Cloud AI Market Report Scope & Overview:

To Get More Information on Cloud AIMarket - Request Sample Report

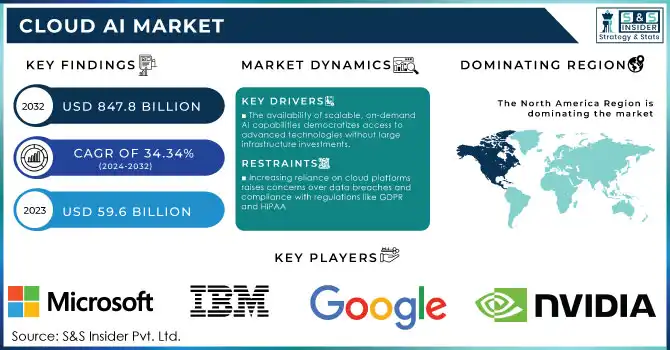

Cloud AI Market was valued at USD 59.6 billion in 2023 and is expected to reach USD 847.8 Billion by 2032, growing at a CAGR of 34.34% from 2024-2032.

The Cloud AI market continues to redefine how industries operate by offering scalable, cost-efficient, and innovative solutions. One of the primary drivers is the explosive growth in global data generation, the immense volume of data necessitates advanced AI-driven tools to process, analyze, and derive actionable insights efficiently. Companies adopting cloud AI solutions report significant operational benefits, such as up to a 40% increase in productivity and faster time-to-market for AI-powered applications, demonstrating the transformative impact of these technologies. Cloud AI applications span a variety of use cases. In customer engagement, 70% of interactions are now managed by AI-driven systems, up from 25% just five years ago, enabling personalized experiences and improved satisfaction. In logistics and supply chain management, AI has optimized inventory control, cutting costs by 20%, and predictive maintenance solutions have reduced equipment downtime by 25%, saving millions annually for businesses. In healthcare, AI diagnostic tools hosted on the cloud have achieved a 15% improvement in diagnostic accuracy, enhancing patient outcomes and reducing hospital readmission rates.

Moreover, cloud AI is contributing significantly to sustainability goals. AI-powered energy management systems can reduce energy consumption by up to 30%, helping organizations align with environmental and financial objectives. The increasing adoption of automation is also evident in the financial sector, where cloud AI fraud detection algorithms have improved accuracy by 20%, mitigating risks and protecting customer assets.

Innovation is further fueled by the rise of AI-as-a-Service (AIaaS), which democratizes access to advanced AI capabilities. This trend is evident in the widespread adoption of multi-cloud environments, with 98% of organizations leveraging multiple cloud platforms to integrate AI seamlessly into their operations. Such solutions enable businesses to scale operations without the need for extensive infrastructure investments, making cloud AI a cornerstone of digital transformation strategies. With its versatility and impact, cloud AI is becoming essential for businesses to thrive in a data-driven economy. The combination of automation, enhanced decision-making, and operational efficiency ensures that cloud AI remains a pivotal tool in reshaping industries across the globe

Cloud AI Market Dynamics

Drivers

-

The availability of scalable, on-demand AI capabilities democratizes access to advanced technologies without large infrastructure investments.

-

AI adoption for automation improves productivity by up to 40%, making processes faster and more efficient.

-

Continuous innovation in AI algorithms and cloud infrastructure enhances the market's capabilities and adoption.

Cloud architecture transforms access to sophisticated technologies by offering elastic and opportunistic AI capabilities on demand while removing the need for substantial investments in infrastructure. Enterprises of every size can tap into powerful AI tools including predictive analytics, natural language processing, and machine learning in the Cloud AI market without investing in expensive infrastructure or managing large IT teams. Allowing organizations to pay only for what they use, AI-as-a-Service (AIaaS) democratizes technology by lowering entry barriers. For example, start-ups can leverage state-of-the-art AI tools to examine customer behaviour or perform other automation without developing in-house solutions, allowing them to be on a similar playing field as large enterprises. There are heavily established platforms like Microsoft Azure AI, Google Cloud AI, and Amazon Web Services (AWS) that provide pre-trained AI models and development frameworks that the user can fine-tune for specific requirements. Such services serve a range of applications, from better inventory management in retail to improved fraud detection in banking, and are allowing industries to become more efficient and innovative.

The on-demand nature of cloud AI solutions also sustains scalability, permitting organizations to modify their usage to current requirements. This allows retailers, for example, to ramp up AI-based solutions for real-time inventory management and automated personalization during peak shopping seasons, before scaling back down. This allows to keep downtime minimal and optimize resources to reduce operational costs while also bringing AI adoption to small and medium enterprises (SMEs). Moreover, it encourages collaboration and experimentation in AI-as-a-Service. For researchers and developers, AI models can be deployed in the cloud and you can start using them essentially immediately instead of waiting for physical infrastructure to be set up and avoiding the incurred costs. This ease of access hastens innovation and enables the creation of cutting-edge solutions that can serve industries around the globe.

The Cloud AI market promotes the broad adoption of AI technologies by removing infrastructure barriers and providing scalable, pay-as-you-go solutions that drive innovation and competitiveness in the digital economy.

Restraints

-

Increasing reliance on cloud platforms raises concerns over data breaches and compliance with regulations like GDPR and HIPAA

-

Initial costs for integrating AI with existing systems, including training and deployment, remain a challenge for small businesses

-

A shortage of professionals proficient in AI and cloud technologies limits the ability of organizations to leverage these solutions effectively

One of the biggest hurdles in the Cloud AI space is the dearth of talent that is proficient in both AI and cloud. But this skills gap prevents organizations from fully utilizing the potential of these advanced tools; for AI solutions to be properly integrated and managed in a cloud environment, expertise in data science, machine learning algorithms, cloud infrastructure, and security protocols is beneficial — if not downright essential. Implementing AI-based cloud solutions is challenging due to the processes involved such as training AI models and integrating them with current business systems. That said, the speed of technology development has left the professional talent market behind. Moreover, it is challenging for businesses, especially SMEs, to find professionals capable of custom AI solutions, maintaining cloud infrastructure, or compliance with changing data privacy laws. The lack of talent can slow down or restrict AI integration, particularly for smaller firms which may not have the bandwidth to employ or educate the required skills. This article argues that the steep learning curve related to such technologies can deter investments as organizations may not want to implement systems they cannot manage.

To alleviate this problem, big leaguers such as Google Cloud, Microsoft Azure, and AWS offer pre-trained AI models, and easy, user-friendly interfaces with support and training to make it easier to use these technologies. Although these initiatives alleviate the shortage of skills, they do not eliminate the requirement for domain experts who can adapt and deploy advanced solutions. The lack of qualified AI and cloud practitioners continues to be a critical bottleneck retarding the generalization of Cloud AI technologies. In facing this challenge, an annual readiness will require sustainable investments in education, training, and incentives to address needs across academia and the workforce to meet growing demands within a fast-speaking discipline.

Cloud AI Market Segment Analysis

By Technology

In 2023, the deep learning segment dominated the market, with a share of 38.78%. The businesses and their customers are getting used to voice assistants, catboats, and other conversational interfaces. NLP techniques give rise to natural language interfaces that respond to natural language input, and therefore a more effective, user-friendly interface. Deep learning techniques have laid the groundwork for NLP models to reach an advanced level of performance for almost any task you can think of, especially language translation and sentiment analysis. Cloud-based AI services can provide the immense data and computing power that these models demand. NLP Powered Cloud AI Services like Amazon Web services & Microsoft Azure enable businesses to use the NLP technology without heavy investments in hardware and expertise with degrees of all sizes.

Deep learning and neural networks have been used for many applications in the fields of natural language processing, image and speech recognition, and predictive analytics. Cloud service providers offer deep learning platforms and tools to rely on which data scientists and developers use to build and train their neural networks. Demand for deep-learning solutions is expected to grow as companies look to automate processes and learn from their data. Additionally, to speed up the training of these sophisticated deep learning models in the cloud, more and more we are turning to specialized hardware—Graphics Processing Units (GPUs), Tensor Processing Units (TPUs), etc. As a result, cloud-based deep learning platforms with this type of hardware accelerator have been developed to provide fast and efficient training.

By Type

In 2023, the solution segment dominated the industry, garnering a readership of 65.7%. One of the most significant market growth drivers is the growing accessibility of cloud-based AI services provided by large technology firms such as Amazon, Microsoft, and Google. By investing heavily in cloud AI platforms and serving them as a service to various businesses, these businesses have made it easier for companies to obtain and utilize AI solutions without incurring the cost of expensive infrastructure and human resources. In other words, demand for cloud AI solutions is projected to rise as businesses continue to tap into the capabilities of AI and machine learning to drive innovation and growth.

The service segment is expected to grow with the highest CAGR during the forecast period. As the adoption of smart technology gathers serious momentum, the demand for Al services is likely to grow. These services facilitate the characteristics of the solution that help businesses run fast and AI services are widespread among businesses for decreasing overall operation expenses which increase profits. AIAAS or Artificial Intelligence as a Service is being utilized by companies to surpass cloud AI services, which involve integration, maintenance, and support.

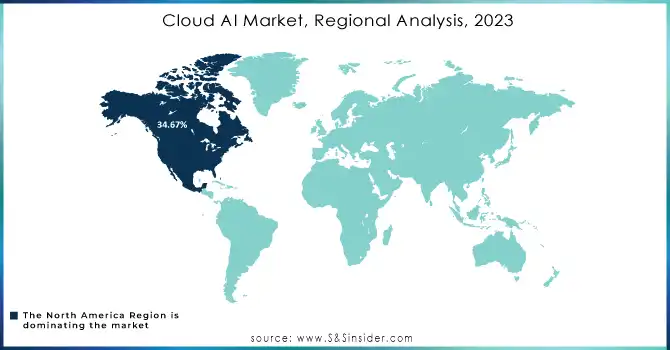

Regional Analysis

North America accounted for the largest revenue share in 2022, at 34.67%. Some of the key players in the region are Apple Inc., Google Inc, IBM Corp., Intel Corp, and Microsoft Corp. The growth in the region could be high since businesses across all sectors are the early adopters of AI and machine learning technologies. Sectors like healthcare, finance, and retail, using A.I functionality, maximizing their operational efficiency, cutting down operational costs and competitiveness. The United States and Canada are home to a large and highly skilled workforce, ready to develop and implement AI solutions. North America has many great universities and research institutions that are leading the way in the field of AI, and as a result producing a constant pipeline of highly skilled individuals pushing the field forward into new areas and applications in the market.

The APAC is most likely to be the fastest-growing region during the forecast period. The heavy investments in cloud and AI technologies are primarily responsible for regional growth. Increasing operational efficiency demand in the manufacturing sector and the use of cloud-based apps and services across many industries is fuelling the growth in demand in APAC.

Do You Need any Customization Research on Cloud AI Market - Enquire Now

Key Players

The major key players along with their products are

-

Amazon Web Services (AWS) - Amazon SageMaker

-

Microsoft - Azure AI

-

Google - Google Cloud AI

-

IBM - IBM Watson

-

Oracle - Oracle Cloud AI

-

Salesforce - Salesforce Einstein

-

NVIDIA - NVIDIA AI

-

Alibaba Cloud - Alibaba Cloud Machine Learning Platform for AI

-

SAP - SAP Leonardo

-

Intel - Intel AI Solutions

-

Accenture - Accenture AI

-

Hewlett Packard Enterprise (HPE) - HPE AI

-

C3.ai - C3 AI Suite

-

Palo Alto Networks - Cortex AI

-

Zoho - Zoho AI

-

Huawei - Huawei Cloud AI

-

Baidu - Baidu AI Cloud

-

SAP - SAP Data Intelligence

-

Tencent Cloud - Tencent AI Lab

-

ThoughtSpot - ThoughtSpot AI

Recent Developments

In April 2024, Google Cloud introduced the public preview of Gemini 1.5 Pro, an AI model integrated into their Vertex AI platform. This enhanced version of Gemini includes breakthrough improvements in processing long-context information (up to 1 million tokens), boosting its utility for industries like gaming and insurance, where complex analyses and tailored AI insights are increasingly in demand. Google Cloud’s strategic focus is on making its advanced AI models more accessible to organizations looking to integrate AI into their existing systems without needing specialized AI expertise.

| Report Attributes | Details |

|

Market Size in 2023 |

USD 59.6 billion |

|

Market Size by 2032 |

USD 847.8 Billion |

|

CAGR |

CAGR of 34.34% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

By Technology (Deep Learning, Machine Learning, Natural Language Processing, Others), |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

|

Company Profiles |

Amazon Web Services (AWS), Microsoft, Google, IBM, Oracle, Salesforce, NVIDIA, Alibaba Cloud, SAP, Intel, Accenture, Hewlett Packard Enterprise (HPE), C3.ai, Palo Alto Networks, Zoho. |

|

Market Drivers |

• The availability of scalable, on-demand AI capabilities democratizes access to advanced technologies without large infrastructure investments |

|

Market Restraints: |

• Increasing reliance on cloud platforms raises concerns over data breaches and compliance with regulations like GDPR and HIPAA |