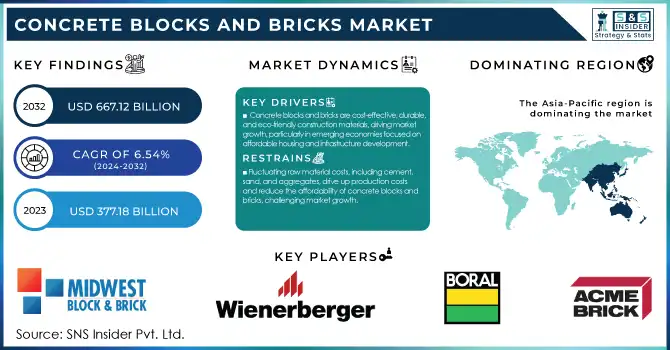

The Concrete Blocks and Bricks Market size was USD 377.18 billion in 2023 and is expected to Reach USD 667.12 billion by 2032 and grow at a CAGR of 6.54% over the forecast period of 2024-2032.

Get E-PDF Sample Report on Concrete Blocks and Bricks Market - Request Sample Report

The concrete blocks and bricks market has witnessed steady growth in recent years, driven by the demand for durable, cost-effective building materials in the construction industry. These products are favored for their strength, versatility, and environmental sustainability, making them a popular choice for both residential and commercial projects. A key trend in the market is the increasing preference for eco-friendly materials, such as recycled concrete blocks, as the construction industry adopts more sustainable practices. This shift aligns with growing regulatory pressures to reduce carbon footprints, as well as consumer demand for greener, energy-efficient buildings.

The market has also seen advancements in manufacturing technologies, leading to the development of lightweight concrete blocks, which offer superior insulation properties and reduce energy consumption. Furthermore, the adoption of automation in production processes has enhanced efficiency and product consistency, lowered costs and enabling mass production. Another emerging trend is the rising use of interlocking concrete blocks, which provide quicker and more cost-effective construction methods, especially in emerging economies where infrastructure development is accelerating. In terms of innovation, there has been a focus on improving the aesthetic appeal of concrete bricks, with companies introducing a variety of finishes and colors to meet the growing demand for visually appealing structures. Additionally, there is a noticeable increase in the use of concrete blocks and bricks for non-residential applications, including landscaping and public infrastructure projects, reflecting the expanding versatility of these materials.

DRIVERS

Concrete blocks and bricks have long been regarded as cost-effective construction materials, which significantly contribute to their widespread use in both residential and commercial construction. Compared to alternatives such as steel or wood, concrete blocks offer an affordable solution, making them an attractive choice, particularly in emerging markets where budget constraints are a priority. The materials are readily available, and their production processes are relatively simple, driving down costs and ensuring a steady supply. Additionally, the long-term durability and minimal maintenance requirements of concrete blocks and bricks further enhance their cost-effectiveness, as they reduce the need for repairs and replacements over time.

The global concrete blocks and bricks market has experienced steady growth, primarily driven by rapid urbanization, infrastructure development, and population expansion. This trend is especially prominent in emerging economies, where construction activities are booming. As governments focus on affordable housing and infrastructure projects, the demand for concrete blocks and bricks is expected to rise significantly. Furthermore, with the increasing emphasis on sustainability, there is a growing trend toward producing eco-friendly concrete blocks made from recycled materials, which supports both cost savings and environmental goals. This market is poised for continued growth, with innovations in manufacturing and material properties further driving market expansion.

RESTRAINT

High raw material costs pose a significant challenge to the concrete blocks and bricks market. The production of concrete involves essential raw materials such as cement, sand, and aggregates, which are subject to price fluctuations based on factors like supply chain disruptions, demand surges, and environmental regulations. When the prices of these materials increase, manufacturers face higher production costs, which often result in increased prices for concrete blocks and bricks. This volatility can strain profit margins and reduce the affordability of these construction materials, especially for large-scale projects. Additionally, manufacturers may struggle to maintain competitive pricing if the cost of raw materials continues to rise. The unpredictability of raw material costs is particularly impactful in regions with limited access to local resources or volatile market conditions, further complicating the cost structure of concrete production and potentially slowing down market growth.

By Type

The Brick segment dominated with the market share over 42% in 2023, due to its long-established presence and widespread use in construction. Brick products, particularly clay bricks, offer significant advantages such as durability, thermal insulation, fire resistance, and aesthetic appeal, making them a preferred choice in residential, commercial, and industrial projects. Additionally, the versatility of bricks in different architectural styles, along with their ability to withstand varying environmental conditions, has contributed to their dominance. The strong demand for traditional brick materials continues to lead the market despite the growing popularity of cement blocks.

