Get more information on Cloud Advertising Market - Request Free Sample Report

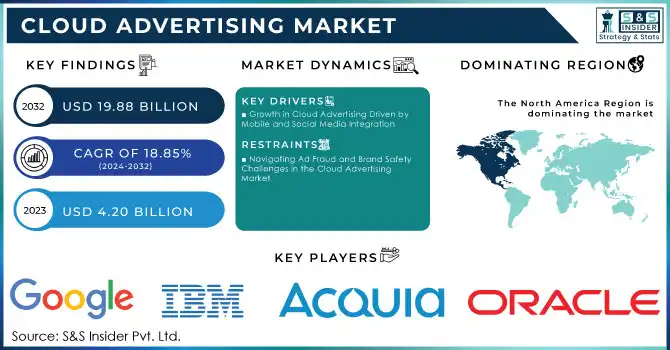

The Cloud Advertising Market Size was valued at USD 4.20 billion in 2023 and is expected to reach USD 19.88 billion by 2032 with a growing CAGR of 18.85% over the forecast period 2024-2032.

The cloud advertising market is experiencing strong growth driven by the increasing demand for digital marketing solutions. As consumer engagement with digital media continues to surge, businesses are turning to cloud advertising to reach their target audiences effectively and efficiently. Platforms like social media, websites, and mobile applications are becoming core elements of marketing strategies, and cloud advertising provides significant advantages such as scalability, real-time campaign management, and seamless cross-platform integration. With cloud-based solutions, businesses can manage and optimize campaigns across multiple channels from a single platform, boosting productivity and simplifying the complex task of ad targeting, measurement, and attribution. As organizations shift towards data-driven marketing strategies, the demand for advanced analytics and personalized advertising continues to rise, propelling the growth of cloud advertising platforms.

Digital marketing is evolving rapidly, with B2B organizations increasingly focusing on brand building alongside demand-generation efforts. Studies show that 26% of marketers find brand investments enhance demand generation by up to 50%, highlighting the growing importance of integrating marketing initiatives. This need for more cohesive marketing strategies correlates with the increasing demand for cloud-based solutions, which enable businesses to track and manage performance in real-time across multiple channels. The demand for digital marketing skills is also rising, with job growth in the sector outpacing the average, fueled by advancements in AI-powered marketing tools and the ongoing shift toward social media marketing. 76% of consumers engage with brands on social media, driving the need for advanced marketing tools and a focus on social selling, particularly across platforms like Instagram and LinkedIn.

Drivers

Growth in Cloud Advertising Driven by Mobile and Social Media Integration

The growing use of mobile devices and social media is a key driver for the cloud advertising market. With consumers increasingly spending time on mobile platforms and engaging with content via social media channels, advertisers are focusing more on optimizing their campaigns for various screen sizes and formats. Cloud advertising platforms offer seamless integration across these multiple channels, ensuring consistent messaging and enhancing engagement with audiences. Moreover, social media advertising has experienced rapid growth, with a significant increase in mobile-first ad formats, including video, interactive, and native ads, as reported by Sprout Social. This trend is further amplified by the rising importance of mobile-centric advertising as more people access content via smartphones and tablets. Cloud-based advertising platforms not only enable businesses to create responsive and adaptive ad campaigns for various devices but also facilitate real-time tracking and optimization, improving overall marketing effectiveness. The ability to integrate across diverse digital ecosystems—mobile apps, websites, and social media makes cloud advertising an essential tool for businesses looking to capitalize on the growing shift toward mobile and social media consumption. This demand is expected to continue to accelerate as mobile ad spending and social media engagement keep rising.

Restraints

Navigating Ad Fraud and Brand Safety Challenges in the Cloud Advertising Market

As businesses increasingly rely on programmatic advertising and third-party data, the risks associated with inflated impressions and clicks lead to wasted budgets and inefficiency. The lack of transparency in automated platforms exacerbates this issue, making it difficult for advertisers to assess the true impact of their campaigns. Additionally, ensuring brand safety, particularly on social media platforms, remains a pressing concern, as ads may appear alongside harmful or controversial content that can damage a brand's reputation and consumer trust. Despite the scalability and efficiency advantages of cloud-based advertising solutions, businesses must rely on third-party platforms, raising the potential for misaligned ad placements. The growing demand for programmatic advertising has underscored the need for enhanced safety measures to mitigate ad fraud and protect brand integrity.

By Service

In 2023, Platform as a Service (PaaS) dominated the cloud advertising market, accounting for approximately 54% of the total revenue. PaaS offers a comprehensive platform for businesses to design, develop, and manage their advertising campaigns without the complexity of managing infrastructure. This service allows companies to leverage cloud-based tools and resources, which include data analytics, machine learning algorithms, and automation features, all integral to optimizing ad campaigns across multiple channels. The scalability and flexibility provided by PaaS are key drivers of its growth, as businesses can easily scale their operations to meet changing demands while maintaining high levels of performance and efficiency. Additionally, PaaS platforms enable real-time data processing, which is essential for delivering personalized, targeted advertising and improving ROI. The increasing shift towards data-driven marketing strategies further contributes to the growing adoption of PaaS in cloud advertising. PaaS solutions, such as Google Cloud, Amazon Web Services, and Microsoft Azure, provide integrated advertising and analytics tools that help advertisers reach their target audiences more effectively, streamline their operations, and reduce costs.

By Deployment

In 2023, the hybrid deployment model captured the largest share of revenue in the cloud advertising market, accounting for approximately 44%. Hybrid deployment combines the benefits of both public and private cloud environments, providing businesses with greater flexibility and control over their advertising data and operations. This model allows organizations to store sensitive data on private clouds while utilizing the scalability and efficiency of public clouds for their advertising campaigns. As businesses continue to prioritize data security, compliance, and performance optimization, the hybrid approach offers a balanced solution that meets diverse needs. Furthermore, hybrid cloud environments enable seamless integration across multiple advertising platforms, enhancing cross-channel marketing strategies and ensuring more effective campaign execution. The growing demand for hybrid cloud solutions reflects businesses' increasing need to adapt to changing market dynamics while maintaining operational flexibility.

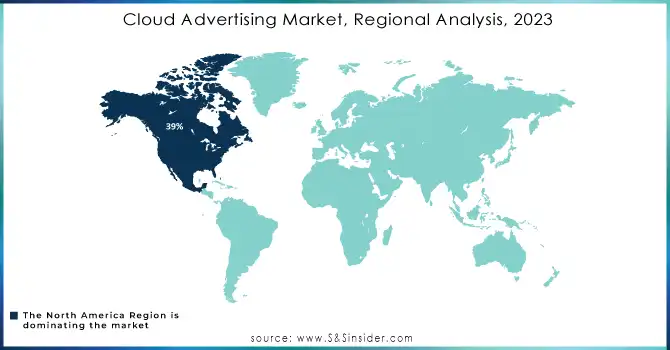

In 2023, North America dominated the cloud advertising market, capturing around 39% of the global revenue. This growth is driven by the region's advanced digital infrastructure, strong presence of tech giants like Google, Facebook, and Amazon, and high consumer demand for digital ads. The integration of AI and machine learning in cloud platforms has fostered innovation, making real-time, data-driven marketing more efficient. Additionally, the rise of programmatic advertising and the increasing use of mobile and social media have further boosted cloud-advertising adoption. With businesses focusing on enhancing targeting and customer engagement, North America remains a key player, and this trend is expected to continue as digital marketing continues to expand.

Asia-Pacific (APAC) is the fastest-growing region in the cloud advertising market, driven by the rapid adoption of digital technologies in countries like China, India, Japan, and Southeast Asia. Mobile usage and internet penetration have significantly increased, resulting in a surge in online ad spend, particularly on mobile and social media platforms. The region's expanding e-commerce sector, especially in China and India, also boosts demand for cloud-based advertising solutions. Governments' investments in digital infrastructure further support this growth. The rise of social media influencers and localized content creators accelerates cloud advertising's adoption, with businesses leveraging cloud platforms for personalized, data-driven campaigns. As digital transformation continues, APAC's cloud advertising market is poised for further expansion.

Need Any Customization Research On Cloud Advertising Market - Inquiry Now

Some of the major players in Cloud Advertising Market with their product:

IBM (Watson Advertising)

Acquia (Acquia Marketing Cloud)

Oracle (Oracle Advertising and Customer Experience)

Imagine Communications (Versio)

Salesforce (Salesforce Marketing Cloud)

FICO (FICO Advertising Solutions)

Google (Google Ads, Google Marketing Platform)

Adobe (Adobe Advertising Cloud)

SAP (SAP Customer Experience)

Demandbase (Demandbase One)

Sailthru (Sailthru Marketing Cloud)

Experian (Experian Marketing Services)

Kubient (Kubient Advertising Platform)

Nielsen (Nielsen Marketing Cloud)

InMobi (InMobi Advertising Solutions)

HubSpot (HubSpot Marketing Hub)

Marin Software (MarinOne)

MediaMath (MediaMath TerminalOne)

PEGA (PEGA Marketing Cloud)

Sitecore (Sitecore Experience Platform)

List of companies that are potential customers for the cloud advertising market:

Amazon

eBay

Microsoft

Apple

Ford

BMW

Walmart

Target

Expedia

Airbnb

HSBC

JPMorgan Chase

Netflix

Disney

On October 7, 2024, AWS showcased its innovations in content monetization and cloud broadcast at Advertising Week and NAB Show in New York. The AWS Media & Entertainment, Games, and Sports team highlighted strategies for enhancing customer engagement and content monetization across platforms, with a focus on leveraging data for personalized experiences.

July 30, 2024 – Acquia introduced Multi-Experience Operations, a new feature of the Acquia Cloud Platform, designed to streamline the delivery of digital experiences at scale. This enhancement combines the multi-site advantages of Drupal CMS with the performance and scalability of Acquia Cloud Next

July 29, 2024 – Experian launched a new retail media solution aimed at enhancing identity resolution, ad targeting, and attribution for retail media networks. Leveraging its identity graph and measurement tools, the solution helps connect advertising actions to measurable outcomes, improving overall ad effectiveness for retailers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.20 Billion |

| Market Size by 2032 | USD 19.88 Billion |

| CAGR | CAGR of 18.85% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Infrastructure as a Service (IaaS), Software as a Service (SaaS), Platform as a Service (PaaS)) • By Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud) • By End User (BFSI, Government, IT & Telecommunication, Media & Entertainment, Retail Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM, Acquia, Oracle, Imagine Communications, Salesforce, FICO, Google, Adobe, SAP, Demandbase, Sailthru, Experian, Kubient, Nielsen, InMobi, HubSpot, Marin Software, MediaMath, PEGA, and Sitecore |

| Key Drivers | • Growth in Cloud Advertising Driven by Mobile and Social Media Integration |

| Restraints | • Navigating Ad Fraud and Brand Safety Challenges in the Cloud Advertising Market |

Ans: The market is expected to grow to USD 19.88 billion by the forecast period of 2032.

Ans. The CAGR of the Cloud Advertising Market for the forecast period 2024-2032 is 18.85%.

ANS: Yes, you can ask for the customization as pas per your business requirement.

Ans. North America region is dominating the Cloud Advertising Market

Ans:

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Advertising Spend Breakdown by Platform

5.2 Consumer Reach and Engagement

5.3 Programmatic Advertising Adoption

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Cloud Advertising Market Segmentation, by Service

7.1 Chapter Overview

7.2 Infrastructure as a Software as a Service (IaaS)

7.2.1 Infrastructure as a Software as a Service (IaaS) Market Trends Analysis (2020-2032)

7.2.2 Infrastructure as a Software as a Service (IaaS) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Software as a Service (SaaS)

7.3.1 Software as a Service (SaaS) Market Trends Analysis (2020-2032)

7.3.2 Software as a Service (SaaS) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Platform as a Service (PaaS)

7.4.1 Platform as a Service (PaaS) Market Trends Analysis (2020-2032)

7.4.2 Platform as a Service (PaaS) Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Cloud Advertising Market Segmentation, by Deployment

