To get more information on Commercial Refrigeration Equipment Market - Request Free Sample Report

The Commercial Refrigeration Equipment Market Size was valued at USD 39.88 Billion in 2023 and is expected to reach USD 65 Billion by 2032 and grow at a CAGR of 5.58 % over the forecast period 2024-2032.

The Commercial Refrigeration Equipment Market is seeing consistent expansion to increasing demand in the food and beverage industry, as well as retail and hospitality sectors. This need is caused by the requirement for effective cooling options to preserve perishable items, particularly in developing countries with growing food stores. The market is additionally supported by the expansion of the global food trade, requiring strong refrigeration systems for storing and delivering frozen foods, processed foods, and seafood. Technologies like liquid-vapor compression and ammonia absorption are improving product options and increasing customer interest.

In addition, manufacturers are focusing on research and development efforts to enhance temperature control and design, in order to meet the growing demand for monitoring and regulating commercial kitchen settings. Automated control systems in smart refrigeration units are becoming more popular, as ENERGY STAR-certified models use much less energy compared to traditional systems. As stated by the Federal Energy Management Program, energy-efficient commercial refrigerators use an average of 1.89 kWh per day, in contrast to 4.44 kWh for less efficient models, demonstrating the market's inclination towards energy-saving options.

Another significant market trend is the growing anxiety over high-GWP refrigerants and their impact on climate. Manufacturers are creating options that lessen environmental harm, like advanced magnetic cooling systems. These systems, backed by data from the U.S. Department of Energy, have the potential to improve energy efficiency by as much as 30%, providing advantages for the environment and lowering operational expenses. The emphasis on sustainable and energy-efficient refrigeration solutions is anticipated to fuel market expansion in the future.

MARKET DYNAMICS

DRIVERS

Rising global food trade, especially in frozen and processed foods, is boosting demand for advanced commercial refrigeration systems to ensure proper storage and transportation of perishable goods.

The process of international food trade that increases worldwide due to the growing popularity of various types of meals, frozen and processed foods first of all, is the primary factor that for the development of contemporary advanced commercial refrigeration systems. Growing international trade results in the increasing demand for effective, stable and reliable methods of storage and transportation of various perishable products. Frozen and processed foods require precise temperature controls because the quality, the safety and the shelf life of these products may be rather different and various. Another reason for the growing popularity of refrigeration systems is their effectiveness for retail. Not only systems of this type allow retaining the freshness of the product but they also cut down spoilage that is crucial for cutting down the losses retailers and suppliers may suffer due to non-optimal conditions during storage and transportation. Finally, increasing role of processed food in the diet of modern Americans may also contribute to the growing demand for powerful refrigeration options. These systems are characterized by the effective use of modern technology such as the range of possibilities to monitor the efficiency of the system remotely and improved energy consumption. The growing popularity of these systems may be also explained by the increasing stringency of rules that are developed to ensure the quality and the safety of the food the companies produce. Thus, these rules make companies purchase permission to preserve food according to these regulations and to meet the demand of their customers. Generally, the growing international food trade plays a critical role in the growing popularity of powerful modern refrigeration systems and stimulates the development of new ideas and technologies to improve the process of food transportation between countries.

Technological innovations in refrigeration, including liquid-vapor compression, ammonia absorption systems, and smart refrigeration with automated controls, are driving demand by enhancing efficiency and usability for commercial kitchens and retailers.

