Get More Information on Coating Equipment Market - Request Sample Report

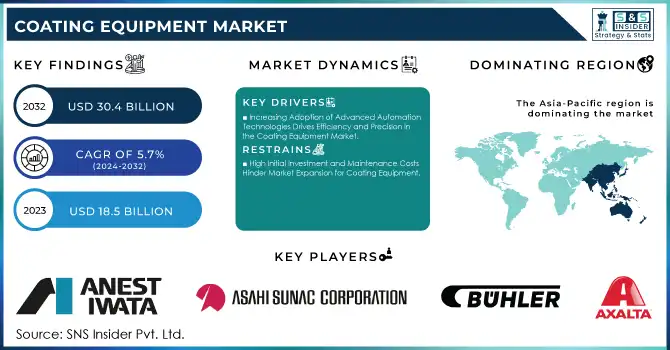

The Coating Equipment Market Size was valued at USD 18.5 billion in 2023 and is expected to reach USD 30.4 billion by 2032 and grow at a CAGR of 5.7% over the forecast period 2024-2032.

The Coating Equipment Market is growing rapidly due to increased demand in automobile, construction, and aerospace industries. Technological advancements in coating systems, stricter environmental regulations, and increased adoption of automation are the core dynamic factors shaping the market. Companies are innovating to specifically meet the need for durable coatings in automotive applications and also eco-friendly systems with less environmental impact. For instance, Nordson and Durr automated coating systems, are a necessity in precision applications since they boost the efficiency of production and reduce labor costs. Other companies such as OC Oerlikon Corporation AG are contributing to growth through high-performance PVD coating systems used in thin-film applications that serve the increasingly needed corrosion-resistant coatings. Such systems now incorporate shifts in favor of powder and electrostatic spray equipment that improve efficiency and reduce material waste on application. The mass manufacturers seek to work with such sustainable and high-quality coating solutions, thus making it a priority for them.

The latest market trends and developments reflect the industry's sense of encouragement to expand globally and diversify its product base. This is seen by the plans announced by JSW Paints in May 2024, regarding entering the auto-coating market, which will be a step toward diversifying its specialty coatings with offerings for specialized automotive applications. This is one way companies are extending their portfolios by entering high-growth fields. In September 2024, for instance, Qemtex launched a powder coating plant in the UAE to get the global markets moving which is another strategic move by the company to strengthen its manufacturing base. This expansion also points toward a trend of companies setting up regional production facilities to better their supply chain with the speed of response to global demands. Such changes indicate that geographic expansion and focused innovation will continue to be at the heart of the agenda for coating equipment companies looking for new markets and better delivery. These trends show that globalization and technological advancement will propel the market forward with key players positioning themselves in the market for efficiency, precision, and environmental stewardship.

Drivers:

Increasing Adoption of Advanced Automation Technologies Drives Efficiency and Precision in the Coating Equipment Market

The demand for automation in coating applications is rapidly rising as manufacturers seek to improve productivity, quality, and consistency in their operations. Automated coating equipment significantly reduces the need for manual intervention, leading to greater accuracy, less material wastage, and faster production rates. This adoption is particularly prominent in sectors such as automotive, electronics, and aerospace, where precision is essential. For instance, automated systems by companies like Nordson and Durr facilitate precise control over coating thickness and coverage, resulting in consistent product quality and reduced defects. Additionally, automation minimizes labor costs and can handle complex coating requirements that would be challenging to achieve manually. As industries continue to modernize production facilities, the demand for advanced automated coating equipment is expected to further strengthen.

Rising Demand for Eco-Friendly Coating Solutions Pushes Growth in the Coating Equipment Market

Environmental regulations are increasingly pressuring companies to adopt eco-friendly practices, propelling the demand for sustainable coating equipment. Traditional coatings often contain volatile organic compounds (VOCs), which contribute to environmental pollution and health hazards. In response, the market is witnessing a shift toward equipment capable of applying water-based, powder, or low-VOC coatings, reducing the environmental impact of coating processes. For example, powder coating equipment from ITW Gema AG enables high-efficiency applications without releasing harmful VOCs, making it a popular choice across industries prioritizing sustainable practices. This trend is particularly strong in developed regions with strict environmental regulations, as industries are under more pressure to comply with eco-friendly standards. The shift toward sustainable coating solutions is expected to continue driving innovation and growth in the coating equipment market.

