Cloud Computing Market was valued at USD 605.3 billion in 2023 and is expected to reach USD 2619.2 billion by 2032, growing at a CAGR of 17.7% from 2024-2032.

This report includes a detailed regulatory analysis, examining key policies influencing market growth. It highlights network infrastructure expansion by region in 2023, alongside the rise in cybersecurity incidents from 2020-2023, including estimated weekly attacks. Adoption rates of emerging technologies are also analyzed, offering insights into shifting trends. Additionally, the report explores cloud services usage by region, providing a comparative outlook. An emphasis is placed on green cloud technologies and their carbon impact, addressing sustainability concerns. This comprehensive overview ensures a clear understanding of current and future market dynamics, helping stakeholders navigate the evolving cloud landscape.

U.S. Cloud Computing Market was valued at USD 178.66 billion in 2023 and is expected to reach USD 677.09 billion by 2032, growing at a CAGR of 15.95% from 2024-2032.

Growth is driven by rapid digital transformation across industries, increasing adoption of AI, big data analytics, and IoT, and a strong push toward remote and hybrid work models. Enterprises are shifting from traditional IT infrastructure to scalable, cost-efficient cloud services. Government initiatives supporting cloud adoption and stringent data security regulations further bolster market demand. Moreover, the expansion of hyperscale data centers and increased investments in edge computing and 5G technologies continue to accelerate cloud deployment across sectors, solidifying the U.S. as a global leader in cloud innovation.

Get more information on Cloud Computing Market - Request Sample Report

Drivers

Growing demand for scalable IT infrastructure to support remote work, data storage, and business continuity is fueling market expansion

Growing demand for expandable IT infrastructure is strongly leading to the growth of cloud computing across sectors. Companies are making a growing trend from on-site systems to cloud-based systems in order to promote operational efficiency, support remote workforce, and achieve easy access to data from any location. Business continuity, particularly in uncertain settings, is fostered by cloud services' elasticity, and sudden scaling according to demand fluctuations. Enterprises gain benefits of lower IT costs, seamless updates, and little infrastructure spending. Furthermore, the increasing prevalence of cloud-native applications and microservices is building pressure on needing scalable platforms. With companies endeavoring to enhance their agility and resilience, the cloud provides unequalled scalability, accessibility, and dependability. Such benefits are persuading businesses to invest higher in cloud infrastructure, accelerating the market's growth pattern relentlessly across industries.

Restraints

Security concerns surrounding data breaches, unauthorized access, and compliance risks are limiting broader enterprise adoption of cloud solutions

Security concerns are a critical limitation affecting the extensive use of cloud computing services. Enterprises are subject to ongoing concern about data breaches, unauthorized access, and exposure of sensitive data. In spite of the strong security mechanisms provided by large cloud vendors, companies are still worried about shared responsibility models and off-premises risks of storing sensitive data. Moreover, regulations like GDPR, HIPAA, and sector-specific norms contribute to the added complexity of cloud migration. Any misconfiguration or lack of monitoring can result in legal and financial issues. Fears regarding internal threats, cyberattacks, and sovereignty of the data make these concerns even more intense. This constraint is especially significant for industries such as finance and healthcare, where data security is a top priority. Therefore, these risks are preventing some businesses from going all out on cloud adoption.

Opportunities

Expansion of edge computing and IoT ecosystems is creating demand for hybrid and multi-cloud architectures across industries

Growth of edge computing and Internet of Things (IoT) ecosystems is fueling the need for hybrid and multi-cloud solutions. As more devices become connected across industries such as manufacturing, healthcare, and transportation, the need for processing lower latency nearer to sources of data increases. Edge computing supports real-time response and analysis, but connection to centralized cloud environments is necessary for general scalability and management of data. Such an ecosystem is driving the growth of hybrid cloud deployments that leverage public and private environments to best support performance. Enterprises are also adopting multi-cloud strategies in order to avoid vendor lock-in and increase flexibility. The confluence of IoT, edge, and cloud platforms offers tremendous opportunity for providers to provide tailored end-to-end solutions. This blending is transforming the cloud computing scenario and opening new growth opportunities

Challenges

Complexity in managing multi-cloud environments and vendor lock-in is creating operational and integration challenges for enterprises

Complexity in managing multi-cloud infrastructure is a fast-evolving concern for organizations embarking on varied cloud strategies. Organizations tend to engage with several cloud providers to prevent reliance on one, improve performance, and conform to regulatory needs. This results in fragmented infrastructure, disparate security policies, and integration challenges across platforms. Every cloud service possesses different APIs, billing methods, and management consoles, so its unified governance and optimization become difficult. Moreover, vendor lock-in issues remain, since the migration from one platform to another may entail prohibitive expense and business disruption. Interoperability issues among cloud ecosystems introduce another layer of complication. Sophisticated tools and trained professionals are needed to navigate such environments optimally. Such issues create immense hurdles to painless cloud usage, stifling the promise and slowing down cloud transformation at an enterprise level.

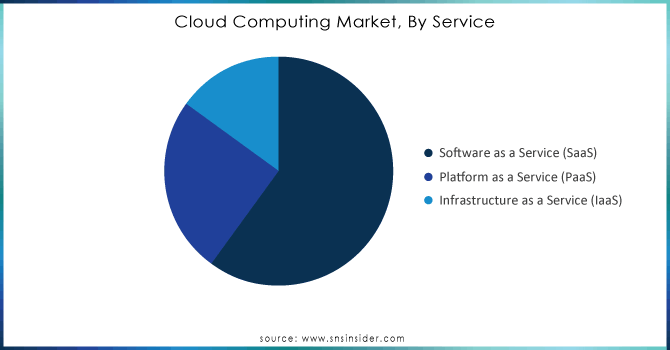

By Service

Software as a Service led the Cloud Computing Market in 2023 with the largest revenue percentage of approximately 49% because it is cost-effective, scalable, and easy to deploy. Companies from various industries opt for SaaS solutions for CRM, ERP, and collaboration applications, minimizing complicated infrastructure management. The pay-as-you-go pricing and regular updates appeal to businesses demanding flexibility and low maintenance. SaaS also facilitates remote work and worldwide accessibility, which further boosted its usage during and post-pandemic.

Infrastructure as a Service is expected to grow at the fastest CAGR of approximately 19.63% during the forecast period of 2024 to 2032, with the increasing need for scalable computing resources and data storage services. Small and medium enterprises and enterprises are shifting away from on-premises infrastructure to IaaS to maintain cost control, agility, and rapid deployment. The spread of AI, big data, and IoT applications also drives IaaS adoption, as they necessitate high-performance computing and large-scale storage infrastructures.

Need any customization research/data on Cloud Computing Market - Enquiry Now

By Enterprise Size

Large Enterprises led the Cloud Computing Market with the largest revenue share of around 63% in 2023 because they have large IT budgets, intricate infrastructure requirements, and international operations. These companies increasingly depend on cloud solutions to improve scalability, security, and operational efficiency. They spend on cloud-based analytics, disaster recovery, and enterprise applications to aid digital transformation and competitiveness. Moreover, their requirement for handling large volumes of data and maintaining business continuity further propels cloud adoption across various business functions.

Small & Medium Enterprises (SMEs) are anticipated to expand at the fastest CAGR of approximately 18.88% during 2024-2032, as they look for cost-effective and scalable cloud solutions to compete with big companies. Cloud computing offers SMEs access to enterprise-grade tools without large upfront costs, enabling agility, remote work, and digital customer engagement. Government support and increasing awareness of cloud benefits among SMEs also contribute to adoption, especially in developing economies where digitalization is accelerating rapidly.

By Deployment

Public cloud segment led the Cloud Computing Market with the highest share of revenues, approximately 43%, during 2023, due to affordability, convenience in access, and extensive scalability. Public clouds are extensively utilized by organizations to host applications, store data, and execute workloads without worrying about infrastructure administration. Key players such as AWS, Microsoft Azure, and Google Cloud provide strong security, flexibility, and worldwide presence, making public cloud a favorite among companies looking to minimize capital costs and shorten deployment timelines.

The Hybrid cloud segment is expected to expand at the fastest CAGR of around 21.00% during the forecast period from 2024 to 2032, owing to the growing demand for flexibility, data sovereignty, and workload optimization. Organizations are merging on-premise infrastructure with private and public clouds to build tailored environments that reconcile control and scalability. Hybrid configurations enable smooth data mobility, disaster recovery, and regulatory compliance, particularly for industries such as finance and healthcare. The need for hybrid solutions increases with the increase in edge computing and IoT.

By Workload

Application Development & Testing led the Cloud Computing Market in 2023 with the largest revenue share of nearly 28%, driven by the increasing need for agile development, continuous integration, and accelerated time-to-market. Cloud platforms offer developers scalable environments, automated tools, and testing frameworks that lower the cost and enhance the quality of software. Companies and startups utilize cloud services for DevOps, mobile application development, and software lifecycle management, so the segment is a central part of digital transformation programs among industries.

Resource Management is expected to grow at the fastest CAGR of approximately 19.77% from 2024 to 2032, as companies seek to streamline cloud expenditure, capacity planning, and workload distribution. Sophisticated monitoring, automation, and analytics tools enable businesses to manage computing resources in an optimal manner and eliminate wastage. With hybrid and multi-cloud environments becoming increasingly complex, monitoring of resources in real-time and cost governance become imperative. This creates demand for smart resource management solutions in industries such as IT, manufacturing, and retail.

By End-use

The BFSI segment led the Cloud Computing Market with the largest revenue share of around 20% in 2023 as a result of its keen emphasis on security, compliance, and delivery of digital services. Banks and financial institutions are deploying cloud-based core banking systems, fraud detection, and customer analytics to improve operational efficiency and customer experience. The use of cloud enables 24/7 operations, disaster recovery, and fintech application innovation, which makes it part of the continuous digital transformation of the financial industry.

The Manufacturing segment is expected to grow at the fastest CAGR of approximately 21.16% during the period 2024-2032, fueled by the fast growth of Industry 4.0 technologies. Cloud computing is being used by manufacturers for real-time monitoring, predictive maintenance, supply chain optimization, and smart factory operations. Cloud platforms allow for easy integration of IoT, robotics, and AI across production lines. As manufacturers seek efficiency, scalability, and cost savings, cloud-based solutions are becoming key to attaining competitive edge in global markets.

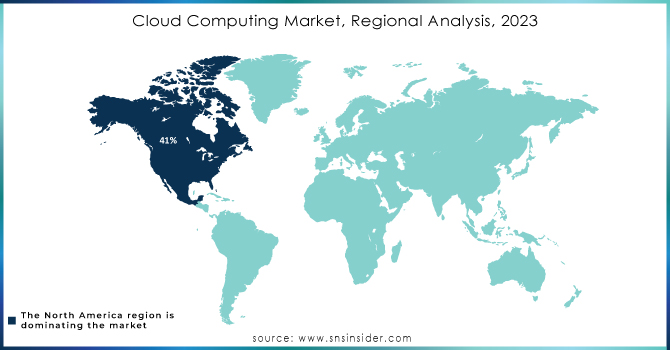

North America dominated the Cloud Computing Market in 2023 with the highest revenue share of about 39%, owing to the strong presence of major cloud service providers such as Amazon Web Services, Microsoft Azure, and Google Cloud. The region benefits from advanced IT infrastructure, high cloud adoption across industries, and significant investments in AI, big data, and cybersecurity. Enterprises in North America are early adopters of digital transformation, leveraging cloud technologies for scalability, innovation, and competitive advantage across sectors like finance, healthcare, and retail.

Asia Pacific is expected to grow at the fastest CAGR of about 20.09% from 2024 to 2032, driven by rapid digitalization, expanding internet penetration, and increasing cloud adoption among small and medium enterprises. Countries like China, India, and Southeast Asian nations are witnessing growing investments in cloud infrastructure and smart city projects. The rising demand for remote work, e-commerce, and mobile applications further accelerates cloud deployment. Government initiatives supporting digital transformation and local data centers also boost market expansion across the region.

In April 2024, Google introduced Axion, a custom Arm-based server chip designed to make cloud computing more affordable. Expected to launch later in the year, Axion will power YouTube ad workloads, positioning Google alongside competitors like Amazon and Microsoft. Snap has shown early interest in the technology.

In January 2024, American Tower partnered with IBM to enhance cloud solutions by integrating IBM’s hybrid cloud technology and Red Hat OpenShift into its Access Edge Data Centers. This will enable businesses to leverage IoT, 5G, AI, and network automation for digital transformation.

In January 2024, Eviden and Microsoft announced the expansion of their partnership in order to enable Microsoft Cloud and AI solutions across various segments. Overall, Eviden’s move will support its global network growth strategy.

In March 2023, the U.S. Department of Defense announced the awarding of its Joint Warfighting Cloud Capability contract, value at $9 billion, to major cloud providers, including AWS, Microsoft, Google, Oracle and others. The contract is part of the Pentagon’s policy to switch to the multi-cloud system, aimed at national security and defense.

The European Union launched the Gaia-X initiative in June 2023, a European cloud ecosystem was created to satisfy the requirements of data sovereignty and security. The initiative is supported by the EU law, the €5 billion worth Gaia-X foundation, according to the EU government official publications. This act is expected to reduce the U.S.-based cloud providers in Europe.

Amazon Web Services (AWS) (EC2, S3)

Microsoft (Azure Virtual Machines, Azure Storage)

Google Cloud (Google Compute Engine, Google Kubernetes Engine)

IBM (IBM Cloud Private, IBM Cloud Kubernetes Service)

Oracle (Oracle Cloud Infrastructure, Oracle Autonomous Database)

Alibaba Cloud (Elastic Compute Service, Object Storage Service)

Salesforce (Salesforce Sales Cloud, Salesforce Service Cloud)

SAP (SAP HANA Enterprise Cloud, SAP Business Technology Platform)

VMware (VMware vCloud, VMware Cloud on AWS)

Rackspace (Rackspace Cloud Servers, Rackspace Cloud Files)

Dell Technologies (VMware Cloud Foundation, Virtustream Enterprise Cloud)

Hewlett Packard Enterprise (HPE) (HPE GreenLake, HPE Helion)

Tencent Cloud (Tencent Cloud Compute, Tencent Cloud Object Storage)

Adobe (Adobe Creative Cloud, Adobe Document Cloud)

Red Hat (OpenShift, Red Hat Cloud Infrastructure)

Cisco Systems (Cisco Webex Cloud, Cisco Intersight)

Fujitsu (Fujitsu Cloud Service K5, Fujitsu Cloud IaaS Trusted Public S5)

Huawei (Huawei Cloud ECS, Huawei Cloud OBS)

Workday (Workday Human Capital Management, Workday Financial Management)

NetApp (NetApp Cloud Volumes, NetApp Cloud Insights), and others players.

| Report Attributes | Details |

| Market Size in 2023 | US$ 605.3 Billion |

| Market Size by 2031 | US$ 2619.2 Billion |

| CAGR | CAGR of 17.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Public Cloud, Private Cloud, Hybrid Cloud) • By Enterprise Size (Large Enterprises, Small & Medium Enterprises) • By Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS)) • By Industry (BFSI, IT and Telecommunications, Government, Consumer Goods, and Retail, Healthcare, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | IBM Corporation (U.S.), AWS (US), SAP SE (Germany), Microsoft (US), VMware, Inc. (U.S.), Google (US), Alibaba Cloud (China), Adobe (US), DigitalOcean (US), Salesforce (US), Oracle (US), Workday (US), Fujitsu (Japan), VMWare (US), Sage (UK), Rackspace (US), DXC (US), Tencent (China), NEC (Japan), Joyent (US), Virtustream (US), Skytap (US), Bluelock (US), Navisite (US), CenturyLink (US), OVH (France), Infor (US), Intuit (US), OpenText (Canada), Cisco (US), Box (US) |

| Key Drivers | • Integration of Big Data, AI, and Machine Learning with the Cloud to Enhance Market |

| Market Opportunities | • Government attempts to accelerate cloud use are expanding. |

Ans: Cloud Computing Market was valued at USD 605.3 billion in 2023 and is expected to reach USD 2619.2 billion by 2032, growing at a CAGR of 17.7% from 2024-2032.

Ans: The U.S. Cloud Computing Market was valued at USD 178.66 billion in 2023, with strong contributions from AI, IoT, and big data adoption.

Ans: Software as a Service (SaaS) led the market in 2023 with a 49% revenue share due to its scalability, affordability, and ease of deployment.

Ans: Large Enterprises held a 63% revenue share in 2023, leveraging cloud for scalability, business continuity, and global digital transformation initiatives.