Advancement in refrigeration technology led to significant changes in the environment for such businesses as restaurants or stores, making the solutions more efficient and user-friendly. One of the elements of modern refrigeration that becomes increasingly standard and popular is a liquid-vapor compression system. The use of such systems as the foundation for the bulk of contemporary refrigeration delivery is impressive since they provide more excellent energy effectiveness and reliability compared to conventional approaches. A special type of refrigerant travels through the system and changes phases numerous times to absorb and release heat most efficiently. It leads to decreased power use and lower operational expenses for the consumers. Additionally, many people are interested in ammonia absorption systems as they are relatively safe for the environment without losing the efficiency for the large-scale supply. The ammonia serves as a refrigerant in the cooling process that is enabled by the use of heat sources rather than electric power. Such solutions are cheap and environmentally friendly with the subsequent decrease of energy costs, which makes it an appealing alternative for industrial businesses. Finally, with the advent of smart refrigeration technology, there are changes in the way businesses work with their cooling systems. The automated controls allow immediate monitoring and adaptation to facilitate the best temperature effect while decreasing energy waste and prolonging the lifespan of a piece of equipment. The integration of the Internet of Things may ensure proactive maintenance and warn the people about the potential problem at the moment, which is necessary for preventing larger losses. In conclusion, the overall effect of these trends makes the solutions more attractive by providing dependable, cheap, and environmentally friendly refrigeration options for the commercial kitchens, as well as retailers. It results in better operational efficiency and food safety.

RESTRAIN

High initial costs of advanced and energy-efficient commercial refrigeration systems may deter smaller businesses from upgrading, limiting market penetration.

One of the most substantial obstacles for small businesses is the expensive initial cost of implementing more advanced, energy-efficient commercial refrigeration systems. While the new system would save money in the long run because it uses less power and has lower operating costs, a small business may be unable to afford the high initial expense. Smaller companies often operate on low margins and are unable to invest in new equipment by setting significant amounts of money aside, especially given that their current maintenance needs are still relatively simple. It is to a severe degree a lack of desire to invest that restricts the market acceptance of these technologies, both in terms of overall progress and creativity. As a result, a large number of smaller businesses may not experience the benefits of higher productivity or the relative eco-friendliness of the more modern solutions, merely reinforcing the old, inefficient methods in the market. The shift is not as quick as expected, and, as a result, the environmental goals can suffer, as well as the development of the sector on the whole.

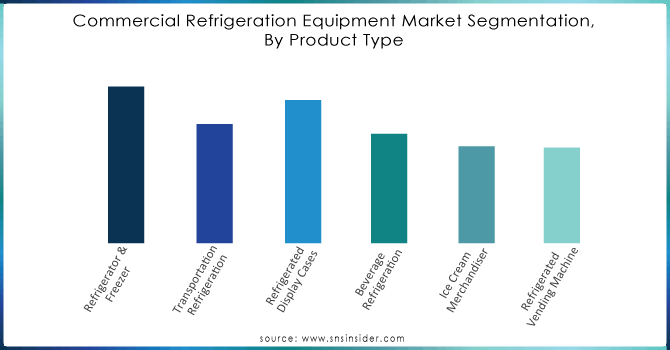

By Product Type

The refrigerators and freezers segment registered the market share of over 24.08% in 2023. It happened due to the development of the traveling and tourism sector all around the world, as a consequence, millions of dining restaurants and eateries started to be emerged. This particular part also talks about blast chillers, which are mainly used to freeze or cool the item at a lower temperature to avoid any bacteria to grow in the stored product and, in general, the usage of chillers is expanding because healthcare professionals are widely utilizing it to preserve tissue samples of vaccines and controlled tests as well as critical medicines.

Need any customization research on Commercial Refrigeration Equipment Market - Enquiry Now

REGIONAL ANALYSIS

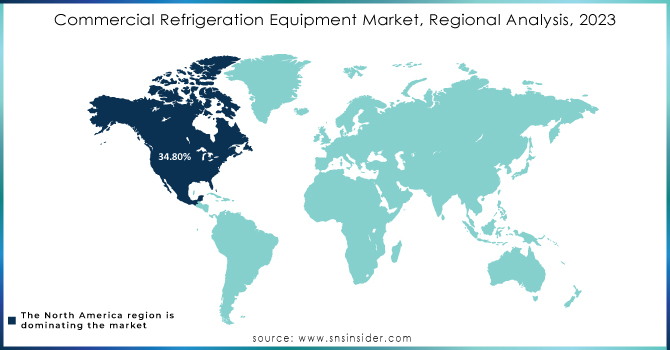

North America region dominated the market share over 34.8% in 2023. The worldwide market for commercial refrigeration equipment. The notable expansion is due to the well-established retail sector and the presence of large grocery chains like Walmart, Costco, Kroger, Publix, etc., in the area. Additionally, the regional market is being further promoted by the significant presence of different top commercial refrigeration equipment manufacturers, along with the early uptake of smart equipment in commercial kitchens.

Asia Pacific is expected to witness a growth at CAGR of over 6.4% from 2024 to 2032, Due to rising demand for products caused by better economic conditions, stable employment rates, increasing disposable income, and higher spending on leisure activities such as travel and dining out. The thriving travel & tourism sector in countries like Malaysia, Indonesia, and Singapore is also boosting the growth of the segment.

Some of the major key players of Commercial Refrigeration Equipment Market

AHT Cooling Systems GmbH: (Plug-in refrigerators, refrigerated and freezer display cabinets)

Ali Group S.r.l. a Socio Unico: (Ice makers, blast chillers, refrigerated counters)

Carrier: (Refrigeration display cases, cold rooms, food retail refrigeration systems)

Daikin Industries Ltd: (Packaged refrigeration units, refrigeration condensing units)

Dover Corporation: (Refrigeration display cases, walk-in coolers, freezers)

Electrolux AB: (Commercial refrigerators, upright refrigerators, chest freezers)

Hussmann Corporation: (Multi-deck merchandisers, vertical freezers, refrigerated display cases)

Illinois Tool Works Inc.: (Walk-in refrigerators, refrigerated prep tables, beverage refrigeration systems)

Johnson Control: (Smart refrigeration systems, cooling units, industrial refrigeration solutions)

Lennox International Inc.: (Refrigerated air handlers, cooling equipment, walk-in coolers)

Panasonic Corporation: (Showcase refrigerators, refrigerated counters, ice makers)

Whirlpool Corporation: (Commercial chest freezers, upright freezers, refrigerators)

Danfoss A/S: (Refrigeration compressors, electronic expansion valves, condensers)

True Manufacturing Co., Inc.: (Commercial refrigerators, beverage coolers, under-counter refrigeration)

United Technologies Corporation: (Retail refrigeration solutions, cold storage systems)

The Manitowoc Company, Inc.: (Ice machines, walk-in freezers, refrigerated beverage dispensers)

Blue Star Limited: (Deep freezers, cold rooms, water coolers)

GE Appliances, a Haier company: (Commercial coolers, refrigerated display cases, ice machines)

Frigoglass SAIC: (Bottle coolers, upright freezers, ice-cold merchandisers)

Standex International Corporation: (Refrigerated merchandising solutions, foodservice refrigeration, blast chillers)

In January 2023: Daikin Industries, Ltd. invested in Atomis Co., Ltd., a company originating from Kyoto University. Atomis is involved in the development of innovative functional materials using "metal-organic frameworks (MOFs)." This investment from Daikin is aimed at developing next-generation refrigerants and equipment that are environmentally friendly.

In February 2023: Carrier launched a Carbon Air Purifier with UV in their Healthy Homes portfolio. This product delivers air purification to help in the reduction of unwanted odor, volatile organic compounds, and common household gases from indoor air.

In March 2023: Carrier launched the Transicold EverFRESH active controlled atmosphere system for refrigerated containers. This software development helped transporters to carry a wide range of perishable goods, including high value products.

In September 2023: Carrier partnered with Relayr, Inc., an industrial Internet of Things (IIoT) technology company, an innovative Refrigeration-as-a-Service (RaaS) offering for customers. This collaboration will help food retailers avoid the upfront investment required for refrigeration equipment and infrastructure.

In November 2023: Whirlpool Corporation introduced SlimTech insulation, the vacuum-insulated structure (VIS) technology, in a refrigerator. According to the company, this technology signifies a substantial transformation in refrigeration technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 39.88 Billion |

| Market Size by 2032 | US$ 65 Billion |

| CAGR | CAGR of 5.58 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Product Type (Refrigerator & Freezer, Transportation Refrigeration, Refrigerated Display Cases, Beverage Refrigeration, Ice Cream Merchandiser, Refrigerated Vending Machine) • By Refrigerant Type (Fluorocarbons, Hydrocarbons, Inorganics) • By Application (Hotels & Restaurants, Supermarkets & Hypermarkets, Convenience Stores, Bakeries) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AHT Cooling Systems GmbH, Ali Group S.r.l. a Socio Unico, Carrier, Daikin Industries Ltd, Dover Corporation, Electrolux ABm,Hussmann Corporation, Illinois Tool Works Inc, Johnson Control, Lennox International Inc.,Panasonic Corporation: , Whirlpool Corporation, Danfoss A/S, True Manufacturing Co., Inc.,United Technologies Corporation, The Manitowoc Company, Inc., Blue Star Limited, GE Appliances, a Haier company, Frigoglass SAIC, Standex International Corporation |

| Key Drivers | •Rising global food trade, especially in frozen and processed foods, is boosting demand for advanced commercial refrigeration systems to ensure proper storage and transportation of perishable goods. • Technological innovations in refrigeration, including liquid-vapor compression, ammonia absorption systems, and smart refrigeration with automated controls, are driving demand by enhancing efficiency and usability for commercial kitchens and retailers. |

| RESTRAINTS | • High initial costs of advanced and energy-efficient commercial refrigeration systems may deter smaller businesses from upgrading, limiting market penetration. |

Ans: North America is the dominating region in the Commercial Refrigeration Equipment Market.

Ans: Rising global food trade, especially in frozen and processed foods, is boosting demand for advanced commercial refrigeration systems to ensure proper storage and transportation of perishable goods.

Ans: Refrigerator & Freezer segmentation is the dominating segment by Product Type in the Commercial Refrigeration Equipment Market.

Ans: Commercial Refrigeration Equipment Market size was USD 39.88 Billion in 2023 and is expected to Reach USD 65 Billion by 2032.

Ans: The Commercial Refrigeration Equipment Market is expected to grow at a CAGR of 5.58%.

TABLE OF CONTENT

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Manufacturing Output, by Region, (2020-2023)

5.2 Utilization Rates, by Region, (2020-2023)

5.3 Maintenance and Downtime Metrix

5.4 Technological Adoption Rates, by Region

5.6 Export/Import Data, by Region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Commercial Refrigeration Equipment Market Segmentation, By Product Type

7.1 Chapter Overview

7.2 Refrigerator & Freezer

7.2.1 Refrigerator & Freezer Market Trends Analysis (2020-2032)

7.2.2 Refrigerator & Freezer Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Transportation Refrigeration

7.3.1 Transportation Refrigeration Trends Analysis (2020-2032)

7.3.2 Transportation Refrigeration Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Refrigerated Display Cases

7.4.1 Refrigerated Display Cases Market Trends Analysis (2020-2032)

7.4.2 Refrigerated Display Cases Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Beverage Refrigeration

7.5.1 Beverage Refrigeration Market Trends Analysis (2020-2032)

7.5.2 Beverage Refrigeration Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Ice Cream Merchandiser

7.6.1 Ice Cream Merchandiser Market Trends Analysis (2020-2032)

7.6.2 Ice Cream Merchandiser Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Refrigerated Vending Machine

7.7.1 Refrigerated Vending Machine Market Trends Analysis (2020-2032)

7.7.2 Refrigerated Vending Machine Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Commercial Refrigeration Equipment Market Segmentation, By Refrigerant Type

8.1 Chapter Overview

8.2 Fluorocarbons

8.2.1 Fluorocarbons Market Trends Analysis (2020-2032)

8.2.2 Fluorocarbons Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Hydrocarbons

8.3.1 Hydrocarbons Market Trends Analysis (2020-2032)

8.3.2 Hydrocarbons Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Inorganics

8.4.1 Inorganics Market Trends Analysis (2020-2032)

8.4.2 Inorganics Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Commercial Refrigeration Equipment Market Segmentation, By Application

9.1 Chapter Overview

9.2 Hotels & Restaurants

9.2.1 Hotels & Restaurants Market Trends Analysis (2020-2032)

9.2.2 Hotels & Restaurants Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Supermarkets & Hypermarkets

9.3.1 Supermarkets & Hypermarkets Market Trends Analysis (2020-2032)

9.3.2 Supermarkets & Hypermarkets Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Convenience Stores

9.4.1 Convenience Stores Market Trends Analysis (2020-2032)

9.4.2 Convenience Stores Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Bakeries

9.5.1 Bakeries Market Trends Analysis (2020-2032)

9.5.2 Bakeries Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Commercial Refrigeration Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.2.4 North America Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.2.5 North America Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.2.6.2 USA Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.2.6.3 USA Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.2.7.2 Canada Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.2.7.3 Canada Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.2.8.3 Mexico Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Commercial Refrigeration Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Commercial Refrigeration Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.7.2 France Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.3.2.7.3 France Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.3.2.8.3 UK Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Commercial Refrigeration Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.6.2 China Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.4.6.3 China Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.7.2 India Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.4.7.3 India Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.8.2 Japan Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.4.8.3 Japan Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.4.9.3 South Korea Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.4.11.3 Singapore Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.12.2 Australia Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.4.12.3 Australia Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Commercial Refrigeration Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.5.1.5 Middle East Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Commercial Refrigeration Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.2.4 Africa Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.5.2.5 Africa Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Commercial Refrigeration Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.4 Latin America Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.6.5 Latin America Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.6.6.3 Brazil Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.6.7.3 Argentina Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.6.8.3 Colombia Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Commercial Refrigeration Equipment Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Commercial Refrigeration Equipment Market Estimates and Forecasts, By Refrigerant Type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Commercial Refrigeration Equipment Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 AHT Cooling Systems GmbH

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Ali Group S.r.l. a Socio Unico

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Carrier

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Daikin Industries Ltd

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Dover Corporation

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Electrolux AB

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Hussmann Corporation

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Illinois Tool Works Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Johnson Control

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Lennox International Inc.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Product Type

Refrigerator & Freezer

Transportation Refrigeration

Refrigerated Display Cases

Beverage Refrigeration

Ice Cream Merchandiser

Refrigerated Vending Machine

By Refrigerant Type

Fluorocarbons

Hydrocarbons

Inorganics

By Application

Hotels & Restaurants

Supermarkets & Hypermarkets

Bakeries

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Postal Automation Systems Market size was USD 0.76 Billion in 2023 and will reach to USD 1.38 Billion by 2032 and grow at a CAGR of 6.9% by 2024-2032.

The Handheld Chemical and Metal Detector Market Size was valued at USD 3.29 billion in 2023 and is expected to reach USD 10.03 billion by 2032 and grow at a CAGR of 13.19% over the forecast period 2024-2032.

The Dehumidifier Market Size was estimated at USD 3.13 billion in 2023 and is expected to arrive at USD 5.37 billion by 2032 with a growing CAGR of 6.18% over the forecast period 2024-2032.

The Flexitank Market Size was estimated at USD 1.15 billion in 2023 and is expected to arrive at USD 7.46 billion by 2032, at a CAGR of 23.09% from 2024-2032.

The Cooling Tower Market Size was esteemed at USD 2.08 billion in 2023 and is supposed to arrive at USD 3.07 billion by 2031 and develop at a CAGR of 5.01% over the forecast period 2024-2031.

The Vibration Control System Market Size was esteemed at USD 5.21 billion in 2023 and is supposed to arrive at USD 8.87 billion by 2032 and develop at a CAGR of 6.1% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone