versatility. SBCs offer a powerful combination of adhesion, toughness, and flexibility, making them ideal for diverse applications. They can withstand a wide range of weather conditions while maintaining resilience, proving their worth in sealants, adhesives, roofing materials, and insulation. SBCs offer more than just performance, they present exciting opportunities for innovation, including the development of eco-friendly formulas and cutting-edge technology. This focus on sustainability and continuous improvement positions SBCs as a vital partner in meeting the ever-evolving needs of the construction sector for high-performance elastomeric materials.

By Application

The Residential construction sub-segment led the construction elastomer market and captured over 52% of the market share by value in 2023. This dominance is fueled by the impressive physical property’s elastomers offer for homes and buildings. From weatherability and impact resistance to elasticity, flexibility, and aesthetics, elastomers provide a winning combination. Additionally, they boast superior heat resistance, thermal stability, and strong adhesion, and contribute to improved construction safety. By developing innovative and sustainable elastomer solutions that meet the evolving needs of the residential construction industry.

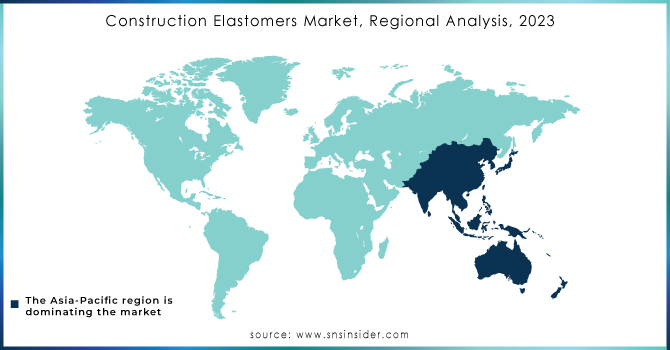

Regional Analysis

The Asia-Pacific region held the largest market share around 44% in 2023. The automotive industry, particularly the rising electric vehicle market in China alone sold 3.3 million units in 2021 and is a major consumer of elastomers used in tires, belts, and hoses. the construction sector across the region is experiencing explosive growth, according to the National Bureau of Statistics China, the output value of construction works reached CNY 25.92 trillion, reflecting an impressive 11% increase. This led to a surge in demand for elastomers used in construction materials like adhesives and sealants. India is also one of the world's largest consumers of construction elastomers. The Indian government's "Make in India" initiative is expected to significantly accelerate the construction industry's growth, further propelling the demand for construction elastomers throughout the forecast period. In essence, a growing automotive industry, a booming construction sector, and an overall rise in infrastructure development solidify Asia-Pacific's position at the forefront of the elastomer market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Raw Key Manufacturers

-

Arkema S.A (Pebax)

-

Dynasol Elastomers (Calprene)

-

BASF SE (Elastollan)

-

Evonik Industries AG (Vestamid)

-

Dow (ENGAGE)

-

SIBUR (SIBUR TPE)

-

Covestro AG (Desmopan)

-

DuPont (Hytrel)

-

Huntsman Corporation (Irogran)

-

Mitsubishi Chemical Company (Thermoplast)

-

Teknor Apex Company (Monprene)

-

China Petroleum and Chemical Corporation (Sinopec TPE)

-

Lubrizol Corporation (Estane)

-

Kraton Corporation (Kraton G)

-

Tosoh Corporation (Nipol)

-

ExxonMobil (Vistalon)

-

LG Chem (LUPOY)

-

Wacker Chemie AG (Elastosil)

-

LANXESS AG (Therban)

-

SABIC (Lexan)

Key Users in End -Use Industry

-

DR Horton

-

Lennar Corporation

-

PulteGroup

-

KB Home

-

Meritage Homes

-

Toll Brothers

-

Century Communities

-

Ryan Homes

-

Hovnanian Enterprises

-

Richmond American Homes

-

Cavco Industries

Recent Development:

-

In February 2023: The isoprene-related product market, Kuraray Co., Ltd. announced the completion of a new factory in Thailand. This facility is expected to come online soon in phases and will boost the global supply chain for key products like MPD, SEPTON, and GENESTAR, catering to the rising global demand for these materials.

-

In February 2024: Arkema ramps up Pebax elastomer production with a new, advanced facility in France. This allows them to produce both their eco-friendly and classic elastomers, used in everything from sports shoes to medical devices.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.7 Billion |

| Market Size by 2032 | US$ 9.5 Billion |

| CAGR | CAGR of 5.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By type (Thermoset, Thermoplastic) • By chemistry (Styrene block copolymers (SBC), Thermoplastic polyurethanes (TPU), Styrene-butadiene (SBR), Ethylene-propylene (EPM/EPDM), Natural Rubber (NR), Thermoplastic polyolefin (TPO), Butyl Elastomer (IIR), Acrylic (ACM) Elastomer, Thermoplastic vulcanizate (TPV), Silicone (Q) Elastomer, Others) • By Application (Residential, Non-residential, Civil Engineering) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Huntsman Corporation, S. A, Chemical Corporation, Dow, Teknor Apex Company, Covestro AG, Lubrizol Corporation,Mitsubishi Chemical Company, BASF SE, Kraton Corporation, China Petroleum, Tosh Corporation, DuPont |

| DRIVERS | • Rising demand from the construction sector |

| Restraints | • Elastomers for building are more expensive than traditional materials. |