Get more information on Coiled Tubing Market - Request Free Sample Report

The Coiled Tubing Market size was valued at USD 3.78 Billion in 2023. It is expected to grow to USD 6.50 Billion by 2032 and grow at a CAGR of 5.58% over the forecast period of 2024-2032.

The coiled tubing market is witnessing significant expansion globally due to the development in Enhanced Oil Recovery methods. Furthermore, the oil industry aims to improve the production from mature reservoirs. This expansion is strongly connected with the increased utilization of EOR methods including thermal recovery, gas injection, and chemical injection among others. The increased execution of these methods requires the version of proper coiled tubing solutions. Moreover, EOR methods are especially important in the U.S. since they can extract 30 to 60 % of the bulky trail in a reservoir compared to the 10 to 40 percent recovered through primary and secondary methods. Notably, CO2-EOR is becoming increasingly popular as it can produce extensive extra oil shockingly, as no less than 114 conventions that are coaching CO2 have created another horrendous 000 of CO2. Besides, it is yielding more than 280,000 barrels of oil each day, which equates to the addition of 89,000,000 barrels. Therefore, the market continues to expand due to the development of technology used in capturing CO2 from industrial operations. Among the advances, there is a project delivered by Dakota Gasification Company to the Weyburn field. In this case, coiled tubing is used to inject and control fluids and gases in wells. For example, the in-house production of coil forming tubes at Kametstal in their 400/200 mills’ coil line represents a technological advancement that saves the cost by improving operational effectiveness. Its wire rod forming process for tubing fabrication that develops stronger tubes that are also less expensive to manufacture. The firm decreased its dependency on imports and reduced replacement cost. This example proves that the market is expanding due to the level of improvement in the coiled tube being on par with the advancement of EOR technologies that prolong the lifespan of oil reservoirs and increase their output.

The global coiled tubing market is expanding significantly, fueled by advancements in oil recovery technologies and increased environmental regulations. This growth is driven by the rising adoption of Enhanced Oil Recovery (EOR) techniques, such as thermal recovery, gas injection, and chemical injection, which utilize coiled tubing for efficient well intervention and fluid management. A recent development that underscores the importance of technological innovation is the U.S. Department of Energy’s (DOE) announcement of up to $30 million in funding for technologies aimed at reducing methane emissions from natural gas flaring. This initiative aligns with President Biden’s U.S. Methane Emissions Reduction Action Plan and seeks to convert wasted natural gas into valuable products, such as sustainable chemicals and fuels, while mitigating methane emissions. The funding opportunity highlights the need for advanced solutions that can capture and utilize associated gas, thereby reducing the reliance on flaring and venting. In the context of the coiled tubing market, such technological advancements have a direct impact, as coiled tubing systems are integral to the efficient management and injection of gases and fluids in oil wells. For example, the integration of coiled tubing in these innovative projects could enhance the efficiency of capturing and converting methane, driving further demand for coiled tubing systems. The market's growth is thus not only driven by traditional oil recovery methods but also by evolving technologies that address environmental challenges and optimize resource utilization. This correlation underscores the expanding role of coiled tubing in supporting both conventional and emerging oil and gas technologies, reinforcing its critical role in the industry's advancement.

Market Dynamics

Drivers

The worldwide coiled tubing market is seeing substantial expansion due to higher investments in exploration and production (E&P) and increased efforts to explore hydrocarbon resources. Operators are making significant investments in drilling and production operations to fulfill the increasing demand for oil and gas and meet energy requirements. The increase in investments is especially noticeable in the United States, as it has placed a strong emphasis on the tight oil industry in order to become a top producer of global oil and gas. The U.S. Energy Information Administration (EIA) reported that around 3.04 billion barrels (equivalent to 8.32 million barrels per day) of crude oil were extracted from tight-oil sources in the U.S. in 2023, accounting for roughly 64% of the nation's total crude oil output that year.The DPR emphasizes how the oil and gas industry can change rapidly, with rig productivity metrics varying greatly based on active rigs and well completions. The DPR's methods for smoothing data consider fluctuations in production caused by factors like weather and market issues, highlighting the importance of dependable drilling technologies (DPR). Coiled tubing is essential for enabling well intervention and drilling operations. Utilization in hydraulic fracturing, well stimulation, and work over operations is crucial for hydrocarbon production, making it indispensable. The technology offers an affordable way to maintain and improve production rates, crucial for meeting rising energy needs and optimizing resource extraction. The coiled tubing market is anticipated to experience significant benefits as the industry grows and invests in new technologies. Advancements in coiled tubing technology are expected to aid in the effective and affordable extraction of oil and gas.

The well intervention sector is expected to lead the coiled tubing market, due to the rising need for specialized services in older and developing oil fields. Coiled tubing services are highly valued for well intervention operations because of their ability to efficiently complete various tasks, including stimulation, re-perforation, fluid pumping, fishing, sand control, and zonal isolation. The increasing investment in improving well performance and cleaning operations is also driving this demand. With the depletion of oil and gas reservoirs, the demand for completion and mechanical operations such as fishing, perforation of producing wells, scale removal, and setting plugs or packers is on the rise. These actions are crucial for maintaining and increasing production from current wells, particularly in mature offshore areas like those in the Gulf of Mexico and onshore areas throughout the United States. Ongoing exploration and production operations in areas abundant in shale gas in North America and Asia-Pacific offer potential long-term prospects for coiled tubing services. North America is in the lead when it comes to the significant amount of coiled tubing units, showing the high demand. In 2019, North America had 665 coiled tubing units, of which 432 were located in the United States. The market's expansion is also shown through important contracts, like Ukrgasvydobuvannya JSC's July 2020 tender for coiled tubing and nitrogen-compressor equipment services, emphasizing the essential role of coiled tubing in contemporary well intervention. Therefore, the growing need for effective well intervention activities in mature fields is a major factor pushing the expansion of the coiled tubing market, establishing its importance as a vital service in the oil and gas sector.

Restraints

The coiled tubing market is encountering major difficulties because of the fluctuations in crude oil prices and the expensive upkeep linked with these services. Changes in global market conditions, policy shifts, and supply and demand dynamics strongly impact fluctuations in crude oil prices. For example, sudden and unpredictable fluctuations in oil prices can be triggered by factors such as geopolitical tensions, regulatory changes for environmental protection, and shifts in global energy consumption patterns. These changes in prices have a direct effect on how profitable and how much money oil and gas companies can invest, causing them to decrease their exploration and production work. In periods of low oil prices, companies frequently reduce non-essential activities such as well interventions and services that depend on coiled tubing. Also, the expenses related to coil tubing operations maintenance are significantly high, covering costs for equipment maintenance, skilled workers, and necessary Service s needed to guarantee the safe and effective provision of these services. In a volatile market, low profit margins make it challenging for service providers to either absorb or transfer these expenses to clients, making them especially burdensome. As a result, the coiled tubing market's growth is limited by the combination of fluctuating crude oil prices and expensive maintenance costs. Businesses might choose to postpone or scrap scheduled well interventions, cut back on maintenance activities, or look for cheaper options, all of which could result in a decrease in the need for coiled tubing services. In order to stay competitive in a volatile market, the coiled tubing market needs to find ways to lower costs and improve efficiency while facing economic challenges in the oil and gas industry.

The coiled tubing market encounters major obstacles because of the risks involved in coiled tubing operations and the strict regulations regarding operational safety. Coiled tubing is defined by its thin-walled tubing, prone to bending and straightening while enduring high internal pressure. This constant pressure can worsen even small defects in the tubing, whether they are due to corrosion, physical harm, or production imperfections. Research indicates that the majority of coiled tubing string failures in the last twenty years, between 80 to 90%, were caused by corrosion, mechanical damage, human error, and manufacturing problems. The tubing's susceptibility to corrosion, due to its thin walls, may result in critical malfunctions while in use. Additionally, inadequate handling or exposure to harsh conditions can lead to mechanical damage, thereby heightening the likelihood of failure. Potential failures can create safety risks and lead to substantial financial losses from both downtime and equipment replacement costs. Furthermore, the oil and gas sector must adhere to strict government safety regulations, such as those imposed by OSHA in the US, which require strict compliance with safety standards during operations. Although necessary for worker safety and environmental protection, these regulations increase operational costs and complexity for companies offering coiled tubing services. Adhering to these rules typically involves significant spending on safety education, machinery upkeep, and following strict operational procedures, all of which can impact the profitability of coiled tubing activities.

Segment Analysis

By Medium

Based on medium, Well Intervations & Production capture the largest share in coiled tubing market with 70% of share in 2023. The dominance of this segment highlights how important it is for improving the efficiency and flexibility of oil and gas extraction. Coiled tubing, a lengthy pipe of small diameter, is commonly used in well interventions for tasks like cleanouts, plug removals, and stimulations to maintain and enhance well performance. The technology's capacity to offer immediate, on-the-move interventions with little set-up time makes it the preferred option for enhancing well production. Schlumberger and Halliburton are at the forefront of the market, providing cutting-edge coiled tubing solutions that improve operational efficiency and safety. Schlumberger's SPECTRUM™ Coiled Tubing services incorporate state-of-the-art materials and live monitoring to enhance dependability and prolong the lifespan of well interventions. Halliburton's HydraRite® Coiled Tubing technology provides strong solutions for intricate interventions, such as high-pressure tasks and deep well uses, solidifying its dominance in the market. The industry's expansion is propelled by rising worldwide need for hydrocarbon resources and the necessity for economical, effective production methods. The flexibility of coiled tubing enables various uses, such as hydraulic fracturing and acidizing, making it an appealing choice for operators looking to improve their production methods. This substantial market share indicates the crucial role that well interventions and production play in the coiled tubing industry, underscoring its significance in contemporary oil and gas activities.

By Location

Based On Location, Onshore is dominate the Coiled Tubing Market with 60% of share in 2023. The strong growth of domestic shale gas and tight oil reserves, especially in areas like North America, where advancements in hydraulic fracturing and horizontal drilling have transformed onshore oil and gas production, is a major factor in this dominance. The increase in oil and gas extraction has led to a need for coiled tubing services, crucial for improving productivity and maximizing yields from current wells. Onshore operations are a more appealing choice for operators due to their cost-effectiveness when compared to offshore projects. Expenses for onshore wells, such as land acquisition, drilling, completion, facilities, processing, and transportation, are easier to handle compared to the costly nature of offshore projects. Nevertheless, numerous land-based oilfields, with a production history of more than 150 years, are currently encountering faster depletion rates. The decrease in production has forced operators of assets to make significant investments in recovery techniques and interventions on wells to maximize output and prolong the lifespan of these fields. Coiled tubing is essential for activities like well cleanouts, acidizing, and stimulation, which help to maintain and improve production levels. Baker Hughes and Weatherford International have been leading the way by offering specialized coiled tubing services designed for the specific obstacles of land-based fields. An example is Baker Hughes' CoilTrak™ Coiled Tubing Services, which provide accuracy and effectiveness in well intervention to assist operators in reaching maximum production levels. As land-based oil fields get older and run out of resources, the need for coiled tubing in land-based operations is predicted to stay high, underscoring its important position in the worldwide energy industry.

