Cloud Native Storage Market Report Scope & Overview:

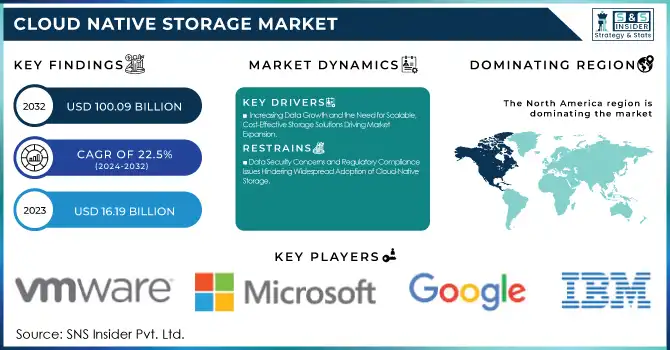

The Cloud Native Storage Market Size was valued at USD 16.19 Billion in 2023 and is expected to reach USD 100.09 Billion by 2032 and grow at a CAGR of 22.5% over the forecast period 2024-2032.

To Get More Information on Cloud Native Storage Market - Request Sample Report

The Cloud Native Storage Market is experiencing significant growth, driven by the increasing adoption of cloud-native technologies across industries. As organizations continue their journey toward digital transformation, the need for scalable, flexible, and efficient storage solutions has become paramount. Cloud-native storage, designed specifically for containerized applications and microservices architectures, offers robust capabilities like scalability, automation, and seamless integration with cloud environments. These attributes are fueling its widespread adoption across sectors such as BFSI, healthcare, retail, IT & telecom, manufacturing, and government.

In 2023, the U.S. federal government focused on modernizing its IT infrastructure through the "Cloud Smart" strategy. This initiative, as outlined in a report by the U.S. Government Accountability Office (GAO) in September 2022, aims to improve the efficiency of federal agencies by leveraging cloud services. The strategy is focused on enhancing security, optimizing procurement processes, and addressing workforce challenges, all while aiming to achieve long-term cost savings. Despite hurdles like ensuring cybersecurity, managing costs, and upskilling the workforce, the federal government's commitment to cloud adoption is clear, with billions of dollars earmarked annually for cloud investments. This shift to the cloud, including the adoption of cloud-native storage solutions, is expected to further accelerate as agencies continue to migrate to secure, scalable, and cost-effective commercial cloud services. This growing demand for cloud-native storage is in line with broader digital transformation efforts in the public and private sectors.

Cloud Native Storage Market Dynamics

Key Drivers:

-

Rising Adoption of Cloud-Native Architectures and Containerized Applications Enhances Demand for Cloud-Native Storage Solutions

The adoption of cloud-native architectures, including containerized applications, microservices, and Kubernetes, has drastically transformed how organizations approach IT infrastructure. As businesses move to embrace these modern, agile architectures, the need for cloud-native storage solutions has surged. Containerized environments, in particular, require flexible, scalable, and efficient storage solutions to manage the dynamic nature of containers, which can scale in and out quickly. Cloud-native storage solutions, which include block, object, and file storage designed to integrate seamlessly with container orchestration tools like Kubernetes, provide the ideal foundation for these environments. These solutions enable organizations to manage persistent storage for applications with high availability, low latency, and strong scalability.

Furthermore, cloud-native storage supports automated provisioning, scaling, and management of storage resources, making it easier for businesses to meet the storage demands of their cloud-native applications. As more enterprises embrace microservices and cloud-native development methodologies, the demand for such storage solutions will continue to rise, helping businesses optimize their application performance while reducing costs and complexity. This trend is anticipated to fuel the market growth for cloud-native storage over the next several years.

-

Increasing Data Growth and the Need for Scalable, Cost-Effective Storage Solutions Driving Market Expansion

Data is growing at an unprecedented rate across industries, fueled by factors like digital transformation, IoT adoption, and data-intensive applications such as AI, machine learning, and big data analytics. As the volume, velocity, and variety of data continue to expand, traditional storage systems struggle to keep up with the demands of modern workloads. Cloud-native storage solutions offer the scalability and flexibility necessary to handle this rapid data growth efficiently. Unlike traditional on-premises storage, cloud-native storage solutions can scale up or down dynamically to accommodate fluctuating data volumes.

Furthermore, they provide cost-effective pay-as-you-go pricing models, which make it easier for businesses to manage storage costs while meeting their growing data storage requirements. Cloud-native storage technologies such as object storage and distributed file systems are specifically designed to handle large volumes of unstructured data, providing easy data access, enhanced data availability, and built-in redundancy. This scalability and cost efficiency make cloud-native storage an attractive choice for organizations dealing with massive datasets. As enterprises across various sectors, including healthcare, retail, and finance, seek storage solutions to manage this data deluge, the market for cloud-native storage continues to experience robust growth.

Restrain:

-

Data Security Concerns and Regulatory Compliance Issues Hindering Widespread Adoption of Cloud-Native Storage

Despite the numerous benefits of cloud-native storage, data security and regulatory compliance remain significant barriers to its widespread adoption. Organizations often hesitate to migrate sensitive data to cloud-native environments due to concerns about data breaches, unauthorized access, and the potential loss of control over their data. Cloud storage solutions, while offering robust encryption and security features, still face challenges in meeting the stringent security and compliance requirements of highly regulated industries such as healthcare, finance, and government. These industries must adhere to data protection regulations such as GDPR, HIPAA, and SOC 2, which mandate specific safeguards for data security and privacy. Ensuring compliance with these regulations can be complex when data is stored and managed in a distributed, cloud-native environment.

Additionally, businesses often require specialized security measures, such as advanced encryption, identity access management, and regular security audits, to ensure the protection of sensitive data. The perceived risks associated with data security and compliance, combined with a lack of familiarity with cloud-native solutions, could slow down adoption and hinder market growth. Organizations are increasingly focusing on overcoming these barriers by implementing stronger security frameworks and working with cloud providers that meet regulatory standards. However, until these concerns are fully addressed, they may continue to limit the widespread adoption of cloud-native storage solutions.

Cloud Native Storage Market Segments Analysis

By Deployment

The Public Cloud segment has become the dominant force in the Cloud Native Storage Market, accounting for 68% of the market revenue in 2023. This growth is primarily driven by the increasing shift of enterprises to cloud infrastructures, where storage solutions are flexible, cost-efficient, and highly scalable. Major public cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are continuously innovating and expanding their cloud-native storage offerings.

For instance, AWS has recently launched the Amazon FSx for OpenZFS, providing scalable file storage that integrates with cloud-native applications. Similarly, Microsoft Azure has enhanced its Azure Blob Storage to support a broader range of cloud-native workloads, offering improved data redundancy and faster access times.

The Private Cloud segment is experiencing the highest CAGR of 23.44% within the forecasted period, signaling a shift towards more tailored and secure cloud storage solutions. Organizations are opting for private cloud deployments to maintain greater control over their data, comply with regulatory requirements, and ensure enhanced security. Private clouds offer a hybrid environment, combining the scalability of public clouds with the security of on-premises solutions.

For example, VMware recently launched VMware Tanzu Kubernetes Grid, a platform that helps enterprises deploy and manage cloud-native applications on private cloud environments, offering a seamless storage experience. IBM has also developed the IBM Cloud for Financial Services, which combines private cloud infrastructure with cloud-native storage solutions to ensure compliance with financial regulations while offering enhanced scalability and security.

By End Use

In 2023, the Media & Entertainment segment holds the largest revenue share of 24% in the Cloud Native Storage Market. This dominance can be attributed to the explosive growth of digital content creation, streaming services, and the increasing need for efficient management and distribution of large multimedia files. Media companies are leveraging cloud-native storage to store, manage, and distribute high-definition videos, graphics, and other media content globally.

For example, AWS introduced AWS Media Services, a suite of tools tailored for media workflows, allowing content creators to edit, process, and deliver video files directly from the cloud. Google Cloud also launched Cloud Storage for Firebase, optimizing storage for large-scale video and media applications, which simplifies backend infrastructure for media apps.

The Banking, Financial Services, and Insurance (BFSI) sector is experiencing the highest CAGR within the forecasted period, reflecting the increasing reliance on digital banking, online transactions, and secure data storage. As financial institutions continue to digitize and adopt cloud solutions, the demand for cloud-native storage solutions that ensure data security, scalability, and regulatory compliance is on the rise.

IBM’s Cloud for Financial Services offers secure, compliant cloud-native storage solutions tailored for the BFSI sector, while Oracle’s Autonomous Database on Cloud provides a secure platform for managing financial data with cloud-native storage capabilities.

Regional Analysis

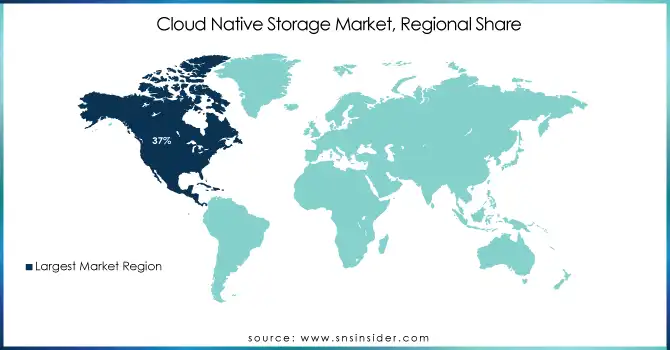

In 2023, North America holds the dominant share in the Cloud Native Storage Market, with an estimated market share of approximately 37%. This is largely due to the rapid adoption of cloud technologies, advanced digital infrastructure, and the presence of key market players in the region. Major cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are headquartered in North America, driving significant demand for cloud-native storage solutions.