Ans: North America dominated with a 39% revenue share, supported by strong digital infrastructure and early adoption of cloud technologies.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1. Regulatory Analysis

5.2. Network Infrastructure Expansion by Region (2023)

5.3. Cybersecurity Incidents by Region (2020–2023) Estimated Reported Cases or Weekly Attacks

5.4. Adoption Rates of Emerging Technologies

5.5. Cloud Services Usage by Region

5.6 Green Cloud & Carbon Impact Key Data

6. Competitive Land scape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Cloud Computing Market Segmentation, By Service

7.1 Chapter Overview

7.2 Infrastructure as a Service (IaaS)

7.2.1 Infrastructure as a Service (IaaS) Market Trends Analysis (2020-2032)

7.2.2 Infrastructure as a Service (IaaS) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Platform as a Service (PaaS)

7.3.1 Platform as a Service (PaaS) Market Trends Analysis (2020-2032)

7.3.2 Platform as a Service (PaaS) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Software as a Service (SaaS)

7.4.1 Software as a Service (SaaS) Market Trends Analysis (2020-2032)

7.4.2 Software as a Service (SaaS) Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Cloud Computing Market Segmentation, By Enterprise Size

8.1 Chapter Overview

8.2 Large Enterprises

8.2.1 Large Enterprises Market Trends Analysis (2020-2032)

8.2.2 Large Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Small & Medium Enterprises

8.3.1 Small & Medium Enterprises Market Trends Analysis (2020-2032)

8.3.2 Small & Medium Enterprises Market Size Estimates and Forecasts To 2032 (USD Billion)

9. Cloud Computing Market Segmentation, By Deployment

9.1 Chapter Overview

9.2 Public

9.2.1 Public Market Trends Analysis (2020-2032)

9.2.2 Public Market Size Estimates and Forecasts To 2032 (USD Billion)

9.3 Private

9.3.1 Private Market Trends Analysis (2020-2032)

9.3.2 Private Market Size Estimates and Forecasts To 2032 (USD Billion)

9.4 Hybrid

9.4.1 Hybrid Market Trends Analysis (2020-2032)

9.4.2 Hybrid Market Size Estimates and Forecasts To 2032 (USD Billion)

10. Cloud Computing Market Segmentation, By Workload

10.1 Chapter Overview

10.2 Application Development & Testing

10.2.1 Application Development & Testing Market Trends Analysis (2020-2032)

10.2.2 Application Development & Testing Market Size Estimates and Forecasts To 2032 (USD Billion)

10.3 Data Storage & Backup

10.3.1 Data Storage & Backup Market Trends Analysis (2020-2032)

10.3.2 Data Storage & Backup Market Size Estimates and Forecasts To 2032 (USD Billion)

10.4 Resource Management

10.4.1 Resource Management Market Trends Analysis (2020-2032)

10.4.2 Resource Management Market Size Estimates and Forecasts To 2032 (USD Billion)

10.5 Orchestration Services

10.5.1 Orchestration Services Market Trends Analysis (2020-2032)

10.5.2 Orchestration Services Market Size Estimates and Forecasts To 2032 (USD Billion)

10.6 Others

10.6.1 Others Market Trends Analysis (2020-2032)

10.6.2 Others Market Size Estimates and Forecasts To 2032 (USD Billion)

11. Cloud Computing Market Segmentation, By End-Use

11.1 Chapter Overview

11.2 BFSI

11.2.1 BFSI Market Trends Analysis (2020-2032)

11.2.2 BFSI Market Size Estimates and Forecasts To 2032 (USD Billion)

11.3 IT & Telecom

11.3.1 IT & Telecom Market Trends Analysis (2020-2032)

11.3.2 IT & Telecom Market Size Estimates and Forecasts To 2032 (USD Billion)

11.4 Retail & Consumer Goods

11.4.1 Retail & Consumer Goods Market Trends Analysis (2020-2032)

11.4.2 Retail & Consumer Goods Market Size Estimates and Forecasts To 2032 (USD Billion)

11.5 Manufacturing

11.5.1 Manufacturing Market Trends Analysis (2020-2032)

11.5.2 Manufacturing Market Size Estimates and Forecasts To 2032 (USD Billion)

11.6 Energy & Utilities

11.6.1 Energy & Utilities Market Trends Analysis (2020-2032)

11.6.2 Energy & Utilities Market Size Estimates and Forecasts To 2032 (USD Billion)

11.7 Healthcare

11.7.1 Healthcare Market Trends Analysis (2020-2032)

11.7.2 Healthcare Market Size Estimates and Forecasts To 2032 (USD Billion)

11.8 Media & Entertainment

11.8.1 Media & Entertainment Market Trends Analysis (2020-2032)

11.8.2 Media & Entertainment Market Size Estimates and Forecasts To 2032 (USD Billion)

11.9 Government & Public Sector

11.9.1 Government & Public Sector Market Trends Analysis (2020-2032)

11.9.2 Government & Public Sector Market Size Estimates and Forecasts To 2032 (USD Billion)

11.10 Others

11.10.1 Others Market Trends Analysis (2020-2032)

11.10.2 Others Market Size Estimates and Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Cloud Computing Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.2.4 North America Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.2.5 North America Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.2.6 North America Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.2.7 North America Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.2.8.2 USA Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.2.8.3 USA Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.2.8.4 USA Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.2.8.5 USA Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.2.9.2 Canada Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.2.9.3 Canada Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.2.9.4 Canada Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.2.9.5 Canada Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.2.10.2 Mexico Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.2.10.3 Mexico Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.2.10.4 Mexico Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.2.10.5 Mexico Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Cloud Computing Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.3.1.8.2 Poland Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.1.8.3 Poland Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.1.8.4 Poland Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.3.1.8.5 Poland Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.3.1.9.2 Romania Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.1.9.3 Romania Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.1.9.4 Romania Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.3.1.9.5 Romania Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.1.12 Rest of Eastern Europe

