Get more information on Commerce Cloud Market - Request Sample Report

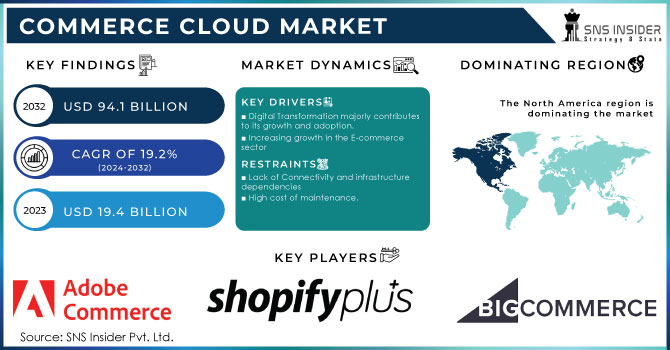

The Commerce Cloud Market was valued at USD 21.0 Billion in 2023 and is expected to reach USD 138.3 Billion by 2032, growing at a CAGR of 23.35% from 2024-2032.

The commerce cloud market is rapidly growing due to the increased accessibility and adoption of smooth digital shopping experiences and cloud solutions by businesses. Such platforms assist organizations to organize and operate online selling, customer, and product inventory management in a single scalable and cost-efficient manner. Moving to the cloud enables businesses to streamline operations, reduce expenses, and provide better omnichannel customer experiences across the web, mobile, and social media touchpoints. This market is driven by the expansion of e-commerce and the growing focus on omnichannel retail strategies. Increasing demand for cloud-based solution providers that can scale to handle massive transaction loads, customer information, and product catalogs. Also, the integration of emerging technologies such as artificial intelligence, machine learning, and data analytics into commerce cloud platforms is enhancing their potential by allowing businesses to deliver personalized shopping experiences, predictive recommendations, and improved inventory management.

As cyber threats become more prevalent, advanced security capabilities make sense as well, something that cloud-based commerce platforms also provide. As organizations gradually move into a digital-first approach, the emphasis is more on secure payment processing, data protection, and fraud prevention. This increased focus on safety & security is prompting the adoption of commerce cloud solutions with robust encryption and global data protection regulations. With businesses rapidly adopting cloud technologies, the commerce cloud market is poised for continued growth allowing retailers to scale and engage customers in an increasingly competitive landscape.

Drivers

Cloud solutions reduce the need for physical infrastructure and maintenance, offering businesses a more affordable way to scale operations.

Cloud solutions reduce the dependence on physical infrastructure — including servers and data centers — by providing businesses with a virtual environment in which operations can be handled. In the old world, organizations invested heavily in hardware, storage, and IT maintenance, which meant high upfront costs with constant upgrade, energy, and maintenance costs. Cloud platforms remove these challenges by providing on-demand access to computing resources, with businesses only paying for what they use.

Organizations that experience variable demand, especially during seasons or promotional events, benefit most from this flexibility. With a cloud solution, businesses can scale resources up or down with no major capital investment. In addition, since maintenance, updates, and security are handled by cloud service providers, businesses can focus on their core operations instead of IT management.

Apart from savings on infrastructure, cloud solutions increase operational efficiency. These solutions automate and simplify essential tasks, such as order fulfillment, inventory management, and customer relationship management, which reduces manual work and minimizes mistakes. They also incorporate advanced technologies such as artificial intelligence and data analytics, enabling companies to gain insights, tailor consumer experiences, and make data-driven decisions. Cloud technology creates a competitive advantage in an era where agility and cost are crucial aspects. Cloud solutions eliminate the complexities of physical infrastructure and deliver seamless scalability to enable businesses to free up resources for addition, increase productivity, and achieve sustainable growth in a rapidly evolving digital marketplace.

The growth of online shopping drives the need for scalable, efficient cloud platforms to manage sales, inventory, and customer data.

The integration of AI, machine learning, and data analytics enhances personalization, predictive

recommendations, and inventory management.

Restraints

Cloud solutions require reliable and high-speed internet, limiting adoption in regions with poor infrastructure.

The success of cloud solutions largely relies on powerful and fast internet connections. While on-premises systems function on localized networks, cloud systems absolutely need a stable connection to transfer data, access applications and have updates in real time. This dependency can pose serious problems in the world, however, as many areas have poorly developed or unstable internet infrastructure, resulting in frequent breaks in connectivity, interrupted workflows, limited access to important data, and negative customer experiences. lack of high-speed internet further prevents them from leveraging more advanced cloud-based capabilities like real-time analytics, AI-based integration, and end-to-end omnichannel support. As an example, slow or unstable internet can lead to latency in transaction processing, updating inventories, or delivering relevant customer interactions— all vital components of modern commerce solutions.

Additionally, businesses in regions with poor internet access infrastructure are more exposed to operational risk, such as downtime and lost revenue from outages or a lack of bandwidth. But, this is more of a concern in those industries where continuous access to cloud platforms is required, like e-commerce, because hundreds of transactions are executed within seconds and if cloud platforms go down, then the customers have to face inconvenience. Even though cloud providers are coming out with clout designed for low bandwidth environments and are embracing edge computing as a potential solution, this reliance on solid internet connections is an ever-growing challenge. This challenge will only be resolved through investment in internet infrastructure, government measures to widen broadband access, and technological innovation to help counteract the impact of poor connectivity while improving the accessibility of cloud solutions.

Rising cyber threats and potential data breaches deter businesses from fully adopting cloud-based solutions.

Transitioning to cloud platforms involves significant investment in setup, customization, and employee training.

By Type

In 2023, the platform segment dominated the market and accounted for a revenue share of more than 65%. The platform segment is primarily driven by a growing demand for scalable and customizable e-commerce solutions. To stand out in a highly competitive digital market, businesses are looking for platforms that can handle complex and personalized customer experiences. The need for seamless integration with existing IT infrastructure to enable businesses to manage their online and offline operations from one platform is fueling this trend. Omni-channel retailing is another big driver of the change with companies shopping for platforms that can provide a seamless experience across the touchpoints like web, mobile, and social media. Furthermore, as businesses continue to embrace AI and ML for commerce cloud applications, there will be further growth opportunities, allowing for more advanced analytics, personalized recommendations, and automated customer service.

The service segment also is expected to grow at the fastest CAGR during the forecast period. With the growing adoption of commerce cloud platforms by businesses, the demand for professional services including implementation, integration, and support is also gaining momentum. This pattern is especially vital for large enterprise organizations with unique custom solutions in business and for regulatory reasons. Another major factor is the rising requirement for managed services to offer continuous assistance and enhancement of commerce cloud environments. Such services allow companies to gain the highest value from their commerce cloud investments by enabling these services to perform so they are on top of their game in performance, security, and scalability. In addition, the growing adoption of hybrid and multi-cloud strategies will also help service providers provide their expertise regarding the integration and management of multiple cloud environments, thus further fuelling the growth of this segment.

By Enterprise Size

In 2023, The large enterprise segment dominated the market and captured the largest market share. Several trends are accelerating growth for this segment, including digital transformation and the requirement for sophisticated and configurable platforms that are integrated and aligned to enterprise systems. Comprehensive commerce cloud solutions are used by large enterprises to offer their customers a cutting-edge customer experience with features such as personalized marketing aided by in-depth analytics and omnichannel integration capabilities. They allow enterprises to optimize their supply chain, improve inventory management, and streamline operations in multiple regions.

The SME segment is expected to register the fastest CAGR during the forecast period. Specifically, the SME industry is adjusted by inexpensive solutions, expansion-friendly, as well as simple to use and accessible for fast growth and adaptation. A major trend that will have a very high impact in this segment is that SMEs have started using pay-as-you-go and subscription-based models which allow them to scale without heavy upfront investments. With the cloud, small enterprises can make use of cutting-edge technology and functionality that were once only available to bigger corporations because of resource limitations. With the prominence of E-commerce and digital channels, increasing realization for SMEs has been to shift towards cloud platforms that can improve their online reach, simplify order processing, and provide an impeccable shopping experience for their customers.

By Offering

The public segment Dominated the market and represented over 58% in 2023, capturing the largest market share. Concurrently, the market space for public clouds is seeing strong acceleration as more enterprises are adopting cloud-native technologies to scale their digital presence fast. One of the most important trends is the development of omnichannel retail strategies, leading to the need for scalable and flexible infrastructure; this results in public cloud solutions. Retailers are turning to public cloud platforms to better integrate their online and in-store selling, provide more seamless customer experiences, and start to leap into advanced analytics for better-targeted marketing. In addition, public cloud services allow businesses especially SMEs to reduce capital spending while benefiting from the lower initial costs and pay-as-you-go pricing models to be able to scale up and down swiftly.

The hybrid segment is expected to grow at the fastest CAGR during the forecast period. Hybrid cloud is the hot thing right now in the marketplace, especially for enterprises that need the scalability of the public cloud but want to retain a higher degree of control provided through the use of private cloud infrastructure. One of the dominant trends fuelling this growth is the requirement for businesses to retain control over sensitive data and mission-critical applications while exploiting the scale and flexibility of the public cloud. Hybrid cloud solutions provide enterprises with the capability to optimize their IT environments by deploying sensitive workloads on private clouds and less critical operational aspects on public clouds. This allows a level of customization to facilitate specific business needs.

North America dominated the market and accounted for a revenue share of over 36% in the market share of the commerce cloud market in 2023. Increasing adoption of digital transformation strategies and advanced cloud technologies among businesses significantly driving the growth of the market. One of the obvious reasons for the emergence of the e-commerce and omnichannel retail is that the companies want to provide a better experience to the customers and at the same time, operate in a more economical manner: complementary to the robust infrastructure and as a major technology stronghold, India would be well placed for market growth. The opportunities are – using the power of AI and machine learning for personalized customer experiences in North America, exploring emerging sectors like IoT and blockchain for innovative commerce solutions, as well as providing commerce solutions.

Asia Pacific is expected to emerge as the fastest-growing commerce cloud market with a CAGR of 24.56% from 2024 to 2032. This growth is primarily due to the rapid economic developments in Asia Pacific, which has led to increased internet penetration and a growing middle class. A key growth driver behind this is the increased availability of e-commerce platforms and digital payment systems across countries such as China, India, and in Southeast Asia. Companies can seize opportunities in this region by focusing on the growing need to offer hyper-local products and services and emphasizing mobile-first approaches as well as catering to data privacy and regulatory challenges that vary across different markets. The increasing emphasis on digital transformation across enterprises also offers immense growth opportunities for commerce cloud solutions.

Need any customization research on Commerce Cloud Market - Enquiry Now

The major key players along with their products are

Salesforce - Salesforce Commerce Cloud

Adobe Inc. - Adobe Commerce (formerly Magento)

SAP SE - SAP Commerce Cloud

Oracle Corporation - Oracle CX Commerce

IBM Corporation - IBM Sterling Commerce

BigCommerce - BigCommerce Platform

Shopify Inc. - Shopify Plus

HCL Technologies - HCL Commerce

Wix.com Ltd. - Wix eCommerce

OpenText Corporation - OpenText TeamSite

Elastic Path - Elastic Path Commerce Cloud

Episerver (Optimizely) - Optimizely Commerce Cloud

VTEX - VTEX Commerce Platform

In November 2024, Salesforce announced enhancements to its Commerce Cloud platform, integrating advanced AI capabilities to improve personalized shopping experiences.

In October 2024, Adobe released a major update to Adobe Commerce, introducing new AI-driven analytics tools to assist businesses in optimizing their e-commerce strategies.

In September 2024, SAP launched a new version of SAP Commerce Cloud, featuring improved scalability and integration options to support complex business models.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 21.0 Billion |

|

Market Size by 2032 |

USD 138.3 Billion |

|

CAGR |

CAGR of 23.35% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Platform, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Salesforce, Adobe Inc., SAP SE, Oracle Corporation, IBM Corporation, BigCommerce, Shopify Inc., HCL Technologies, Wix.com Ltd., OpenText Corporation, Elastic Path, Episerver (Optimizely), VTEX |

|

Key Drivers |

• The growth of online shopping drives the need for scalable, efficient cloud platforms to manage sales, inventory, and customer data. |

|

RESTRAINTS |

• Rising cyber threats and potential data breaches deter businesses from fully adopting cloud-based solutions. |

Ans- Transitioning to cloud platforms involves significant investment in setup, customization, and employee training.

Ans- The growth of online shopping drives the need for scalable, efficient cloud platforms to manage sales, inventory, and customer data.

Ans- the Asia-Pacific is expected to register the fastest CAGR during the forecast period.

Ans: Connectivity and infrastructure dependencies is the major restraints for the commerce cloud market.

Ans The Commerce Cloud Market was valued at USD 21.0 Billion in 2023 and is expected to reach USD 138.3 Billion by 2032, growing at a CAGR of 23.35% from 2024-2032.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Commerce Cloud Market Segmentation, by Type

7.1 Chapter Overview

7.2 Platform

7.2.1 Platform Market Trends Analysis (2020-2032)

7.2.2 Platform Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3Services

7.3.1Services Market Trends Analysis (2020-2032)

7.3.2Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Commerce Cloud Market Segmentation, By Offering

8.1 Chapter Overview

8.2 Private

8.2.1 Private Market Trends Analysis (2020-2032)

8.2.2 Private Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Hybrid

8.3.1 Hybrid Market Trends Analysis (2020-2032)

8.3.2 Hybrid Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Public

8.4.1 Public Market Trends Analysis (2020-2032)

8.4.2 Public Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Commerce Cloud Market Segmentation, By Enterprise Size

9.1 Chapter Overview

9.2 Large Enterprises

9.2.1 Large Enterprises Market Trends Analysis (2020-2032)

9.2.2 Large Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Small & Medium Enterprises

9.3.1 Small & Medium Enterprises Market Trends Analysis (2020-2032)

9.3.2 Small & Medium Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Commerce Cloud Market Segmentation, By Vertical

10.1 Chapter Overview

10.2 Fashion and Apparel

10.2.1 Fashion and Apparel Market Trends Analysis (2020-2032)

10.2.2 Fashion and Apparel Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Electronics and Appliances

10.3.1 Electronics and Appliances Market Trends Analysis (2020-2032)

10.3.2 Electronics and Appliances Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Food and Beverages

10.4.1 Food and Beverages Market Trends Analysis (2020-2032)

10.4.2 Food and Beverages Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Pharmaceutical and Grocery

10.5.1 Pharmaceutical and Grocery Market Trends Analysis (2020-2032)

10.5.2 Pharmaceutical and Grocery Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Others

10.6.1 Others Market Trends Analysis (2020-2032)

10.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Commerce Cloud Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.2.4 North America Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.2.5 North America Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.2.6 North America Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.2.7.2 USA Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.2.7.3 USA Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.2.7.4 USA Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.2.8.2 Canada Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.2.8.3 Canada Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.2.8.4 Canada Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.2.9.2 Mexico Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.2.9.3 Mexico Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.2.9.4 Mexico Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Commerce Cloud Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.3.1.7.3 Poland Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.3.1.7.4 Poland Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.3.1.8.3 Romania Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.3.1.8.4 Romania Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Commerce Cloud Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.3.2.5 Western Europe Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.3.2.6 Western Europe Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.3.2.7.3 Germany Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.3.2.7.4 Germany Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.8.2 France Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.3.2.8.3 France Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.3.2.8.4 France Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.9.2 UK Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.3.2.9.3 UK Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.3.2.9.4 UK Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.3.2.10.3 Italy Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.3.2.10.4 Italy Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.3.2.11.3 Spain Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.3.2.11.4 Spain Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.3.2.14.3 Austria Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.3.2.14.4 Austria Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Commerce Cloud Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.4 Asia Pacific Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.4.5 Asia Pacific Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.4.6 Asia Pacific Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.7.2 China Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.4.7.3 China Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.4.7.4 China Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.8.2 India Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.4.8.3 India Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.4.8.4 India Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.9.2 Japan Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.4.9.3 Japan Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.4.9.4 Japan Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.10.2 South Korea Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.4.10.3 South Korea Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.4.10.4 South Korea Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.4.11.3 Vietnam Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.4.11.4 Vietnam Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.12.2 Singapore Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.4.12.3 Singapore Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.4.12.4 Singapore Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.13.2 Australia Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.4.13.3 Australia Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.4.13.4 Australia Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Commerce Cloud Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.4 Middle East Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.5.1.5 Middle East Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.5.1.6 Middle East Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.5.1.7.3 UAE Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.5.1.7.4 UAE Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Commerce Cloud Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.2.4 Africa Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.5.2.5 Africa Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.5.2.6 Africa Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Commerce Cloud Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.4 Latin America Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.6.5 Latin America Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.6.6 Latin America Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.7.2 Brazil Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.6.7.3 Brazil Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.6.7.4 Brazil Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.8.2 Argentina Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.6.8.3 Argentina Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.6.8.4 Argentina Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.9.2 Colombia Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.6.9.3 Colombia Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.6.9.4 Colombia Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Commerce Cloud Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Commerce Cloud Market Estimates and Forecasts, by Offering (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Commerce Cloud Market Estimates and Forecasts, by Enterprise Size (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Commerce Cloud Market Estimates and Forecasts, by Vertical (2020-2032) (USD Billion)

12. Company Profiles

12.1 Salesforce

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Adobe Inc.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 SAP SE

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Oracle Corporation

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 IBM Corporation

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 BigCommerce

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Shopify Inc.

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 HCL Technologies

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Wix.com Ltd.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 OpenText Corporation

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Platform

Services

By Offering

Private Cloud

Public Cloud

Hybrid Cloud

By Enterprise Size

Large Enterprise

SMEs

By Vertical

Fashion and Apparel

Electronics and Appliances

Food and Beverages

Pharmaceutical and Grocery

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Network Attached Storage Market was worth USD 31.71 billion in 2023 and is predicted to be worth USD 109.72 billion by 2032, growing at a CAGR of 14.82% between 2024 and 2032.

The DevSecOps Market Size was valued at USD 6.3 billion in 2023, projected to reach USD 45.93 billion by 2032 and grow at a CAGR of 24.7% by 2024-2032.

Serverless Architecture Market was valued at USD 10.21 billion in 2023 and is expected to reach USD 78.12 billion by 2032, growing at a CAGR of 25.42% by 2032.

The Digital Payments Market Size was valued at USD 103.63 Billion in 2023 and will reach USD 409.28 Billion by 2032 and grow at a CAGR of 16.52% by 2032.

The Online Banking Market Size was valued at USD 4.4 billion in 2023 and is expected to reach USD 6.0 billion by 2032 and grow at a CAGR of 3.6% by 2024-2032.

The Retail Media Platform Market Size was valued at USD 16.1 Billion in 2023 and will reach USD 33.7 Billion by 2032, growing at a CAGR of 8.6% by 2032.

Hi! Click one of our member below to chat on Phone