Get More Information on Concrete Restoration Market - Request Sample Report

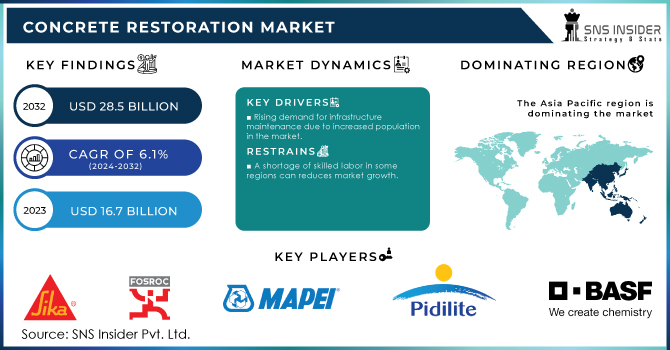

The Concrete Restoration Market size was valued at USD 17.1 Billion in 2023. It is expected to grow to USD 31.8 Billion by 2032 and grow at a CAGR of 6.4% over the forecast period of 2024-2032.

The concrete restoration market is experiencing growth due to a notable increase in investments in renovation and remodeling activities. With the change of emphasis on extending relatively new structures instead of rebuilding new ones have seen a large increase in demand for concrete restoration. Structural Safety and Economic Building Strategy Homeowners and businesses focus on utmost structural integrity while also economizing how buildings can be made more durable. Home remodeling is on an upward trend as heightened awareness of maintaining and upgrading existing buildings has become central to national construction studies, according to the National Association of Home Builders (NAHB). The lifestyle changes, higher property prices, and the necessity for modern amenities in antiquated buildings are further contributing to this trend. Moreover, the government has taken this to new heights with incentives and funding assistance for infrastructure upgrades. These factors as mentioned above, along with the increasing focus on sustainable and eco-friendly practices are driving the necessity of concrete restoration which is one of the key trends in this market.

According to the U.S. Census Bureau, expenditures on residential improvements and repairs in the United States reached approximately USD 538 billion in 2023, reflecting a steady increase from previous years. This growth indicates rising investments in renovation and remodeling activities as property owners focus on extending the lifespan of their existing structures.

Increased influence of environmental concerns in the concrete restoration market. The restoration market is influenced by the pressure to shift from traditional methods that led to carbon pollution and push towards sustainable restoration practices. As awareness of climate change grows and there is a reduction in carbon emissions, the market for eco-friendly repairing and restoration solutions is setting in. Some of the key best practices are to use recycled aggregate concrete (RAC), a type of sustainable concrete made with demolished waste concrete, and low-carbon and polymer-modified repair products. Such innovations are not only reducing the environmental footprint but also contributing to global sustainability targets like the UN's Sustainable Development Goals (SDGs). Moreover, more restoration companies are getting certified in green standards which promotes eco-friendly practices. With governments taking a more serious stand on environmentally friendly methods, green building is a growing social trend. For example, governments in the EU have introduced incentives and standards for the use of recycled content in construction. This means that efforts to push the market in a more sustainable direction are both growing and solving important environmental issues such as resource depletion and waste.

According to the European Environment Agency (EEA), the use of recycled aggregates in construction reached approximately 12% of total aggregates used in the EU in 2022, reflecting increasing efforts to promote sustainable construction and reduce waste. This shift is driven by policies under the EU Waste Framework Directive, which aims to achieve a 70% recycling target for construction and demolition waste by 2025.

Drivers

Durability, and cost-effectiveness of restoration projects.

Rising demand for infrastructure maintenance due to increased population in the market.

Growing demand for infrastructure upkeep is one of the major factors expected to drive the concrete restoration market size over upcoming years, in line with the ongoing rise in population levels. Growing urban populations consume higher use of existing infrastructure roads, bridges, water systems, and public buildings and increase the rate of wear. Such events create an impetus to continue regular maintenance and restoration projects by local governments and authorities in order to maintain public safety and continuous services. Rapid population influx into urban areas quickly exposes the reliability of older infrastructure, since experienced usage is magnified by until-recent rapid growth. On top of that, governments are putting in big budgets for maintenance projects to correct structural defects and extend the lifetime serviceability of public assets. For instance, in 2021, the U.S. government passed the Infrastructure Investment and Jobs Act with USD 110 billion for roads, bridges, and large-scale infrastructure projects. These projects are vital in maintaining and repairing infrastructure as urban populations continue to grow, which is driving up demand for concrete restoration services.

Restraint

Regulatory hurdles in developed in the concrete restoration markets

A shortage of skilled labor in some regions can reduce market growth.

High Regulation in Developed Regions, a Restraint for the Concrete Restoration Market Restoration is often made more difficult by very strict building codes and safety regulations, that require compliance at the local, state, as well as federal levels concerning rebuilding. But outside of the need for this energy, there is a level of complexity in places such as the U.S. with the Occupational Safety and Health Administration (OSHA) and Environmental Protection Agency through which project costs can increase due to stringent guidelines around worker safety, material handling, and environmental impacts that lengthens timelines. Following these regulations requires compliance not just with protocols for safety, but also approved materials and techniques that may not reflect the latest in restoration. Likewise, in the EU the Construction Products Regulation imposes high demands on quality standards and certification aspects that add additional levels of documentation. Although these regulatory frameworks are necessary to ensure safety and quality, they can also have the effect of creating a lot of administrative and financial overhead that restricts what restoration firms can do and use when developing new solutions. Developed markets, particularly the European Union (EU), create a challenge for concrete restoration product manufacturers due to stringent regulations. The EU's EN 1504 regulation mandates strict quality standards for raw materials used in restoration products. This ensures product effectiveness and durability, but can also make manufacturing more complex. Manufacturers must adhere to specific control and testing guidelines outlined in the regulation. this ensures product quality, but it can be a costly and time-consuming process.

Opportunities

Increased government spending on infrastructure projects.

Surging adoption of renewable energy sources in the Concrete Restoration Market.

As governments invest in repairing and upgrading existing infrastructure like roads, bridges, dams, and buildings, the demand for concrete restoration services will rise significantly. This creates more business opportunities for companies specializing in concrete repair. Increased spending might also prioritize preventative maintenance projects to extend the lifespan of existing infrastructure. This could lead to more frequent, smaller-scale concrete restoration jobs, further benefiting the market.

By Material Type

Quick-setting cement mortar dominated the concrete restoration market with the largest revenue share of about 48% in 2023. This mortar is popularly used because of its fast-setting properties, which can be in a few minutes to hours so you can complete the project faster and minimize downtime. This rapid strength gain is important for restoration work in high-traffic applications, such as road reconstruction, bridge repair, and even commercial areas, where extended closures can affect daily living and increase costs. Besides, when it comes to repairing the cracks in the concrete foundation about connection void, nothing beats quick-setting cement mortar that is strong enough for speedy and durable adhesion on existing concrete. It is also very suitable for all infrastructures subject to strong conditions or various chemical spills, because of its resistance to water and chemicals. To satisfy the non-relaxed Das at work during government infrastructure projects and maintenance works, quick-setting cement mortar is quite in demand to fit urgent timelines and give sustenance to repairs. These attributes contribute to it being the preferred choice for contractors and project managers alike, which leads to its market dominance.

By Target Application

Buildings and balconies segment dominated the concrete restorations market with the highest revenue share of about 40% in 2023. Buildings and balconies represent the highest share of the concrete restoration market since such structures require the most frequent repair and maintenance activities. Residential and commercial buildings are exposed all the time to moisture, temperature, and pollution which causes deterioration of concrete. As these are exposed to the outside environment, balconies are a prime suspect for structural damage and vulnerability such as cracks, corroded reinforcing steel, and water leakage. There is also a constant factor of foot traffic and weight load that contribute to areas often needing restoration. Apart from this, increasing urbanization and growing population in the cities are escalating stress on residential and commercial buildings thereby compelling frequent restoration works. Moreover, safety issues and regulatory standards also warrant balcony and building facade repair soon to prevent any accidents as well as structural failures. The above-mentioned factors, along with an increase in the renovation of buildings in turn boost the demand for concrete restoration services, and therefore, buildings & balconies are likely to remain as largest end-use segment.

The Asia-Pacific region led the concrete restoration market which occupied 55% of the market share in 2023. This dominance is driven by a rapidly growing population in countries like China and India. These surging populations strain existing concrete infrastructure, demanding regular maintenance and restoration to prevent collapse. Furthermore, APAC's booming economies fuel extensive infrastructure projects urbanization, modernization, and industrial expansion all necessitating repairs to bridges, pipelines, buildings, and other structures. Large-scale infrastructure restoration initiatives across the region further propel demand for concrete restoration solutions.

North America is the second dominating region in the concrete restoration market. Here, demand is driven by the need for restoration across various infrastructure categories. The need to maintain and repair aging commercial and residential buildings fuels the market. Additionally, restoration projects on transportation infrastructure like bridges, pipelines (including oil & natural gas), and water structures are a major driver.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Sika AG (Sika MonoTop)

Fosroc International Ltd (Renderoc HB2)

Mapei S.p.A (Planitop 400)

BASF SE (MasterEmaco S 488)

Saint-Gobain Weber S.A. (Webercem HB30)

Master Builders Solutions (MasterBrace ADH 1460)

Fyfe Co. LLC (Tyfo Fibrwrap)

The Euclid Chemical Company (Duralflex Fastpatch)

RPM International Inc. (Rust-Oleum EpoxyShield)

Pidilite Industries Ltd (Dr. Fixit Pidicrete URP)

3M Company (3M Concrete Repair Self-Leveling)

Cemex S.A.B. de C.V. (Proconcrete Repair M)

Parchem Construction Supplies Pty Ltd (Emer-Proof Aqua-Barrier)

GCP Applied Technologies Inc. (Silcor 900 HA)

Ardex Group (Ardex A 38 MIX)

W.R. Meadows Inc. (Meadow-Patch T1)

Laticrete International Inc. (NXT Level Plus)

Simpson Strong-Tie Company Inc. (SET-XP Epoxy Anchoring Adhesive)

Kryton International Inc. (Krystol T1 Concrete Waterproofing)

Nafico Ltd. (Nafico Mortar L1)

In May 2023, Sika AG significantly bolstered its global presence through the strategic acquisition of MBCC. This move expands their reach across all regions and grants them a wider range of products and services, allowing them to cater to the entire construction life cycle.

In September 2022, Fosroc strategically extended its reach into the Qatari market by appointing Mannai Trading Company as its exclusive distributor. This partnership ensures the comprehensive supply of Fosroc's high-performance construction chemicals across various sectors, including the construction, infrastructure, oil, and gas industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 17.1 Billion |

| Market Size by 2032 | US$ 31.8 Billion |

| CAGR | CAGR of 6.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type (Shotcrete, Quick setting cement mortar, Fiber concrete, Others (concrete bonding agents, grout, etc.)) • By Application (Water and wastewater treatment, Dams & Reservoirs, Roads, Highways & Bridges, Marine, Buildings & Balconies, Others) |

| Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Pidilite Industries, Sika, Fosroc, Mapei S.p.A, BASF SE, Saint-Gobain Weber S.A., Master Builders Solutions, Fyfe, The Euclid Chemical Company, RPM International, and other players. |

| DRIVERS | • Increasing demand for the infrastructure. • Increasing population. |

| Restraints | • The European Union's regulation • Gives material control and testing guidelines |

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: The unusual coronavirus outbreak had resonated throughout the global economy, affecting global supply chains that transfer materials and components fast across borders and between fabrication locations. As a result, there have been delays or non-arrival of raw materials, messed up money transfers, and an increase in absenteeism among production line workers. The global economy and the performance of numerous industries have been impacted by these issues. The loss of many industries has a direct impact on the market for concrete rehabilitation.

Ans: Increasing demand for the infrastructure and Increasing population are the drivers for antimicrobial plastics market.

Ans: Installed on large concrete foundations and Expanding the use of renewable energy are the opportunity for Concrete Restoration Market.

Ans. The projected market size for the Concrete Restoration Market is USD 28.5 Billion by 2032.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

3.1 Market Driving Factors Analysis

3.1.2 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 PESTLE Analysis

3.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by l Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Concrete Restoration Market Segmentation, by Material Type

7.1 Chapter Overview

7.2 Shotcrete

7.2.1 Shotcrete Market Trends Analysis (2020-2032)

7.2.2 Shotcrete Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Quick setting cement mortar

7.3.1 Quick setting cement mortar Market Trends Analysis (2020-2032)

7.3.2 Quick Setting Cement Mortar Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Fiber concrete

7.4.1 Fiber concrete Market Trends Analysis (2020-2032)

7.4.2 Fiber concrete Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Concrete Restoration Market Segmentation, by Target Application

8.1 Chapter Overview

8.2 Water & Wastewater Treatment

8.2.1 Water & Wastewater Treatment Market Trends Analysis (2020-2032)

8.2.2 Water & Wastewater Treatment Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Dams & Reservoirs

8.3. Dams & Reservoirs Market Trends Analysis (2020-2032)

8.3.2 Dams & Reservoirs Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Roads, Highways & Bridges

8.4.1 Roads, Highways & Bridges Market Trends Analysis (2020-2032)

8.4.2 Roads, Highways & Bridges Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Marine

8.5.1 Marine Market Trends Analysis (2020-2032)

8.5.2 Marine Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Buildings & Balconies

8.6.1 Buildings & Balconies Market Trends Analysis (2020-2032)

8.6.2 Buildings & Balconies Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Concrete Restoration Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.2.4 North America Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.2.5.2 USA Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.2.6.2 Canada Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Concrete Restoration Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Concrete Restoration Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.3.2.6.2 France Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Concrete Restoration Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.4.5.2 China Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.4.5.2 India Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.4.5.2 Japan Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.4.9.2 Australia Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Concrete Restoration Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Concrete Restoration Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.5.2.4 Africa Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Concrete Restoration Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.6.4 Latin America Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Concrete Restoration Market Estimates and Forecasts, by Material Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Concrete Restoration Market Estimates and Forecasts, by Target Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Sika

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 Fosroc

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Mapei S.p.A

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 BASF SE

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Saint-Gobain Weber S.A.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Master Builders Solutions

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Fyfe

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 The Euclid Chemical Company

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 RPM International

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Pidilite Industries

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Material Type

Shotcrete

Quick setting cement mortar

Fiber concrete

Others

By Target Application

Dams & Reservoirs

Roads, Highways & Bridges

Marine

Buildings & Balconies

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Battery Metals Market size was USD 10.6 Billion in 2023 and is expected to reach USD 21.3 Billion by 2032 and grow at a CAGR of 8.1% from 2024-2032.

The Maleic Anhydride Market size was USD 3.7 Billion in 2023 and is expected to reach USD 5.3 Billion by 2032 and grow at a CAGR of 4.1% by 2024-2032.

Explore the Nitrocellulose Market, covering trends in coatings, inks, and explosives. Learn about the growing demand for nitrocellulose in automotive paints, printing inks, and personal care products, and how it drives innovation across industries like de

Octyl Alcohol Market Size was valued at USD 6.6 Billion in 2023 and is expected to reach USD 8.4 Billion by 2032 and grow at a CAGR of 2.7% over the forecast period 2024-2032.

The Biosurfactants Market Size was valued at USD 3.85 Billion in 2023 and is expected to reach USD 6.82 Billion by 2032, growing at a CAGR of 6.57% over the forecast period of 2024-2032.

The Adhesive Films Market Size was valued at USD 19.30 Billion in 2023 and is expected to reach USD 30.64 Billion by 2032, growing at a CAGR of 5.27% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone