Get More Information on Cold Chain Equipment Market - Request Sample Report

The Cold Chain Equipment Market was valued at USD 21.40 billion in 2023, and it is expected to reach USD 110.41 billion by 2032, registering a CAGR of 20.06% from 2024 to 2032.

The use of cold chain equipment has become a critical tool for the food and beverage industry since its technology is linked to food safety, food hygiene, health benefits, and environmental benefits. The industry has highly relied on the processed food sector due to changing lifestyles, rapid urbanization, and population increase as well as increased purchasing power. According to the World Population Review, it has been estimated that 4.3 billion or about 55% of the global population are currently living in towns and cities. Further, the type of food being consumed has also favored the use of cold chain equipment since most people prefer consuming frozen and processed food. In addition, the international business of fish and meat has also boosted the demand for temperature-controlled storage capacity. Commission of email purchase is among the reasons suspected to have influenced the high demand for cold chain equipment.

India is the world leader in milk production and number two in the production of fruits and vegetables. This country also produces a significant amount of meat, seafood, and poultry. However, food and agriculture are substantially lost due to the ineffective cold supply chain. Thus, as the Food and Agriculture Organization states, every year about 1.3 billion tonnes are lost. This equals one-third of the production result. These losses vary from USD 8 to USD 15 billion. Therefore, the cold chain sector’s development is of crucial importance to avoid such issues forming. Alternatively, the pharmaceutical field is another vital area requiring a well-handling cold supply chain network. Hence, the necessity for vaccines and other pharma raw materials storage and transportation, as well as life-saving drug delivery, promoted a highly efficient and strong cold supply chain network.

Cold Storage is a vital preliminary requirement for preserving perishable agricultural products. The major components are demand/entrepreneur driven, and the government assists in the drawl of credit linked subsidies for the same. The subsidy is 35% of project cost in general areas and 50% in hilly and scheduled areas through State Horticulture Mission. One important credit-linked scheme is to check/post-harvest loss of perishables of agriculture and horticulture. Financial Support is also given for providing pre-cooling units, cold room, pack houses, integrated pack house, preservation unit, reefer transport, ripening chamber etc. Mission for Integrated Development of Horticulture provides financial support for cold storage under the cold chain.

MARKET DYNAMICS

DRIVERS

Increased food safety means more stringent standards and current equipment of the cold chain.

Governments all over the world tend to implement higher food safety requirements. It means that all companies dealing with the manufacture, transportation, and storage of products, especially perishable products, must be equipped with the most modern and effective cold chain equipment. Such compliance will guarantee the maintenance of both food and medicines at an acceptable temperature, and there will thus be no risks to food entry and sales.

According to, the U.S. Food and Drug Administration provides that the FSMA Food Safety Modernization Act imposes strict safety requirements on cold chain storage units, focusing on microbiological, water, and sanitation safety to avoid pollution. The facility should include risk-focused specifications for prevention-requiring controls and be equipped with modern monitoring equipment that enables the detection of risks. Sanitary transport rules also require that cold chain storage equipment support the conditions to ensure safe food during transport and, therefore, the demand for reliable, advanced, and sanitary equipment is rising. Furthermore, every facility should implement a food defense plan to ensure security against deliberate pollution. This implies that the equipment should be traceable by location and be securely locked. Third-party certification affects the choices of numerous clients of food chain storage equipment that comply will be selling much better than not inspected ones. Under the Foreign Supplier Verification Program, importers must verify that foreign suppliers’ equipment complies with U.S. standards. The FFVP is an incentive scheme that motivates high-quality, certified units to be bought. The Voluntary Qualified Importer Program enforces the most stringent safety and quality requirements achievable and takes into account the impact of obligatory adherence to these standards in the general dynamics. One of the most important impediments is compliance costs that are predicted to grow creating incentives to invest in more sophisticated compliant storage units and, in their turn, fostering innovation in the industry.

New technology with smart monitoring and solar-powered storage can make cold chain more efficient and enable it to operate even in remote areas.

Cold chain is a vital element for many industries that operate with perishable goods, including food, pharmaceuticals and some chemicals, among others. Modern technology, such as smart monitoring and solar-powered storage solutions can address some of the issues long-associated with these systems, such as maintaining the temperature and monitoring the state of the cargo, as well as providing the system with a consistent source of energy, which increases the overall efficiency of cold chain equipment.

The type of energy storage that is most commonplace in the power grid is pumped hydropower. The storage technologies that are most regularly with solar power plants are either electrochemical storage or thermal storage. There are other types of storage that may be fast-discharging or high-capacity, which might allure grid operators.

The most obvious problem with PV panels efficiency is solar intermittency. The half of a 24 hour-day is not visible except for a very brief period at extreme latitudes and times of the year. Solar power users need other power sources to use for the power that they need after sunset, and utilities cannot rely on solar power alone to provide the electricity for their customers. One solution to storing solar power to use at night is to capture extra energized during daylight hours and store the energy. However, storage problems are typical. For example, batteries add to the cost of solar power installation. The cost of batteries to provide solar power for a home not including battery installation, maintenance, and lifetime replacement costs to store energy is between $8,000 and $10,000.

Smart monitoring is made possible by the internet of things that continuously monitors the state of objects and reports the data to a central database. In the case of monitoring the cold chain, these are the sensors placed in storage units and in transport. These sensors continuously monitor temperature, humidity and location, uploading the data to a central system. This enables the logistic crew to receive a warning and transport the goods away if the freezing conditions are not met and the food starts to spoil. On the other hand, if the temperature becomes close to freezing and threatens to damage the cargo, the food can be quickly taken out.

RESTRAIN

No reliable power and cold storage in poor countries makes it hard for the cold chain equipment market to grow there.

Power supply and lack of cold storage infrastructure render poor country’s unpopular destinations for cold chain equipment. This is associated with power outages, which occur on both irregular and frequent bases in such countries. In Sub-Saharan Africa and some parts of India, where the power supply devices are not steady, it is difficult for cold storage equipment to maintain consistent cooling. Perishable items such as food and pharmaceuticals cannot be stored or transported when the cold chains are not operational. the poor country’s do not have enough capital to create proper lighting during cold storage. Transporting the fresh perishable goods to various places immediately after the harvest is a challenge in the poor country hence excessive products, which are perishable go to waste. These challenges in these countries disallow the growth of the cold chain equipment market.

Prices of steel and copper, key materials in cold chain equipment, can swing, affecting how much it costs to make.

There are significant price fluctuations of steel and copper that are essential materials for the production of the cold chain equipment. Prices of these metals are often driven by the global market processes, such as supply chain disruptions, escalating military conflicts, and diving of the world economy. Regions of Latin America and certain parts of Southeast Asia display high volatility of the economies. The supplies are battling with these price fluctuations while attempt to produce the end-products at the viable costs. When there are high prices for metals, the price of the final product is higher, and the product can be less affordable, which can hinder the growth of the market in the volatile regions.

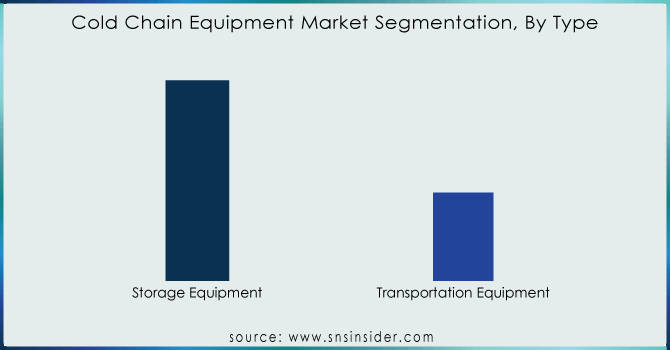

By Type

In 2023, the storage equipment segment accounts for a major share in the total market and is estimated at 74.75% in forecasted period. The types of storage equipment are cold rooms, refrigerators, freezers, and others. These are designed to be at a particular range of temperature suitable for the product stored in it.

Transportation equipment is expected to be the fastest CAGR and at a value of 20% over the selected period of 2023. These will be based on the mode of transport of vehicle and also, the specific requirements of the product being transported outside. The types of equipment based on this are refrigerated trucks, containers, vans and ships with refrigeration, air cargo containers, and others.

Need any customization research on Cold Chain Equipment Market - Enquiry Now

By Application

The fish, meat, & seafood category is projected to hold a market share of 20.75% in 2023. Refrigerated storage of fish, meat, and seafood is highly essential as meat becomes a perfect breeding ground for harmful bacteria the moment the animal is slaughtered. Food, meat, and seafood are among the high-risk commodities that should be refrigerated. As such, refrigeration solutions play a pivotal role in seeing to it that the quality of the commodities in question is maintained and that the shelf life of the same is extended. The rate of multiplication of bacteria in meat stored between 5°C and 63°C is very fast. For fish, meat, and seafood products, the best temperature for storage is at the 0°C and 5°C range.

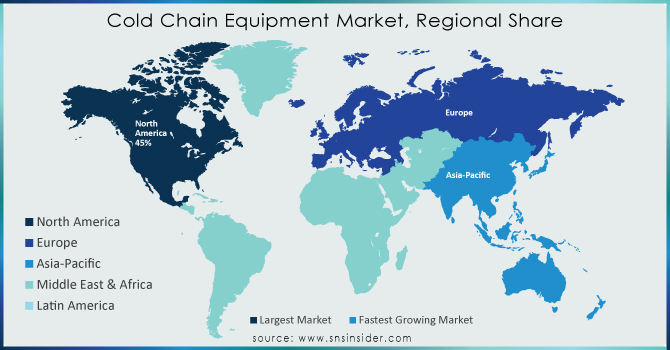

REGIONAL ANALYSIS

North America was the leading region in the overall market in 2023, with a share of 45.0%. The cold chain equipment market in North America was a very well-conceived and a well-established market in many of the end-use markets such as the food, pharmaceutical, and chemical sector. The region is home to many of the major companies that provide cold chain equipment solution. One of the examples would be the Lineage Logistics which is the world’s largest temperature-controlled warehousing and logistics company.

Asia Pacific is anticipated to grow at the highest CAGR of 23.5% during the forecasted period. The market is in the expansion mode as increasing needs for the provision of fresh and frozen foods, medicines, and other perishable products are inevitable in the region. Many of the most heavily and densely populated areas in the world are in Asia Pacific and there is a growing awareness of maintaining the quality and safety factor while in transit or during storage.

Some of the major players in the Cold Chain Equipment Market are Thermo King, Carrier Transicold, Zanotti SpA, Viessmann, Schmitz Cargobull, Fermod, Intertecnica, ebm-papst Group, CAREL, Bitzer, Kelvion, Incold S.p.A., Rivacold srl, Kason Industries, Inc., CHG Europe BV and other players.

Thermo King-Company Financial Analysis

Recent Developments

In February 2024: Through a strategic partnership with Canadian Pacific Kansas City (CPKC), Americold Realty, a temperature-controlled warehousing and transportation company, announced plans to establish its first site and co-locate Americold warehouse facilities on the CPKC network. By fusing CPKC's vast rail network with its cold storage capabilities, Americold would be able to offer a unique product and serve a larger number of clients in North America.

In March 2023: Trane Technologies, a worldwide pioneer in climate innovation, endorsed the use of fossil-free hydrotreated vegetable oil fuel as a sustainable replacement for diesel fuel in Thermo King cold chain solutions. While the use of HVO fuel improves product performance, allowing for a 90% reduction in greenhouse gas emissions and more than 30% in particulate matter. The endorsement came after extensive tests, including a successful pilot with a national food distributor.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 21.40 Bn |

| Market Size by 2032 | US$ 110.41 Bn |

| CAGR | CAGR of 20.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type: (Storage Equipment (On-grid (Walk-in coolers, Walk-in freezers, Ice-lined refrigerators, Deep freezers), Off-grid (Solar Chillers, Milk Coolers, Solar powered cold boxes, Others), Others), Transportation Equipment) • By Application: (Fruits & Vegetables, Fruit & pulp concentrates, Dairy Products, Fish, Meat, & Seafood, Processed Food, Pharmaceuticals, Bakery & Confectionaries, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Thermo King, Carrier Transicold, Zanotti SpA, Viessmann, Schmitz Cargobull, Fermod, Intertecnica, ebm-papst Group, CAREL, Bitzer, Kelvion, Incold S.p.A., Rivacold srl, Kason Industries, Inc., CHG Europe BV |

| Key Drivers | • Increased food safety means more stringent standards and current equipment of the cold chain. • New technology with smart monitoring and solar-powered storage can make cold chain more efficient and enable it to operate even in remote areas. |

| Market Restraints | • No reliable power and cold storage in poor countries makes it hard for the cold chain equipment market to grow there. • Prices of steel and copper, key materials in cold chain equipment, can swing, affecting how much it costs to make. |

Ans: The Cold Chain Equipment Market is expected to grow at a CAGR of 20.06%.

Ans: Cold Chain Equipment Market size was USD 21.40 billion in 2023 and is expected to Reach USD 110.41 billion by 2032.

Ans: Storage Equipment is the dominating segment by type in the cold chain equipment market.

Ans: Stricter rules on food safety mean companies need up-to-date cold chain equipment.

Ans: North America is the dominating region in the Cold Chain Equipment Market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Cold Chain Equipment Market Segmentation, By Type

7.1 Introduction

7.2 Storage Equipment

7.2.1 On-grid

7.2.1.1 Walk-in coolers

7.2.1.2 Walk-in freezers

7.2.1.3 Ice-lined refrigerators

7.2.1.4 Deep freezers

7.2.2 Off-grid

7.2.2.1 Solar Chillers

7.2.2.2 Milk Coolers

7.2.2.3 Solar powered cold boxes

7.2.2.4 Others

7.2.3 Others

7.3 Transportation Equipment

8. Cold Chain Equipment Market Segmentation, By Application

8.1 Introduction

8.2 Fruits & Vegetables

8.3 Fruit & pulp concentrates

8.4 Dairy Products

8.5 Fish, Meat, & Seafood

8.6 Processed Food

8.7 Pharmaceuticals

8.8 Bakery & Confectionaries

8.9 Others

9. Regional Analysis

9.1 Introduction

9.2 North America

9.2.1 Trend Analysis

9.2.2 North America Cold Chain Equipment Market, By Country

9.2.3 North America Cold Chain Equipment Market, By Type

9.2.4 North America Cold Chain Equipment Market, By Application

9.2.5 USA

9.2.5.1 USA Cold Chain Equipment Market, By Type

9.2.5.2 USA Cold Chain Equipment Market, By Application

9.2.6 Canada

9.2.6.1 Canada Cold Chain Equipment Market, By Type

9.2.6.2 Canada Cold Chain Equipment Market, By Application

9.2.7 Mexico

9.2.7.1 Mexico Cold Chain Equipment Market, By Type

9.2.7.2 Mexico Cold Chain Equipment Market, By Application

9.3 Europe

9.3.1 Trend Analysis

9.3.2 Eastern Europe

9.3.2.1 Eastern Europe Cold Chain Equipment Market, By Country

9.3.2.2 Eastern Europe Cold Chain Equipment Market, By Type

9.3.2.3 Eastern Europe Cold Chain Equipment Market, By Application

9.3.2.4 Poland

9.3.2.4.1 Poland Cold Chain Equipment Market, By Type

9.3.2.4.2 Poland Cold Chain Equipment Market, By Application

9.3.2.5 Romania

9.3.2.5.1 Romania Cold Chain Equipment Market, By Type

9.3.2.5.2 Romania Cold Chain Equipment Market, By Application

9.3.2.6 Hungary

9.3.2.6.1 Hungary Cold Chain Equipment Market, By Type

9.3.2.6.2 Hungary Cold Chain Equipment Market, By Application

9.3.2.7 Turkey

9.3.2.7.1 Turkey Cold Chain Equipment Market, By Type

9.3.2.7.2 Turkey Cold Chain Equipment Market, By Application

9.3.2.8 Rest of Eastern Europe

9.3.2.8.1 Rest of Eastern Europe Cold Chain Equipment Market, By Type

9.3.2.8.2 Rest of Eastern Europe Cold Chain Equipment Market, By Application

9.3.3 Western Europe

9.3.3.1 Western Europe Cold Chain Equipment Market, By Country

9.3.3.2 Western Europe Cold Chain Equipment Market, By Type

9.3.3.3 Western Europe Cold Chain Equipment Market, By Application

9.3.3.4 Germany

9.3.3.4.1 Germany Cold Chain Equipment Market, By Type

9.3.3.4.2 Germany Cold Chain Equipment Market, By Application

9.3.3.5 France

9.3.3.5.1 France Cold Chain Equipment Market, By Type

9.3.3.5.2 France Cold Chain Equipment Market, By Application

9.3.3.6 UK

9.3.3.6.1 UK Cold Chain Equipment Market, By Type

9.3.3.6.2 UK Cold Chain Equipment Market, By Application

9.3.3.7 Italy

9.3.3.7.1 Italy Cold Chain Equipment Market, By Type

9.3.3.7.2 Italy Cold Chain Equipment Market, By Application

9.3.3.8 Spain

9.3.3.8.1 Spain Cold Chain Equipment Market, By Type

9.3.3.8.2 Spain Cold Chain Equipment Market, By Application

9.3.3.9 Netherlands

9.3.3.9.1 Netherlands Cold Chain Equipment Market, By Type

9.3.3.9.2 Netherlands Cold Chain Equipment Market, By Application

9.3.3.10 Switzerland

9.3.3.10.1 Switzerland Cold Chain Equipment Market, By Type

9.3.3.10.2 Switzerland Cold Chain Equipment Market, By Application

9.3.3.11 Austria

9.3.3.11.1 Austria Cold Chain Equipment Market, By Type

9.3.3.11.2 Austria Cold Chain Equipment Market, By Application

9.3.3.12 Rest of Western Europe

9.3.3.12.1 Rest of Western Europe Cold Chain Equipment Market, By Type

9.3.2.12.2 Rest of Western Europe Cold Chain Equipment Market, By Application

9.4 Asia-Pacific

9.4.1 Trend Analysis

9.4.2 Asia Pacific Cold Chain Equipment Market, By Country

9.4.3 Asia Pacific Cold Chain Equipment Market, By Type

9.4.4 Asia Pacific Cold Chain Equipment Market, By Application

9.4.5 China

9.4.5.1 China Cold Chain Equipment Market, By Type

9.4.5.2 China Cold Chain Equipment Market, By Application

9.4.6 India

9.4.6.1 India Cold Chain Equipment Market, By Type

9.4.6.2 India Cold Chain Equipment Market, By Application

9.4.7 Japan

9.4.7.1 Japan Cold Chain Equipment Market, By Type

9.4.7.2 Japan Cold Chain Equipment Market, By Application

9.4.8 South Korea

9.4.8.1 South Korea Cold Chain Equipment Market, By Type

9.4.8.2 South Korea Cold Chain Equipment Market, By Application

9.4.9 Vietnam

9.4.9.1 Vietnam Cold Chain Equipment Market, By Type

9.4.9.2 Vietnam Cold Chain Equipment Market, By Application

9.4.10 Singapore

9.4.10.1 Singapore Cold Chain Equipment Market, By Type

9.4.10.2 Singapore Cold Chain Equipment Market, By Application

9.4.11 Australia

9.4.11.1 Australia Cold Chain Equipment Market, By Type

9.4.11.2 Australia Cold Chain Equipment Market, By Application

9.4.12 Rest of Asia-Pacific

9.4.12.1 Rest of Asia-Pacific Cold Chain Equipment Market, By Type

9.4.12.2 Rest of Asia-Pacific Cold Chain Equipment Market, By Application

9.5 Middle East & Africa

9.5.1 Trend Analysis

9.5.2 Middle East

9.5.2.1 Middle East Cold Chain Equipment Market, By Country

9.5.2.2 Middle East Cold Chain Equipment Market, By Type

9.5.2.3 Middle East Cold Chain Equipment Market, By Application

9.5.2.4 UAE

9.5.2.4.1 UAE Cold Chain Equipment Market, By Type

9.5.2.4.2 UAE Cold Chain Equipment Market, By Application

9.5.2.5 Egypt

9.5.2.5.1 Egypt Cold Chain Equipment Market, By Type

9.5.2.5.2 Egypt Cold Chain Equipment Market, By Application

9.5.2.6 Saudi Arabia

9.5.2.6.1 Saudi Arabia Cold Chain Equipment Market, By Type

9.5.2.6.2 Saudi Arabia Cold Chain Equipment Market, By Application

9.5.2.7 Qatar

9.5.2.7.1 Qatar Cold Chain Equipment Market, By Type

9.5.2.7.2 Qatar Cold Chain Equipment Market, By Application

9.5.2.8 Rest of Middle East

9.5.2.8.1 Rest of Middle East Cold Chain Equipment Market, By Type

9.5.2.8.2 Rest of Middle East Cold Chain Equipment Market, By Application

9.5.3 Africa

9.5.3.1 Africa Cold Chain Equipment Market, By Country

9.5.3.2 Africa Cold Chain Equipment Market, By Type

9.5.3.3 Africa Cold Chain Equipment Market, By Application

9.5.2.4 Nigeria

9.5.2.4.1 Nigeria Cold Chain Equipment Market, By Type

9.5.2.4.2 Nigeria Cold Chain Equipment Market, By Application

9.5.2.5 South Africa

9.5.2.5.1 South Africa Cold Chain Equipment Market, By Type

9.5.2.5.2 South Africa Cold Chain Equipment Market, By Application

9.5.2.6 Rest of Africa

9.5.2.6.1 Rest of Africa Cold Chain Equipment Market, By Type

9.5.2.6.2 Rest of Africa Cold Chain Equipment Market, By Application

9.6 Latin America

9.6.1 Trend Analysis

9.6.2 Latin America Cold Chain Equipment Market, By Country

9.6.3 Latin America Cold Chain Equipment Market, By Type

9.6.4 Latin America Cold Chain Equipment Market, By Application

9.6.5 Brazil

9.6.5.1 Brazil Cold Chain Equipment Market, By Type

9.6.5.2 Brazil Cold Chain Equipment Market, By Application

9.6.6 Argentina

9.6.6.1 Argentina Cold Chain Equipment Market, By Type

9.6.6.2 Argentina Cold Chain Equipment Market, By Application

9.6.7 Colombia

9.6.7.1 Colombia Cold Chain Equipment Market, By Type

9.6.7.2 Colombia Cold Chain Equipment Market, By Application

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Cold Chain Equipment Market, By Type

9.6.8.2 Rest of Latin America Cold Chain Equipment Market, By Application

10. Company Profiles

10.1 Thermo King

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 The SNS View

10.2 Carrier Transicold

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 The SNS View

10.3 Zanotti SpA

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 The SNS View

10.4 Viessmann

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 The SNS View

10.5 Schmitz Cargobull

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 The SNS View

10.6 Fermod

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 The SNS View

10.7 Intertecnica

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 The SNS View

10.8 ebm-papst Group

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 The SNS View

10.9 CAREL

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 The SNS View

10.10 Bitzer

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 The SNS View

11. Competitive Landscape

11.1 Competitive Benchmarking

11.2 Market Share Analysis

11.3 Recent Developments

11.3.1 Industry News

11.3.2 Company News

11.3.3 Mergers & Acquisitions

12. USE Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Storage Equipment

On-grid

Walk-in coolers

Walk-in freezers

Ice-lined refrigerators

Deep freezers

Off-grid

Solar Chillers

Milk Coolers

Solar powered cold boxes

Others

Others

Transportation Equipment

By Application

Fruits & Vegetables

Fruit & pulp concentrates

Dairy Products

Fish, Meat, & Seafood

Processed Food

Pharmaceuticals

Bakery & Confectionaries

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Machine Tools Market size was estimated at USD 106.55 billion in 2023 and is expected to reach USD 189.44 billion by 2032 at a CAGR of 6.65% by 2024-2032.

The Residential Air Purifiers Market Size was estimated at USD 11.16 billion in 2023 and is expected to arrive at USD 23.24 billion by 2032 with a growing CAGR of 8.49% over the forecast period 2024-2032.

The Plastic Fasteners Market Size was estimated at USD 5.36 billion in 2023 and is expected to arrive at USD 9.00 billion by 2032 with a growing CAGR of 5.93% over the forecast period 2024-2032.

The Agricultural Equipment Market size was valued at USD 164.5 Bn in 2023 and is expected to reach USD 261.38 Bn by 2032 and grow at a CAGR of 5.28 % over the forecast period 2024-2032.

The Ventilation System Market size was USD 29.74 billion in 2023 and is expected to reach USD 53.84 billion by 2031 and grow at a CAGR of 7.7% over the forecast period of 2024-2031.

The Mining Equipment Market size was estimated at USD 142 Billion in 2023 and is expected to reach USD 223.14 Billion by 2032 at a CAGR of 5.15% during the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone