Get E-PDF Sample Report on Concrete Floor Coating Market - Request Sample Report

The Concrete Floor Coating Market Size was valued at USD 4.75 Billion in 2023. It is estimated to hit USD 7.61 Billion by 2032 and grow at a CAGR of 5.4% over the forecast period of 2024-2032.

The increasing demand for durable and visually appealing flooring solutions, concrete floor coating market has experienced a surge in popularity. Concrete floor coatings are applied to protect and enhance the surface of concrete floors. These coatings provide a protective layer that safeguards the concrete from wear and tear, chemical spills, and other potential damages.

In accordance with data from the U.S. Census Bureau, the 2021 total value of construction put in place in the United States amounted to approximately USD 1800 Billion. Such a tendency toward the increased investment in the construction of various industrial and commercial buildings is directly followed by the rising demand for concrete flooring solutions. The latter should be of the highest quality to ensure that the surfaces are durable, aesthetically pleasing, and free from related problems.

The concrete floor coating market is driven by the growing construction industry, particularly in developing economies, which has led to an increased demand for durable and aesthetically pleasing flooring solutions. Additionally, the rising awareness about the benefits of concrete floor coatings, such as their ability to improve safety, hygiene, and ease of maintenance, has further fueled market growth. In terms of product types, the concrete floor coating market offers a wide array of options to cater to diverse customer needs. Epoxy coatings, polyurethane coatings, and acrylic coatings are among the most commonly used products in this industry. Each type of coating possesses unique characteristics and benefits, allowing customers to choose the most suitable option based on their specific requirements.

In 2023, Sherwin-Williams, a leading player in the concrete floor coatings market, launched a new line of epoxy floor coatings specifically designed for high-traffic industrial environments. This innovative product features enhanced durability and chemical resistance, making it suitable for facilities such as manufacturing plants and warehouses. The launch is part of Sherwin-Williams’ strategy to meet the growing demand for robust and aesthetically appealing flooring solutions in the industrial sector.

One of the main drivers of the demand of concrete floor coatings is the growing investment in the development of infrastructure, especially in the emerging markets. According to the World Bank, the global infrastructure investment is expected to be around 94 trillion dollars through the year 2040, with a great part of this amount going to the developing regions. Governments acknowledge the urgent need in the new infrastructure all over the world, and it includes not only transportation systems but also public and commercial buildings. For example, in 2021 the U.S. federal government announced the 1.2 trillion dollars infrastructure investment plan.

Coatings of concrete floors are one of examples of such materials which market will grow due to the government strategies and subsidizing, as it allows making construction safer and more durable. Overall, it can be argued that the role of the state is vital for driving the market growth in the case of such materials as the government is one of the main consumers of the infrastructure.

Drivers

Increasing popularity of aesthetically appealing and durable flooring solutions

Rising construction activities worldwide

The surge in construction activities, ranging from residential buildings to commercial complexes and industrial facilities, necessitates the use of durable and aesthetically appealing flooring solutions. Concrete floor coatings provide an ideal solution, as they offer enhanced durability, resistance to wear and tear, and an attractive finish. Moreover, the increasing urbanization and population growth in many countries have led to a higher demand for housing and commercial spaces. As a result, construction companies are actively engaged in constructing new buildings and renovating existing structures to meet these demands. Concrete floor coatings play a crucial role in enhancing the longevity and visual appeal of these spaces, making them more appealing to potential buyers or tenants.

Restrain

High cost associated with the concrete floor coatings hamper the market growth.

Fluctuating prices of raw materials

The problem of high costs experiences a lot of floor coating products due to the expensiveness of the materials and further application. It should be noted that the demand for the establishment of flooring products is constantly on the rise, and people keep demanding more modern, aesthetically pleasant, comfortable, and durable tools to cover their floors. At the same time, the majority of such coatings requires more investments in materials and application. Moreover, for high-quality coatings it is necessary to hire qualified personnel, and these services are also honored. In such a way, the product has a number of positive capacities, but the price factor becomes a barrier to its implementation and further growth. It means that if some customers are ready to invest in the most expensive means, the majority in the less developed and more price-sensitive markets will prefer not to buy or to wait for more beneficial periods.

Opportunities

Development of advanced coating technologies and the introduction of innovative product

Rising demand for decorative and customized flooring options

In recent years, there has been a noticeable shift in consumer preferences towards decorative and customized flooring solutions. Traditional flooring materials such as tiles, carpets, and hardwood are gradually being replaced by concrete floor coatings. This transition can be attributed to several factors, including the durability, versatility, and cost-effectiveness offered by concrete coatings. One of the primary drivers behind this rising demand is the desire for personalized spaces. Homeowners and businesses alike are seeking unique and visually appealing flooring options that reflect their individual styles and tastes. Concrete floor coatings provide an ideal canvas for customization, allowing for a wide range of colors, patterns, and textures to be applied. This versatility enables customers to create truly one-of-a-kind flooring designs that enhance the overall aesthetics of their spaces.

By Product

The epoxy coating segment dominated the concrete floor coating market with the highest revenue share of about 63% in 2022. Epoxy coatings have established themselves as the preferred choice for concrete floor protection and enhancement due to their exceptional qualities. These coatings are renowned for their durability, resistance to chemicals, and ability to withstand heavy foot traffic and machinery. Moreover, epoxy coatings offer a glossy finish that enhances the aesthetic appeal of concrete floors, making them an attractive option for various industries and applications. Furthermore, epoxy coatings provide a protective barrier that safeguards concrete floors against wear and tear, moisture, stains, and other forms of damage.

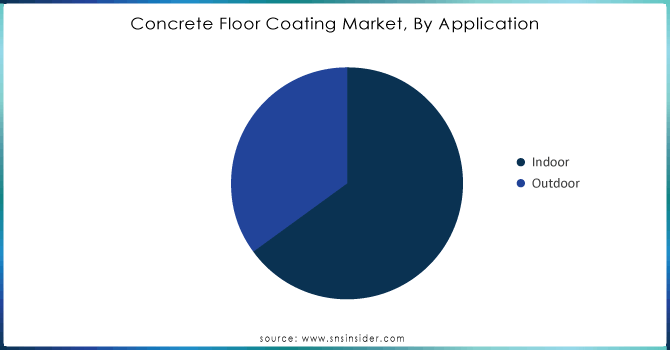

By Application

Indoor segment held the largest market share around 69% in 2023. The rising penetration of sports stadiums in the U.S. and Canada on account of the popularity of such sports as football, rugby, ice hockey, and tennis among others is expected to propel the role of the flooring solutions.

The considerable expansion prospects for the market players from the increasing usage of concrete floor coating solutions as a flavoring agent and acidulant in the food & beverage industry have also been observed. In addition, the product is utilized as an acidity regulator, food preservative, and pharmaceutical excipient apart from being a vital raw material for polyesters and an active ingredient for alkyd resins.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

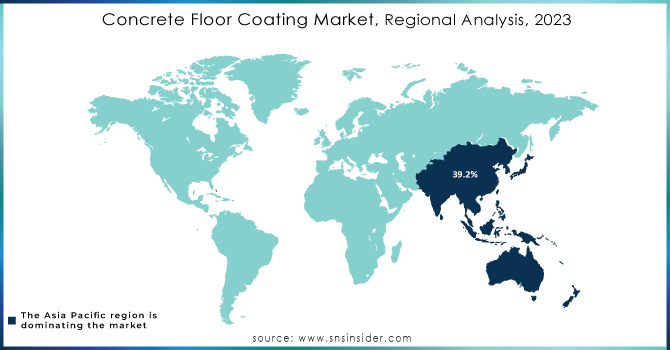

Asia Pacific dominated the concrete floor coating market with the highest revenue share of about 39.2% in 2023. This regional growth can be primarily attributed to the booming construction industry in Asia Pacific. The region is currently experiencing significant growth in construction, driven by factors such as rapid urbanization, population growth, and infrastructure development. According to our research, Asia-Pacific is expected to account for USD 7.5 trillion of global construction output by 2030. Furthermore, the Asia Pacific region is also witnessing substantial industrialization, fueled by the rising demand for consumer goods, increased investments in manufacturing industries, and favorable government policies. This industrialization trend is directly contributing to the growth of the concrete floor coatings market, as industrial floors require coatings to enhance durability and safety. Moreover, there is a growing demand for decorative concrete floor coatings in the Asia Pacific region, driven by the expanding middle-class population and rising disposable incomes. Additionally, there is a strong emphasis on green building practices in the region, motivated by increasing environmental concerns, government regulations, and cost savings. As a result, the adoption of eco-friendly coatings is on the rise, further driving the growth of the market.

North America is the second-largest market for the concrete floor coating market and is expected to grow with a CAGR of about 5.7% during the forecast period. The growth of the market in this region is mainly owing to the thriving construction industry. The construction sector in North America is experiencing remarkable expansion with more than 30% market share, fueled by factors such as population growth, infrastructure development, and increased investments in real estate. Moreover, the region is witnessing a surge in demand for eco-friendly coatings due to environmental concerns, government regulations, and heightened awareness among consumers. Additionally, industrialization is on the rise in North America, driven by the growing demand for consumer goods and substantial investments in the manufacturing industry. Furthermore, there is an increasing demand for decorative concrete floor coatings in the region, as disposable incomes rise, the desire for aesthetically pleasing interiors grows, and awareness about the benefits of decorative coatings spreads.

Tennant Coatings (Tennant Ecoat)

Vanguard Concrete Coating (Vanguard Polyurea Coating)

BASF SE (MasterTop 1327)

Trucrete Surfacing Systems (Trucrete Epoxy Flooring)

PPG Pittsburgh Paints (Pittsburgh Paints & Stains Epoxy Floor Coating)

North American Coating Solution (NACS Epoxy Coating)

Sherwin-Williams Company, (Sherwin-Williams Epoxy Floor Coating)

Elite Crete Systems (Elite Crete Polyurethane Coating)

Pratt & Lambert (Pratt & Lambert Epoxy Coating)

Florock (Florock FloroCrete)

Axalta Coating Systems (Axalta Dura-Plate 1000)

Rust-Oleum Corporation (Rust-Oleum EpoxyShield)

Sika AG (Sikafloor-265)

Krylon (Krylon Industrial Epoxy Coating)

Concrete Coatings Inc. (Concrete Coatings Decorative Sealer)

ArmorPoxy (ArmorPoxy Epoxy Floor Coating)

Epo-Poxy (Epo-Poxy 4100)

Nox-Crete Products Group (Nox-Crete Epoxy Coating)

Sovereign Chemicals (Sovereign ArmorSeal)

Grip-Rite (Grip-Rite Epoxy Floor Coating)

In June 2023, PPG, a leading manufacturer of paints and coatings, made an exciting announcement regarding the expansion of its PPG FLOORING concrete coatings offering. This expansion includes a comprehensive range of integrated systems consisting of primers, base coats, and topcoats. These systems are specifically designed for environments that require electrostatic protection, ensuring the utmost durability and reliability.

In Jan 2020, Florock Polymer Flooring, a renowned manufacturer of commercial, industrial, and institutional concrete floor coatings, introduced the FloroStone Decorative Flooring System. This system revolutionizes decorative epoxy flooring by combining a sanitary, high-performance traffic surface with modern and upscale aesthetics. Not only does it provide an attractive appearance, but it also offers an economical and quick-turnaround solution.

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.75 Billion |

| Market Size by 2032 | US$ 7.61 Billion |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Epoxy, Acrylic, Polyurethanes, Polyaspartic, and Others) • By Application (Indoor and Outdoor) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Tennant Coatings, Vanguard Concrete Coating, BASF SE, Trucrete Surfacing Systems, PPG Pittsburgh Paints, North American Coating Solution, The Sherwin-Williams Company, Elite Crete Systems, Pratt & Lambert, Florock, Axalta Coating Systems, |

| Key Drivers | • Increasing popularity of aesthetically appealing and durable flooring solutions • Increasing demand for protective coatings • Rising construction activities worldwide |

| Market Restraints | • High cost associated with the concrete floor coatings • Fluctuating prices of raw materials |

Ans. The Compound Annual Growth rate for the Concrete Floor Coating Market over the forecast period is 5.5%.

Ans. The projected market size for the Concrete Floor Coating Market is USD 7.6 billion by 2032.

Ans: The indoor application segment dominated the Concrete Floor Coating Market with the highest revenue share of about 60.5% in 2023.

Ans: Yes, you can ask for the customization as per your business requirement.

Ans: The United States holds the largest revenue share in the North America region.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

3.1 Market Driving Factors Analysis

3.1.2 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 PESTLE Analysis

3.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by l Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Concrete Floor Coating Market Segmentation, by Product

7.1 Chapter Overview

7.2 Epoxy

7.2.1 Epoxy Market Trends Analysis (2020-2032)

7.2.2 Epoxy Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Acrylic

7.3.1 Acrylic Market Trends Analysis (2020-2032)

7.3.2 Acrylic Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Polyurethanes

7.4.1 Polyurethanes Market Trends Analysis (2020-2032)

7.4.2 Polyurethanes Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Polyaspartic

7.5.1 Polyaspartic Market Trends Analysis (2020-2032)

7.5.2 Polyaspartic Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Concrete Floor Coating Market Segmentation, by Application

8.1 Chapter Overview

8.2 Indoor

8.2.1 Indoor Market Trends Analysis (2020-2032)

8.2.2 Indoor Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Outdoor

8.3.1 Outdoor Market Trends Analysis (2020-2032)

8.3.2 Outdoor Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Concrete Floor Coating Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.4 North America Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.5.2 USA Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.6.2 Canada Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.7.2 Mexico Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Concrete Floor Coating Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.5.2 Poland Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.6.2 Romania Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Concrete Floor Coating Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.4 Western Europe Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.5.2 Germany Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.6.2 France Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.7.2 UK Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.8.2 Italy Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.9.2 Spain Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.12.2 Austria Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Concrete Floor Coating Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.4 Asia Pacific Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 China Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 India Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 Japan Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.6.2 South Korea Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.7.2 Vietnam Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.8.2 Singapore Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.9.2 Australia Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Concrete Floor Coating Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.4 Middle East Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.5.2 UAE Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Concrete Floor Coating Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.4 Africa Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Concrete Floor Coating Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.4 Latin America Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.5.2 Brazil Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.6.2 Argentina Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.7.2 Colombia Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Concrete Floor Coating Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Concrete Floor Coating Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Tennant Coatings

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 Vanguard Concrete Coating

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 BASF SE

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Trucrete Surfacing Systems

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 PPG Pittsburgh Paints

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 North American Coating Solution

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 The Sherwin-Williams Company

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Elite Crete Systems

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Pratt & Lambert

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Florock

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product

Epoxy

Acrylic

Polyaspartic

Others

By Application

Indoor

Outdoor

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Liquid Ring Compressors Market Size was USD 1.22 Billion in 2023 and will reach to USD 1.97 Billion by 2032 and grow at a CAGR of 5.6% by 2024-2032.

Chromatography Resin Market Size was USD 2.6 billion in 2023 and is expected to reach $5.1 billion by 2032, growing at a CAGR of 7.4% from 2024 to 2032.

The Thermal Interface Materials Market size was valued at USD 3.71 billion in 2023 and is expected to reach USD 9.49 billion by 2032, with a growing at CAGR of 11.02% over the forecast period 2024-2032.

The Hydrogen Peroxide Market size was valued at USD 3.36 billion in 2023 and will reach USD 5.26 billion by 2032 and grow at a CAGR of 5.26% by 2024-2032.

The Cotton Yarn Market size was valued at USD 81.95 Billion in 2023 and is expected to reach USD 117.69 Billion by 2032 and grow at a CAGR of 4.10% over the forecast period of 2024-2032.

The Greenhouse Film Market Size was valued at USD 6.76 Billion in 2023 and is expected to reach USD 16.55 Billion by 2032, growing at a CAGR of 10.47% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone