Compressor Rental Market Report Scope & Overview:

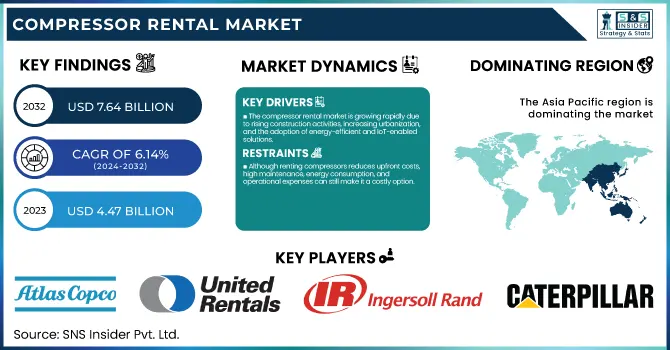

The Compressor Rental Market was estimated at USD 4.47 billion in 2023 and is expected to reach USD 7.64 billion by 2032, with a growing CAGR of 6.14% over the forecast period 2024-2032. This report offers unique insights into operational efficiency and utilization trends in the Compressor Rental Market, focusing on industry-specific utilization rates and regional rental duration patterns. It analyzes maintenance and downtime metrics, highlighting efficiency challenges and service optimization. The study explores technological advancements, including IoT-enabled monitoring and energy-efficient compressors shaping the rental landscape. Additionally, global trade trends provide a macroeconomic perspective on rental compressor demand. To enhance uniqueness, the report includes insights on the impact of sustainability initiatives on compressor rentals and the rising demand for hybrid/electric rental compressors in response to stricter emission regulations.

To Get more information on Compressor Rental Market - Request Free Sample Report

Compressor Rental Market Dynamics

Drivers

-

The compressor rental market is growing rapidly due to rising construction activities, increasing urbanization, and the adoption of energy-efficient and IoT-enabled solutions.

The compressor rental market is experiencing significant growth, driven by the increasing demand from the construction industry. The demand for compressed air solutions has grown as infrastructure projects continue to increase worldwide from residential, commercial, and industrial development. Air compressors are prominent in construction activities to drive pneumatic tools, spray concrete, and etc. Contractors renting compressors gain flexibility and cost savings easy access to advanced equipment without the need for heavy capital investment. Urbanization, especially in Asia-pacific and the middle east, and smart city projects will also drive demand in emerging economies. Sustainable and energy-efficient compressors are being adopted, in line with growing strict environmental rules. Moreover, the trend of IoT-based rental solutions minimizes operational downtime and increases real-time insights thereby making rental air compressors more appealing. The increase in construction activity will lead to steady growth in the compressor rental industry and lucrative opportunities for service providers.

Restraint

-

Although renting compressors reduces upfront costs, high maintenance, energy consumption, and operational expenses can still make it a costly option.

While renting compressors eliminates the need for large upfront investments, maintenance and operational costs remain a significant concern. And the multi-facility rental companies must ensure that each compressor gets regular maintenance and servicing as well as meets safety and environmental standards, which raises the operations costs. In addition, since compressors are power-intensive equipment, energy consumption is a leading contributor, with high electricity or fuel costs contributing to the overall cost. Frequent breakdowns, or performance inefficiencies, might even prompt rapid repairs, or replacements, adding additional costs. Additional to this, rental agreements commonly encompass insurance, transportation and assembly charges; further centering in on cost outlay. In certain industries, where the compressor is in constant or periodic use over an extended period, cumulative rental and servicing costs can sometimes exceed the cost of ownership. Focus on Cost Effective Solutions: Companies should consider rental plans, energy-efficient models, and predictive maintenance plans, which will help in reducing operational costs while still maintaining up-time. However, despite these costs, renting is a perfectly qualifying solution for companies looking for flexibility and to avoid capital expenditures and fixed overheads.

Opportunities

-

Rapid industrialization, urbanization, and infrastructure growth in Asia-Pacific and Africa are driving the demand for rental compressors.

The expansion of the compressor rental market in emerging regions, particularly Asia-Pacific and Africa, is driven by rapid industrialization and urbanization. As a result of this, these areas are especially undergoing more infrastructure developments, manufacturing activities, energy projects, and so on that require easy access to compressed air solutions. The majority of companies in these markets use compressors, albeit on a rental rather than a purchase basis, as this requires lower initial expenditures and fewer maintenance responsibilities. Moreover, government initiatives promoting industrial growth and the rise of foreign investments in construction, mining, and oil & gas sectors are also driving demand for rental of compressors. The growing number of smart cities and megastructures, particularly in India, China and South Africa, has also bolstered market opportunities. Stock image and stock photo may combine to be available in stock market However, challenges such as inconsistent regulatory frameworks and lack of awareness among small businesses may hinder growth. Due to this, the demand in emerging markets for affordable and flexible air compression solutions makes these areas significant growth markets for compressor rental.

Challenges

-

Limited awareness among SMEs about the cost-saving and flexible benefits of compressor rentals hinders market penetration.

Many small and medium-sized enterprises (SMEs) lack awareness of the advantages of compressor rentals, limiting market penetration. In developing regions, many businesses still choose to buy compressors, believing it is a more economical long-term investment. However, you also need to consider elements like maintenance costs, depreciation, and how rentals allow for flexibility. This is also due to limited access to information and a failure of rental service providers to actively promote their services. When deep on the investment side, SMEs who are operating on a shoestring may not have delved into the vast pool of ownership and rental options available, thinking that renting will be more expensive or just not available to them. In addition, rental companies are not engaging in targeted marketing campaigns or educational initiatives, leading to low adoption rates. Addressing this gap needs more awareness programs, forming strategic partnerships, and developing customized rental solutions for SMEs. As such, the compressor rental market could grow further by overcoming these challenges to reach small enterprises with lower-priced offerings.

Compressor Rental Market Segmentation Analysis

By End-Use Industry

The construction segment dominated with a market share of over 32% in 2023, owing to the extensive use of compressed air for a wide range of applications which includes road construction, tunneling, concrete spraying, and demolition. Large construction projects, for example, need a temporary yet efficient compressed air solution, so in general, it is more cost beneficial to rent a compressor rather than buy one. Construction operations are usually in remote or temporary sites, so permanent compressors are not practical. The growing emphasis on smart cities and urbanization alongside infrastructure development accelerates compressor rentals. To reduce maintenance cost and the flexibility of operations, contractors and construction firms prefer rental options. The expanding usage of green and energy-efficient compressors further plays a role in increasing the dependence of the construction industry on rental solutions.

By compressor type

The Rotary Screw segment dominated with a market share of over 68% in 2023, due to its superior efficiency, reliability, and ability to deliver a continuous supply of compressed air. They are extensively utilized in construction, manufacturing, oil & gas, and mining sectors, where a steady stream of high-volume airflow is essential. Low maintenance requirements, energy efficiency, and operation for an extended period without overheating have made them a popular choice for large scale industrial application. New developments in rotor screws, such as their energy-saving models with variable-speed drives, have also solidified the market leaders. In recent years, as industries are becoming more focused on productivity and value for money, the rental market for rotary screw compressors is also continuously increasing.

Compressor Rental Market Regional Outlook

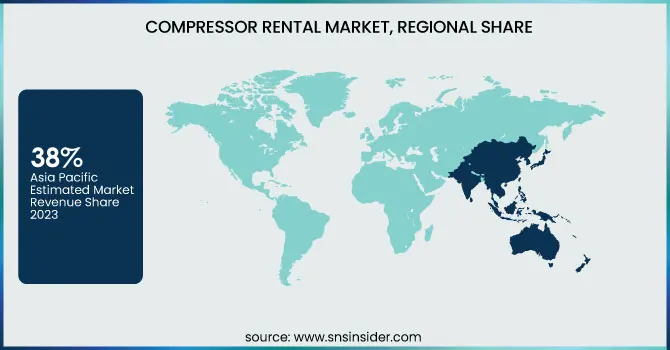

The Asia-Pacific region dominated with a market share of over 38% in 2023, due to its rapid industrial growth, urbanization, and large-scale infrastructure projects in countries like China, India, and Japan. Increasing construction, manufacturing and oil & gas sectors to drive demand for rental compressors due to their cost and flexibility advantage over purchased of compressors. Moreover, government initiatives encouraging industrialization coupled with the implementation of energy-efficient equipment is further anticipated to fuel the market growth. The preference for renting over purchasing, particularly among cost-conscious businesses, bolsters the region’s dominance in the market. The increasing foreign investment and technological advancement in compressed air solutions are likely to drive the growth of the APAC compressor rental market even further.

North America is witnessing significant growth, driven by the increasing demand from industries such as oil & gas, construction, mining, and power generation. The growing demand for shale gas exploration, as well as offshore drilling activities, especially in North America, is anticipated to further drive the demand for high-performance rental compressors. Moreover, the increasing number of infrastructure projects and tight environmental regulations favoring energy-saving solutions are accelerating the uptake of advanced rental compressors. Also, renting solutions are preferred over capital investments, and technological advancements making compressors more efficient and durable add to the growth of the market as well. North America is one of the rapidly growing compressor rental markets globally, owing to the cost-effectiveness and operational flexibility offered.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players in the Compressor Rental Market

-

Atlas Copco (Rotary Screw Compressors, Oil-Free Air Compressors)

-

United Rentals, Inc. (Portable Air Compressors, High-Pressure Compressors)

-

Ingersoll Rand (Electric & Diesel Air Compressors, Reciprocating Compressors)

-

Caterpillar Inc. (Diesel-Powered Compressors, Portable Compressors)

-

Hertz Equipment Rental Corporation (Industrial Air Compressors, Towable Compressors)

-

Ashtead Group Plc (High-Pressure Compressors, Air Boosters)

-

H&E Equipment Services (Rotary Screw Compressors, Oil-Free Compressors)

-

Loxam Group (Portable Compressors, High-Capacity Air Compressors)

-

HSS Hire (Electric & Diesel Air Compressors, Silent Compressors)

-

Aggreko (Oil-Free Air Compressors, Modular Air Systems)

-

Sunbelt Rentals (Towable Compressors, High-Pressure Compressors)

-

Boels Rental (Electric Compressors, Industrial Air Compressors)

-

Blueline Rental (Portable Air Compressors, Diesel Compressors)

-

Aerzen Rental (Oil-Free Screw Compressors, Turbo Compressors)

-

Sullair (Rotary Screw Air Compressors, High-Capacity Compressors)

-

Kaeser Kompressoren (Industrial Air Compressors, Blowers)

-

Doosan Portable Power (Portable Air Compressors, High-Pressure Air Compressors)

-

ELGi Compressors (Rotary Screw Air Compressors, Oil-Free Compressors)

-

Quincy Compressor (Reciprocating Air Compressors, Rotary Screw Compressors)

-

BAUER Compressors (Breathing Air Compressors, High-Pressure Compressors)

Suppliers for (High-quality oil-free and oil-lubricated air compressors for various industries) on Compressor Rental Market

-

Atlas Copco Specialty Rental

-

Modern Energy Rental

-

Shiv Shakti Air Compresso

-

Aggreko

-

Shaktiman Equipments

-

Kirloskar Pneumatic Company Limited

-

ELGi Equipments Limited

-

Ingersoll Rand

-

Sullair

-

Doosan Portable Power

Recent Development

-

In July 2024: Atlas Copco launched the X-Aira 1200-40, an advanced addition to its DrillAir range. This portable air compressor is specifically designed for deep drilling applications, offering enhanced efficiency with a lower carbon footprint.

-

In June 2023: Atlas Copco successfully completed the acquisition of National Pump & Energy (NPE), a key provider of dewatering, environmental services, and water treatment solutions across Australia and New Zealand.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.47 Billion |

| Market Size by 2032 | USD 7.64 Billion |

| CAGR | CAGR of 6.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By end-use industry (Construction, Mining, Oil & Gas, Power, Manufacturing, Chemical) • By compressor type (Rotary Screw, Reciprocating) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Atlas Copco, United Rentals, Inc., Ingersoll Rand, Caterpillar Inc., Hertz Equipment Rental Corporation, Ashtead Group Plc, H&E Equipment Services, Loxam Group, HSS Hire, Aggreko, Sunbelt Rentals, Boels Rental, Blueline Rental, Aerzen Rental, Sullair, Kaeser Kompressoren, Doosan Portable Power, ELGi Compressors, Quincy Compressor, BAUER Compressors. |