By Application

The Residential segment dominated with the market share over 48% in 2023, primarily due to the material's advantages in home construction. Concrete blocks and bricks offer excellent durability, providing long-lasting strength against external elements, making them ideal for residential buildings. Additionally, they provide superior insulation, helping to regulate indoor temperatures and reduce energy costs. These properties make concrete blocks and bricks an attractive and cost-effective choice for homeowners and builders alike. As a result, this segment remains a key driver of demand, especially in regions experiencing growth in housing construction and residential developments.

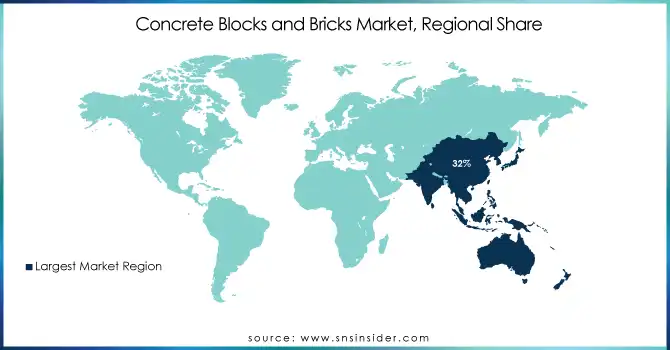

The Asia-Pacific region dominated with the market share over 32% in 2023, due to its rapid urbanization, large-scale construction projects, and expanding infrastructure development in countries like China, India, and Japan. The demand for concrete blocks and bricks is primarily driven by residential, commercial, and industrial construction activities. The region benefits from abundant low-cost labor and readily available raw materials, making production more cost-effective. These factors, along with the growing need for sustainable building solutions, have fueled significant market growth, positioning Asia-Pacific as the leader in the global concrete blocks and bricks market.

North America, especially the United States and Canada, is witnessing the fastest growth in the Concrete Blocks and Bricks Market. This growth is driven by rising demand for residential and commercial buildings, as well as a shift towards sustainable construction practices that prioritize eco-friendly materials like concrete blocks and bricks. Additionally, ongoing renovation and remodelling projects in both urban and suburban areas are further boosting market demand. The region's commitment to green building standards, energy-efficient construction, and the use of durable materials contributes significantly to the expanding market for concrete blocks and bricks.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Some of the major key players of the Concrete blocks and bricks Market

Suppliers for (Concrete blocks, bricks, cement, ready-mix concrete) on Concrete blocks and bricks Market

In December 9, 2024: Cemex, a leading provider of building materials, is playing a key role in constructing the new Howard Frankland Bridge in Tampa, Florida. The USD 865 million project, which involves the supply of 141,000 cubic yards of concrete, will be the largest bridge by surface area in the state, designed to enhance hurricane evacuation preparedness and regional connectivity.

In January 8, 2025: Wienerberger India's flagship product, Porotherm Smart Bricks, has achieved an impressive environmental milestone with the lowest carbon footprint in a recent Life Cycle Analysis (LCA). The bricks demonstrated a Global Warming Potential (GWP) of just 97.103 Kg CO2e per ton, outpacing other materials, with a lifespan of 150 years.

In August 8, 2024: Boral Limited is developing a next-generation lower carbon concrete using Australian calcined clay as an alternative to traditional cement. In collaboration with industry partners and researchers, Boral is working to demonstrate the technical feasibility of this innovative product for Australian buildings and infrastructure. The project, co-funded by the Commonwealth’s CRC Program, aims to reduce the carbon intensity of concrete while ensuring a sustainable supply of supplementary cementitious materials.

| Report Attributes | Details |

| Market Size in 2023 | USD 377.18 billion |

| Market Size by 2032 | USD 667.12 billion |

| CAGR | CAGR of 6.54% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Cement Block (Hollow, Fully Solid, Cellular), Brick (Clay, Fly Ash Clay, Sand Lime, Others) • By Application (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Acme Brick Company, Boral, Wienerberger AG, Midwest Block & Brick, Concrete Products, Tristar Brick & Block LTD, Ideal Concrete Block, CEMEX, Lignacite Ltd., Bauroc AS, Hi-Way Concrete, Brampton Brick, Oldcastle, Forterra, Rocla, Hanson UK, Kingspan, Fendt, Teifoc, Cemex USA |

| Key Drivers | • Concrete blocks and bricks are cost-effective, durable, and eco-friendly construction materials, driving market growth, particularly in emerging economies focused on affordable housing and infrastructure development. |

| RESTRAINTS | • Fluctuating raw material costs, including cement, sand, and aggregates, drive up production costs and reduce the affordability of concrete blocks and bricks, challenging market growth. |

Ans: Asia-Pacific dominated the Concrete blocks and bricks Market in 2023

Ans: The “Brick” segment dominated the Concrete blocks and bricks Market.

