Cloud Disaster Recovery Market Size & Overview:

The Cloud Disaster Recovery Market was valued at USD 9.7 billion in 2023 and is expected to reach USD 71.8 billion by 2032, growing at a CAGR of 24.94% from 2024-2032.

Get more information on Cloud Disaster Recovery Market - Request Sample Report

The Cloud Disaster Recovery (CDR) market is experiencing significant growth, as businesses increasingly leverage cloud solutions to safeguard mission-critical data and maintain business continuity. As more business processes leverage cloud-based infrastructures for storage, services, and applications, the need for viable disaster recovery solutions has increased. With advantages like cost savings, scalability, and flexibility, cloud disaster recovery enables customers to receive fast and direct assistance without the infrastructure expenditures necessary for techniques of restoration that are defined by tradition. The growing amount of data being generated worldwide, the growing popularity of cloud services, and the increasing number of cyber-attacks have increased the demand for reliable and accessible backup solutions. Rapid growth in global data generation is one of the key factors driving the growth of this market. According to a study, data generation in 2023 reached 120 zettabytes of which a substantial amount is being stored in cloud environments. Such rapid data directives further fuel the need to safeguard data and recover from a disaster quickly in the event of a system failure or natural disaster. Additionally, reports suggest that 92% of companies use a form of cloud service, further increasing the demand for disaster recovery solutions.

The growing threat of cyberattacks will also fuel the need for cloud disaster recovery solutions. According to the Ponemon Institute, companies have, on average, experienced a cyberattack in the past 12 months (60%) and cyber disaster recovery systems that can rapidly return to production in the wake of the latest security calamity (e.g. ransomware attacks) are in demand. Furthermore, the requirement to comply with regulatory frameworks, such as the General Data Protection Regulation (GDPR) and Health Insurance Portability and Accountability Act (HIPAA), is leading organizations to deploy disaster recovery in a way that regulations require, which is anticipated to boost the growth of the disaster recovery market. Affordability also plays a key role in driving cloud disaster recovery adoption rates higher. Cloud solutions allow for a pay-as-you-go pricing model, making them far more appealing to smaller to medium-sized enterprise (SME) organizations compared to traditional, capital-intensive disaster recovery approaches that require heavy investment in infrastructure and staffing. Such cost-effectiveness allows businesses to attain an equilibrium between their security and finance.

The cloud disaster recovery market is set to keep growing as new technologies emerge, cyber threats rise, regulations increase, and the need for data continuity grows. With cloud adoption and digitalization growing, organizations will get more reliant on cloud disaster recovery solutions to protect their data while ensuring undisturbed business continuity.

Cloud Disaster Recovery Market Dynamics

Drivers

-

The enforcement of regulations like GDPR and HIPAA is pushing organizations to adopt cloud disaster recovery solutions to ensure compliance with data protection laws.

-

Cloud disaster recovery provides a pay-as-you-go model, making it more affordable for businesses, especially SMEs, compared to traditional recovery systems.

-

Innovations in cloud technology, including automation and AI-driven solutions, are enhancing the efficiency and reliability of cloud disaster recovery systems.

In particular, as cloud technology develops, automation and AI-based solutions are transforming the entire cloud disaster recovery (CDR) systems, providing efficiency and reliability for cloud-based systems. A significant position is played in automation because it simplifies the disaster recovery process. This allows systems to autonomously identify and recover from failures, without requiring human interaction. This improves recovery times, reduces errors, and offers a unified response to disruptions. For example, automated failover systems can immediately shift operations to secondary cloud infrastructure, minimizing downtime and ensuring business continuity. Even more so AI and ML add new levels of predictive analytics and capabilities to these. Using large collections of historical data, AI models can predict areas of potential failure or risk, which helps businesses take pre-emptive action before disasters occur.

Incorporating machine learning into recovery plan development will allow IT organizations to derive learning from past incidents and constantly revise recovery strategies accordingly. And they boost the speed of data recovery — especially in multi-cloud scenarios, where data is often spread across multiple platforms. The enhanced capabilities of stability AI make cloud disaster recovery solutions more efficient and scalable, which is crucial as enterprises increasingly store large volumes of data in the cloud.