Regional Analysis

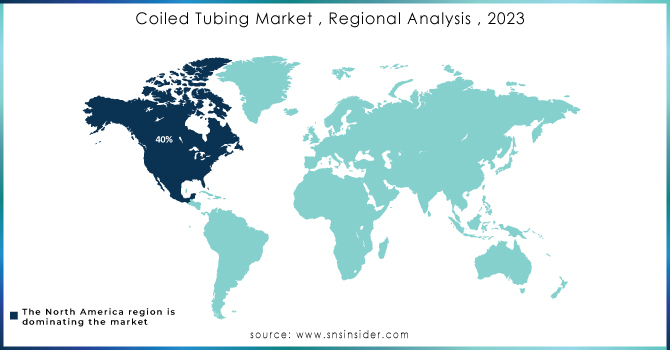

North America dominate the Coiled Tubing Market with 40% of share in 2023. The region's dominance is attributed to the substantial growth of shale gas and tight oil reserves, leading to a notable rise in the need for coiled tubing services. The United States has been leading the way in this market expansion, largely due to its advancements in technology related to hydraulic fracturing and horizontal drilling. Discoveries in areas such as the Permian Basin, Bakken Shale, and Eagle Ford Shale have provided North America with abundant oil and gas resources, solidifying its position as a major player in the global energy industry. The increased oil and gas production in North America has created a higher demand for well intervention and stimulation services, with coiled tubing being essential. Coiled tubing is extensively utilized in a range of activities such as well cleaning, acid treatment, fracturing, and drilling, playing a crucial role in boosting well performance. As the production of shale oil and gas has increased, the demand for these services has also gone up, strengthening the coiled tubing market in the area. Key players in North America, like Halliburton, Schlumberger, and Baker Hughes, have played a crucial role in propelling the market's expansion. These companies provide various coiled tubing services and technologies tailored to address the specific obstacles of oilfields in North America. Schlumberger's ACTive Services offer live downhole readings while coiled tubing is in operation, allowing operators to use data to improve production efficiency. Likewise, Halliburton's Frac Express™ Coiled Tubing Unit is created for effectively executing high-pressure fracturing and well intervention tasks, specifically for the unconventional resource market.

Europe is holding second largest market share in coiled Tubing market in 2023. The growing demand for effective well intervention and enhanced oil recovery (EOR) methods in mature North Sea fields, which have been producing oil and gas for many years, is the main factor behind this substantial market share. As these fields near the end of their productive life, the need for coiled tubing services has increased, as operators aim to optimize production and prolong the life of their assets. Coiled tubing is extremely beneficial in these situations due to its capacity to carry out a range of tasks below the surface, such as cleanouts, acid stimulation, and nitrogen lifting, without requiring a complete rig. This results in lower operational expenses and downtime. Nations such as the United Kingdom, Norway, and the Netherlands have been leading the way in implementing advanced coiled tubing technologies to tackle the issues of decreasing production rates and the intricate geology of the North Sea. The dedication to innovation and the utilization of advanced technologies in the area have greatly contributed to sustaining and potentially improving production levels in these well-established fields. For example, Altus Intervention, a top service provider in the area, has created customized coiled tubing solutions designed for the specific needs of the North Sea environment, such as interventions in highly deviated wells and operations in challenging offshore conditions. Additionally, the strict environmental regulations in Europe have also encouraged the use of coiled tubing, as it provides a more eco-friendly alternative to conventional drilling and intervention methods by emitting fewer emissions and having a smaller surface footprint.

Need any customization research on Coiled Tubing Market - Enquiry Now

The major key players of the market are Altus Intervention, Calfrac Well Services Ltd., Baker Hughes Company, Halliburton, Step Energy Services, Key Energy Services, Llc., Oceaneering International, Inc., Schlumberger Limited, Trican, Weatherford International Plc. and Other Players

Recent Development:

In May 2022: Halliburton unveiled the installation of an extensive coiled tubing intervention system at its New Iberia Training Facility in Louisiana. This system, featuring Halliburton's V135HP coiled tubing injector, a reel with a capacity to hold 36,000 feet of 2-3/8-inch coiled tubing, and a tension lift frame with a remarkable 750-ton capacity, stands as the largest, most potent, and robust system ever deployed.

In December 2022: Baker Hughes revealed its intention to acquire wells specialist Altus in March, assuming the employment of the company's 1,200 personnel, with over 500 situated in Portlethen near Aberdeen.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.78 Billion |

| Market Size by 2032 | USD 6.50 Billion |

| CAGR | CAGR 5.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Well Intervention & Production [Well Completion, Well Cleaning, Others], Drilling, Others) • By Operation (Circulation, Pumping, Logging, Perforation, Others) • By Application (Onshore and Offshore) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Altus Intervention, Calfrac Well Services Ltd., Baker Hughes Company, Halliburton, Step Energy Services, Key Energy Services, Llc., Oceaneering International, Inc., Schlumberger Limited, Trican, Weatherford International Plc |

| Key Drivers |

|

| Restraints |

|

Ans: - Coiled Tubing Market Size was valued at USD3.78 Billion in 2023.

Ans: Increased investments and exploration and production efforts are propelling the growth of the coiled tubing market.

Ans: - 3 segments of the Coiled Tubing Market.

Ans: - The major key players of the market are Altus Intervention, Calfrac Well Services Ltd., Baker Hughes Company, Halliburton, Step Energy Services, Key Energy Services, Llc., Oceaneering International, Inc., Schlumberger Limited, Trican, Weatherford International Plc

Ans: - Key Stakeholders Considered in the study are Raw material vendors, Regulatory authorities, including government agencies and NGOs, Commercial research, and development (R&D) institutions, Importers and exporters, etc.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Coiled Tubing Market Segmentation, by Service

7.1 Chapter Overview

7.2 Well Intervention & Production

7.2.1 Well Intervention & Production Market Trends Analysis (2020-2032)

7.2.2 Well Intervention & Production Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.1 Well Completion

7.2.1.1 Well Completion Market Trends Analysis (2020-2032)

7.2.1.2 Well Completion Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.2 Well Cleaning

7.2.2.1 Well Cleaning Market Trends Analysis (2020-2032)

7.2.2.2 Well Cleaning Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Others

7.2.3.1 Others Market Trends Analysis (2020-2032)

7.2.3.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Drilling

7.3.1 Drilling Market Trends Analysis (2020-2032)

7.3.2 Drilling Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Others

7.4.1 Others Market Trends Analysis (2020-2032)

7.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Coiled Tubing Market Segmentation, by Operation

8.1 Chapter Overview

8.2 Circulation

8.2.1 Circulation Market Trends Analysis (2020-2032)

8.2.2 Circulation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Pumping

8.3.1 Pumping Market Trends Analysis (2020-2032)

8.3.2 Pumping Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Logging

8.4.1 Logging Market Trends Analysis (2020-2032)

8.4.2 Logging Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Perforation

8.5.1 Perforation Market Trends Analysis (2020-2032)

8.5.2 Perforation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Coiled Tubing Market Segmentation, by Application

9.1 Chapter Overview

9.2 Onshore

9.2.1 Onshore Market Trends Analysis (2020-2032)

9.2.2 Onshore Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Offshore

9.3.1 Offshore Market Trends Analysis (2020-2032)

9.3.2 Offshore Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Coiled Tubing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.2.4 North America Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.2.5 North America Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.5 USA

10.2.5.1 USA Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.2.5.2 USA Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.2.5.3 USA Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 Canada

10.2.6.1 Canada Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.2.6.2 Canada Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.2.7.3 Canada Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Mexico

10.2.7.1 Mexico Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.2.7.2 Mexico Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.2.7.3 Mexico Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Coiled Tubing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.5 Poland

10.3.1.5.1 Poland Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.1.5.2 Poland Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.1.5.3 Poland Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.3.1.6 Romania

10.3.1.6.1 Romania Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.1.6.2 Romania Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.1.6.3 Romania Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Hungary

10.3.1.7.1 Hungary Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.1.7.2 Hungary Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.1.7.3 Hungary Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.3.1.8 Turkey

10.3.1.8.1 Turkey Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.1.8.2 Turkey Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.1.8.3 Turkey Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.3.1.9 Rest of Eastern Europe

10.3.1.9.1 Rest of Eastern Europe Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.1.9.2 Rest of Eastern Europe Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.1.9.3 Rest of Eastern Europe Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Coiled Tubing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.4 Western Europe Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.5 Western Europe Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.3.2.5 Germany

10.3.2.5.1 Germany Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.5.2 Germany Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.5.3 Germany Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.3.2.6 France

10.3.2.6.1 France Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.6.2 France Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.6.3 France Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.3.2.7 UK

10.3.2.7.1 UK Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.7.2 UK Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.7.3 UK Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 Italy

10.3.2.8.1 Italy Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.8.2 Italy Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.8.3 Italy Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.3.2.9 Spain

10.3.2.9.1 Spain Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.9.2 Spain Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.9.3 Spain Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.3.2.10 Netherlands

10.3.2.10.1 Netherlands Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.10.2 Netherlands Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.10.3 Netherlands Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Switzerland

10.3.2.11.1 Switzerland Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.11.2 Switzerland Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.11.3 Switzerland Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Austria

10.3.2.12.1 Austria Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.12.2 Austria Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.12.3 Austria Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Rest of Western Europe

10.3.2.13.1 Rest of Western Europe Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.13.2 Rest of Western Europe Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.3.2.13.3 Rest of Western Europe Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Coiled Tubing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.4.4 Asia Pacific Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.4.5 Asia Pacific Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.4.5 China

10.4.5.1 China Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.4.5.2 China Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.4.5.3 China Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.4.6 India

10.4.6.1 India Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.4.6.2 India Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.4.6.3 India Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.4.7 Japan

10.4.7.1 Japan Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.4.7.2 Japan Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.4.7.3 Japan Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.4.8 South Korea

10.4.8.1 South Korea Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.4.8.2 South Korea Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.4.8.3 South Korea Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.4.9 Vietnam

10.4.9.1 Vietnam Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.2.9.2 Vietnam Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.2.9.3 Vietnam Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.4.10 Singapore

10.4.10.1 Singapore Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.4.10.2 Singapore Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.4.10.3 Singapore Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Australia

10.4.11.1 Australia Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.4.11.2 Australia Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.4.11.3 Australia Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.4.12 Rest of Asia Pacific

10.4.12.1 Rest of Asia Pacific Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.4.12.2 Rest of Asia Pacific Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.4.12.3 Rest of Asia Pacific Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Coiled Tubing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.1.4 Middle East Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.1.5 Middle East Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.5.1.5 UAE

10.5.1.5.1 UAE Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.1.5.2 UAE Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.1.5.3 UAE Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.5.1.6 Egypt

10.5.1.6.1 Egypt Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.1.6.2 Egypt Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.1.6.3 Egypt Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion

10.5.1.7 Saudi Arabia

10.5.1.7.1 Saudi Arabia Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.1.7.2 Saudi Arabia Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.1.7.3 Saudi Arabia Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Qatar

10.5.1.8.1 Qatar Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.1.8.2 Qatar Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.1.8.3 Qatar Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.5.1.9 Rest of Middle East

10.5.1.9.1 Rest of Middle East Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.1.9.2 Rest of Middle East Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.1.9.3 Rest of Middle East Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Coiled Tubing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.2.4 Africa Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.2.5 Africa Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.5 South Africa

10.5.2.5.1 South Africa Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.2.5.2 South Africa Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.2.5.3 South Africa Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 Nigeria

10.5.2.6.1 Nigeria Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.2.6.2 Nigeria Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.2.6.3 Nigeria Coiled Tubing Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.5.2.7 Rest of Africa

10.5.2.7.1 Rest of Africa Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.2.7.2 Rest of Africa Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.5.2.7.3 Rest of Africa Coiled Tubing Market Estimates and Forecasts, by Application(2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Coiled Tubing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.6.4 Latin America Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.6.5 Latin America Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.5 Brazil

10.6.5.1 Brazil Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.6.5.2 Brazil Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.6.5.3 Brazil Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Argentina

10.6.6.1 Argentina Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.6.6.2 Argentina Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.6.6.3 Argentina Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Colombia

10.6.7.1 Colombia Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.6.7.2 Colombia Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.6.7.3 Colombia Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Rest of Latin America

10.6.8.1 Rest of Latin America Coiled Tubing Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.6.8.2 Rest of Latin America Coiled Tubing Market Estimates and Forecasts, by Operation (2020-2032) (USD Billion)

10.6.8.3 Rest of Latin America Coiled Tubing Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Altus Intervention

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Calfrac Well Services Ltd.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Baker Hughes Company

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Halliburton

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Step Energy Services

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Key Energy Services, Llc.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Oceaneering International, Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Schlumberger Limited

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Trican

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Weatherford International Plc.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Medium

Well Intervations & Production

Drilling

Others

By Operation:

Circulation

Pumping

Logging

Perforation

Others

By Location

Onshore

Offshore

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Industrial Dryers Market was estimated at USD 13.99 billion in 2023 and is expected to reach USD 24.85 billion by 2032, with a growing CAGR of 6.59% over the forecast period 2024-2032.

The Downhole Tools Market size was valued at USD 5.32 Billion in 2023. It is expected to grow to USD 7.99 Billion by 2032 and grow at a CAGR of 4.41% over the forecast period of 2024-2032.

Automotive Lead-Acid Battery Market was estimated at USD 24.67 Bn in 2023 and is expected to reach USD 40.60 Bn by 2032, at a CAGR of 5.69% from 2024 to 2032.

Heavy Construction Equipment Market was estimated at USD 201.92 Bn in 2023 and is expected to reach USD 313.01 Bn by 2032 at a CAGR of 4.99% from 2024-2032.

The Fluid Handling Systems Market Size was estimated at USD 74.55 billion in 2023 and is expected to arrive at USD 111.28 billion by 2032 with a growing CAGR of 4.55% over the forecast period 2024-2032.

Air Separation Plant Market was esteemed at USD 5.71 billion in 2023 and is supposed to arrive at USD 9.40 billion by 2032, at a CAGR of 5.69% from 2024-2032.

Hi! Click one of our member below to chat on Phone