12.3.1.12.1 Rest of Eastern Europe Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.3.1.12.2 Rest of Eastern Europe Cloud Computing Market Estimates and Forecasts By Enterprise Size (2020-2032) (USD Billion)

12.3.1.12.3 Rest of Eastern Europe Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.1.12.4 Rest of Eastern Europe Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.3.1.12.5 Rest of Eastern Europe Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Cloud Computing Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.3.2.4 Western Europe Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.5 Western Europe Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.6 Western Europe Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.3.2.7 Western Europe Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.3.2.8.2 Germany Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.8.3 Germany Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.8.4 Germany Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.3.2.8.5 Germany Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.3.2.9.2 France Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.9.3 France Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.9.4 France Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.3.2.9.5 France Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.3.2.10.2 UK Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.10.3 UK Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.10.4 UK Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.3.2.10.5 UK Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.3.2.11.2 Italy Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.11.3 Italy Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.11.4 Italy Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.3.2.11.5 Italy Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.3.2.12.2 Spain Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.12.3 Spain Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.12.4 Spain Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.3.2.12.5 Spain Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.3.2.15.2 Austria Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.15.3 Austria Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.15.4 Austria Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.3.2.15.5 Austria Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.3.2.16 Rest of Western Europe

12.3.2.16.1 Rest of Western Europe Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.3.2.16.2 Rest of Western Europe Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.16.3 Rest of Western Europe Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.16.4 Rest of Western Europe Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.3.2.16.5 Rest of Western Europe Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Cloud Computing Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.4.4 Asia Pacific Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.5 Asia Pacific Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.6 Asia Pacific Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.4.7 Asia Pacific Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.4.8.2 China Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.8.3 China Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.8.4 China Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.4.8.5 China Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.4.9.2 India Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.9.3 India Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.9.4 India Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.4.9.5 India Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.4.10.2 Japan Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.10.3 Japan Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.10.4 Japan Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.4.10.5 Japan Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.4.11.2 South Korea Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.11.3 South Korea Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.11.4 South Korea Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.4.11.5 South Korea Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.4.12.2 Vietnam Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.12.3 Vietnam Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.12.4 Vietnam Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.4.12.5 Vietnam Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.4.13.2 Singapore Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.13.3 Singapore Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.13.4 Singapore Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.4.13.5 Singapore Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.4.14.2 Australia Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.14.3 Australia Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.14.4 Australia Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.4.14.5 Australia Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.4.15 Rest of Asia Pacific