In addition to this, another domain where AI and automation can help is the rising demand for laws and regulations on compliance. Automated recovery processes also help businesses adhere to stricter data protection regulations such as GDPR and HIPAA, which are pushed for through legislation around the world. It not only guarantees that recovery actions are performed, in compliance with law provisions, but also avoids operational disruptions during recovery. With the advancement of cloud technologies, automation, and AI, cloud disaster recovery is poised to become an essential element of business resilience in the modern digital landscape.

Restraints

-

Transferring large volumes of data to and from the cloud can incur high costs, which may be a barrier for organizations with significant data storage needs.

-

Integrating cloud disaster recovery systems with legacy on-premise systems can be complex and costly, leading to longer deployment times.

-

Some cloud disaster recovery solutions may lack the ability to be fully customized to meet the unique needs of specific industries or businesses, limiting flexibility.

Cloud disaster recovery (CDR) solutions offer many benefits including easy scalability, cost-effectiveness, and timeliness of recovery, but the best solutions on the market do not yet fully address the customization of different needs of industries or businesses. Most of the available off-the-shelf solutions are generically designed to address the needs of a wide spectrum of users. For businesses with more complex IT environments, mission-critical applications, or specific requirements these solutions may not be a perfect fit. As a result, certain industries like healthcare and finance that work with sensitive data are governed by compliance mandates like HIPAA or GDPR and have specific industry compliance issues, security protocols, and system architectures necessitating custom recovery plans. Such inflexibility can make it difficult to implement a recovery process that meets the organization’s unique operating model and risk management needs. Cloud platforms do provide a handful of customization tools, but it can be difficult for businesses to adapt them to what they need. Changing recovery time objectives (RTOs), recovery point objectives (RPOs), connecting up legacy systems, or adapting the recovery plan could be challenging or involve considerable extra cost. This could result in slower deployment times or greater costs for businesses to close these gaps.

In addition, if the solution does not provide flexibility and seamless operations, it could get difficult to integrate cloud disaster recovery systems with already existing on-premise infrastructures or multi-cloud setups. Then many businesses would have no option but to turn to third parties or make further investments in specialty service to achieve the level of customization they need for disaster recovery.

However, cloud providers are slowly making strides toward improving the flexibility of their solutions, as businesses increasingly want more bespoke disaster recovery options. The difficult part, though, is between offering scalable systems and those that meet the exact requirements of a business within a sector. This gap is a major hurdle for organizations in the cloud disaster recovery market that has specific recovery needs.

Cloud Disaster Recovery Market Segment Analysis

By Organization Size

The Cloud Disaster Recovery (CDR) market is currently dominated by the large enterprises segment with a revenue share more than of 72.25% in 2023, due to complex IT infrastructures, large volumes of data operations, and recovery requirements. These enterprises invest a significant amount of money into disaster recovery, but it tends to be around the systems responsible for ensuring business functions always work, & revolve largely around functionality, and not so much around security. The investment typically encompasses customized CDR to enable business continuity, a movement lifted further by the ubiquitous digital transformation and cloud migration initiatives. This growth is forecasted to continue since large enterprises plan on continuously enhancing their operational resilience to meet a range of cyber threats and evolving regulatory standards.

The smaller and medium-sized enterprise (SME) market is expected to register the highest CAGR during the forecast period. The low cost, scalability, and flexibility of cloud disaster recovery solutions have prompted SMEs to increasingly migrate on-premises workloads to the cloud. Such organizations that may not have the resources for technology find cloud-based disaster recovery to be an easy and economical way to ensure that they are safeguarding their data and applications. With growing awareness around data protection and business continuity, especially due to rising cyberattacks and operational disruption, an increasing number of SMEs are switching to cloud disaster recovery. In addition, demand for next-generation and relevant recovery solutions will continue to benefit from the ongoing transition to cloud technologies, as businesses focus on ensuring business continuity.

By Deployment

The hybrid segment dominated the Cloud Disaster Recovery (CDR) market and represented a significant revenue share of 42% in 2023, attributed to its agility while yielding the benefits of both private and public cloud environments. With a hybrid solution, organizations can store sensitive data on the private clouds and benefit from public cloud scaling and cost-effective capabilities for their less-critical operations. With this model, businesses can meet compliance needs, address security requirements, meet recovery objectives, and take advantage of cloud scalability. The flexibility of hybrid structures makes this model favourable for enterprises with differing recovery or business objectives because they allow for the widest array of IT environments. The hybrid approach is likely to remain the leading deployment model, especially with businesses focused on trusted, flexible, and scalable disaster recovery services across hybrid multi-cloud environments.

