Get More Information on Construction Chemicals Market - Request Sample Report

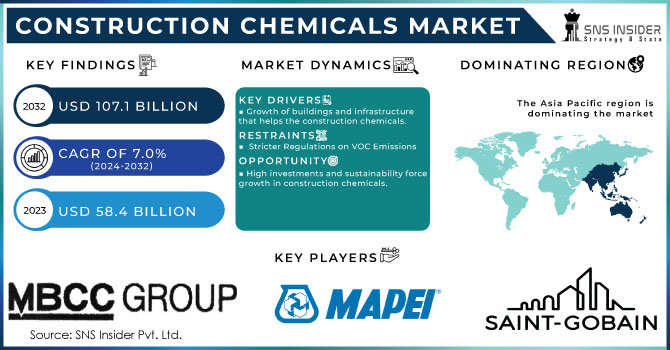

The Construction Chemicals Market was worth USD 58.4 billion in 2023 and is expected to grow to USD 107.1 billion by 2032, with a CAGR of 7.0% in the forecast period 2024-2032.

The construction chemicals market is on a growth trajectory and is expected to reflect high growth levels of demand mainly driven by high-performance and sustainable building solutions. The main drivers of the market are the growth in the need for long-lasting, efficient construction materials owing to urbanization and infrastructure development, and strict regulations about sustainability and environmental concerns. In light of such factors, companies innovate by developing products that meet both performance criteria and eco-friendly requirements. In addition, growth in pre-fabrication and modular construction is fueling demand for specialty chemicals with material property-enhancing properties as well as properties that save time on site.

In August 2024, Brenntag Specialties formed a distribution partnership with Nouryon to further build its portfolio in construction chemicals. In this alliance, Brenntag aimed to combine Nouryon's innovative products with Brenntag's complete distribution network to make quality solutions more accessible to customers. Such cooperation would likely strengthen their market positions and help them respond to the changing needs of the construction sector. Furthermore, the NextGen Summit 2024 highlighted an emerging opportunity in construction chemicals. The demand for innovation and sustainability will be the call to respond to the ever-growing demands of the construction industry.

In recent strategic moves, the leading companies have highlighted efforts to further expand their footprint in the construction chemicals segment. For example, in March 2024, the company made a significant announcement when it announced speeding up its construction chemicals while sustaining the development of breakthrough decarbonization technologies. This action aligns with the global push toward reducing carbon emissions in construction practices, which typifies the company's proactive approach to sustainability. In June 2024, Saint-Gobain strengthened its market position by acquiring a UK-based construction chemicals company for $800 million. It would further bolster its offerings, and thereby the company would be in a better position to take advantage of growth in specialty construction solutions in the UK market.

In April 2024, Univar Solutions and Dow are expanding their partnership to offer the construction industry high-performance building solutions customized for these customers. This must mean that through this partnership Univar and Dow briefed the requirement of bringing innovative products to the market to support the current industry demands in efficiency and sustainability. Combining their different expertise, they will together bring forward advanced solutions that may enhance the construction process and also consider the environmental perspective.

Hence, innovation, collaboration, and sustainability are aspects in which the construction chemical market seeks consolidation as it continues to change to meet the demands of modern construction practice.

KEY DRIVERS:

Growing Demand for Eco-Friendly Products in Various Industries Boosts the Construction Chemicals Market Growth

Rising awareness about environmental sustainability is creating a thrust for green construction chemicals in different sectors. The main reasons are stringent regulations on the environment and the increasing demand for sustainable materials from consumers. Builders, contractors, and developers are increasingly focusing on low-environmental impact construction chemicals without losing performance. The novelty in bio-based and recycled materials is dramatically penetrating the space where ordinary chemicals had long been ruling. They seem to offer several end advantages, including reduced carbon footprints and enhanced energy efficiency. Thus, water-based adhesives and sealants now rule the roost with many construction companies adopting and ensuring that whatever emanates from these are fewer volatile organic compounds (VOCs). This is further fueled by the increasing adoption of green building certifications like LEED. Thus, manufacturers are increasingly focusing on the development of products meeting such changing market demands and contributing to the construction chemicals market growth.

Rapid Urbanization and Infrastructure Development Propel Construction Chemicals Market Growth

Rapid urbanization of the emerging markets, with infrastructure to follow, is one of the major growth drivers for construction chemicals. Such population growth creates demand for housing, more commercial space, and infrastructure including road, bridge, and public utilities construction. As such growth happens, the need for newer innovative construction solutions regarding the durability, safety, and aesthetics of buildings and infrastructure is raised. Along with the necessity to have better construction materials, the use of construction chemicals, such as admixtures, sealants, and coatings, is being increasingly utilized for the improvement of the properties of materials and speeding up the construction pace. The improvement efforts, particularly in developing countries, made by governments also offer profitable opportunities for manufacturers of construction chemicals. For example, most governments are implementing policies that promote the upgrading of transport networks and public facilities, which naturally drives demand for high-performance construction chemicals. This convergence between urban growth and investment in infrastructure is providing a fertile ground for the construction chemicals market, with market stakeholders looking for innovative yet dependable solutions to tackle some of the biggest challenges of modern construction.

RESTRAIN:

High Cost of Raw Materials Acts as a Restraint in the Construction Chemicals Market

Fluctuating raw material prices are thus a major concern for the construction chemicals market. Most of these construction chemicals rely on petrochemical derivatives and other raw materials that vary and change on a market basis that changes with geopolitics, disaster, or economic uncertainty. When raw materials become pricey, manufacturers may find it difficult to maintain profit margins, thus increasing the costs to end-users. Thus, this will avoid the use of construction chemicals, especially among smaller contractors who have no room to digest any price change. Besides, the expensive cost of attaining sustainable raw materials will also further limit the alternatives that manufacturers would have in coming up with ecologically friendly products. This would mean construction companies might tend to compromise on lower prices in place of their actual performance or sustainability standards, which might impact the growth rate of the market for construction chemicals. Such challenges for manufacturers need careful attention while looking into strategies for the optimization of raw material sourcing and production processes to reduce cost pressures while maintaining customer demands.

OPPORTUNITY:

Growing Focus on Smart and Innovative Construction Solutions Presents Opportunities in the Market

Growing emphasis on smart construction and innovative building solutions promotes opportunities within the construction chemicals market. The demand for advanced materials and technologies, based on their ability to enhance construction efficiency, sustainability, and performance, will characterize the evolution of the industry. This is due to the trends for smart cities, incorporating digital technologies into construction processes, and the increasing interest in building automation systems. As a direct result of these trends, there is now encouragement to develop solutions from construction chemical manufacturers that ensure not only traditional performance but also other parameters like energy efficiency, moisture resistance, and smart functionalities. For instance, innovation in the market with self-healing and responsive smart coatings. Just such developments are opening the way for collaborative partnerships and cooperation with the suppliers of technology who would like to expand their markets, offer more products in the construction chemicals industry, and attract new customer segments. The embracing of this kind of trend allows manufacturers a chance to be at the top by being current with the requirements of the changing market landscape.

CHALLENGES:

Intense Competition Among Key Players Creates Challenges in the Construction Chemicals Market

Competition from key players has been a major concern for construction chemicals manufacturing companies. The market is still expanding, and with this comes the entry of other firms to vie for market share and even further diversify by trying to create a product difference from that of others. This gets translated into disastrous pricing strategies with a corollary loss in profit margins and forcing companies to innovate relentlessly to stay on the radar. The competitive landscape further increases the complexity as it involves compliance with very stringent regulatory standards and meeting customer expectations. The pressure is such that huge investments need to be made in research and development for innovative products not only ensuring regulatory requirements are met but also surpassing competitors in performance. In addition, the mandates for effective marketing strategies to deliver the unique features and benefits of construction chemicals can be resource-intensive. This way, manufacturers need to meet the requirements of profitability and a high number of market participants simultaneously. Companies need strategic approaches, namely focus on niche markets, improvement of customer relationships, and incorporation of technological advancement to make their product differentiators.

By Product Type

By type, the Concrete Admixtures segment dominated the construction chemicals market and crossed 63% of the market in 2023. Cement might be the base; however, concrete was far from that flawless blend of cement, crushed rock, sand, and water. Concrete admixtures came to the rescue for the perfect finish and strength. These additives were primarily used to decrease the water content in concrete and thereby arrive at a stronger final product. Construction adhesives occupy a small yet profitable growth period for this segment, construction adhesives were specially made out of cement, epoxy, and polymers for an unbreakable bond that not only adds strength to the material it is used upon but also self-develops the life span of the adhesive.

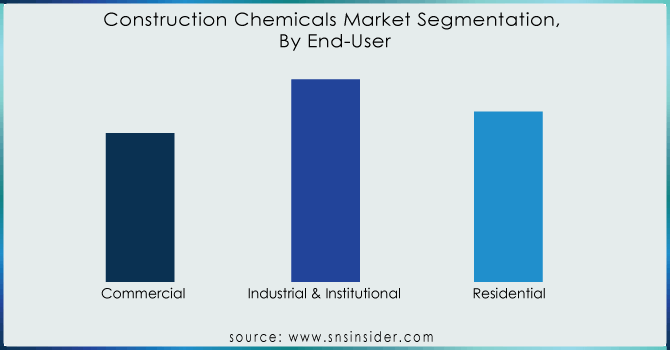

By End-user

The Residential segment is growing at a remarkable growth rate with a market share of 32% in 2023 in the construction chemicals market, owing to the rise in demand for modern infrastructure and smart homes. Adhesives, waterproofing chemicals, and concrete admixtures are types of construction chemicals that are involved in the residential sector while developing the structure of buildings by which the building could sustain itself for a longer period. Also rising demand for construction chemicals in the residential sector is the growing awareness about the need for energy-efficient buildings. On the other hand, increasing urbanization and population in developing nations are also offering significant growth opportunities to the residential construction sector. Thus, overall lucrative growth within the residential segment in the global construction chemical market is expected during the forecast period.

Get Customized Report as per Your Business Requirement - Request For Customized Report

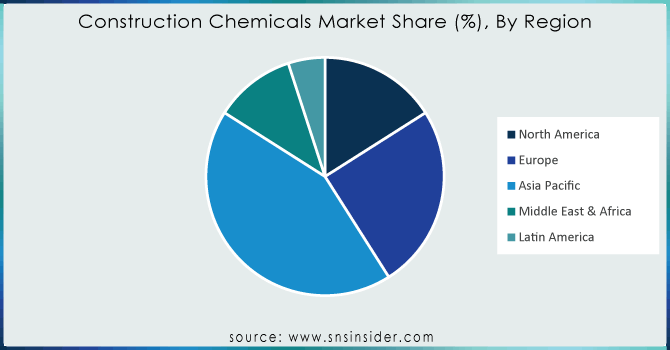

In 2023, Asia Pacific dominated the construction chemicals market with a market share of about 43%, driven by the growing building and construction industry across various economies that include China, India, Japan, and Australia. Additionally, growth is also supported by increasing government and foreign investments in mega projects. This has made the construction chemical manufacturers in this region concentrate heavily on the incorporation of sustainable and technologically advanced materials in concrete admixtures, waterproofing solutions, and industrial flooring. India has taken its growth path in construction chemicals to stand among the global leaders in terms of growth and profitability. It was ranked third in global profitability. This growth is impelled by various construction activities across sectors, with a similar trend continuing in 2023 and gaining momentum in infrastructure development. The North American region will also witness significant growth in the market. This can be attributed to strong US construction spending in both public and private sectors in early 2023 compared to previous years. Likewise, Europe also portrays a potential market soon due to the major application of construction chemicals in both residential and commercial construction purposes.

Key Players

Ardex Group (Ardex X 7, Ardex K 15, Ardex WPM 300)

Arkema (Kraton, Eliokem, Rilsan)

BASF SE (MasterSeal, MasterEmaco, Elastocrete)

Cross International Plc (Cross Riser Seal, Cross Duct Seal, Cross Wall Seal)

Dow Inc. (DOWSIL 736, DOWSIL 795, DOWSIL 3145)

Fosroc, Inc. (Fosroc Renderoc, Fosroc Conbextra, Fosroc Nitobond)

Henkel AG & Co. KGaA (SikaBond, Loctite PL Premium, Ceresit)

MBCC Group (Master Builders Solutions, MBT Admixtures, MBCC MasterSeal)

MAPEI S.p.A. (Mapelastic, Ultraplan, Keraflex)

Pidilite Industries Ltd. (Fevicol, Dr. Fixit, M-Seal)

RPM International Inc. (Rust-Oleum, DAP, Tremco)

Saint-Gobain (Gyproc, Isover, Weber)

Sika AG (Sikaflex, SikaTop, SikaBond)

Tata Chemicals (Tata Chemicals White Cement, Tata Chemicals T-Plus, Tata Chemicals Varnish)

The Dow Chemical Company (DOWSIL Sealants, DOWSIL Construction Grade, DOWSIL 100% Silicone)

The Lubrizol Corporation (Lubrizol CPVC, Lubrizol G-Block, Lubrizol R&D Coatings)

W. R. Grace & Co. (Grace Construction Products, Aqualoc, Adva)

Tremco Incorporated (Tremco Sealants, Tremco Weatherproofing, Tremco Insulation)

H.B. Fuller Company (FullerMax, Loxeal, Lepage)

GCP Applied Technologies (Grace Construction Products, Easi-Set, ADVA)

RECENT DEVELOPMENTS

April 2024: Vink Chemicals, one of the major players, began constructing an entirely new production site in Schwerin, Germany. Located in the Göhrener Tannen industrial estate, this facility provides 45 permanent jobs and has made it possible to bring further raw materials into production.

February 2023: Sika is leading key industries and has acquired the MBCC Group. The transaction will boost Sika's Total worldwide product and service portfolio and drive the industry's key shift toward low-carbon and sustainable construction methods.

June 2023: Fosroc allied with Chemtech, one of the large construction chemicals companies. Both companies have entered this partnership to use Chemtech's network for the manufacturing and distribution of all types of construction chemicals produced by Fosroc.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 58.4 billion |

|

Market Size by 2032 |

USD 107.1 Billion |

|

CAGR |

CAGR of 7.0% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Type (Adhesives & Sealants. Anchors & Grouts, Concrete Admixtures, Concrete Protective Coatings, Flooring Resins, Repair & Rehabilitation Chemicals, Surface Treatment Chemicals, Waterproofing Solutions) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

RPM International Inc., MAPEI S.p.A., Cross International Plc, MBCC Group, Saint-Gobain, Sika AG, Ardex Group, Oriental Yuhong, Arkema, Huntsman International LLC, CEMEX, S.A.B. de C.V., MC-Bauchemie, Fosroc, Inc., LATICRETE International, Inc., H.B. Fuller Company, Jiangsu Subote New Material Co., Henkel AG & Co. KGaA, BASF SE and other players |

|

Key Drivers |

•Growing Demand for Eco-Friendly Products in Various Industries Boosts the Construction Chemicals Market Growth |

|

Restraints |

•High Cost of Raw Materials Acts as a Restraint in the Construction Chemicals Market |

Ans: Asia Pacific region holds the largest market share in the Construction Chemicals Market during the forecast period.

Ans: Strict VOC regulations, cost concerns, skilled labor limitations, and environmental worries restrain construction chemicals market growth.

Ans: Concrete admixtures are the most popular type, making up over 63% of the market in 2023. These additives help concrete become stronger and more durable.

Ans: Construction Chemicals Market size was USD 58.4 billion in 2023 and is expected to Reach USD 107.1 billion by 2032.

