Commercial Vehicles Market Report Scope & Overview:

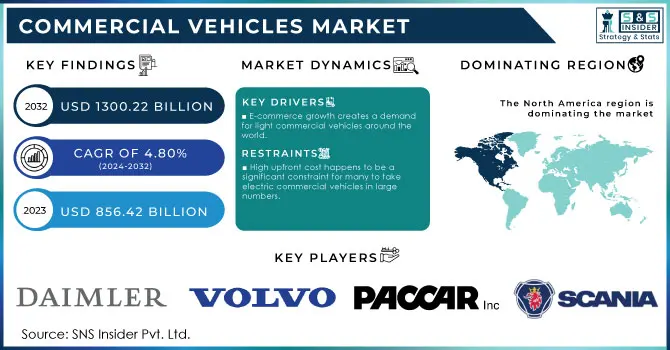

The Commercial Vehicles Market Size was valued at USD 856.42 Billion in 2023 and is expected to reach USD 1300.22 Billion by 2032 and grow at a CAGR of 4.80% over the forecast period 2024-2032. Commercial vehicles in the international market are growing much faster than others. There is a higher demand in areas such as logistics, construction, and passenger transportation. In these sectors, commercial vehicles play a role in the form of LCVs, heavy trucks, and buses that provide the required transportation. New policy-making by the government in the United States has heavily impacted the market.

Get More Information on Commercial Vehicles Market - Request Sample Report

The U.S. government's aim at reducing emission and transport with a sustainable future nudged incentives and more strict regulations towards automobile manufacturers to produce environmentally friendly commercial vehicles like electric Truck and hybrid trucks. The U.S. Environmental Protection Agency (EPA) standards for Phase 2 Greenhouse Gas Emissions from heavy-duty vehicles will cut CO2 by an estimated 1.3 billion metric tons by 2030. It is believed to force manufacturers toward more fuel-efficient designs, as accounts declare. This move has accelerated innovation, fueling the sector to take up greener technologies.

Some of the major technological advancements in the commercial vehicles sector include electric powertrain, advanced driver assistance systems, and autonomous driving technologies. The European Union has mandated that from 2024, all new commercial vehicles shall be equipped with advanced driver-assistance systems, including AEB and LDW. As a result, nearly 80% of new commercial vehicles sold in the EU, by 2023, carried an installed ADAS. Electric commercial vehicles, in themselves, are gaining popularity because of environmental concerns and lower operating costs. A lot of optimization also seems to happen in the usage of fleet management system through IoT and telematics that reduce downtime and enhance efficiency. Such technological progress will continue to propel the market in the future.

The market offers huge future opportunities, particularly in the United States, with industries taking advantage of this to replace aging fleets with more efficient and technologically advanced vehicles. In logistics, sales of electric commercial vehicles are likely to increase with the rapid development of e-commerce. Smart city initiatives and infrastructure development projects also provide growth opportunities for electric and autonomous buses in the urban transportation sector.

Commercial Vehicles Market Dynamics

Key Drivers:

-

E-commerce growth creates a demand for light commercial vehicles around the world.

Through sheer leaps in e-commerce, there has been strong and rising demand for light commercial vehicles (LCVs) in last-mile delivery. This mainly happens in urban areas where deliveries become an issue if the transportation solution provided is not enough to keep pace with growing customer demands for on-time and efficient delivery services. This is due to increased volumes, and companies like Amazon and UPS are investing more in their fleet expansion. Electric LCVs are also in demand. This is not just an American phenomenon but an all-over-globe one. Both developed and emerging economies are on the lookout for commercial vehicles because of sustainable transportation initiatives.

-

Demand for electric commercial vehicles because of sustainable transportation initiatives.

Global policies provide for improving the standards of emission and increase the adoption of electric vehicles that would minimize carbon footprints. Such global policies created an empowering environment for adopting electric commercial vehicles, especially in regions such as the U.S. and Europe, where subsidies and tax incentives are available for companies adopting greener technologies.

For instance, California's Zero-Emission Vehicle mandate has forced a number of manufacturers to create electric trucks and buses. In California, they have a regulation stating that 100 percent of new sales of medium- and heavy-duty trucks sold in the state will be zero emission by 2035 to reduce pollution. There is the global development toward sustainable transport; this too will mean a move to more EVs and subsequently increases the demand for electric commercial vehicles.

Restraint

-

High upfront cost happens to be a significant constraint for many to take electric commercial vehicles in large numbers.

Definitely, the big challenge that holds back the commercial vehicles market, collectively and the electric ones, is the high initial cost. While electric trucks and buses offer long-term economies because of lower fuel and maintenance costs, higher acquisition prices are a big obstacle even to smaller businesses and fleets. Most importantly, the reason is a very expensive battery technology which makes electric trucks and buses costlier than the equivalents which run on an internal combustion.

The setting of charging infrastructure also adds to the financial burden. These factors further delay the speed of transition to electric commercial vehicles, especially in areas where any such government subsidy or incentive is scarce. The overall cost of owning these vehicles is very appealing over time but often not immediately apparent to companies focusing more on the short-term financial gains.

Commercial Vehicles Market Segmentation Overview

By Product

In 2023, LCVs had the highest market share of 74.61%. LCVs are used more for their flexibility in urban as well as suburban transport. Thus, they come in handy in very sectors like logistics and delivery. The increase in e-commerce has boosted the demand for LCVs. E-commerce companies are increasing at a rapid pace, and efficiently solving last-mile delivery problems in a significant number of its urban markets.

Buses & Coaches is likely to have the highest growth rate in forecasting years with a CAGR of 6.95% from 2024 to 2032. This can be because of the increased investments in public transport. There is a shift toward electric buses owing to sustainable urban mobility initiatives. Several countries are planning to create electric fleets of buses with an aim of reducing pollution and supporting green public transport solutions.

By End User

In 2023, logistics held the largest market share of 28.09%. This market growth is due to increased demand in logistic services due to high e-commerce growth and the urgent need for more efficient transport and distribution networks that required commercial vehicles in logistics. This sector, however, sees usage of LCVs increase with the rise in the number of last-mile delivery services.

Passenger transportation, however, is expected to grow at the fastest clip in the forecast period, growing at a CAGR of 6.41% during 2024-2032. This is led by wide adoption of electric buses in urban landscapes, smart city initiatives, and rising efforts to cut down traffic congestion through public transport initiatives. Many countries have taken up a focus on electrifying their public transport fleets, thereby bolstering the demand for electric buses and coaches.

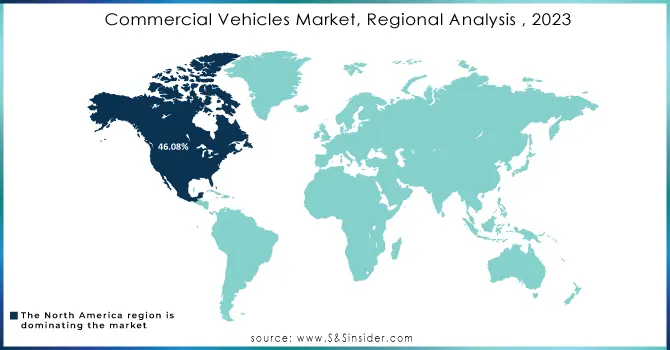

Commercial Vehicles Market Regional Analysis

The North America region had the largest share in 2023 at 46.08% in the Commercial Vehicles Market. In 2024, US sales is going to be highest with 11,630k vehicles units. This is because of the immense usage of commercial vehicles in most logistics, construction, and public transportation sectors within the same region. Strong adherence to strict emissions regulation coupled with an increasing trend in electric commercial vehicles in the U.S. has triggered the growth in this market.

Asia-Pacific is likely to be the most rapidly growing region in terms of CAGR from 2024 to 2032 at 6.08%. Unit sales in the Commercial Vehicles market in Asia is expected to reach 7.09 Million vehicles in 2024. Factors related to rapid urbanization and increasing industrial activities, among others, are promoting growth in the region coupled with the boom in e-commerce, which is also improving demand for commercial vehicles, especially in China and India. In addition, the adoption of electric vehicles in this region will further boost the growth in this market even more.

Need Any Customization Research On Commercial Vehicles Market - Inquiry Now

Key Players in Commercial Vehicles Market

Some of the major players in the Commercial Vehicles Market are

-

Daimler AG (Freightliner Trucks, Mercedes-Benz Vans)

-

Volvo Group (Volvo Trucks, Mack Trucks)

-

PACCAR Inc. (Kenworth, Peterbilt)

-

Navistar International Corporation (International Trucks, IC Bus)

-

Scania AB (Heavy Trucks, Buses)

-

Ford Motor Company (Ford Transit, Ford F-Series)

-

Toyota Motor Corporation (Toyota Hilux, Hino Trucks)

-

General Motors Company (GMC Sierra)

-

Fiat Chrysler Automobiles (RAM Trucks, Fiat Professional)

-

Tata Motors Limited (Tata Prima, Tata Xenon)

-

Isuzu Motors Ltd. (Isuzu D-Max, Isuzu N-Series)

-

Mitsubishi Fuso Truck and Bus Corporation (Canter Trucks, Fuso Buses)

-

Hyundai Motor Company (Hyundai HD Trucks, Hyundai H350)

-

MAN SE (MAN Trucks, MAN Buses)

-

Ashok Leyland (Dost, U Truck)

-

Mahindra & Mahindra Ltd. (Bolero Pik-Up, Mahindra Blazo)

-

BYD Company Ltd. (Electric Buses, Electric Trucks)

-

Iveco S.p.A. (Daily Vans, Stralis Trucks)

-

Nissan Motor Co., Ltd. (Nissan NV Vans, Nissan Titan)

-

Rivian Automotive (Electric Delivery Vans, Electric Pickup Trucks)

Recent Trends

-

May 2024: Daimler Truck is pushing toward a future of driverless rides down US roads – and has dropped a big hint as to what's in store. It unveiled the self-driving Freightliner eCascadia technology demonstrator, which is one of the largest makers of commercial vehicles around the world, and it aims to demonstrate combined electric propulsion and self-driving tech.

-

September 2024: The 120-year-old truck manufacturer Navistar has rebranded under International Motors-a move the leaders of the OEM said marked a strategic shift toward providing fully comprehensive fleet and transportation solutions. According to them, the brand's evolution will therefore represent the broader transformation since Traton took it over in 2021.

-

September 2024: Mahindra & Mahindra Ltd. is one of the leading automotive companies operating in India. Today, the Company has announced its overall auto sales of the month of September 2024. The company reflects overall positive growth in its sales with 24 percent year over year, but decent increase has been noted in the commercial vehicle segment. In total, a total sales volume of 87,839 units were recorded.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 856.42 Billion |

| Market Size by 2032 | US$ 1300.22 Billion |

| CAGR | CAGR of 4.80 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Light Commercial Vehicles (LCVs), Buses & Coaches, and Heavy Trucks) • By End-user (Industrial, Mining & Construction, Passenger Transportation, Logistics, and Others) • By Propulsion Type (IC Engine, Hybrid, Electric Vehicle) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Daimler AG, Volvo Group, PACCAR Inc., Navistar International Corporation, Scania AB, Ford Motor Company, Toyota Motor Corporation, General Motors Company, Fiat Chrysler Automobiles, Tata Motors Limited, Isuzu Motors Ltd., Mitsubishi Fuso Truck and Bus Corporation, Hyundai Motor Company, MAN SE, Ashok Leyland, Mahindra & Mahindra Ltd., BYD Company Ltd., Iveco S.p.A., Nissan Motor Co., Ltd., Rivian Automotive. |

| Key Drivers | • E-commerce growth creates a demand for light commercial vehicles around the world. • Demand for electric commercial vehicles because of sustainable transportation initiatives. |

| Restraints | • High upfront cost happens to be a significant constraint for many to take electric commercial vehicles in large numbers. |