For example, AWS’s S3 Storage and Amazon Elastic File System (EFS) have become pivotal in supporting businesses that require scalable and cost-effective storage solutions. The U.S. government is also accelerating the adoption of cloud technologies, further bolstering market growth.

The Asia Pacific (APAC) region is the fastest-growing region in the Cloud Native Storage Market, with an estimated CAGR of approximately 24.06% during the forecasted period. This rapid growth is driven by the region's increasing digitalization, high mobile internet penetration, and the widespread adoption of cloud computing technologies by businesses across sectors such as retail, manufacturing, BFSI, and telecommunications.

For example, companies such as Alibaba Cloud in China and TCS in India are spearheading cloud-native storage adoption, providing businesses with scalable and efficient storage solutions for handling massive data volumes.

Do You Need any Customization Research on Cloud Native Storage Market - Enquire Now

Key Players

Some of the major players in the Cloud Native Storage Market are:

-

Microsoft (Azure Blob Storage, Azure Kubernetes Service (AKS))

-

IBM, (IBM Cloud Object Storage, IBM Spectrum Scale)

-

AWS (Amazon S3, Amazon EBS (Elastic Block Store))

-

Google (Google Cloud Storage, Google Kubernetes Engine (GKE))

-

Alibaba Cloud (Alibaba Object Storage Service (OSS), Alibaba Cloud Container Service for Kubernetes)

-

VMWare (VMware vSAN, VMware Tanzu Kubernetes Grid)

-

Huawei (Huawei FusionStorage, Huawei Cloud Object Storage Service)

-

Citrix (Citrix Hypervisor, Citrix ShareFile)

-

Tencent Cloud (Tencent Cloud Object Storage (COS), Tencent Kubernetes Engine)

-

Scality (Scality RING, Scality ARTESCA)

-

Splunk (Splunk SmartStore, Splunk Enterprise on Kubernetes)

-

Linbit (LINSTOR, DRBD (Distributed Replicated Block Device))

-

Rackspace (Rackspace Object Storage, Rackspace Managed Kubernetes)

-

Robin.Io (Robin Cloud Native Storage, Robin Multi-Cluster Automation)

-

MayaData (OpenEBS, Data Management Platform (DMP))

-

Diamanti (Diamanti Ultima, Diamanti Spektra)

-

Minio (MinIO Object Storage, MinIO Kubernetes Operator)

-

Rook (Rook Ceph, Rook EdgeFS)

-

Ondat (Ondat Persistent Volumes, Ondat Data Mesh)

-

Ionir (Ionir Data Services Platform, Ionir Continuous Data Mobility)

-

Trilio (TrilioVault for Kubernetes, TrilioVault for OpenStack)

-

Upcloud (UpCloud Object Storage, UpCloud Managed Databases)

-

Arrikto (Kubeflow Enterprise, Rok (Data Management for Kubernetes)

Recent Trends

-

In August 2023, Microsoft enhanced its Azure Elastic SAN service by supporting private endpoints and enabling volume sharing via SCSI (Small Computer System Interface) Persistent Reservation.

-

In August 2023, AWS announced the opening of the AWS Israel (Tel Aviv) Region, which will provide developers, startups, enterprises, and public sector organizations in Israel with more options for hosting applications and serving end users locally.

-

In August 2023, Google introduced three advanced cloud storage solutions: Cloud Storage FUSE, catering to AI applications requiring file system semantics; Parallelstore, a parallel file system optimized for AI and High-Performance Computing (HPC) workloads utilizing GPUs; and NetApp integration for seamless data management.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 16.19 Billion |

| Market Size by 2032 | US$ 100.09 Billion |

| CAGR | CAGR of 22.5 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution [Object Storage, Block Storage, File Storage, Container Storage, Others], Services [System Integration & Deployment, Training & Consulting, Support & Maintenance]) • By Deployment (Private Cloud, Public Cloud) • By Enterprise Size (SMEs, Large Enterprises) • By End Use (BFSI, Telecom & IT, Healthcare, Retail & Consumer Goods, Manufacturing, Government, Energy & Utilities, Media & Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microsoft, IBM, AWS, Google, Alibaba Cloud, VMWare, Huawei, Citrix, Tencent Cloud, Scality, Splunk, Linbit, Rackspace, Robin.Io, MayaData, Diamanti, Minio, Rook, Ondat, Ionir, Trilio, Upcloud, Arrikto |

| Key Drivers | • Rising Adoption of Cloud-Native Architectures and Containerized Applications Enhances Demand for Cloud-Native Storage Solutions • Increasing Data Growth and the Need for Scalable, Cost-Effective Storage Solutions Driving Market Expansion |

| Restraints | • Data Security Concerns and Regulatory Compliance Issues Hindering Widespread Adoption of Cloud-Native Storage |