12.4.15.1 Rest of Asia Pacific Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.4.15.2 Rest of Asia Pacific Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.15.3 Rest of Asia Pacific Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.15.4 Rest of Asia Pacific Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.4.15.5 Rest of Asia Pacific Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.5 Middle East and Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Cloud Computing Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.5.1.4 Middle East Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.1.5 Middle East Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.1.6 Middle East Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.5.1.7 Middle East Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.5.1.8.2 UAE Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.1.8.3 UAE Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.1.8.4 UAE Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.5.1.8.5 UAE Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.5.1.12 Rest of Middle East

12.5.1.12.1 Rest of Middle East Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.5.1.12.2 Rest of Middle East Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.1.12.3 Rest of Middle East Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.1.12.4 Rest of Middle East Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.5.1.12.5 Rest of Middle East Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Cloud Computing Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.5.2.4 Africa Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.2.5 Africa Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.2.6 Africa Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.5.2.7 Africa Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.5.2.10 Rest of Africa

12.5.2.10.1 Rest of Africa Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.5.2.10.2 Rest of Africa Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.2.10.3 Rest of Africa Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.2.10.4 Rest of Africa Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.5.2.10.5 Rest of Africa Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Cloud Computing Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.6.4 Latin America Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.6.5 Latin America Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.6.6 Latin America Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.6.7 Latin America Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.6.8.2 Brazil Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.6.8.3 Brazil Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.6.8.4 Brazil Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.6.8.5 Brazil Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.6.9.2 Argentina Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.6.9.3 Argentina Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.6.9.4 Argentina Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.6.9.5 Argentina Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.6.10.2 Colombia Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.6.10.3 Colombia Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.6.10.4 Colombia Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.6.10.5 Colombia Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12.6.11 Rest of Latin America

12.6.11.1 Rest of Latin America Cloud Computing Market Estimates and Forecasts, By Service (2020-2032) (USD Billion)

12.6.11.2 Rest of Latin America Cloud Computing Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.6.11.3 Rest of Latin America Cloud Computing Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.6.11.4 Rest of Latin America Cloud Computing Market Estimates and Forecasts, By Workload (2020-2032) (USD Billion)

12.6.11.5 Rest of Latin America Cloud Computing Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

13. Company Profiles

13.1 Amazon Web Services (AWS)

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services of fered

13.1.4 SWOT Analysis

13.2 Microsoft

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services of fered

13.2.4 SWOT Analysis

13.3 Google Cloud

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services of fered

13.3.4 SWOT Analysis

13.4 IBM

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services of fered

13.4.4 SWOT Analysis

13.5 Oracle

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services of fered

13.5.4 SWOT Analysis

13.6 Alibaba Cloud

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services of fered

13.6.4 SWOT Analysis

13.7 Salesforce

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services of fered

13.7.4 SWOT Analysis

13.8 SAP

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services of fered

13.8.4 SWOT Analysis

13.9 VMware

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services of fered

13.9.4 SWOT Analysis

13.10 Rackspace

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services of fered

13.10.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Service

Infrastructure as a Service (IaaS)

Platform as a Service (PaaS)

Software as a Service (SaaS)

By Enterprise Size

Large Enterprises

Small & Medium Enterprises

By Deployment

Public

Private

Hybrid

By Workload

Application Development & Testing

Data Storage & Backup

Resource Management

Orchestration Services

Others

By End-use

BFSI

IT & Telecom

Retail & Consumer Goods

Manufacturing

Energy & Utilities

Healthcare

Media & Entertainment

Government & Public Sector

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Arm Based Servers Market was valued at USD 6.87 billion in 2023 and is expected to reach USD 22.79 billion by 2032, growing at a CAGR of 14.32% by 2032

The Web 3.0 Blockchain Market was USD 3.59 billion in 2023 and is expected to reach USD 104.04 Billion by 2032, growing at a CAGR of 45.47% by 2024-2032.

The Personal Development Market Size was valued at USD 45.32 Billion in 2023 and will reach USD 68.64 Billion by 2032 and grow at a CAGR of 4.79% by 2032.

Business Email Compromise Market was valued at USD 1.35 billion in 2023 and is expected to reach USD 7.24 billion by 2032, growing at a CAGR of 20.53% from 2024-2032.

The Esports Market was valued at USD 2.0 billion in 2023 and is expected to reach USD 13.7 billion by 2032, growing at a CAGR of 23.76% from 2024-2032.

The Customer Experience Management Market size was valued at USD 13.4 Billion in 2023. It is expected to hit USD 47.83 Billion by 2032 and grow at a CAGR of 15.2% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone