Construction Drone Market Size & Trends:

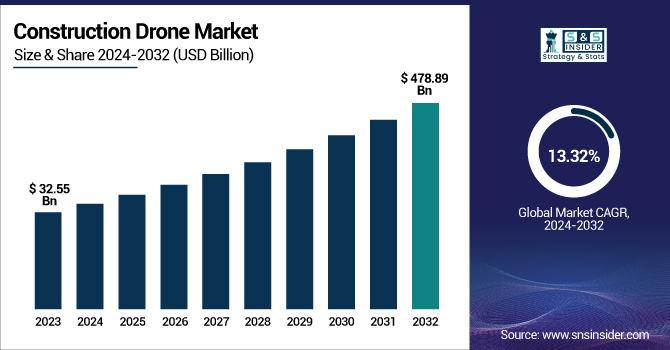

The Construction Drone Market was valued at USD 5.05 billion in 2023 and is expected to reach USD 15.51 billion by 2032, growing at a CAGR of 13.32% over the forecast period 2024-2032.

To Get more information on Construction Drone Market - Request Free Sample Report

The construction drone market is maturing, with drones being used at all stages of a project, starting from site surveying and extending to progress monitoring and inspections. LiDAR and thermal imaging take the guessing out of mapping and structural analysis. That is, the improvement of 5G will allow for more efficient and effective real-time data sharing and control at a greater distance between all components of the telephone, enabling faster and more reliable remote operations. With AI and machine learning, automation is becoming smarter, allowing drones to recognise patterns, identify problems, and fine-tune processes, which is making construction processes safer, more efficient, and faster decision-making possible. The US Construction Survey 2024 gave us more numbers on the actual percentage of drone usage for contractors in the United States. 45% of civil contractors have fully integrated drones into their workflow, rising to 67% for larger firms. More than 1.7 million commercial drone registrations across the country are helping boost this surge. Drones used in construction have increased the measurement accuracy by 61%, and the time taken to acquire data has been cut down by 53%, thus eliminating the hassle of the whole construction process.

The U.S. Construction Drone Market is estimated to be USD 1.44 billion in 2023 and is projected to grow at a CAGR of 12.73%. In addition to traditional efficiencies promising to cut costs and speed up timelines, a combination of factors associated with the U.S. construction drone market is expanding the market tremendously. Drones have become a major tool in surveying building sites, tracking overall progress, and finding design flaws early on, before they can lead to costly rework. They also help in measuring raw materials and making 3D models and 2D maps of the buildings.

Construction Drone Market Dynamics

Key Drivers:

-

Advancing Drone Technology Boosts Construction Efficiency, Safety, and Real-Time Monitoring Across All Project Types

Several key factors are driving the construction drone market, most notably advancements in drone technology, which have made precision, efficiency, and cost savings accessible to a wider range of construction projects. For surveying, inspection, and monitoring purposes, drones are gaining popularity, thus eliminating the need for human resources and enabling expedient data collection in real-time, further reducing timelines for construction projects. The increasing need for safety on construction sites is also anticipated to accelerate the adoption of drones in safety inspection to detect hazards more rapidly and avoid accidents. Market expansion is also aided by regulatory advancements and the wider acceptance of employing drones in construction in residential, commercial, and industrial areas.

Restrain:

-

Regulatory Challenges Limit Drone Adoption in Construction and Hinder Seamless Integration Across Global Project Sites

One of the primary restraints in the construction drone market is regulatory hurdles. Drones are subject to stringent regulations and guidelines that vary by region, which can limit their usage and slow adoption, especially in countries with complex airspace rules. For instance, there are restrictions on drone flight altitudes, no-fly zones, and requirements for pilot certification, all of which can complicate operations, particularly for large-scale industrial projects. The lack of standardized regulations across different regions also creates uncertainty, limiting the market's expansion and hindering the widespread integration of drone technology into construction practices.

Opportunity:

-

Drone Integration Drives Smart Construction Logistics, Sustainability, and Advanced Monitoring with AI and Digital Solutions

With automation and digitalization reaching new heights or perhaps distances in construction, drone integration in logistics and material handling has never been more promising. The use of drones can help organizations in achieving a better supply chain management process as drones allow for quicker deliveries, material tracking, and more accurate stock management. Another opportunity right now lies in the swift emergence of drone-focused software and AI-driven analytic capabilities, which provide construction companies with increasingly advanced tools for the examination, monitoring, and upkeep of construction projects. Furthermore, with the rising importance of sustainability, drones are being used more in promoting environmental monitoring by identifying and mitigating impacts at construction sites, thus further propelling growth opportunities in green and smart city initiatives.

Challenges:

-

Battery Limitations and Skilled Operator Needs Challenge Full Drone Utilization in Construction Industry Operations

Another challenge is the limited battery life and payload capacity of drones, which can restrict their operational time and the scope of tasks they can perform. In construction, where drones are required to cover large areas and carry heavier equipment for inspections or material handling, these limitations can be a significant barrier. Additionally, the need for skilled operators and technical expertise to manage drone operations, handle data collection, and interpret analytics presents another challenge. Without proper training and skilled personnel, construction companies may struggle to fully leverage drone technology, leading to inefficiencies and underutilization of their capabilities.

Construction Drone Market Segmentation Outlook

By Type

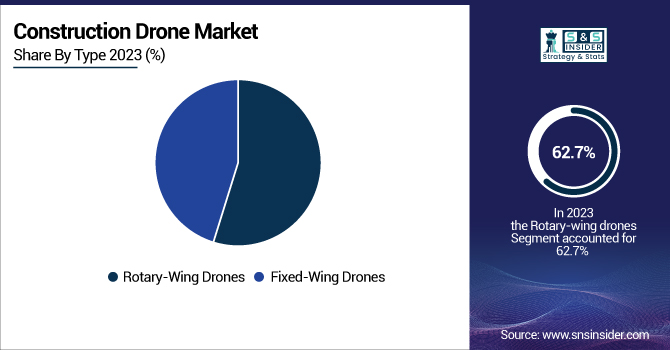

Rotary-wing drones accounted for 62.7% of the construction drone segment in 2023. These drones, though more commonly referred to as quadcopters or multi-rotors, are preferred when versatility, stability, and occasional hover time are required, such as during surveying, inspection, and aerial imaging applications. This makes them particularly useful for construction sites with rugged terrain and cramped spaces, as they can operate in tight spaces and navigate around obstructions. It is because of these features that they are now used frequently in residential, commercial, and industrial construction.

Fixed-wing is projected to witness the highest CAGR during the forecast period of 2024-2032. High-Altitude Long Endurance Drones. These are the favoured drones when a high range and extensive area coverage is required, since they are more capable of enduring long hours in high-speed flight. With high-resolution imagery capturing over large areas and extended battery duration with efficient payload capacity, they are bound to become more useful one day for large-scale construction projects, especially infrastructure monitoring or environmental impact studies. Advancements in drone technology and automation are accelerating this growth even more.

By Application

The surveying segment led the construction drone market with a revenue share of 36.7% in 2023. The major applications where drones are used for surveying are topographic mapping, land surveys, and volumetric surveys. The leading role of the data is majorly attributed to their capability of offering accurate and high-resolution data while in addition, while also minimizing human efforts and maximizing operational efficiency. Plus, the ability of drones to survey hard-to-reach and also dangerous locations makes them even more attractive for use in surveying construction projects.

From 2024 to 2032, safety is expected to see the fastest CAGR. Construction sites are starting to use drones more as part of their safety protocols, allowing them to monitor conditions, spot potential hazards, and confirm compliance with safety regulations. As the need for better construction site safety and a reduction of accidents comes to the forefront, drones are emerging as a critical source of real-time aerial surveillance of sites, allowing for the detection of potential hazards before they develop into major issues (for example, structural integrity or worker safety violations) That rising usage of safety applications is allowing them to proliferate market.

By End-Use

In 2023, the construction drone market in the residential sector will account for the largest share of 38.5% of the overall construction drone market. Drones are being more commonly used these days in residential construction, for land surveying, site inspection, and aerial imaging. They have great potential for improving project efficiency while reducing costs and increasing accuracy, which is why they are a great tool in the process of residential construction. Furthermore, the increasing popularity of smart homes and sustainable building techniques is catalyzing the adoption of drone technology in this industry.

From 2024 to 2032, the industrial sector is anticipated to have the highest CAGR. Drones are used as tools for monitoring large-scale industrial construction projects, monitoring marine logistics, and conducting safety inspections. This capability for monitoring device standing, surveying infrastructure, and conducting the motion of products in real-time makes a large distinction in the industry. Industrial drone usage will keep booming: As industrial construction projects become larger and more intricate, we will see rapid growth in the need for drone technology.

Construction Drone Market Regional Insights

North America accounted for a share of 38.9% in the construction drones market in 2023. With several large construction firms in the area, paired with advancements in drone regulation, this region is sparking chains of drone technology adoption. In the US, construction firms such as Skanska and Bechtel make use of drones for surveying, monitoring the site, and tracking construction progress. Mainly for big infrastructures, drones can serve as useful tools in providing data for planning and, in turn, lowering the costs of fieldwork. Finally, the USA has clear regulatory frameworks like FAA’s Part 107, which have encouraged the development of drone applications in construction.

CAGR in Asia Pacific is projected to be the highest from 2024 to 2032. It represents the rapid growth of the construction industry of nations such as China and India, where drones are continually being utilized for commercial building and mega infrastructure ventures. One such firm, China State Construction Engineering Corporation, has started using drones to survey and monitor large construction areas, increasing workplace safety and productivity. In the same vein, the construction house in India is now using drones for faster land surveys, efficient project execution, and quality control on-site. Along with growing government support for drone technology and the requirement for fast construction processes, this region holds the potential to grow instantly in this market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Major Players in the Construction Drone Market are:

-

DJI (Phantom 4 RTK)

-

Parrot (Anafi USA)

-

Delair (Delair UX11)

-

senseFly (eBee X)

-

Skydio (Skydio 2)

-

Quantum Systems (Quantum Trinity F90+)

-

Autel Robotics (Autel EVO II RTK)

-

Aerovironment (Quantix Mapper)

-

Yuneec (H520 RTK)

-

Flyability (Elios 2)

-

3DR (Site Scan)

-

Kespry (Kespry 2S)

-

Vantage Robotics (Vantage V2)

-

Altitude Angel (Angel UAV)

-

DroneDeploy (DroneDeploy Software)

Recent Development

-

In April 2025, DJI's Zenmuse L2 LiDAR technology is transforming road construction in South Korea, enabling precise topographic surveys and efficient mapping of challenging terrains. The integration of this advanced drone solution is improving safety, reducing project timelines, and enhancing infrastructure development.

-

In October 2024, DELAIR acquired Grenoble-based drone manufacturer SQUADRONE SYSTEM, a leader in drone swarm and industrial inspection technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.05 Billion |

| Market Size by 2032 | USD 15.51 Billion |

| CAGR | CAGR of 13.32% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Fixed-wing drone, Rotary-wing drone) • By Application (Surveying, Inspection & monitoring, Aerial imaging & photography, Safety, Logistics) • By End-Use (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DJI, Parrot, Delair, senseFly, Skydio, Quantum Systems, Autel Robotics, Aerovironment, Yuneec, Flyability, 3DR, Kespry, Vantage Robotics, Altitude Angel, DroneDeploy. |