8.1 Chapter Overview

8.2 Public

8.2.1 Public Market Trends Analysis (2020-2032)

8.2.2 Public Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Private

8.3.1 Private Market Trends Analysis (2020-2032)

8.3.2 Private Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Hybrid

8.4.1 Hybrid Market Trends Analysis (2020-2032)

8.4.2 Hybrid Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Cloud Advertising Market Segmentation, by End User

9.1 Chapter Overview

9.2 BFSI

9.2.1 BFSI Market Trends Analysis (2020-2032)

9.2.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Government

9.3.1 Government Market Trends Analysis (2020-2032)

9.3.2 Government Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 IT & Telecommunication

9.4.1 IT & Telecommunication Market Trends Analysis (2020-2032)

9.4.2 IT & Telecommunication Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Media & Entertainment

9.5.1 Media & Entertainment Market Trends Analysis (2020-2032)

9.5.2 Media & Entertainment Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Retail

9.6.1 Retail Market Trends Analysis (2020-2032)

9.6.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7Education

9.7.1Education Market Trends Analysis (2020-2032)

9.7.2Education Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Others

9.8.1 Others Market Trends Analysis (2020-2032)

9.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Cloud Advertising Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.2.4 North America Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.2.5 North America Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.2.6.2 USA Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.2.6.3 USA Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.2.7.2 Canada Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.2.7.3 Canada Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.2.8.2 Mexico Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.2.8.3 Mexico Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Cloud Advertising Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.1.6.2 Poland Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.1.6.3 Poland Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.1.7.2 Romania Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.1.7.3 Romania Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Cloud Advertising Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.4 Western Europe Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.5 Western Europe Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.6.2 Germany Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.6.3 Germany Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.7.2 France Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.7.3 France Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.8.2 UK Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.8.3 UK Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.9.2 Italy Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.9.3 Italy Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.10.2 Spain Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.10.3 Spain Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.13.2 Austria Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.13.3 Austria Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Cloud Advertising Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.4.6.2 China Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.4.6.3 China Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.4.7.2 India Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.4.7.3 India Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.4.8.2 Japan Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.4.8.3 Japan Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.4.9.2 South Korea Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.4.9.3 South Korea Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.4.10.2 Vietnam Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.4.10.3 Vietnam Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.4.11.2 Singapore Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.4.11.3 Singapore Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.4.12.2 Australia Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.4.12.3 Australia Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Cloud Advertising Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.1.4 Middle East Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.1.5 Middle East Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.1.6.2 UAE Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.1.6.3 UAE Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Cloud Advertising Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.2.4 Africa Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.2.5 Africa Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Cloud Advertising Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.6.4 Latin America Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.6.5 Latin America Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.6.6.2 Brazil Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.6.6.3 Brazil Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.6.7.2 Argentina Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.6.7.3 Argentina Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.6.8.2 Colombia Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.6.8.3 Colombia Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Cloud Advertising Market Estimates and Forecasts, by Service (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Cloud Advertising Market Estimates and Forecasts, by Deployment (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Cloud Advertising Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11. Company Profiles

11.1 IBM

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Acquia

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Oracle

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Imagine Communications

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Salesforce

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 FICO

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Google

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Adobe

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 SAP

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Demandbase

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Service

Infrastructure As A Software As A Service (IaaS)

Software As A Service (SaaS)

Platform As A Service (PaaS)

By Deployment

Public

Private

Hybrid

By End User

BFSI

Government

IT & Telecommunication

Media & Entertainment

Retail

Education

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Sales Performance Management Market Size was valued at USD 2.26 Billion in 2023 and is expected to reach USD 8.21 Billion by 2032 and grow at a CAGR of 15.5% over the forecast period 2024-2032.

Network-as-a-Service (Naas) Market size was recorded at USD 19.2 billion in 2023 and is expected to reach USD 285.9 billion by 2032, growing at a CAGR of 35% over the forecast period of 2024-2032.

The Deception Technology Market was valued at USD 2.0 Billion in 2023 and is expected to reach USD 6.6 Billion by 2032, growing at a CAGR of 13.72% from 2024-2032.

Virtual Sports Market was valued at USD 15.88 billion in 2023 and is expected to reach USD 65.20 billion by 2032, growing at a CAGR of 17.05% from 2024-2032.

A2P Messaging Market Size was valued at USD 70.01 Bn in 2023 and is expected to reach USD 106.12 Bn by 2032, while growing at a CAGR of 4.73% over 2024-2032.

The Connected Mining Market Size was USD 12.80 billion in 2023 and is expected to reach USD 31.31 Bn by 2032, growing at a CAGR of 10.48% by 2024-2032.

Hi! Click one of our member below to chat on Phone