Connected Aircraft Market Report Scope & Overview:

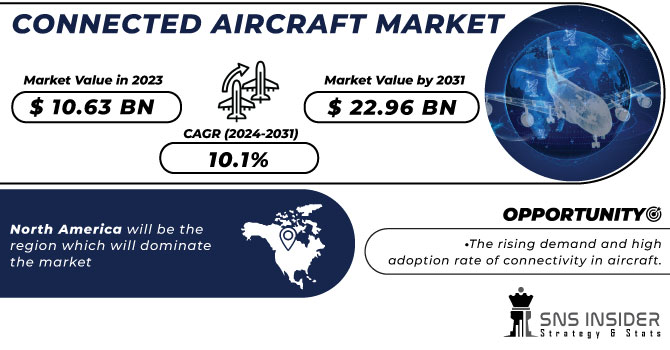

The Connected Aircraft Market is expected to reach USD 22.96 Billion by 2031 and was valued at USD 10.63 Billion in 2023, the CAGR growth rate is expected to be 10.1% over the forecasted period of 2024-2031.

In order to improve numerous areas of flight operations, safety, passenger experience, and maintenance, connected aircraft integrate cutting-edge communication, data-sharing, and networking Platform. Real-time data interchange between the aircraft, ground systems, and other aircraft is made possible by these technologies, enhancing performance in terms of efficiency, safety, and all-around quality. Passengers on connected aircraft have access to high-speed internet, enabling them to remain in touch, do business, or access entertainment while in the air. Long-haul and business travellers should pay particular attention to this aspect. Modern communication systems are installed in connected aircraft's flight decks to give pilots access to real-time weather updates, air traffic updates, and operational data. Decision-making and situational awareness are enhanced.

Get More Information on Connected Aircraft Market - Request Sample Report

Connected aircraft continuously communicate information to ground-based operations, such as engine performance, flight telemetry, and system health. Predictive analytics, performance monitoring, and maintenance all make use of this data. Connected aircraft can send vital safety information in real time, enabling quicker responses to possible problems or emergencies. This helps make flight operations safer. Connected aircraft can forecast their maintenance requirements and spot possible problems before they result in unforeseen maintenance events through continuous monitoring and data analysis. As a result, downtime is cut down, increasing aircraft availability. Connected aircraft can optimise routes, use less fuel, and pay less for operations thanks to real-time data on engine performance and weather conditions.

Market Dynamics:

Driver

-

The rising Platform advancement

Faster and farther-reaching flights are made possible by jet engines, which are more effective and powerful than piston engines. Electronic systems have taken the place of conventional mechanical control systems thanks to fly-by-wire Platform. This makes it possible to operate an aircraft more precisely, lessens the workload on the pilot, and improves safety. Digital displays and multipurpose screens have taken the place of the traditional analogue instruments in the cockpit. Pilots have access to real-time data, charts, and navigational information thanks to glass cockpits.

Restrain

-

The high cost associated with connectivity element

Opportunity

-

The rising demand and high adoption rate of connectivity in aircraft.

Particularly among business travellers and passengers on lengthy flights, there has been a huge increase in demand for in-flight Wi-Fi and entertainment alternatives. Productivity for business travellers: In-flight connectivity enables them to work, read emails, take part in video conferences, and stay productive while in the air, minimising downtime. By luring travellers who place a high priority on connectivity when booking their tickets, airlines that provide dependable in-flight connectivity acquire a competitive edge. Connectivity makes it possible to collect real-time data from aircraft systems, increasing the effectiveness of maintenance work and enabling airlines to track and enhance performance.

Challenge

-

The rising threats related to the system hacking or data breaching.

Impact of Recession

Airlines that are experiencing financial difficulties during a recession would not have as much money to invest in connectivity infrastructure and upgrades. The drop in the revenue generated by the major players operating in this market was observed around 10%, this may cause planned connectivity improvements to stall or be delayed. The recession may make passengers less likely to pay for these services, even though connectivity can be a cash generator through in-flight Wi-Fi fees, advertising, and e-commerce options. It is possible that airlines need to review their pricing and revenue plans. The recession may cause airlines to postpone plans for modernising their fleet, such as retrofitting older aircraft with connection options. Airlines might give more urgent cost-saving efforts priority.

Impact of Russia Ukraine War

International relations and political changes may have an impact on the regulatory environment. Airlines and internet providers may have to handle changing laws pertaining to data security, international agreements, and cross-border communications. Heightened geopolitical tensions may make people more worried about the security of connected Platform on aeroplanes. To defend against potential threats, airlines and Platform providers may need to strengthen their cybersecurity protocols. For instance, the cyberthreats because of global disruptions was observed to increase at 25%.

For in-flight connectivity, connected aircraft rely on satellite communication. Geopolitical developments, particularly prospective limitations on satellite communication bands, may have an impact on the accessibility and dependability of satellite services.

Market Segmentation

By Type

-

Hardware

-

Software

By Platform

-

Commercial

-

Business & General Aviation

-

Military

By Connectivity

-

In-Flight

-

Air-to-Air

-

Air-to Ground

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Regional Analysis:

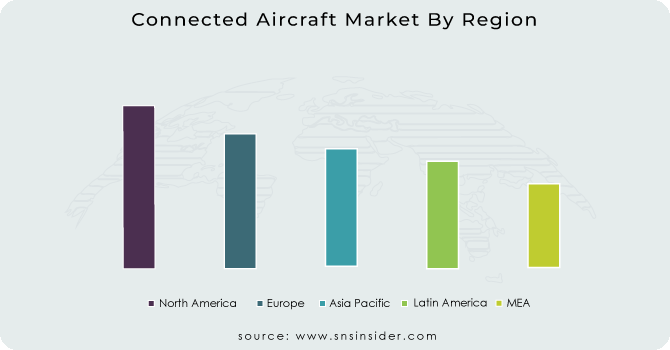

North America will be the region which will dominate the market because, the adoption of connected aircraft is in the forefront in North America, especially in the United States. On both domestic and foreign flights, many American airlines provide in-flight Wi-Fi. In-flight connection is now widely used because the Federal Communications Commission (FCC) has been active in regulating it. North American travellers frequently demand dependable in-flight Wi-Fi, thus airlines have made investments in mode

APAC will be the region with the highest CAGR growth rate, Due to increased air travel, higher passenger expectations, and a growing middle class, connected aircraft usage is significantly increasing in the Asia-Pacific area. Airlines in nations like China, Japan, and South Korea are putting money into in-flight entertainment and Wi-Fi. In order to accommodate the demand for connectivity, satellite communication companies are expanding their coverage in the area rising their fleets to provide these services.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

The major key players are Honeywell International, Raytheon Technologies, Thales Group, Viasat, Gogo, Cobham, Kontron, Collins, BAE Systems, and others.

Raytheon Technologies-Company Financial Analysis

Recent Industry Development

-

Connectivity over 5G: The adoption of 5G Platform in aviation is on the rise. Passengers may stream high-definition entertainment and utilise data-intensive applications thanks to its faster and more dependable in-flight internet.

-

Low Earth Orbit (LEO) Satellite Networks: The capacity and coverage of in-flight connection are increasing thanks to LEO satellite constellations being created by firms like SpaceX (Starlink) and OneWeb. Even in remote areas, these systems offer high-bandwidth access to aeroplanes with low latency.

-

Hybrid Networks: To ensure constant connectivity throughout a flight, airlines are investigating hybrid connectivity solutions that mix satellite, ground-based, and cellular networks. Cost and performance are optimised using this method.

| Report Attributes | Details |

| Market Size in 2023 | US$ 10.63 Billion |

| Market Size by 2031 | US$ 22.96 Billion |

| CAGR | CAGR of 10.1% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hardware, Software) • By Platform (Commercial, Business & General Aviation, Military) • By Connectivity (In-Flight, Air-to-Air, Air-to Ground) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Honeywell International, Raytheon Technologies, Thales Group, Viasat, Gogo, Cobham, Kontron, Collins, BAE Systems |

| Key Drivers | • The rising Platform advancement |

| Market Opportunity | • The rising demand and high adoption rate of connectivity in aircraft. |