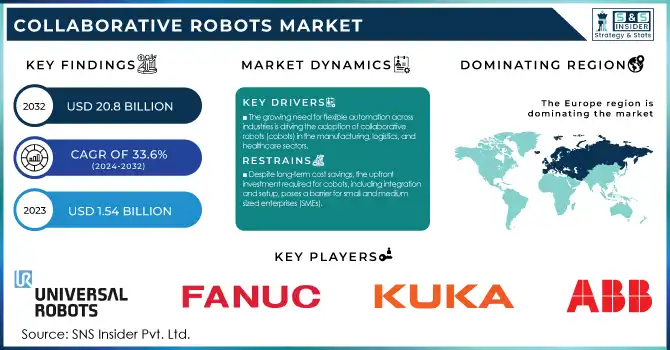

The Collaborative Robots Market size was valued at USD 1.54 Billion in 2023 and is expected to grow to USD 20.8 Billion by 2032 and grow at a CAGR of 33.6 % over the forecast period of 2024-2032.

To get more information on Collaborative Robots Market - Request Free Sample Report

The collaborative robots market has been growing with the developments in automation and the rising interest in cost-effectiveness in various industries. According to the latest data from the International Federation of Robotics and the U.S. Bureau of Labor Statistics, automation adoption in manufacturing has increased by over 40% in the last five years. This has been mainly caused by the developed countries labor shortages and rising wages. The U.S. government has also engaged in promoting technology in advanced manufacturing, including automation with such activities as the Advanced Manufacturing Leadership Strategy, investing $1.2 billion in the enhancement of robotics in 2023 within the automotive, electronics, and other industries. At the same time, in Asian-Pacific China and South Korea have been among the top investors in robotics in the industry 4.0 framework. MIIT (Ministry of Industry and Information Technology) reported that China was the leader in industrial robot installation in 2023, having around 35% of all industrial robots globally. EU has also supported the adoption of cobots, investing a lump sum of €7.5 billion in various sectors between 2021 and 2027, through its Digital Europe Programme. These government efforts have been significantly driving the collaborative robot market, positioning cobots as an important part of industrial automation, particularly in automotive, electronics, and healthcare.

Trends of the Collaborative Robots Market

The major beneficial Cobot market trends include advances in safety standards and technological development. IRSC (International Robot Safety Conference) 2024, mentioned the ISO 10218 standard revisions to meet the current demand for human-safe cobots. This is an important trend since collaborative robots will continue working side-by-side with human workers, using them in such manufacturing, electronics, and automotive applications. The integration of artificial intelligence is another beneficial trend since this makes robots more autonomous and better at understanding the risks, hence safer and more efficient. A recent market development in September 2024 is ABB Robotics’ panoramic innovator, the Ultra Accuracy feature for the GoFa cobots. This feature allows the safe performance of ultra-precision paths, as cobots maintain an exceptional path accuracy of 0.03 millimeters. The cobots use pre-calibrated designs and make use of the RobotStudio AR software to enable manufacturers to simulate and program tasks offline with nearly perfect accuracy, reducing OPEX and deployment time. All these trends allow to make more industrial applications automated due to the demanding precision acceptor – such as electronic, automotive, and aerospace ones. As companies increasingly rely on automation to boost productivity, the cobot market is expected to grow rapidly, driven by innovation and evolving safety standards.

Drivers

The growing need for flexible automation across industries is driving the adoption of collaborative robots (cobots) in the manufacturing, logistics, and healthcare sectors.

Advances in safety features and AI-driven technologies have enabled better human-robot collaboration, making cobots more user-friendly and boosting their adoption in various applications.

One of the key factors propelling the collaborative robots market is the growing demand for automation in a variety of industries. Companies today face many obstacles, including a lack of manpower, and the need to increase salaries and streamline operations, and collaborative robots or cobots are the perfect solution. This equipment offers to operate in conjunction with a human, creating a more secure and efficient workflow. Cobots are mainly used in the manufacturing, logistics, and healthcare sectors. For example, in the automotive industry, cobots are mainly used for assembly, welding, and painting. Ford and BMW have deployed cobots in their production, resulting in enhanced quality and lower levels of human labor.

In the electronics industry, cobots are also applied for PCB assembly and component placement, which require a high level of accuracy and repetitive precision. The International Federation of Robotics reported that in 2023, in comparison to the previous year, about 10 percent more cobots had been installed. Another study showed that cobots would be applied in about 29 percent of global manufacturing facilities by 2026, indicating significant application growth. In the healthcare industry, cobots gradually gain popularity and are used in different areas, including non-invasive surgeries, rehabilitation, and laboratory automation. In hospitals, they are deployed to handle hazardous materials, reducing human contact with harmful substances. Increases in the use of automation-based solutions and ease of programming contribute to the growth of demand for cobots.

Restraints

Despite long-term cost savings, the upfront investment required for cobots, including integration and setup, poses a barrier for small and medium-sized enterprises (SMEs).

Compared to traditional industrial robots, collaborative robots often have limitations in terms of payload and operational speed, restricting their use in heavy-duty applications.

One of the key restraints in the collaborative robots market is their limited payload and speed capabilities. Collaborative robots are designed to work alongside humans and, therefore, have to be safe for interaction. This design means that they are less capable than traditional industrial robots intended to process heavy materials at high speeds. Most cobots only have a payload of around 3-35 kg. This restraint makes businesses in certain industries less likely to purchase these compared to industrial robots, which can have a payload of over 500kg. Based on a survey by Universal Robots conducted in 2023, some 25 percent of manufacturers choose traditional industrial robots because they require higher payloads and speed, even though cobots offer superior flexibility. Ultimately, the restraints stop cobots from replacing traditional robots in industries that require industrial robots’ high capabilities, such as automotive assembly or heavy material handling.

By Payload Capacity

The up to 5kg payload capacity segment dominated the collaborative robots market in 2023, comprising 45% of the revenue share. The main reason for this dominance is the increased manufacturing of lightweight, versatile robots that can be utilized in a wide range of industrial settings, particularly small and medium enterprises. According to the European Robotics Association, up to 5kg of cobots are mainly used in assembly, material handling, and pick-and-place operations, which require high precision but can be performed without heavy lifting. The governments have supported this trend by offering incentives for SMEs to implement automation to increase efficiency and competitiveness. It can be illustrated by the Small Business Administration (SBA) which has introduced grants for SMEs in the U.S. to purchase light robots in 2023, which caused their sales to increase by 30% in the country. This segment is expected to remain dominant due to its flexibility, cost-effectiveness, and ease of programming, which appeal to a wide range of industries.

By Vertical

In 2023, the automotive industry accounted for more than 25% of the revenue share in the market of collaborative robots. Cobots have become widespread in automotive production, they are used for welding, painting, gluing, and assembling. This approach allows manufacturers to ensure efficient production and eliminate as much human error as possible. According to the U.S. Department of Commerce, the use of such robots in automotive production has increased by 22% over the past year. The main reason for this trend is the ever-increasing pressure on auto manufacturers to optimize their production. Recurrent labor shortages have become an accelerator of robotic implementation, especially given the fact that, as noted by the U.S. Department of Commerce, the production of such type of transport supports more than 400,000 jobs. Another reason for the growth is the support from the state in the form of subsidies and tax incentives that are given by most states to companies that adopt robotics.

On the other hand, the electronics segment will grow with the most significant CAGR over the forecast period. This is due to the ever-increasing demand for electronics all over the world and the search for the possibility of maximum miniaturization and greater precision of the component manufacturing process. The South Korean Ministry of Trade, Industry, and Energy highlights that in 2023, the use of cobots in the electronics production sector increased by 35% in contrast to the previous year, which, given the dynamics of the global market, is likely to increase.

Regional Analysis

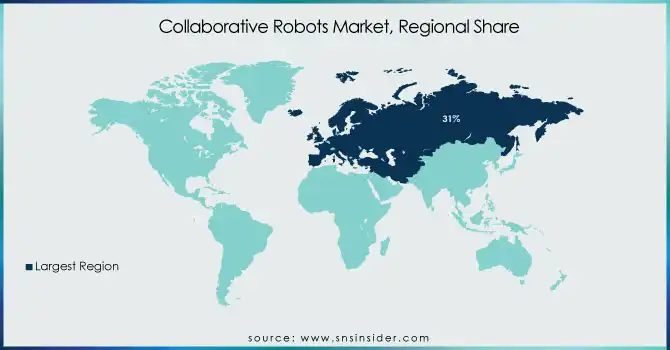

In 2023, Europe dominated the collaborative robots market owing to a revenue share of more than 31%. Europe as stringent industrial automation witnessed lucrative growth in Germany, France, and Italy. Germany reported a leading number of cobots as the government’s Industries 4.0 initiative focused on digital adoption and incorporation of robots in the manufacturing sector. According to the European Commission, robot and automation investments increased by 15% in 2023, understanding that this strategy would enhance productivity and reduce labor costs in the automotive, aerospace, and electronics industries. Moreover, European producers increased cobot incorporation to address their sustainability goals, reduce emissions, and improve precision in complex applications. According to the French Ministry of Economy and Finance, France`s robotics sector experienced a 12% growth in cobot implementation in 2023. The country is a prime market in Europe, with the government’s France Relance recovery plan prompting increased deployment.

The Asia-Pacific region is projected to grow with a significant CAGR during the forecast period. Noteworthy, China, Japan, and South Korea reported lucrative growth during this period as the drivers of automation and government incentives for industrial development. China remains the largest deployer of industrial robots and enacts cobot incorporations as part of the nation’s “Made in China 2025” strategy. The Ministry of Industry and Information Technology noted that more than 150,000 cobots were employed in Chinese factories during 2023, representing a 25% increase from 2022.

On the other hand, North America generated a considerable market share as automation investments increased, primarily in the healthcare, automotive, and electronics industries. According to the U.S. Bureau of Economic Analysis (BEA), in 2023 automation technologies investment soared by 18%, with cobots being the key drivers. In America, the number of government-sponsored inventions in the U.S. and Canada in the robotics industry is on the rise. NIST’s U.S. government funds for automation and AI will upsurge the market.

Need any customization research on Collaborative Robots Market - Enquiry Now

Key Players

Universal Robots (UR3e, UR5e)

FANUC Corporation (CR-15iA, CR-35iA)

KUKA AG (LBR iiwa, KMP 600)

ABB Ltd. (YuMi, IRB 6700)

Yaskawa Electric Corporation (Motoman HC10, Motoman HC20)

Rethink Robotics (Baxter, Sawyer)

Adept Technology (Adept Viper, Adept Cobra)

Teradyne Inc. (Universal Robots, DENSO VS-068)

Staubli Robotics (TX2-60, TX2-40)

Nachi-Fujikoshi Corp. (MZ07, MZ12)

Omron Corporation (LD series, TM series)

Epson Robots (C4, G3 series)

Kawasaki Heavy Industries (DUA Series, RS007N)

Doosan Robotics (M0609, M0617)

Robot System Products AB (RSP X, RSP U)

Siasun Robot & Automation Co., Ltd. (SR Series, Yaskawa Robots)

MOTOMAN (MH Series, MPL Series)

Insight Robotics (Firebot, Drones for Search & Rescue)

AUBO Robotics (AUBO-i5, AUBO-i3)

Hannover Messe (E-Series, K-Series) and others

Recent Developments

May 2023: Universal Robots, a prominent cobot manufacturer, announced the launch of a new UR20 model with higher payload capacity and longer reach. Designed for heavy-duty manufacturing in automotive, aerospace, and other industries, the new product will allow the company to increase its market share.

July 2023: FANUC Corporation unveiled a new robotics manufacturing facility in Japan. The project was supported by government funding, as Japan seeks to become a leader in industrial automation. With its new facility, FANUC will expand production volumes by 30% to accommodate the growing demand for cobots in the Asia-Pacific region.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.54 Billion |

| Market Size by 2032 | USD 20.8 Billion |

| CAGR | CAGR of 33.6 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Payload (Up to 5 Kg, 5-10 Kg, Above 10 Kg) • By Application (Assembly, Pick & Place, Handling, Packaging, Quality Testing, Machine Tending, Gluing & Welding, Others) • By Industry (Automotive, Electronics, Metals & Machining, Plastics and Polymers, Food and Beverages, Furniture and Equipment, Pharma, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Universal Robots, FANUC Corporation, KUKA AG, ABB Ltd., Yaskawa Electric Corporation, Rethink Robotics, Adept Technology, Teradyne Inc., Staubli Robotics, Nachi-Fujikoshi Corp., Omron Corporation, Epson Robots, Kawasaki Heavy Industries, Doosan Robotics, Robot System Products AB |

| Key Driver | •The growing need for flexible automation across industries is driving the adoption of collaborative robots (cobots) in the manufacturing, logistics, and healthcare sectors •Advances in safety features and AI-driven technologies have enabled better human-robot collaboration, making cobots more user-friendly and boosting their adoption in various applications. |

| Market Restraints | •Despite long-term cost savings, the upfront investment required for cobots, including integration and setup, poses a barrier for small and medium-sized enterprises (SMEs). •Compared to traditional industrial robots, collaborative robots often have limitations in terms of payload and operational speed, restricting their use in heavy-duty applications. |

Ans: Yes, you can customize the report as per your requirements.

Ans: The Asia Pacific region is dominating the Collaborative Robots Market.

Ans: The Collaborative Robots Market is to grow at a CAGR of 33.6% Over the forecast period of 2024-2032

Ans: The Collaborative Robots Market size was valued at USD 1.89 Bn in 2023.

Ans: The forecast period for the Collaborative Robots Market is 2024-2031.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Feature Analysis, 2023

5.2 User Demographics, 2023

5.3 Integration Capabilities, by Software, 2023

5.4 Impact on Decision-making5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Collaborative Robots Market Segmentation, By Payload Capacity

7.1 Chapter Overview

7.2 Up to 5kg

7.2.1 Up to 5kg Market Trends Analysis (2020-2032)

7.2.2 Up to 5kg Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Up to 10kg

7.3.1 Up to 10kg Market Trends Analysis (2020-2032)

7.3.2 Up to 10kg Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Above 10kg

7.4.1 Above 10kg Market Trends Analysis (2020-2032)

7.4.2 Above 10kg Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Collaborative Robots Market Segmentation, By Application

8.1 Chapter Overview

8.2 Assembly

8.2.1 Assembly Market Trends Analysis (2020-2032)

8.2.2 Assembly Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Pick & Place

8.3.1 Pick & Place Market Trends Analysis (2020-2032)

8.3.2 Pick & Place Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Packaging

8.4.1 Packaging Market Trends Analysis (2020-2032)

8.4.2 Packaging Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Handling

8.5.1 Handling Market Trends Analysis (2020-2032)

8.5.2 Handling Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Quality Testing

8.6.1 Quality Testing Market Trends Analysis (2020-2032)

8.6.2 Quality Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Gluing & Welding

8.7.1 Gluing & Welding Market Trends Analysis (2020-2032)

8.7.2 Gluing & Welding Market Size Estimates and Forecasts to 2032 (USD Billion)

8.9 Machine Tending

8.8.1 Machine Tending Market Trends Analysis (2020-2032)

8.8.2 Machine Tending Market Size Estimates and Forecasts to 2032 (USD Billion)

8.9 Others

8.9.1 Others Market Trends Analysis (2020-2032)

8.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Collaborative Robots Market Segmentation, By Vertical

