Cloud System Management Market Size & Overview:

Get more information on Cloud System Management Market - Request Sample Report

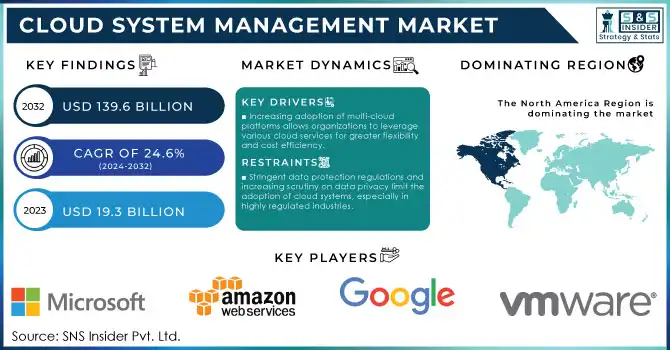

The Cloud System Management Market was valued at USD 19.3 billion in 2023 and is expected to reach USD 139.6 billion by 2032, growing at a CAGR of 24.6% over the forecast period 2024-2032.

Growing demand from large and small companies adopting public and private resources from numerous providers has increased the need for cloud services that can automate the management of separate complex and hybrid multi-clouds. Rising adoption of cloud-based technologies across several industries, which are driving the growth in the Cloud Systems Management Market. Around 90% of the companies are using cloud-based technologies, 45% of which are using public cloud, and around two-thirds of them are using private cloud services.

In addition, the U.S. & Western Europe holds the major part of around 80% of the cloud computing market globally. The dominance of the Americas can primarily be attributed to early technological innovations, strong digital infrastructures, and regulatory frameworks attracting new entrants. AWS, Microsoft Azure, and Google Cloud Platform are the top three cloud players with the widest data center footprint, by which they also invest heavily in their product portfolio development through a rich R&D investment strategy. These companies have a variety of cloud services, IaaS (Infrastructure as a Service), PaaS (Platform as a Service), and Saas (Software-as-a-Service) that help businesses to scale from low-level expense budgets to high-end innovation concepts. Artificial Intelligence for IT Operations (AIOps) combined with cloud systems management software drives growth. These provide integrated Artificial Intelligence (AI) capabilities for IT operations (AIOps), allowing organizations' IT activities to be automated. More and more companies are using these sophisticated solutions to avoid high downtime costs due to application and infrastructure issues AIOps helps businesses avoid the astronomical costs of hosting websites, initiating e-commerce portals, or simply running applications with all kinds of technicalities.

For a more comprehensive AIOps solution, IBM aims to reduce cloud spend while ensuring application performance and managing incidents efficiently. Moreover, AppDynamics, the Central Nervous System is a solution designed to deliver increased application and business performance visibility, and automatic anomaly detection regarding end-to-end customers' experience concerns connecting applications with infrastructure components so operations can learn early on potential issues. BigPanda is an event correlation and automation platform, offering out-of-the-box integrations, machine learning to reduce alert noise from IT Noisezialism (TM), and automated incident response.

Furthermore, cloud management solutions administrators may utilize to keep track of everything from resource deployment and use to Kubernetes, data integration, and disaster recovery. They manage the platforms, infrastructure, applications, cloud provider and cloud service provider resources, and data that comprise a cloud. For instance, EY has teamed with SAP and Microsoft to assist financial services organizations in pursuing cloud transformation. EY delivers industry-specific IP, while Microsoft provides cloud infrastructure. Banks, insurance companies, and capital market groups are the focus of the relationship. EY also focuses on vertical cloud products in the healthcare, power utilities, and retail industries.

Cloud System Management Market Dynamics

Drivers

-

Accelerated investment in digital transformation, especially in sectors like BFSI, healthcare, and manufacturing, boosts demand for robust cloud management systems.

-

Increasing adoption of multi-cloud platforms allows organizations to leverage various cloud services for greater flexibility and cost efficiency.

Multi-cloud is a significant trend that drives the growth of the cloud system management market. To achieve better performance, improve data protection, and avoid vendor lock-in, organizations are using a multi-cloud strategy more frequently. It allows businesses to place different workloads on different types of environments, taking advantage of the specific benefits of various cloud service providers. According to a recent report, by 2024, more than 85% of enterprises worldwide will adopt a multi-cloud architecture, highlighting the increasing demand for digital flexibility. The pandemic-driven shift to hybrid work environments has only accelerated this trend as organizations around the world adopt infrastructures that are both scalable and resilient, as well as geographically dispersed.

In fact, in the financial sector, multinational banks tend to be using multi-cloud to stay compliant with regulations across jurisdictions. Likewise, industrial giants use multi-cloud platforms to connect IoT apps with smart analytics applications to experience real-time insights and predictive maintenance. To simplify multi-cloud management, cross-platform integration tools are being offered by companies like Microsoft Azure and Amazon Web Services (AWS) such as AWS Outposts and Azure Arc. Interoperability can become a problem – hence the need for more advanced cloud system management tools to assure interoperability to the fullest extent, optimal costs, and security of data management. This only reinforces the trend of more extensive solutions being required for cloud monitoring, workload orchestration, and security management, and the demand for it continues to grow.

-

Increasing trend of Artificial Intelligence for IT Operations (AIOps), to reduce cost, increase privacy, and help in decision-making.

AI plays a vital role in reshaping IT operations by combining AI and machine learning to incorporate this emerging discipline, enhancing the way the processes are managed automatically, foretelling anomalies before they occur, and enabling better decision-making. Features here include real-time monitoring to catch anomalies ASAP, automated incident response powered by machine learning for a low MTTR (mean time to resolution), and predictive analytics in the form of alerts that predict pending problems. The best part is that collaboration tools help in enhancing teamwork, among IT and DevOps teams. Today, organizations are more likely to adopt a multi-cloud approach for flexibility and control, regulatory compliance, business continuity, or performance optimization efforts - integrating different cloud services from multiple providers.

Restraints:

-

Stringent data protection regulations and increasing scrutiny on data privacy limit the adoption of cloud systems, especially in highly regulated industries.

-

The surge in sophisticated cyberattacks targeting cloud infrastructure raises security concerns, deterring broader adoption in some regions.

The increasing prevalence of sophisticated cyberattacks targeting cloud infrastructure poses a significant challenge to the widespread adoption of cloud system management solutions. Attackers exploit vulnerabilities in cloud environments, which are often complex due to multi-cloud and hybrid setups, to gain unauthorized access to sensitive organizational data. This risk becomes especially critical for industries like BFSI, healthcare, and government, where data breaches can have severe consequences, including financial loss, reputational damage, and regulatory penalties.

Additionally, the interconnected nature of cloud services magnifies the impact of security breaches, as a single vulnerability can cascade through multiple systems. Organizations also face challenges in maintaining consistent security policies across diverse platforms and applications. While advancements in encryption and identity management technologies help mitigate these risks, persistent concerns about security and compliance continue to restrain cloud system management market growth.

Cloud System Management Market Segment Analysis

By Component

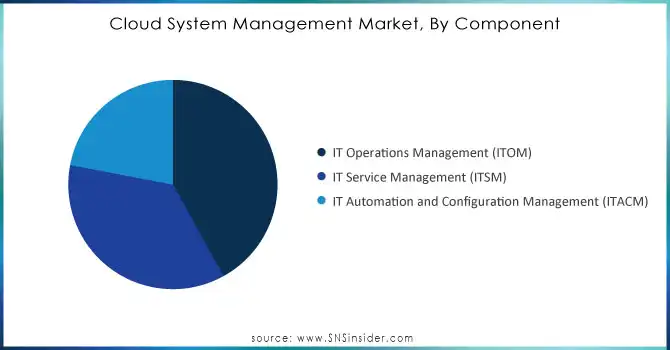

The IT operations management segment led the market with 42% of the market share in 2023, due to the increasing need for secure transactions across BFSI and IT firms. With increased banks and financial services organizations looking to monetize data by predicting customer spending patterns and insights driven by unstructured datasets, demand continues to increase in the banking and financial services firms for AI, predictive analytics, and big data to strengthen such a business model. FinOps is built on the cloud and multi-cloud financial management thus becoming a prominent driver of cloud management for systems and services.

Do you need any customization research on Cloud System Management Market - Enquire Now

By Deployment Model

The on-premise segment led the Cloud System Management market with more than 58% of the market share, as it furnishes organizations with an improved data security level. There are various circumstances where on-premises solutions are still favored over cloud-based services, such sectors consist of the ones with the strictest policies on data sovereignty, organizations with sensitive data sets, and those who have already integrated legacy systems inside their enterprises. On top of this, there’s a need for full control over hardware and infrastructure, where on-premise platforms work well. For instance, healthcare operations involve advanced equipment such as intrusion detection systems, firewalls, and encrypted patient records. HSMs are used by banks and other financial organizations to facilitate multi-factor authentication and to assist in safeguarding their hardware-based security equipment. Tokenization and POS encryption are frequently used in the retail industry. Data loss prevention (DLP) and industrial control system (ICS) security in the manufacturing sectors access controls, data classification, and recurring vulnerability assessments are adopted in government sectors.

By Verticals

The largest share of the cloud systems management market was held by the BFSI segment. The demand for AI, data modeling, and Big Data is rising among banking and financial services firms to strengthen their business model. This will allow banks and financial services to monetize data by forecasting client spending patterns and gaining insights from unstructured information. Therefore, multi-cloud budgetary control and FinOps based on cloud systems are highly adopted across BFSI. The simplification of data science and machine learning in the banking and other financial sectors attracts mission-critical cloud management development.

Moreover, the GDPR-made BFSI-based enterprises help in regulation, banks, investment funds, insurance companies, and allied businesses have been tasked with managing their data even closer to avoid fines and reputational loss from failing to comply with the regulations. Similarly, American Fidelity, an additional insurance products and enrollment benefits provider, covers more than 1.5 million policyholders in 49 states across America with over 2.5 million policies. It needed help in realizing the performance of its critical customer-facing enrollment systems. These enrollments run further across a hybrid, multi-cloud environment built on a mix of on-premise systems, Azure, and AWS environments. Dynatrace offers several tools for monitoring, enabling single-view-based visibility across its terrain, thereby eliminating performance blind spots and highly improving AF's application performance.

Cloud System Management Market Regional Analysis

North America led the market with about 38% of the Cloud System Management market share in 2023, as it has recorded rapid growth in trend due to the early adoption of emerging technologies and a highly competitive landscape. The penetration of cloud systems management software in the region has also been encouraged by an impressive readiness level among end-users to adopt emerging technologies, encouraging key providers to develop and offer advanced cloud services. Moreover, the demand for new solutions based on the latest technologies is driven by the further rollout of wireless connectivity and an increasing adoption of connected and IoT-enabled devices. In that respect, companies aggressively invest in modern technologies in search of gaining an advantage over their competitors. For instance, major companies in the U.S. such as AWS, Microsoft Azure, IBM, Honeywell, etc. are investing in IoT (Internet of Things) services and cloud platforms to boost their company security as well as profitability.

The Asia-Pacific region is set for significant growth in the cloud system management market due to urbanization, technological advancements, and government investments in digital economies. The adoption of cloud-based solutions has surged with advancements in telecommunications, IoT, and cloud computing. For example, over 60% of businesses and government entities in China are integrating cloud computing into daily operations, driven by these trends and supportive government policies. APAC is likely to earn a significant cloud system management market share. Because of government programs aimed at improving technology, China and Japan are likely to be the fastest-expanding cloud system management markets.

Recent Developments in the Cloud System Management Market

-

In March 2024, Oracle and NVIDIA today announced a broader partnership to provide global customers with autonomous AI solutions. Governments and businesses can implement AI factories by using Oracle's distributed cloud, AI infrastructure, and generative AI services, along with NVIDIA's accelerated processing and generative AI software.

-

AWS and HashiCorp, a leading cloud infrastructure automation company teamed up to launch integrations between Amazon Web Services (AWS) services with Terraform Cloud in November 2024. This enables a customer to administer cloud infrastructure as code and multiple clouds from the same location.

Key Players

Service Providers / Manufacturers

-

VMware (vRealize Suite, VMware vCloud Director)

-

Microsoft (Azure Arc, Microsoft 365)

-

IBM (IBM Cloud Pak for Automation, IBM Cloud Pak for Multicloud Management)

-

Google (Google Cloud Platform, Anthos)

-

Oracle (Oracle Cloud Infrastructure, Oracle Enterprise Manager)

-

ServiceNow (Cloud Management, ServiceNow ITSM)

-

Datadog (Datadog Cloud Monitoring, Datadog APM)

-

BMC Software (BMC Helix, TrueSight)

-

Splunk (Splunk Cloud, IT Service Intelligence)

-

AWS (Amazon EC2, AWS CloudFormation)

Key Users

-

Siemens

-

Pfizer

-

L’Oréal

-

Tesla

-

SAP

-

Cognizant

-

Sony

-

Samsung

-

Lockheed Martin

-

BMW Group

| Report Attributes | Details |

| Market Size in 2023 | US$ 19.3 Bn |

| Market Size by 2032 | US$ 139.6 Bn |

| CAGR | CAGR of 24.6% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (IT Operations Management, IT Service Management, IT Automation and Configuration Management) • By Deployment Model (On-premises, Cloud) • By Organization Size (Small and Medium-sized Enterprises, Large Enterprises) • By Verticals (Banking, Financial Services, and Insurance, Telecommunications, IT and ITeS, Government and Public Sector, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Media and Entertainment, Healthcare and Life Sciences, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

VMware, Microsoft, IBM, Google, Oracle, ServiceNow, Datadog, BMC Software, Splunk, AWS

|

| Key Drivers |

• Accelerated investment in digital transformation, especially in sectors like BFSI, healthcare, and manufacturing, boosts demand for robust cloud management systems.

• Increasing adoption of multi-cloud platforms allows organizations to leverage various cloud services for greater flexibility and cost efficiency. • Increasing trend of Artificial Intelligence (AIOps) in IT, to reduce cost, increase privacy, and help in decision-making. |

| Market Restraints |

• Stringent data protection regulations and increasing scrutiny on data privacy limit the adoption of cloud systems, especially in highly regulated industries.

• The surge in sophisticated cyberattacks targeting cloud infrastructure raises security concerns, deterring broader adoption in some regions. |