The public cloud deployment model is estimated to register the highest compound annual growth rate (CAGR) throughout the forecast period. Today, public cloud offerings are appealing to small and medium-sized businesses (SMBs) and enterprises with basic recovery needs due to their cost effectiveness and scalability. Disaster recovery solutions have to be accessed through public cloud providers such as AWS, Microsoft Azure, and Google Cloud which allow businesses to scale infrastructure on the fly while lowering capital expenses. This segment will grow considerably as public cloud services become increasingly appealing due to their low prices and associated cloud-first strategies. The demand for public cloud models is expected to grow quickly as businesses look for simplified, cost-effective disaster recovery solutions.

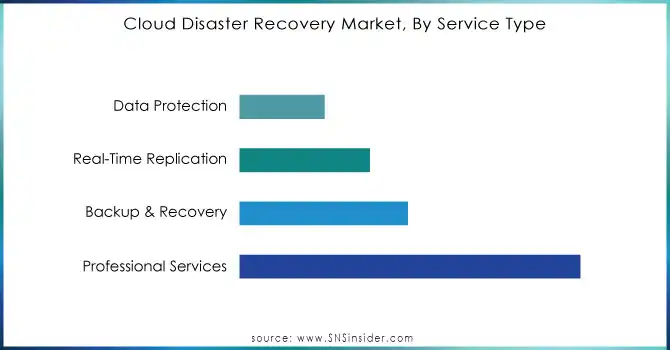

By Service Type

The backup & recovery segment dominated the cloud disaster recovery (CDR) market and accounted for more than 44.28% of revenue share due to the primary requirement of businesses to recover data during unexpected situations such as system crashes, cyberattacks, or natural disasters. Backup & recovery services store reliable copies of data that businesses can restore in the event of an incident that requires recovery, ensuring business continuity. With more organizations moving to the cloud and the amount of data continuing to explode, the need for backup and recovery has accelerated. The segment remains an important area for enterprises and continues to be a crucial part of their DR strategies that reflect the enterprise's focus on data protection and operational resilience. The advancement of technology and cloud adoption will keep backup & recovery on top for some years to come.

The data protection segment is anticipated to grow at the highest compound annual growth rate (CAGR) in the CDR market. With the increasing emphasis on data privacy such as the increase in cyberattacks and GDPR, businesses need a solution that provides data protection as, without it, a company is vulnerable to the very thing that it protects. These solutions protect sensitive data from breaches, rampant cyber and IT disasters, unauthorized access, and corruption. With more businesses adapting to cloud-based solutions, data protection services providing encryption, storage, and access controls are a need. This growth will be fueled by the increasing digital transformation initiatives, hike in data generation, and the escalation of compliance dependencies as enterprises look for a data protection solution for not only safety but also data privacy and regulatory redressal.

Need any customization research on Cloud Disaster Recovery Market - Enquiry Now

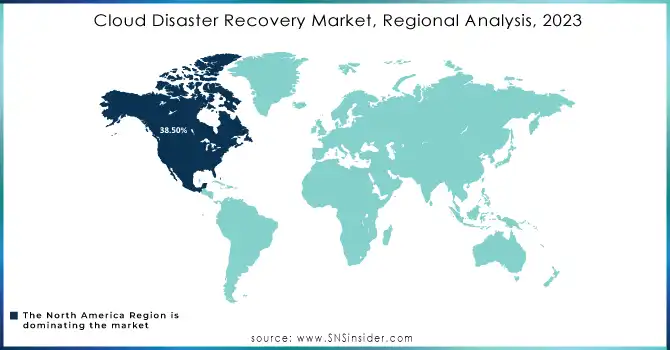

Cloud Disaster Recovery Market Regional Analysis

In 2023, North America dominated the market and held the largest revenue share of more than 38.50%, due to major top cloud service providers being located in this area and advanced cloud technologies being highly developed with greater IT infrastructure investments. Nevertheless, the increase in different cyber-attacks and guidelines like HIPAA and GDPR have made organizations in the region obligatory to employ disaster recovery solutions. Its share in terms of revenue is highest in North America owing to the mature IT ecosystem and rising focus towards business continuity. Then again, the rise in automation-led disaster recovery technologies — a trend likely to grow as organizations remain focused on resiliency and digital transformation– will further bolster its leadership-backed hybrid cloud models.

Asia Pacific (APAC) region is expected to register the highest compound annual growth rate (CAGR) during the forecast period, due to the accelerated digital transformation, increasing cloud adoption, and the rising importance of data security in the region. The increasing cost-efficient cloud-based disaster recovery solutions adoption among SMEs in countries such as China, India, and Southeast Asia is also supporting the same for cloud-based disaster recovery as a service market over the forecast timeframe. This is mostly because of the rising occurrence of cyberattacks and also the government support programs to boost the adoption of cloud in these regions that will help with the expansion of the market in this area. This transition puts SMEs at the center of attention in terms of building data provenance protection and cost-effectively improving operational resilience.

Key players

The major key players along with their products are

-

Amazon Web Services (AWS) - AWS Elastic Disaster Recovery

-

Microsoft - Azure Site Recovery

-

IBM - IBM Disaster Recovery as a Service (DRaaS)

-

Google Cloud - Google Cloud Backup and DR

-

VMware - VMware Site Recovery

-

Dell Technologies - Dell EMC Data Protection Suite

-

Cisco Systems - Cisco HyperFlex Disaster Recovery

-

Hewlett Packard Enterprise (HPE) - HPE GreenLake Disaster Recovery

-

Oracle - Oracle Cloud Disaster Recovery

-

Commvault - Commvault Backup & Disaster Recovery

-

Veeam Software - Veeam Disaster Recovery Orchestrator

-

Zerto - Zerto for Disaster Recovery

-

Acronis - Acronis Cyber Protect Cloud

-

Veritas Technologies - Veritas Resiliency Platform

-

Carbonite (OpenText) - Carbonite Server Backup

-

Datto (Kaseya) - Datto Continuity for Microsoft Azure

-

Unitrends - Unitrends Backup and Disaster Recovery

-

Sungard Availability Services - Managed Disaster Recovery Services

-

Rackspace Technology - Rackspace DRaaS

-

Hitachi Vantara - Hitachi Cloud Disaster Recovery Service

Recent Developments in the Cloud Disaster Recovery Market

-

January 2024: Microsoft expanded its Azure Site Recovery capabilities to include more advanced machine learning features for disaster recovery optimization

-

February 2024: Zerto, a Hewlett Packard Enterprise company, introduced AI-based enhancements for cyber-recovery and disaster recovery, including predictive analytics to optimize recovery points

-

March 2024: AWS (Amazon Web Services) launched new features in its Elastic Disaster Recovery (AWS DRS) service, focusing on faster failback and automated recovery testing

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.7 Bn |

| Market Size by 2032 | US$ 71.8 Bn |

| CAGR | CAGR of 24.94% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Data Protection, Real-Time Replication, Backup & Recovery, Professional Services) • By Deployment (Private, Hybrid, Public) • By Organization Size (Large Enterprises, Small & Medium Enterprises) • By End-Use (BFSI, Retail and Goods, Government and Public Sector, Manufacturing, Healthcare and Life Sciences, Media and Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon Web Services, Microsoft, IBM, Google Cloud, VMware, Dell Technologies, Cisco Systems, Hewlett Packard Enterprise, Oracle, Commvault, Veeam Software, Zerto, Acronis, Veritas Technologies, Carbonite, Datto, Unitrends, Sungard Availability Services, Rackspace Technology, Hitachi Vantara |

| Key Drivers | • The enforcement of regulations like GDPR and HIPAA is pushing organizations to adopt cloud disaster recovery solutions to ensure compliance with data protection laws. • Cloud disaster recovery provides a pay-as-you-go model, making it more affordable for businesses, especially SMEs, compared to traditional recovery systems. • Innovations in cloud technology, including automation and AI-driven solutions, are enhancing the efficiency and reliability of cloud disaster recovery systems. |

| Market Restraints | • Transferring large volumes of data to and from the cloud can incur high costs, which may be a barrier for organizations with significant data storage needs. • Integrating cloud disaster recovery systems with legacy on-premise systems can be complex and costly, leading to longer deployment times. • Some cloud disaster recovery solutions may lack the ability to be fully customized to meet the unique needs of specific industries or businesses, limiting flexibility. |