9.1 Chapter Overview

9.2 Food & Beverage

9.2.1 Food & Beverage Market Trends Analysis (2020-2032)

9.2.2 Food & Beverage Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Automotive

9.3.1 Automotive Market Trends Analysis (2020-2032)

9.3.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Furniture & Equipment

9.4.1 Furniture & Equipment Market Trends Analysis (2020-2032)

9.4.2 Furniture & Equipment Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Plastic & Polymers

9.5.1 Plastic & Polymers Market Trends Analysis (2020-2032)

9.5.2 Plastic & Polymers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Metal & Machinery

9.6.1 Metal & Machinery Market Trends Analysis (2020-2032)

9.6.2 Metal & Machinery Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Pharma

9.7.1 Pharma Market Trends Analysis (2020-2032)

9.7.2 Pharma Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Electronics

9.8.1 Electronics Market Trends Analysis (2020-2032)

9.8.2 Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.9 Others

9.9.1 Others Market Trends Analysis (2020-2032)

9.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Collaborative Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.2.4 North America Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.5 North America Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.2.6.2 USA Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6.3 USA Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.2.7.2 Canada Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7.3 Canada Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.2.8.2 Mexico Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Collaborative Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.3.1.6.2 Poland Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.3.1.7.2 Romania Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Collaborative Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.3.2.4 Western Europe Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.3.2.6.2 Germany Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.3.2.7.2 France Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7.3 France Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.3.2.8.2 UK Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.3.2.9.2 Italy Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.3.2.10.2 Spain Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.3.2.13.2 Austria Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Collaborative Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.4.4 Asia Pacific Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.5 Asia Pacific Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.4.6.2 China Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6.3 China Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.4.7.2 India Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7.3 India Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.4.8.2 Japan Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8.3 Japan Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.4.9.2 South Korea Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.4.10.2 Vietnam Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.4.11.2 Singapore Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.4.12.2 Australia Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12.3 Australia Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Collaborative Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.5.1.4 Middle East Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.5.1.6.2 UAE Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Collaborative Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.5.2.4 Africa Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.5 Africa Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Collaborative Robots Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.6.4 Latin America Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.5 Latin America Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.6.6.2 Brazil Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.6.7.2 Argentina Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.6.8.2 Colombia Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Collaborative Robots Market Estimates and Forecasts, By Payload Capacity (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Collaborative Robots Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Collaborative Robots Market Estimates and Forecasts, By Vertical (2020-2032) (USD Billion)

11. Company Profiles

11.1 Universal Robots

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 FANUC Corporation

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 KUKA AG

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 ABB Ltd.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Yaskawa Electric Corporation

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Rethink Robotics

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Adept Technology

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Teradyne Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Staubli Robotics

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Nachi-Fujikoshi Corp.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Payload Capacity

Up to 5kg

Up to 10kg

Above 10kg

By Application

Assembly

Pick & Place

Handling

Packaging

Quality Testing

Machine Tending

Gluing & Welding

Others

By Vertical

Automotive

Food & Beverage

Furniture & Equipment

Plastic & Polymers

Metal & Machinery

Electronics

Pharma

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The 5G Radio Access Network Market was valued at USD 28.2 billion in 2023 and will reach USD 73.6 billion by 2032, growing at a CAGR of 11.24% by 2032.

The Digital Health Market Size was USD 229.7 billion in 2023 & is expected to reach USD 1306.30 billion by 2032, growing at a CAGR of 20.63% from 2024-2032.

QR Code Payments Market was valued at USD 11.8 billion in 2023 and is expected to reach USD 45.9 billion by 2032, growing at a CAGR of 16.27% over 2024-2032.

The Data Center Construction Market Size was valued at USD 219.02 Billion in 2023 and will reach USD 388.92 Billion by 2032 and grow at a CAGR of 6.7% by 2032.

The Quality Management Software (QMS) Market was valued at USD 9.6 billion in 2023 and is expected to reach USD 24.0 billion & CAGR of 10.70% by 2032.

The Voice Picking Solutions Market Size was USD 2.6 Billion in 2023 & is expected to reach USD 8.78 Billion by 2032, growing at a CAGR of 14.5% by 2024-2032

Hi! Click one of our member below to chat on Phone