Computer Graphics Market Size & Trends:

The Computer Graphics Market size was valued at USD 30.48 billion in 2024 and is expected to reach USD 63.14 billion by 2032, growing at a CAGR of 9.57% over the forecast period 2025-2032. The key driving factors for the computer graphics market are the increase in media content and the need for this content for simulation in key industries such as aerospace and automotive, and cost-effective and complex solutions for advanced graphic technologies.

To Get More Information On Computer Graphics Market - Request Free Sample Report

The computer graphics market growth is fueled by the rising demand for high-quality visual content in industries such as entertainment, automotive, healthcare, and gaming. Technological developments in VR, AR, AI, and 3D modeling are a driving force that impacting the market. This, in turn, is proliferating the computer graphics solutions market due to increased demand for immersive experience, digital simulation, and digital media content. When technology becomes affordable, the market is opened up across continents, grows, and the most attractive markets are the emerging ones.

Meta announced a cheaper VR headset and revealed a prototype for AR glasses with holograms. All of these advancements are designed to render immersive experiences more available to the masses, further accelerating the adoption of VR and AR solutions.

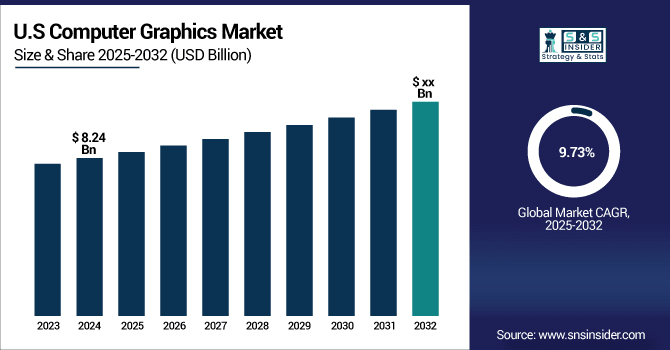

The U.S. Computer Graphics Market size is estimated to be USD 8.24 billion in 2024 and is projected to grow at a CAGR of 9.73%. The demand for cutting-edge visual media in games, entertainment, automotive, and medical sectors is leading to a growth in the U.S. computer graphics market share. The rapid growth of innovations in technologies such as AI, VR, AR, 3D modeling, and strong investments by large technology companies are the main drivers for market expansion.

Computer Graphics Market Dynamics

Key Drivers:

-

Surging Demand for High-Quality Visuals Propels Computer Graphics Across Entertainment, Automotive, and Healthcare Industries

The increase in the computer graphics market is rooted in the improvement seen in industries such as entertainment, automotive, aerospace, and healthcare. This is partly due to the increasing requirement for high-quality visual content driven by gaming, VR, and AR. In addition to this, the increasing use of digital video production, simulation technologies, and computer-aided design (CAD) tools in industries like automotive design and aerospace engineering is further boosting the market growth.

A study published in Engineering.com reveals Tesla uses real-time rendering engines like Unreal Engine to provide instant visual feedback during design iterations, thus speeding up the overall development cycle.

Restrain:

-

High-end End Graphics Face Challenges in Integration Rendering Power, and Skilled Workforce Across Industries

The more advanced graphics get, the more rendering is going to consume processing power, and a portion of companies and/or sectors may lack these capabilities to widely accept new technologies. Additionally, new tools often have to be integrated into old systems, which makes transitioning difficult and slow in most sectors. Specialization in fields such as animation, simulation, and VR is very high, and few people are qualified, raising barriers for companies to strengthen their capacity in this field.

The integration of new computer graphics applications into existing systems is a complex problem, particularly regarding compatibility and data exchange, and the use of special knowledge and techniques used in up-to-date programs, as stated in Programming and Computer Software.

Opportunity:

-

Advances in 3D Modeling and Simulation Drive Growth in Healthcare Education and Emerging Business Segments

Rapid acceleration in 3D modeling and visual immersiveness presents large spaces in industries such as architecture, healthcare, and education. The emerging field of virtual training and simulation for healthcare professionals is opening doors for authentic simulation and practicing medical procedures safely. Moreover, the reduction in the cost of technology for graphics is opening a whole new segment for growth in SMBs, which is one of the great drivers for the computer graphics market.

Challenges:

-

Intermittent Solar Power Generation Highlights the Need for Efficient and Reliable Energy Storage Solutions

A lack of compatibility across platforms and devices can break the ability to properly use computer graphics technologies. The technical challenge here remains making sure that these graphics tools are optimized for the myriad of devices out there, hardware and software are arguably more dynamic than ever before. It also leads to a risk of data security issues in fields such as healthcare and automotive design, where graphics-heavy applications are used, as 3D models and digital assets are vulnerable to unauthorized access or modification.

Computer Graphics Market Segments Analysis

By Software

CAD/CAM has a leading 29.4% share of the computer graphics market in 2024. This is because CAD/CAM is extensively employed in industry fields like automotive, aerospace, and manufacturing for product designing, prototyping well as production lines. CAD/CAM has become an essential part of these sectors due to its ability to precisely model 3D and simulate real-world conditions.

The animation segment is likely to witness growth of the fastest growth between 2025 and 2032. This can be attributed to the increasing need for animated content in games, films, advertising, and virtual reality (VR) applications. As animation leaders refine their capabilities, the tools will become more sophisticated, yielding richer interactive experiences. With consistent investments in premium visual content across industries, particularly in entertainment and media, animation technologies will continue to advance and be widely adopted.

By Services

Consulting had the biggest market share of 38.8% in the computer graphics market in 2024. The increasing need for adequate guidance and tactics in realizing intricate computer graphics technologies among sectors like automotive, healthcare, and entertainment drives this prominence. Consulting services play an important role in helping businesses incorporate new graphic technologies, streamline workflows, and improve productivity, and are therefore another crucial segment within the market.

From 2025 to 2032, integration services are anticipated to expand at the highest CAGR. With more organizations using advanced solutions in computer graphics, integrating such technologies into the existing infrastructure is a greater challenge. New graphics tools need to work together seamlessly over different platforms, devices, and systems, which is why companies require expert integration services.

By Verticals

The market share of Entertainment & Advertising was 19.7% in 2024, and it is predicted to have the highest growth from 2025 to 2032. This is due to the increasing demand for quality visual content in gaming, movies, virtual reality (VR), and digital advertising. With both of these industries constantly changing, the demand for computer graphics tech to create realistic and captivating experiences has also skyrocketed. Advertising is indulging in modern animation and digital design tools to utilize enticing and interactive elements. Furthermore, innovative technologies such as AR, VR, and 3D modeling have been quickly adopted across the entertainment sector, consequently increasing the demand for advanced graphics solutions, which in turn drives the market growth in the coming years.

By End-User

Large Enterprises captured the highest market share in 2024 with a share of 60.6%, thanks to their higher investments in advanced computer graphics technologies for product design, simulations, marketing, and engagement with customers. With the resources to invest in innovative graphics technology, these enterprises can remain competitive and streamline processes. In commercial product development, large enterprises in durable goods sectors, such as automotive, aerospace, and entertainment, have drawn advantage from computer graphics, through product modeling and customer experience.

From 2025 to 2032, the Small & Medium Businesses (SMBs) segment is expected to have the fastest CAGR. The falling price point of next-gen graphics tech, as well as the growing accessibility of cloud-based solutions, is driving increased adoption of CGI tools among SMBs for design, marketing virtual collaboration. With an increasing array of economical and scalable graphics solutions, SMBs can capitalize on ground-breaking innovations to rival larger enterprises. This segment of the market will continue to take off over the next few years.

Computer Graphics Market Regional Outlook

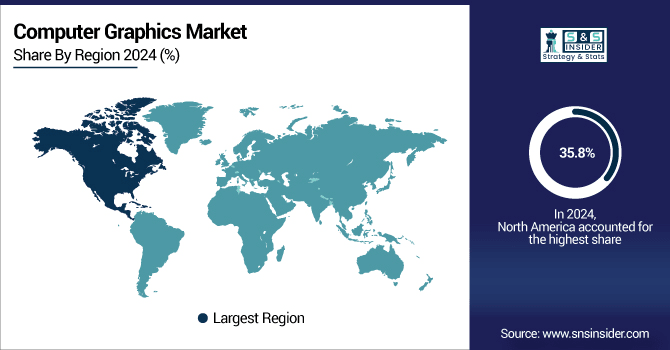

North America held the largest share of the computer graphics market in 2024, at 35.8%, owing to its robust technological infrastructure and reliance on computer graphics solutions within major industry sectors, such as automotive, entertainment, and healthcare. This dominance can be attributed to a good number of tech companies and startups, along with a strong determination towards research and development.

Get Customized Report as Per Your Business Requirement - Enquiry Now

The US holds a leading position in North America, with major market players including NVIDIA, Intel, and Autodesk adding exceptional value for market growth. In this region, a significant share of demand is driven by Hollywood's use of computer graphics in movies and video games.

During the forecast period 2025 to 2032, Asia Pacific is predicted to have the highest CAGR, driven by the rapid adoption of digital technologies in China, India, and Japan. As the gaming market in China is one of the largest in the world, with the industry using state-of-the-art computer graphics in developing games, it is driving the demand for graphics technologies. Another Asian heavyweight is Japan, the home of global animation and gaming leaders. Also, Computer graphics is utilized for product design and simulation in automotive companies in South Korea and China.

The Asia Pacific region is led by China, with significant technology sector investments and increasing digital content demand in media & entertainment, which will boost the regional market expansion.

The computer graphics market in Europe is driven by automotive, aerospace, healthcare, and entertainment, and accounts for a substantial share. It is a hotbed of innovation, with particular focus on the design and simulation technology space, so a major regional player. European companies are investing in advanced computer graphics to develop products, marketing, and digital media.

Germany is the largest country for the adoption of this technology in Europe, partly due to its motor industry, where huge names like BMW, Audi, and Volkswagen widely use computer graphics in vehicle design, prototyping, and simulation.

Latin America and the Middle East & Africa (MEA) are emerging regions in the computer graphics market, attributable to the strong expansion of industries such as entertainment, automotive, and construction. The growing adoption of digital content creation tools in media and advertising is also contributing to the growth of the market in Latin America. On the other hand, there is increasing demand for advanced graphics technologies, such as the incorporation of AR and 3D visualization, across several industries in the MEA region, such as healthcare, construction, and tourism.

Computer Graphics Companies are:

Some of the major players in the Computer Graphics Market are NVIDIA, AMD, Intel, Autodesk, Adobe, Apple, Microsoft, Unity Technologies, Epic Games, and Siemens.

Recent Development:

-

In April 2025, NVIDIA launched the GeForce RTX™ 5060 GPUs, featuring neural rendering and Blackwell architecture innovations.

-

In January 2025, AMD introduced new graphics and gaming products aimed at delivering the ultimate gameplay experience. The latest offerings promise enhanced performance and immersive gameplay for users.

-

In March 2024, Microsoft and NVIDIA announced key integrations to accelerate generative AI for enterprises, including advanced AI tools and enhanced performance through Azure and NVIDIA's hardware.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 30.48 Billion |

| Market Size by 2032 | USD 63.14 Billion |

| CAGR | CAGR of 9.57% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Software (CAD/CAM, Digital Video, Simulation, Imaging, Animation) • By Services (Consulting, Integration, Training and Support) • By Verticals (Aerospace and defense, Automobile, Entertainment and Advertising, Academia and Education, Healthcare, Manufacturing, Architecture, Building and Construction, Others) • By End-User (Small & Medium Businesses, Large Enterprises) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | NVIDIA, AMD, Intel, Autodesk, Adobe, Apple, Microsoft, Unity Technologies, Epic Games, and Siemens. |