Ans: Concrete blocks and bricks are cost-effective, durable, and eco-friendly construction materials, driving market growth, particularly in emerging economies focused on affordable housing and infrastructure development.

Ans: The Concrete blocks and bricks Market was USD 377.18 billion in 2023 and is expected to Reach USD 667.12 billion by 2032.

Ans: The Concrete blocks and bricks Market is expected to grow at a CAGR of 6.54% during 2024-2032.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Concrete blocks and bricks Market Segmentation, By Type

7.1 Chapter Overview

7.2 Cement Block

7.2.1 Cement Block Market Trends Analysis (2020-2032)

7.2.2 Cement Block Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Hollow

7.2.3.1 Hollow Market Trends Analysis (2020-2032)

7.2.3.2 Hollow Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Fully Solid

7.2.4.1 Fully Solid Market Trends Analysis (2020-2032)

7.2.4.2 Fully Solid Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Cellular

7.2.5.1 Cellular Market Trends Analysis (2020-2032)

7.2.5.2 Cellular Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Brick

7.3.1 Brick Market Trends Analysis (2020-2032)

7.3.2 Brick Hydroxide Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Clay

7.3.3.1 Clay Market Trends Analysis (2020-2032)

7.3.3.2 Clay Hydroxide Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Fly Ash Clay

7.3.4.1 Fly Ash Clay Market Trends Analysis (2020-2032)

7.3.4.2 Fly Ash Clay Hydroxide Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 Sand Lime

7.3.5.1 Sand Lime Market Trends Analysis (2020-2032)

7.3.5.2 Sand Lime Hydroxide Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.6 Others

7.3.6.1 Others Market Trends Analysis (2020-2032)

7.3.6.2 Others Hydroxide Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Concrete blocks and bricks Market Segmentation, By Application

8.1 Chapter Overview

8.2 Residential

8.2.1 Residential Market Trends Analysis (2020-2032)

8.2.2 Residential Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Commercial

8.3.1 Commercial Market Trends Analysis (2020-2032)

8.3.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Industrial

8.4.1 Industrial Market Trends Analysis (2020-2032)

8.4.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Concrete blocks and bricks Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.4 North America Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.5.2 USA Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.6.2 Canada Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Concrete blocks and bricks Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Concrete blocks and bricks Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.6.2 France Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4 Asia-Pacific

9.4.1 Trends Analysis

9.4.2 Asia-Pacific Concrete blocks and bricks Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia-Pacific Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.4 Asia-Pacific Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 China Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 India Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 Japan Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.9.2 Australia Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia-Pacific

9.4.10.1 Rest of Asia-Pacific Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia-Pacific Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Concrete blocks and bricks Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Concrete blocks and bricks Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.4 Africa Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Concrete blocks and bricks Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.4 Latin America Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Concrete blocks and bricks Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Concrete blocks and bricks Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Acme Brick Company

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Boral

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Wienerberger AG

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Midwest Block & Brick

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Concrete Products

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Tristar Brick& Block LTD

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Ideal Concrete Block

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 CEMEX

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Lignacite Ltd.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Bauroc AS

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Cement Block

Hollow

Fully Solid

Cellular

Brick

Clay

Fly Ash Clay

Sand Lime

Others

By Application

Residential

Commercial

Industrial

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Cyanate Ester Resin Market was valued at $ 331.3 Million in 2023. It is expected to grow to $ 829.6 Million by 2032 and grow at a CAGR of 10.7% from 2024-2032.

The Alkylamines Market Size was valued at USD 6.24 billion in 2023 and is expected to reach USD 11.11 billion by 2032 and grow at a CAGR of 6.62% over the forecast period 2024-2032.

Chlorine Trifluoride Market was valued at USD 55.08 Million in 2023 and is expected to reach USD 82.81 Million by 2032, at a CAGR of 4.64% from 2024-2032.

The Polyurethanes Market Size was USD 80.7 billion in 2023 and is expected to reach USD 125.7 billion by 2032 and growing at a CAGR of 5.1% by 2024-2032.

The Heterogeneous Catalyst Market size was valued at USD 23.4 Billion in 2023. It is expected to grow to USD 34.9 Billion by 2032 and grow at a CAGR of 4.6% over the forecast period of 2024-2032.

Nitrogen Market size was valued at USD 36.6 billion in 2023 and is estimated to reach USD 71.7 billion by 2032, growing at a CAGR of 7.8% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone