CMO/CDMO Market Report Scope & Overview:

Get more information on CMO/CDMO Market - Request Sample Report

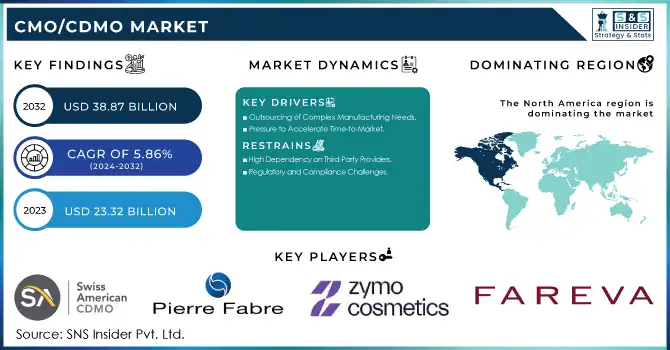

The CMO/CDMO Market was estimated at USD 23.32 billion in 2023 and is expected to reach USD 38.87 billion by 2032, developing at a CAGR of 5.86% over the forecast period 2024-2032.

The Contract Manufacturing Organization (CMO) and Contract Development and Manufacturing Organization (CDMO) market has been experiencing significant growth, driven by key trends in drug development and the need for specialized manufacturing capabilities. Several factors, including the increasing complexity of drug production, the rise of biologics and biosimilars, the growing demand for personalized medicine, and technological advancements have all contributed to the expansion of this sector.

One of the primary drivers is the surge in demand for biologics, which has led many pharmaceutical companies to increasingly rely on CMOs and CDMOs with the expertise and resources required for biologic manufacturing. More than 70% of large pharmaceutical companies have indicated a growing reliance on contract manufacturing for biologics production, a trend that is expected to continue as biologics make up a larger portion of drug portfolios. For example, Lonza's partnership with Moderna to manufacture its COVID-19 vaccine showcases how CDMOs play a pivotal role in scaling up production for high-demand drugs. In 2020, this collaboration led to the production of up to 1 billion vaccine doses, demonstrating the critical role of CDMOs during urgent global health crises.

The rise of personalized medicine has also been a significant factor in the growth of the CMO/CDMO market. The shift towards tailored therapies, including gene and cell therapies, requires specialized, flexible, and scalable manufacturing capabilities. AGC Biologics, for instance, has invested heavily in expanding its capacity to support the growing field of personalized medicine, with new facilities dedicated to gene and cell therapies. The market for personalized medicine is forecasted to continue growing rapidly, driving further demand for specialized manufacturing services.

Technological advancements, such as continuous manufacturing, are reshaping the production processes within the pharmaceutical industry. This technology allows for more efficient, cost-effective, and scalable production, making it highly attractive to drug developers. A survey by the International Society for Pharmaceutical Engineering (ISPE) indicated that over 50% of pharmaceutical companies are adopting continuous manufacturing, with many relying on CDMOs to implement these solutions. For example, major pharmaceutical companies like Pfizer and Takeda are incorporating continuous manufacturing technologies to improve production efficiency and reduce time-to-market.

The COVID-19 pandemic also underscored the essential role of CMOs and CDMOs in ensuring the timely production and delivery of critical medical products. Catalent, a leading CMO, produced over 100 million doses of the Johnson & Johnson COVID-19 vaccine in 2021, demonstrating how CMOs and CDMOs quickly adapted to meet the global demand for vaccines and therapeutics. This partnership exemplifies how CDMOs are integral in addressing urgent healthcare needs. Furthermore, as regulatory requirements become increasingly complex, pharmaceutical companies are turning to CMOs and CDMOs for their regulatory expertise. A survey from WuXi AppTec revealed that 86% of drug developers rely on contract manufacturers to navigate regulatory submissions and ensure compliance with global standards.

Market Dynamics

Drivers

-

Outsourcing of Complex Manufacturing Needs

As drug development becomes more intricate, pharmaceutical companies are increasingly outsourcing production to specialized CMOs and CDMOs. These organizations offer the expertise and infrastructure required to handle advanced manufacturing processes, particularly in biologics, gene therapies, and complex small molecules, enabling companies to manage costs and meet specialized therapy demands.

-

Pressure to Accelerate Time-to-Market

The demand for quicker commercialization of new drugs is a significant driver in the CMO/CDMO market. By outsourcing manufacturing, pharmaceutical companies can streamline production processes, particularly in clinical trials and large-scale manufacturing, reducing time-to-market and ensuring a competitive edge in the fast-evolving pharmaceutical landscape.

-

Navigating Regulatory Complexity and Embracing Sustainability

The increasing complexity of global pharmaceutical regulations is prompting companies to turn to CDMOs for regulatory expertise. Additionally, the shift toward sustainable practices in the industry is driving CDMOs to adopt eco-friendly manufacturing techniques, meeting the growing demand for environmentally conscious production methods while ensuring regulatory compliance.

Restraints

-

High Dependency on Third-Party Providers

Pharmaceutical companies may face risks associated with the high dependency on external CMOs and CDMOs for critical manufacturing processes. Issues such as supply chain disruptions, production delays, or quality control challenges from third-party providers can affect timelines and product consistency, creating potential bottlenecks and operational risks.

-

Regulatory and Compliance Challenges

As the global regulatory landscape becomes increasingly complex, CDMOs must navigate a wide array of compliance requirements. Pharmaceutical companies may face delays or additional costs in ensuring that their outsourced manufacturing partners meet varying regulatory standards across different markets, which can create barriers to seamless production and distribution.

Key Segmentation

By Service

Contract manufacturing was the dominant service in the CMO/CDMO market in 2023, accounting for around 60.0% of the market share. The increasing reliance on third-party manufacturers to handle large-scale production has been a major driver of this segment’s dominance. Pharmaceutical companies opt for contract manufacturing to reduce costs, scale production efficiently, and focus on core competencies, leaving production to specialized partners with the necessary infrastructure.

Contract development services saw the fastest growth and are also anticipated to be over the forecast period. This is due to the increasing complexity of drug formulations and the rising need for specialized drug development expertise. Pharmaceutical companies are increasingly outsourcing their development processes to CMOs and CDMOs to leverage their advanced capabilities in formulation development, clinical trials, and regulatory compliance. The growing focus on personalized medicine and biologics has also contributed to the rapid expansion of contract development services.

By Form

Solid forms and powders dominated the market in 2023, representing around 40.0% of the market share. This form remains the most popular choice for pharmaceutical products, especially oral medications like tablets and capsules. The dominance of solid forms is attributed to their long shelf life, ease of administration, and scalability in production, making them a preferred choice for patients and manufacturers.

The creams segment experienced the fastest growth for 2024-2032. The demand for creams, particularly in skin care and cosmetic applications, has surged due to their broad use in anti-aging treatments, moisturizers, and dermatological solutions. The rise in consumer interest in skincare routines, along with innovations in cream formulations that cater to specific skin concerns, has made this form one of the fastest-growing segments in the market.

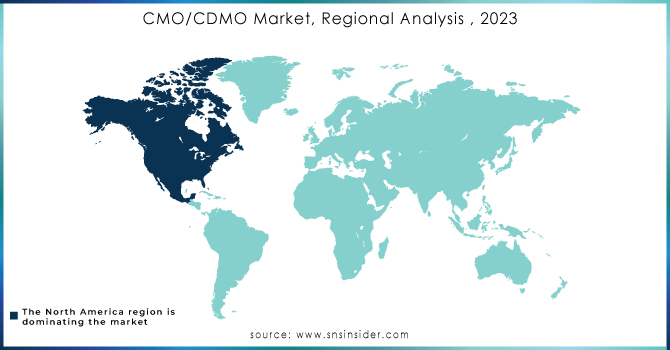

Regional Analysis

North America emerged as the dominant region in the global CMO/CDMO market in 2023, driven by a robust pharmaceutical and biotechnology industry and significant advancements in drug discovery and development. The presence of established players and a strong regulatory framework in countries like the United States bolstered the region's leadership. High investments in biologics and specialty drugs, coupled with the increasing trend of outsourcing manufacturing and development to reduce operational costs, significantly contributed to the market’s growth in this region.

Europe followed closely, with countries like Germany, Switzerland, and the United Kingdom at the forefront due to their well-established pharmaceutical manufacturing infrastructure. The growing emphasis on biosimilars and the expansion of biologics manufacturing capacity further supported the market's expansion in this region. Additionally, stringent regulatory policies ensured high-quality production standards, which boosted the credibility of CDMO services.

The Asia-Pacific region exhibited the fastest growth throughout the forecast period, driven by rising investments in pharmaceutical infrastructure and an increasing number of collaborations between global companies and regional CDMOs. Countries such as China and India emerged as key hubs, offering cost-effective manufacturing solutions and a skilled workforce. Furthermore, government initiatives to promote healthcare innovation and favorable regulatory changes accelerated market growth in the region.

Need any customization on CMO/CDMO Market - Enquiry Now

Key Players and Products Related to CMO and CDMO

-

-

Skincare formulations, topical creams, and personal care products.

-

-

-

Dermatology solutions, cosmetic manufacturing, and pharmaceutical formulations.

-

-

-

Skincare, haircare, and custom cosmetic formulations.

-

-

Fareva

-

Pharmaceuticals, personal care items, and home care solutions.

-

-

Biofarma Srl C.F.

-

Nutraceuticals, dietary supplements, and pharmaceutical manufacturing.

-

-

Chemineau

-

Liquid pharmaceuticals, aerosols, and topical solutions.

-

-

C.O.C. Farmaceutici Srl

-

Oral solids, sterile products, and topical formulations.

-

-

Paragon Nordic

-

Aerosols, emulsions, and personal care items.

-

-

Lonza Group

-

Biopharmaceuticals, small molecule manufacturing, and cell & gene therapies.

-

-

Catalent, Inc.

-

Drug delivery technologies, biologics development, and oral and inhalation product manufacturing.

-

Recent Developments

In September 2024, Samsung Biologics announced a multi-billion-dollar investment to expand its biomanufacturing capacity, including a fifth 180,000 L plant and a dedicated ADC facility in South Korea. Plant 5 is set to be completed by April 2025, increasing total capacity to 784,000 L.

In October 2024, McGuff Pharmaceuticals received FDA approval for its state-of-the-art 86,000-sq.-ft. The sterile fill-and-finish facility is in Santa Ana, CA. This advancement positions the company to expand its presence in the CMO and CDMO markets, addressing the increasing demand for high-quality sterile drug manufacturing services.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 23.32 billion |

| Market Size by 2032 | USD 38.87 Billion |

| CAGR | CAGR of 5.86% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Hair Products, Skin Products, Lip Products, Eye Products, Body Hygiene, Oral Hygiene) • By Service (Contract Development, Contract Manufacturing, Others) • By Form (Solid Form & Powder, Lotions, Creams, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Swiss American CDMO, Pierre Fabre Group, Zymo Cosmetics, Fareva, Biofarma Srl C.F., Chemineau, C.O.C. Farmaceutici Srl, Paragon Nordic, Lonza Group, Catalent Inc., Samsung Biologics, Thermo Fisher Scientific |

| Key Drivers | • Outsourcing of Complex Manufacturing Needs • Pressure to Accelerate Time-to-Market • Navigating Regulatory Complexity and Embracing Sustainability |

| Restraints | • High Dependency on Third-Party Providers • Regulatory and Compliance Challenges |