Cloud Adoption in GCC Market Report Scope & Overview:

Get More Information on Cloud Adoption in GCC Market - Request Sample Report

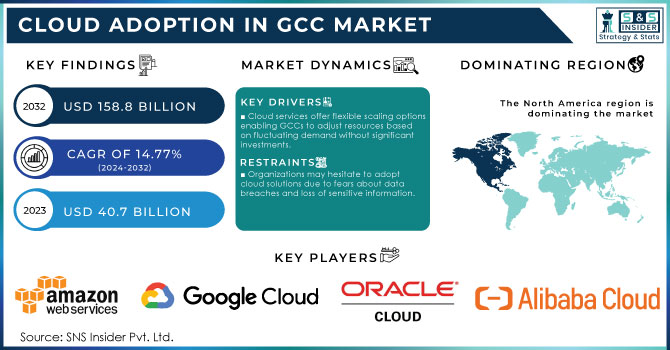

The Cloud Adoption in GCC Market Size was valued at USD 40.7 billion in 2023 and is expected to reach USD 158.8 Billion by 2032, growing at a CAGR of 14.77% from 2024-2032.

The Cloud Adoption in Global Capability Centers Market is growing rapidly as organizations are realizing the advantages of cloud using in improving efficiency and flexibility in their work. At GCCs, which are concentrated in multiple business functions-such as IT, finance, or customer service – there is a trend of moving to cloud solutions to leverage their scalability, flexibility, and cost-efficiency. In particular, according to the International Data Corporation, by 2023, total spending on the public cloud will exceed 500 trillion USD. Thus, the market of cloud services will experience growth in response to the demand from multiple sectors. One key driver of this technology adoption is the pressure of digital transformation as, to gain competitive advantage, GCCs need to innovate and provide solutions faster. For example, survey found that 71% of all GCCs businesses increased cloud adoption during COVID-19 to meet the needs of remote work. Another driver is the prominent role of advanced technologies such as artificial intelligence and data analytics, most of which require cloud using to be practical. In addition to these factors, the need for cybersecurity is also increasing, driving market growth. When opting for cloud solutions, GCCs implement AI and machine learning tools that help to extract and assess information from big data sets, which helps in making more informed decisions and providing better customer services.

For example, after moving their IT service to a cloud, Unilever reported a 25% increase in efficiency, which helped the company become more responsive to market offers. Finally, cloud solutions are also attractive to GCCs in regards to data protection. As the importance of data is growing, cyber threats and hacking risks are on the rise. Therefore cloud services with in-built protective measures are growing in popularity. In conclusion, the Cloud Adoption in Global Capability Centers Market will grow in the future years as GCCs will be increasingly opting for cloud use to boost efficiency, provide better innovation, and ensure data protection.

Cloud Adoption in GCC Market Dynamics

Drivers

-

Cloud services offer flexible scaling options, enabling GCCs to adjust resources based on fluctuating demand without significant investments.

-

Cloud platforms facilitate real-time collaboration among teams across geographical locations, improving productivity and communication.

-

The shift to remote work has increased the demand for cloud solutions that support flexible working environments and access to essential resources from anywhere.

The transition to remote work has significantly increased the demand for cloud solutions in Global Capability Centers (GCCs), as organizations aim to maintain productivity and collaboration despite geographical obstacles. With employees spread across different locations, companies require a robust cloud infrastructure to ensure that essential resources and applications are available anytime and anywhere. This shift is crucial for enabling seamless workflows, effective communication, and project management among distributed teams.

For instance, during the COVID-19 pandemic, many GCCs turned to platforms like Microsoft Azure and AWS to support remote work. These platforms provided essential tools for data storage, collaboration, and application deployment, allowing employees to operate efficiently without the constraints of a physical office. According to report more than 70% of organizations have accelerated their cloud adoption in response to the necessity of remote work, leading to greater operational agility.

Moreover, cloud solutions enable businesses to scale their resources based on demand, allowing them to swiftly adapt to changing business requirements. This flexibility is essential for GCCs seeking to effectively support their workforce in a hybrid work setting.

|

GCC |

Cloud Solution Used |

Impact |

|---|---|---|

|

Accenture |

Microsoft Azure |

Enhanced collaboration tools for remote teams. |

|

Tata Consultancy Services (TCS) |

Amazon Web Services (AWS) |

Improved resource management and scalability. |

|

Infosys |

Google Cloud Platform |

Streamlined operations and data accessibility. |

Restraints

-

Organizations may hesitate to adopt cloud solutions due to fears about data breaches and loss of sensitive information.

-

A lack of skilled professionals to manage and operate cloud technologies can hinder effective cloud implementation.

-

Some businesses may find that cloud solutions do not offer the level of customization they require for specific operational needs.

The statement emphasizes a significant challenge encountered by businesses in the Cloud Adoption in the Global Capability Centers (GCC) Market: the potential lack of customization in cloud solutions. Although cloud services offer scalability and flexibility, they may not fully address the specific operational needs of all organizations. This concern is particularly crucial for GCCs, which typically function in specialized sectors with unique compliance, regulatory, and operational requirements. For example, a financial services firm that must adhere to strict regulations, such as the General Data Protection Regulation (GDPR) in Europe, may find that a generic cloud solution lacks the necessary customization for enhanced data privacy measures and specific reporting functionalities mandated by regulators. Consequently, the organization might struggle to implement essential controls and workflows to meet its compliance obligations, leading to concerns about legal risks and operational efficiency.

This challenge becomes even more pronounced when considering the diverse needs across various industries. For instance, a healthcare organization may require customized solutions for the secure management of electronic health records (EHR), which standard cloud offerings may not adequately accommodate.

|

Industry |

Customization Needs |

Challenges |

|---|---|---|

|

Financial Services |

Compliance, data encryption, risk management |

Limited options in standard cloud solutions |

|

Healthcare |

EHR management, HIPAA compliance |

Need for specialized security features |

|

Retail |

Inventory management, customer analytics |

Difficulty in integrating with existing systems |

|

Manufacturing |

Supply chain visibility, production tracking |

Lack of real-time data customization |

The insufficient number of skilled professionals needed to effectively manage and operate cloud technologies. Successfully implementing cloud solutions requires expertise in several areas, including cloud architecture, security, and data management. In the absence of an adequately trained workforce in these domains, organizations may struggle to fully benefit from cloud solutions. For example, a GCC in the healthcare sector that transitions to cloud-based systems may face serious risks if it lacks staff knowledgeable about compliance with regulations like HIPAA. Insufficient expertise in this area could lead to data breaches or regulatory penalties stemming from the improper management of sensitive information.

Furthermore, the shortage of skilled professionals can result in ineffective cloud management, increasing costs and extending implementation timelines. As a result, organizations may find it challenging to fully leverage the capabilities of cloud technologies, ultimately impacting their operational efficiency and competitive standing in the market.

Cloud Adoption in GCC Market Segmentation Overview

By Service

The Software as a Service (SaaS) segment dominated the market and held the significant revenue share in 2023, driven by several key factors, such as the growing demand for affordable and scalable software solutions, the transition to remote work, and the increasing necessity for enhanced collaboration tools. Companies are increasingly turning to SaaS to optimize their operations, reduce IT infrastructure costs, and enhance accessibility. Additionally, advancements in artificial intelligence and machine learning allow SaaS providers to deliver more sophisticated and customized solutions tailored to specific business requirements. Moving forward, the SaaS market is expected to experience robust growth, with significant adoption anticipated among both SMEs and large enterprises, fueled by ongoing digital transformation efforts and a focus on data-driven decision-making.

The growth of Infrastructure as a Service (IaaS) market is driven by the increasing need for scalable and flexible IT infrastructure, cost savings on hardware investments, and enhanced disaster recovery capabilities. Organizations are adopting IaaS to optimize resource allocation and support digital transformation initiatives. Looking ahead, the IaaS market is expected to experience significant growth, particularly among SMEs and large enterprises, as cloud adoption accelerates and businesses seek efficient, reliable infrastructure solutions.

By Industry Vertical

The IT & Telecommunications segment dominated the market and held significant revenue share in 2023, fueled by several key factors. The increasing demand for scalable and flexible cloud solutions enables organizations to optimize their operations and enhance service delivery. Additionally, the rise in remote work and digital transformation initiatives has accelerated the adoption of cloud technologies, improving collaboration and communication. For instance, 74% of organizations consider digital transformation a key technology initiative, ranking it among their top IT priorities, alongside cybersecurity and cloud solutions. a heightened emphasis on data security and regulatory compliance further drives investments in cloud infrastructure.

The Financial Services sector usually stands as the second-largest segment in cloud adoption. This growth is largely attributed to the demand for better data security, adherence to regulations, and enhanced customer experiences. Financial institutions are increasingly turning to cloud solutions to optimize their operations, cut costs, and improve their analytics capabilities, reinforcing the sector's significance in the cloud adoption landscape.

By Organization Size

In 2023, The Large & Medium Enterprises segment register substantial growth in the Global Capability Center (GCC) market, propelled by a rising demand for scalable cloud solutions, enhanced data management, and greater operational efficiency. These organizations are harnessing cloud technologies to optimize processes, lower IT costs, and foster collaboration. For instance, Research shows that organizations that have fully embraced cloud technologies report a 25-30% improvement in operational efficiency, enabling them to allocate resources more effectively. With the acceleration of digital transformation initiatives, this segment is poised for ongoing expansion, as more enterprises embrace cloud solutions to bolster their data-driven strategies and improve overall business agility and responsiveness in the future.

The Small Enterprises segment is experiencing significant growth in the Global Capability Center (GCC) market, fueled by the rising availability of cost-effective cloud solutions, a need for greater operational flexibility, and enhanced collaboration tools. Small businesses are progressively adopting cloud technologies to optimize their operations, lower overhead costs, and improve customer engagement. As digital transformation initiatives advance, this segment is poised for further expansion, with an increasing number of small enterprises leveraging cloud solutions to enhance their growth strategies and competitiveness in a rapidly changing digital environment.

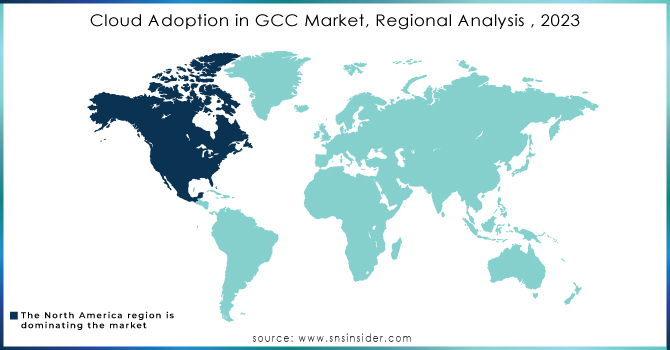

Cloud Adoption in GCC Market Regional Analysis

North America dominated the market and held the significant revenue share in 2023, driven by technological progress and a robust investment environment. The region features a strong technology infrastructure and widespread access to cloud services, facilitating seamless transitions to cloud-based solutions. Major tech players like AWS, Microsoft, and Google are making significant investments to foster innovation, which in turn enhances adoption rates. Additionally, North America's dynamic business landscape, characterized by a high density of large and medium enterprises, increases the demand for cloud solutions. As organizations prioritize digital transformation to enhance operational efficiency and data management, North America achieves a significant market share in the global cloud adoption arena, reinforcing its leadership position in the GCC market.

The Asia Pacific region is anticipated to grow at highest CAGR during the forecast period. This growth is attributed to several factors, including swift digital transformation, greater investments in cloud infrastructure, and an increasing number of organizations embracing cloud-based solutions across various industries. Additionally, the region's expanding economies and a stronger focus on data-driven decision-making significantly contribute to enhancing cloud adoption rates.

Need Any Customization Research On Cloud Adoption in GCC Market - Inquiry Now

Key Players in Cloud Adoption in GCC Market

The major key players are

-

Amazon Web Services (AWS)

-

Microsoft Azure

-

Google Cloud Platform (GCP)

-

IBM Cloud

-

Oracle Cloud

-

SAP

-

Salesforce

-

Alibaba Cloud

-

Dell Technologies

-

VMware

-

Cisco Systems

-

Accenture

-

Capgemini

-

Wipro

-

TCS (Tata Consultancy Services)

-

Infosys

-

Hewlett Packard Enterprise

-

ServiceNow

-

Rackspace

-

Red Hat

Service Supplier

-

Tanium

-

GitHub

-

Atlassian

-

Red Hat

-

Accenture

-

Deloitte

-

MuleSoft

-

China Telecom

-

VMware

-

Pivotal

-

TIBCO Software

-

Oracle

-

Salesforce

-

Microsoft

-

ServiceNow

-

IBM

-

SAP

-

Atlassian

-

CloudHealth Technologies

-

IBM Services

Recent Developments

-

July 24: Amazon Web Services (AWS) has established itself as a leader in the cloud industry, providing more than 200 fully featured services to enhance business operations. However, the vast scale and complexity of AWS can be overwhelming, often resulting in suboptimal utilization, unexpected costs, and potential security vulnerabilities.

-

June 24: The A3 Mega instance type, part of the A3 VM family, is now officially available. This new instance is equipped with the NVIDIA H100 Tensor Core GPU and delivers a 2.4x improvement in large-scale training performance compared to multiple A3 instances.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 40.7 Billion |

| Market Size by 2032 | USD 158.8 Billion |

| CAGR | CAGR of 14.77% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud) • By Service (Infrastructure as a Service (IaaS), Software as a Service (SaaS), Function as a Service (FaaS)) • By Industry Vertical (IT & Telecommunications, Financial Services, Healthcare, Retail, Manufacturing, Education, Government, Others) • By Organization Size (Small Enterprises, Large & Medium Enterprises) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Novartis, Regeneron Pharmaceuticals, Bausch + Lomb, Alcon, Zeiss, Topcon, Abbott Laboratories, Hoya, EyePoint Pharmaceuticals, NIDEK |

| Key Drivers | • Cloud services offer flexible scaling options, enabling GCCs to adjust resources based on fluctuating demand without significant investments. • Cloud platforms facilitate real-time collaboration among teams across geographical locations, improving productivity and communication. |

| RESTRAINTS | • Organizations may hesitate to adopt cloud solutions due to fears about data breaches and loss of sensitive information. • A lack of skilled professionals to manage and operate cloud technologies can hinder effective cloud implementation. |