Ans: The Construction Chemicals Market is expected to grow at a CAGR of 7.0%.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Region, 2023

5.2 Feedstock Prices, by Country, by Region, 2023

5.3 Regulatory Impact, by Country, by Region, 2023

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Product Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Construction Chemicals Market Segmentation, by Product Type

7.1 Chapter Overview

7.2 Adhesives & Sealants

7.2.1 Adhesives & Sealants Market Trends Analysis (2020-2032)

7.2.2 Adhesives & Sealants Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Anchors & Grouts

7.3.1 Anchors & Grouts Market Trends Analysis (2020-2032)

7.3.2 Anchors & Grouts Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Concrete Admixtures

7.4.1 Concrete Admixtures Market Trends Analysis (2020-2032)

7.4.2 Concrete Admixtures Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Concrete Protective Coatings

7.5.1 Concrete Protective Coatings Market Trends Analysis (2020-2032)

7.5.2 Concrete Protective Coatings Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Flooring Resins

7.6.1 Flooring Resins Market Trends Analysis (2020-2032)

7.6.2 Flooring Resins Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Repair & Rehabilitation Chemicals

7.7.1 Repair & Rehabilitation Chemicals Market Trends Analysis (2020-2032)

7.7.2 Repair & Rehabilitation Chemicals Market Size Estimates and Forecasts to 2032 (USD Billion)

7.8 Surface Treatment Chemicals

7.8.1 Surface Treatment Chemicals Market Trends Analysis (2020-2032)

7.8.2 Surface Treatment Chemicals Market Size Estimates and Forecasts to 2032 (USD Billion)

7.9 Waterproofing Chemicals

7.9.1 Waterproofing Chemicals Market Trends Analysis (2020-2032)

7.9.2 Waterproofing Chemicals Market Size Estimates and Forecasts to 2032 (USD Billion)

7.10 Others

7.10.1 Others Market Trends Analysis (2020-2032)

7.10.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Construction Chemicals Market Segmentation, by End-User

8.1 Chapter Overview

8.2 Residential

8.2.1 Residential Market Trends Analysis (2020-2032)

8.2.2 Residential Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Commercial & Industrial

8.3.1 Commercial & Industrial Market Trends Analysis (2020-2032)

8.3.2 Commercial & Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Infrastructure

8.4.1 Infrastructure Market Trends Analysis (2020-2032)

8.4.2 Infrastructure Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Construction Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.2.4 North America Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.2.5.2 USA Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.2.6.2 Canada Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Construction Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Construction Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.6.2 France Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Construction Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.4.5.2 China Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.4.5.2 India Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.4.5.2 Japan Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.4.9.2 Australia Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Construction Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Construction Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.2.4 Africa Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Construction Chemicals Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.6.4 Latin America Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Construction Chemicals Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Construction Chemicals Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10. Company Profiles

10.1 RPM International Inc.

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 MAPEI S.p.A.

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Cross International Plc

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 MBCC Group

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Saint-Gobain

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Sika AG

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Ardex Group

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Arkema

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Fosroc, Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Henkel AG & Co. KGaA

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusio

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product Type

Adhesives & Sealants

Anchors & Grouts

Concrete Admixtures

Concrete Protective Coatings

Flooring Resins

Repair & Rehabilitation Chemicals

Surface Treatment Chemicals

Waterproofing Chemicals

Others

By End-User

Residential

Commercial & Industrial

Infrastructure

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Long-chain Polyamide Market size was USD 2.1 billion in 2023 and is expected to reach USD 3.2 billion by 2032 and grow at a CAGR of 5.0% over the forecast period of 2024-2032.

Explore the Hydroxyethyl Methyl Cellulose (HEMC) Market, covering key applications in construction, pharmaceuticals, and personal care. Learn about rising demand for HEMC in paints, coatings, and adhesives, and the trends driving growth in diverse industr

The Nitrile Gloves Market Size was valued at USD 10.0 billion in 2023, and will reach USD 16.2 billion by 2032, and grow at a CAGR of 5.5% by 2024-2032.

The solar control window film market size was valued at USD 826.39 million in 2023 and is expected to reach USD 1442.60 million by 2032, growing at a CAGR of 6.39% over the forecast period of 2024-2032.

Bio-Based Chemicals Market was valued at USD 70.5 Billion in 2023 and is anticipated to touch USD 167.6 Billion by 2032, at a CAGR of 10.1% from 2024 to 2032.

Ammonia Market size was USD 79.1 billion in 2023 and is expected to reach USD 121.5 billion by 2032 and grow at a CAGR of 4.9% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone