Colloidal Silver Market Report Scope & Overview:

Get More Information on Colloidal Silver Market - Request Sample Report

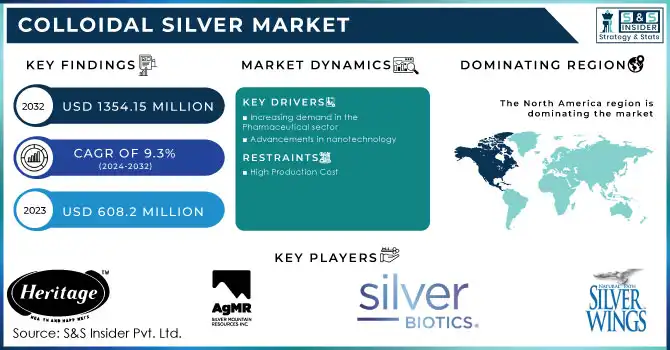

The Colloidal Silver Market size was USD 608.2 million in 2023, is expected to Reach USD 1354.15 million by 2032, and grow at a CAGR of 9.3% over the forecast period of 2024-2032.

Colloidal silver is a water-based solution of microscopic silver particles. The silver particles are so minute that they are invisible to the naked eye. Based on form, the powder segment of the colloidal silver market is expected to grow at a CAGR of 9.1% during the forecast period. Colloidal silver powder is a type of colloidal silver created by dissolving microscopic silver particles in water. The silver particles are so minute that they are invisible to the naked eye. Colloidal silver powder comes in several forms, including liquid, pills, and sprays.

Consumers and businesses would benefit from a favorable regulatory climate for colloidal silver. Organizations would benefit from greater flexibility in how they market and sell their products. More research is being conducted by the FDA on the safety and efficacy of colloidal silver. This would contribute to a more solid scientific foundation for the use of colloidal silver.

MARKET DYNAMICS

KEY DRIVERS

-

Increasing demand in the Pharmaceutical sector

The increasing use of colloidal silver in medicines and medical devices is a prominent driver driving the worldwide colloidal silver market's expansion. Colloidal silver has antimicrobial and antibacterial capabilities that are effective against a variety of diseases. Several studies have shown that colloidal silver can help in wound healing. It is increasingly being utilized to prevent infections in wound dressings, lotions, medical device coatings, and surgical instruments. The increasing issue of antibiotic resistance has increased the demand for colloidal silver as a viable option.

-

Advancements in nanotechnology

RESTRAIN

-

High Production Cost

The cost of production is greatly raised by the complexity of nanoscale colloidal silver synthesis, the requirement for specialized equipment, and the requirement for technical know-how. When colloidal silver nanoparticles are produced using conventional procedures, significant amounts of them are lost. Wider adoption from businesses is hindered by the high expenses associated with producing pharma-grade, extremely pure colloidal silver that complies with regulatory standards. This problem will be solved with improvements in scalable, affordable production.

OPPORTUNITY

-

Rising applications in other end-user sectors

Since colloidal silver has anti-inflammatory and antibacterial characteristics, it is frequently used in healthcare and cosmetic goods including lotions, soaps, and shampoos. Acne, eczema, and psoriasis can all be treated, and it can also speed up the healing process and lessen scarring. Water filtration systems and the treatment of potable water may both benefit from the use of colloidal silver. It can purify water, get rid of germs and microbes, and extend its shelf life. Other applications for colloidal silver include dietary supplements and agriculture.

-

Favorable regulatory scenario from the FDA

CHALLENGES

-

Safety concerns about use of colloidal silver

Excessive colloidal silver consumption can induce argyria, a disorder that causes permanent bluish-grey staining of the skin. According to certain research, ingesting colloidal silver may impair liver function and produce neurotoxicity. These possible adverse effects continue to be a source of concern, and they may stifle market growth until full safety profiles are created through rigorous research.

IMPACT OF RUSSIA UKRAINE WAR

Russia's invasion of Ukraine has impacted negatively on metals exported from these countries Around 10% of the world's silver production is produced by Russia and Ukraine which are two significant silver producers. Due to disruptions in the supply chain caused by Russia and Ukraine, silver prices have surged by more than 30% since February 2022. The cost of colloidal silver products will probably rise as a result of the increase in silver prices. Since the start of the conflict, sales of colloidal silver products have decreased by about 10% in the US. This fall is probably brought on by a number of things, such as rising silver prices, uncertain economic conditions, and unfavorable market mood.

IMPACT OF ONGOING RECESSION

The recession had impacted significantly the colloidal silver market. Due to inflation silver mining and extraction activities are slowed down as mining costs, operational costs, labor costs, transportation costs, and other costs are high which indirectly affects the prices of silver globally. The price of silver has climbed about 20% in the last month to around $25.31 per ounce, outperforming the S&P 500's 5% gain in 2022. During the recession, silver mining stocks surpassed the overall market. Silver prices could reach a nine-year high of $30 per ounce in 2023. The greatest segment of silver consumption is industrial, accounting for over half of total demand. Silver's high price and supply chain disruption have reduced demand and use in industrial and other end-user sectors.

MARKET SEGMENTATION

By Form

-

Powder

-

Liquid

-

Gel

By Particle Size

-

5 to 10nm

-

11 to 20nm

-

21 to 50nm

-

101 to 200nm

By End Use

-

Dietary Supplements

-

Pharmaceutical

-

Cosmetics & Personal care

-

Food and Beverages

-

Water Treatment

-

Other

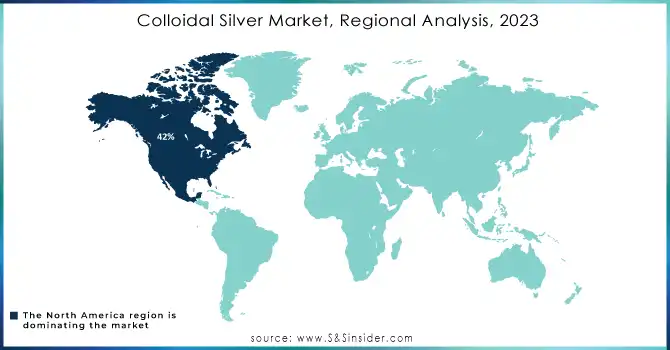

REGIONAL ANALYSIS

North American colloidal silver market is anticipated to grow at a CAGR of 8.9%. Also, it is predicted to have more than 42% of the market share in 2023, making it the dominant region for colloidal silver globally. The increased demand from the dietary supplement, food & beverages, water treatment, and cosmetics industries is responsible for the market's expansion in North America.

Europe's regional market for colloidal silver is expected to grow at a 7.8% CAGR in 2022. Europe is predicted to be the second-largest market for colloidal Silver Market in 2023, accounting for more than 31% of the market share. The rising usage of colloidal silver in the pharmaceutical sector to the market's rise in Europe. colloidal silver markets in Germany are predicted to grow at a CAGR of 7.2% in the forecast period.

The Asia Pacific market is expected to be the fastest-growing market for Global Colloidal Silver Market with a CAGR of 8.6% over the projected period. Growing consumer awareness and the increase of e-commerce platforms are driving market growth in Asia Pacific. The rising awareness of the health benefits of colloidal silver, growing disposable income, and expanding distribution channels. The colloidal silver market in India is expected to grow at a 12% CAGR over the next ten years.

Need Any Customization Research On Colloidal Silver Market - Inquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Colloidal Silver Market are Sovereign Silver, ASAP Silver, Silver Support, Meso Silver, Silver Armor, Heritage Skin Care, Silver Biotics, White Egret, Heritage Products, Silver Solutions, Silver Mountain Minerals, Natural Path Silver Wings, American Biotech Labs, and other key players.

RECENT DEVELOPMENTS

In June 2022, Silver Mountain Minerals launched new colloidal silver hydrosol solutions with concentrations of 10 ppm and 20 ppm. They have a high bioavailability and can be applied topically as well as orally.

In January 2022, Silver Mountain Minerals partnered with the e-commerce site Vitacost.com to increase the availability of its colloidal silver products in the United States. The partnership will give Silver Mountain Minerals access to a new and growing market for its colloidal silver products.

In October 2021, Real Supplements, a maker of specialized vitamins, was purchased by Sovereign Silver. The acquisition increased the range of nutraceutical products offered by Sovereign Silver.

| Report Attributes | Details |

| Market Size in 2023 | USD 608.2 Million |

| Market Size by 2032 | USD 1354.15 Million |

| CAGR | CAGR of 9.3 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form (Powder, Liquid, Gel) • By Particle Size (5 to 10nm, 11 to 20nm, 21 to 50nm, 101 to 200nm) • By End Use (Dietary Supplements, Pharmaceutical, Cosmetics & Personal care, Food and Beverages, Water Treatment, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Sovereign Silver, ASAP Silver, Silver Support, Meso Silver, Silver Armor, Heritage Skin Care, Silver Biotics, White Egret, Heritage Products, Silver Solutions, Silver Mountain Minerals, Natural Path Silver Wings, American Biotech Labs |

| Key Drivers | • Increasing demand in the Pharmaceutical sector • Advancements in nanotechnology |

| Market Restrain | • High Production Cost |