Restraint:

High Initial Investment and Maintenance Costs Hinder Market Expansion for Coating Equipment

Despite the numerous advantages of advanced coating equipment, the high initial costs associated with purchasing and setting up this machinery remain a significant restraint. Sophisticated coating equipment, especially those with automation capabilities, require substantial capital investment, which can be prohibitive for small and medium-sized enterprises (SMEs). Additionally, these systems often involve complex technologies that demand regular maintenance and occasional updates, further adding to the operational costs. For instance, automated electrostatic coating systems may require specialized technicians for servicing and calibration, which can lead to increased expenses over time. This high cost factor can discourage potential adopters, particularly those with limited budgets, and may slow down the widespread adoption of advanced coating equipment across various industries.

Opportunity:

Expansion of Emerging Markets Presents New Growth Opportunities for the Coating Equipment Market

Emerging economies, especially in Asia-Pacific and Latin America, present substantial growth opportunities for the coating equipment market. The rapid industrialization in countries such as India, Brazil, and Vietnam is driving demand for coating equipment across sectors like automotive, consumer goods, and electronics. As manufacturers in these regions seek to enhance production capabilities, many are investing in modernized coating technologies to improve product quality and competitiveness in the global market. For example, India’s growing automotive industry is actively adopting advanced coating systems to meet international standards. Additionally, the cost-effective labor and raw materials available in these regions make them attractive destinations for international companies looking to expand operations. This trend of increased industrial activities and investment in infrastructure creates a favorable environment for coating equipment providers to tap into high-potential markets.

Challenge:

Technical Complexity and Skilled Workforce Requirements Create Operational Challenges in the Coating Equipment Market

The technical complexity of modern coating equipment poses a significant challenge, especially in terms of workforce training and operational efficiency. Advanced coating systems often require specialized knowledge to operate, calibrate, and maintain, and this skill gap can hinder effective utilization. Companies face difficulties in finding qualified personnel with the technical expertise to handle automated and high-precision coating equipment, particularly in regions where technical training programs are limited. This shortage of skilled labor can lead to suboptimal equipment performance and higher maintenance costs, impacting productivity and profitability. Furthermore, as coating equipment becomes more sophisticated, companies must continuously invest in employee training to keep pace with technological advancements, which can add to operational costs and reduce adoption rates among smaller enterprises.

By Coating Type

In 2023, the powder coating equipment segment dominated the Coating Equipment Market, with a market share of approximately 40%. The preference for powder coatings over traditional liquid coatings is growing due to their eco-friendly attributes, cost-effectiveness, and superior durability. Powder coating systems, such as those offered by ITW Gema AG, are widely used in industries like automotive and consumer goods, as they provide a more efficient coating process with minimal waste and no solvents. Powder coatings are especially valued for their environmental benefits, such as the absence of volatile organic compounds (VOCs), making them highly attractive to manufacturers striving to meet stringent environmental regulations. This trend is further supported by advancements in electrostatic spray technology, making powder coating systems faster and more efficient.

By Material

In 2023, the polyester segment dominated the Coating Equipment Market, holding a market share of around 30%. Polyester coatings are highly popular due to their exceptional weather resistance and long-lasting durability, making them a preferred choice in both industrial and architectural applications. For example, polyester-based coatings are commonly used in the automotive and building & infrastructure sectors, where performance under harsh weather conditions is crucial. Additionally, the growing demand for energy-efficient and durable coatings in the construction and automotive industries is contributing to the rise in polyester material usage. This dominance is expected to continue as the polyester material is ideal for a range of applications that require robust and versatile coating solutions.

By End-Use Industry

In 2023, the automotive sector dominated the Coating Equipment Market, with a market share of approximately 35%. The automotive industry’s adoption of advanced coating systems is driven by the increasing demand for high-quality, durable, and aesthetically appealing finishes on vehicles. Technologies like electrostatic spray systems, commonly used in automotive coatings, provide superior coverage and uniformity, which are essential for mass production in automotive manufacturing. Companies such as Nordson Corporation have contributed to this growth by offering coating equipment that improves both the appearance and longevity of automotive products. Moreover, automotive coatings are crucial for protecting against corrosion, UV degradation, and wear, making them an essential part of the manufacturing process in the industry.

In 2023, the Asia-Pacific region dominated the Coating Equipment Market with a market share of approximately 40%. This dominance can be attributed to the rapid industrialization, urbanization, and significant growth in manufacturing industries across countries such as China, India, Japan, and South Korea. These countries represent major hubs for the automotive, electronics, and construction sectors, all of which are major consumers of coating equipment.

For instance, China is the world’s largest automotive manufacturing country, and the demand for advanced automotive coatings, including powder and liquid coating systems, continues to grow as the automotive industry seeks to improve vehicle aesthetics and durability. China's extensive production of electronics also fuels the demand for high-precision coating equipment used in the electronics industry.

Japan, another key player in the region, has long been a leader in technological innovations and is home to major automotive manufacturers like Toyota and Honda, who are actively investing in state-of-the-art coating equipment to meet both domestic and international standards for vehicle finishes. Additionally, India’s burgeoning automotive and construction industries are driving demand for coatings that are both cost-effective and durable, further bolstering the demand for coating equipment. The Asia-Pacific region’s cost-effective production capabilities, combined with a large consumer base and significant investments in infrastructure, have positioned it as the dominant player in the global coating equipment market.

Get Customized Report as per your Business Requirement - Request Sample Report

Recent Developments

October 2024: PPM Technologies launched the FlavorWRIGHT SmartSpray food coating system, offering precise, consistent spray applications for improved quality, efficiency, and reduced waste in food coating processes.

July 2023: Austria-based Miba AG invested USD 17.6 million in opening a new manufacturing facility in South-Eastern Styria. The expansion aimed to double the production area from 3,000 square meters to 6,300 square meters. The facility was built to improve the production of coating systems and related equipment.

May 2023: Sames Kremlin launched a new electrostatic spray gun named Nanogun Airmix Xcite for automotive and wood coating applications. It was designed to deliver excellent performance during operation and was available in 3 pressure ranges: 120, 200, and 400 bar.

Anest Iwata Corporation (Spray Guns, Air Compressors)

Asahi Sunac Corporation (Spray Equipment, Automatic Painting Systems)

Axalta Coating Systems Ltd. (Liquid Coating Systems, Powder Coating Systems)

Buhler AG (PVD Coating Systems, Thin Film Coating Equipment)

Carlisle Companies Inc. (Spray Guns, Fluid Handling Equipment)

Durr AG (Paint Booths, Atomizers)

Exel Industries (Spray Guns, Electrostatic Applicators)

Graco Inc. (Airless Sprayers, Electrostatic Sprayers)

IHI Ionbond AG (PVD Coating Systems, CVD Coating Systems)

ITW Gema AG (Powder Coating Guns, Automatic Coating Equipment)

J. Wagner GmbH (Powder Coating Systems, Spray Guns)

Larius Srl (Airless Sprayers, Pneumatic Pumps)

Nordson Corporation (Powder Coating Systems, Liquid Coating Systems)

OC Oerlikon Corporation AG (Thermal Spray Equipment, PVD Coating Systems)

Plasmatreat GmbH (Plasma Systems, Surface Treatment Equipment)

SATA GmbH & Co. KG (Spray Guns, Air Filtration Systems)

SAMES KREMLIN (Electrostatic Spray Guns, Airless Pumps)

Sulzer Ltd (Mixing and Dispensing Equipment, Spray Nozzles)

Taikisha Ltd (Automated Coating Systems, Paint Circulation Systems)

Therma-Tron-X, Inc. (Electrocoating Equipment, Powder Coating Ovens)

Resins and Polymers

Epoxy Resins

Huntsman Corporation

BASF SE

Dow Chemical Company

Polyester Resins

BASF SE

Royal DSM

SABIC

Acrylic Resins

Arkema S.A.

Evonik Industries

Dow Chemical Company

Polyurethane Resins

Covestro AG

BASF SE

Huntsman Corporation

Pigments and Dyes

Titanium Dioxide

DuPont

Chemours Company

Tronox Limited

Iron Oxide

LANXESS AG

BASF SE

Kronos Worldwide Inc.

Organic Pigments

Clariant International Ltd.

BASF SE

Cabot Corporation

Other Raw Materials

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 18.5 Billion |

| Market Size by 2032 | US$ 30.4 Billion |

| CAGR | CAGR of 5.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Coating Type (Powder coating equipment, Liquid coating equipment, Specialty coating equipment) • By Material (Polyester, Acrylic, PVC, Epoxy, Silicon) • By End-Use Industry (Automotive, Aerospace, Industrial, Building & Infrastructure, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nordson Corporation, IHI Ionbond AG, OC Oerlikon Corporation AG, SATA GmbH & Co. KG, Anest Iwata Corporation, Graco Inc., Axalta Coating Systems Ltd., Carlisle Companies Inc., Wagner Systems Inc., Asahi Sunac Corporation and other key players |

| Key Drivers | • Increasing Adoption of Advanced Automation Technologies Drives Efficiency and Precision in the Coating Equipment Market •Rising Demand for Eco-Friendly Coating Solutions Pushes Growth in the Coating Equipment Market |

| RESTRAINTS | • High Initial Investment and Maintenance Costs Hinder Market Expansion for Coating Equipment |

Ans: The Coating Equipment Market is expected to grow at a CAGR of 5.7%

Ans: The Coating Equipment Market Size was valued at USD 18.5 billion in 2023 and is expected to reach USD 30.4 billion by 2032

Ans: Emerging economies in Asia-Pacific and Latin America, driven by industrialization and cost-effective resources, present significant growth opportunities for the coating equipment market, particularly in the automotive and electronics sectors.

Ans: The technical complexity of modern coating equipment creates challenges in workforce training and operational efficiency, with a shortage of skilled labor hindering optimal performance and increasing costs.

Ans: The Asia-Pacific region dominated the Coating Equipment Market with a 40% share, driven by rapid industrialization, urbanization, and strong demand from automotive, electronics, and construction industries in countries like China, India, Japan, and South Korea.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Coating Equipment Market Segmentation, by Coating Type

7.1 Chapter Overview

7.2 Powder coating equipment

7.2.1 Powder coating equipment Market Trends Analysis (2020-2032)

7.2.2 Powder coating equipment Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Liquid coating equipment

7.3.1 Liquid coating equipment Market Trends Analysis (2020-2032)

7.3.2 Liquid coating equipment Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Specialty coating equipment

7.4.1 Specialty coating equipment Market Trends Analysis (2020-2032)

7.4.2 Specialty coating equipment Market Size Estimates and Forecasts to 2032 (USD Million)

8. Coating Equipment Market Segmentation, by Material

8.1 Chapter Overview

8.2 Polyester

8.2.1 Polyester Market Trends Analysis (2020-2032)

8.2.2 Polyester Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Acrylic

8.3.1 Acrylic Market Trends Analysis (2020-2032)

8.3.2 Acrylic Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 PVC

8.4.1 PVC Market Trends Analysis (2020-2032)

8.4.2 PVC Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Epoxy

8.5.1 Epoxy Market Trends Analysis (2020-2032)

8.5.2 Epoxy Market Size Estimates and Forecasts to 2032 (USD Million)

8.6 Silicon

8.6.1 Silicon Market Trends Analysis (2020-2032)

8.6.2 Silicon Market Size Estimates and Forecasts to 2032 (USD Million)

9. Coating Equipment Market Segmentation, by End-Use Industry

9.1 Chapter Overview

9.2 Automotive

9.2.1 Automotive Market Trends Analysis (2020-2032)

9.2.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Aerospace

9.3.1 Aerospace Market Trends Analysis (2020-2032)

9.3.2 Aerospace Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Industrial

9.4.1 Industrial Market Trends Analysis (2020-2032)

9.4.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Building & Infrastructure

9.5.1 Building & Infrastructure Market Trends Analysis (2020-2032)

9.5.2 Building & Infrastructure Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Coating Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.2.4 North America Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.2.5 North America Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.2.6.2 USA Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.2.6.3 USA Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.2.7.2 Canada Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.2.7.3 Canada Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.2.8.2 Mexico Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.2.8.3 Mexico Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Coating Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.3.1.6.2 Poland Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.3.1.6.3 Poland Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.3.1.7.2 Romania Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.3.1.7.3 Romania Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.3.1.8.2 Hungary Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.3.1.8.3 Hungary Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.3.1.9.2 Turkey Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.3.1.9.3 Turkey Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Coating Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.3.2.4 Western Europe Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.3.2.5 Western Europe Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.3.2.6.2 Germany Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.3.2.6.3 Germany Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.3.2.7.2 France Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.3.2.7.3 France Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.3.2.8.2 UK Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.3.2.8.3 UK Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.3.2.9.2 Italy Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.3.2.9.3 Italy Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.3.2.10.2 Spain Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.3.2.10.3 Spain Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.3.2.13.2 Austria Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.3.2.13.3 Austria Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Coating Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.4.4 Asia Pacific Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.4.5 Asia Pacific Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.4.6.2 China Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.4.6.3 China Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.4.7.2 India Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.4.7.3 India Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.4.8.2 Japan Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.4.8.3 Japan Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.4.9.2 South Korea Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.4.9.3 South Korea Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.4.10.2 Vietnam Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.4.10.3 Vietnam Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.4.11.2 Singapore Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.4.11.3 Singapore Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.4.12.2 Australia Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.4.12.3 Australia Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Coating Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.5.1.4 Middle East Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.5.1.5 Middle East Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.5.1.6.2 UAE Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.5.1.6.3 UAE Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.5.1.7.2 Egypt Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.5.1.7.3 Egypt Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.5.1.9.2 Qatar Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.5.1.9.3 Qatar Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Coating Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.5.2.4 Africa Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.5.2.5 Africa Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.5.2.6.2 South Africa Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.5.2.6.3 South Africa Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Coating Equipment Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.6.4 Latin America Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.6.5 Latin America Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.6.6.2 Brazil Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.6.6.3 Brazil Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.6.7.2 Argentina Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.6.7.3 Argentina Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.6.8.2 Colombia Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.6.8.3 Colombia Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Coating Equipment Market Estimates and Forecasts, by Coating Type (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Coating Equipment Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Coating Equipment Market Estimates and Forecasts, by End-Use Industry (2020-2032) (USD Million)

11. Company Profiles

11.1 Nordson Corporation

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 IHI Ionbond AG

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 OC Oerlikon Corporation AG

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 SATA GmbH & Co. KG

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Anest Iwata Corporation

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Graco Inc.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Axalta Coating Systems Ltd.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Carlisle Companies Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Wagner Systems Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Asahi Sunac Corporation

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Coating Type

Powder coating equipment

Liquid coating equipment

Specialty coating equipment

By Material

Polyester

Acrylic

PVC

Epoxy

Silicon

By End Use Industry

Automotive

Aerospace

Industrial

Building & Infrastructure

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Filled Fluoropolymer Market was valued at USD 3.8 billion in 2023 and is expected to reach USD 6.3 billion by 2032 at a CAGR of 5.8% from 2024-2032.

The Titanium Dioxide Market Size was valued at USD 20.24 billion in 2023 and is expected to reach USD 34.78 billion by 2032, and grow at a CAGR of 6.2% over the forecast period 2024-2032.

The UV Curable Resins & Formulated Products Market Size was USD 5.5 billion in 2023 & will reach to $12.8 Bn by 2032 & grow at a CAGR of 9.9% by 2024-2032.

Gold Mining Market size was valued at USD 207.1 billion in 2023 and is expected to reach USD 281.7 billion by 2032, growing at a CAGR of 3.5% from 2024-2032.

The Wax Market size was USD 10.41 billion in 2023 and is expected to reach USD 14.80 billion by 2032 and grow at a CAGR of 3.99% over the forecast period of 2024-2032.

The Vitamin C Market Size was valued at USD 1.89 billion in 2023 and is expected to reach USD 2.99 billion by 2032 and grow at a CAGR of 5.23% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone