Clinical Trial Management System Market Size Analysis:

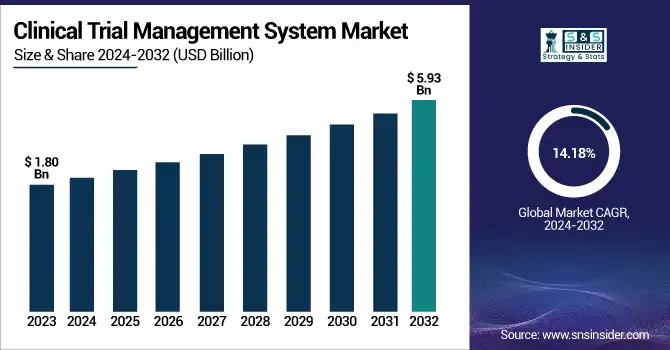

The Clinical Trial Management System Market Size was valued at USD 1.80 Billion in 2023 and is expected to reach USD 5.93 Billion by 2032, growing at a CAGR of 14.18% over the forecast period 2024-2032.

Get more information on Clinical Trial Management System Market - Request Sample Report

The Clinical Trial Management System (CTMS) Market Report provides key statistics, data, and trends, such, as clinical trial volume and growth rate, CTMS adoption rates of pharmaceutical companies, CROs, and research institutions, spending trends on cloud vs on-premise solution and other valuable insights. The report also examines regulatory compliance trends (FDA, EMA, GDPR), and the integration of CTMS with EHR, eTMF, and eCOA. This report provides a comprehensive view of the evolving CTMS landscape, investment patterns, and regulatory shifts shaping the market. Healthcare spending and the rising number of clinical trials are boosting the demand for the clinical trial management system (CTMS) market.

Clinical Trial Management System Market Dynamics

Drivers

-

The increasing complexity of clinical trials necessitates advanced CTMS solutions for efficient data management and process streamlining.

Increasing challenges involved with conducting clinical trials have been a major impetus for advanced Clinical Trial Management Systems (CTMS). Some more recent analyses show that the mean number of eligibility criteria per trial has increased. The number of endpoints in trial protocols also increased, up 86%. A comprehensive study analyzing data from over 16,000 trials found substantial increases in trial complexity across various phases and therapeutic areas over time. These include complexities like the number of endpoints and inclusion-exclusion criteria, which are observed to be associated with longer trial times. For instance, precision medicine trials target niche sub-indications putting the trial in need of nuanced inclusion/exclusion criteria as well as specialized data collection. For instance, a study of an oncology cell therapy capped eligibility based on the expression of human leukocyte antigen (HLA)-A*02:01, with prevalence varying significantly across different regions. As this complexity continues to grow, CTMS solutions will become increasingly critical to managing data and streamlining processes so that trials can continue to be effective and operate in alignment with a regulatory framework.

Restraints

-

High implementation and maintenance costs deter adoption, especially among small to mid-sized organizations.

One of the most important challenges that limit the usage of these management information systems is the higher implementation and maintenance costs of Clinical Trial Management Systems (CTMS) especially for low-cost organizations among small to mid-size businesses. Developing a custom CTMS can range from USD 50,000 to over USD 500,000, depending on the system's complexity and features. The setup fees for off-the-shelf solutions also vary widely with some vendors charging USD 10,000–25,000 for initial implementation. Beyond initial development and setup, ongoing maintenance costs must be considered. These include expenses for system updates, technical support, and compliance with regulatory standards. For instance, validation packages to ensure 21 CFR Part 11 compliance can start around USD 5,000. Furthermore, integrating the CTMS with other essential systems, such as Electronic Data Capture (EDC) tools, may incur additional costs. These substantial financial requirements can deter smaller organizations from adopting CTMS solutions, potentially limiting their ability to manage clinical trials efficiently.

Opportunities:

-

Integration with wearable devices and mobile health technologies enables real-time data collection and remote monitoring, enhancing patient engagement and trial efficiency.

There is a substantial opportunity to improve patient engagement and enhance trial efficiency by incorporating wearable devices and mobile health technologies into CTMS during the course of a clinical trial. Wearable devices including smartwatches and biosensors facilitate real-time capture of physiologic parameters for continuous monitoring, without repeated visits to the clinic. For instance, the Apple Heart Study enrolled over 400,000 participants to assess the Apple Watch's ability to detect atrial fibrillation, demonstrating the scalability and accessibility of wearables in clinical research. Response via proactive change to improve health monitoring through non-invasiveness, innovations such as an electronic finger wrap designed by the University of California San Diego, monitoring an individual by assessing key biomarkers such as glucose and vitamins through sweat analysis, showcase a progressive evolution of technology. This device operates without external power sources, harnessing energy from fingertip sweat, and has shown effectiveness in real-time health monitoring during daily activities.

Companies like Empatica have developed medical-grade wearables, such as the Embrace smartwatch, which continuously monitors physiological signals and has been utilized in various health studies, including those related to epilepsy and stress measurement. Through the use of these technologies, trials are conducted remotely to minimize participant burden and enable high resolution data collection for operational efficiencies and patient-centric design. The evolution of wearable technology is ready to be integrated into CTMS to and transform clinical research methods, increasing data integrity and participant engagement.

Challenges:

-

Ensuring data privacy and security remains a significant concern due to the sensitive nature of patient information and stringent regulatory requirements.

Due to the sensitivity of patient information and stringent regulatory requirements, ensuring data privacy and security in Clinical Trial Management Systems (CTMS) becomes a major challenge. The rapid growth of the clinical trial market, coupled with the huge amount of personal data that comes from things like medical histories and genetic information, has made them prime targets for cyberattacks. A breach can lead to patient harm, regulatory penalties, reputational damage, and operational disruptions. Compliance with regulations like the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) adds complexity. To protect patient information at all stages of its lifecycle, organizations must have strong security measures in place encryption, limited access controls, routine employee awareness, extensive risk assessments, strict audit trails, and adequate data handling in accordance with laws. Moreover, improper management of integration with other systems can make CTMS vulnerable. Ensuring seamless integration while maintaining data security requires careful planning and execution.

Clinical Trial Management System Market Segmentation Analysis

By Solution Type

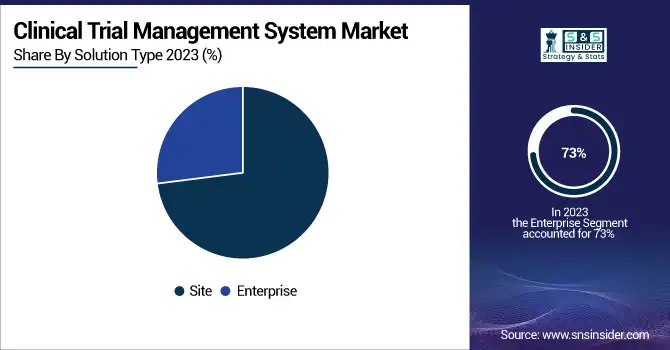

In 2023, CTMS market revenues were dominated by the enterprise segment, which accounted for 73%. This large share of the market is also due to a number of factors such as an increase in adoption of integrated CTMS solutions by large pharmaceutical companies and research organizations. Enterprise-level CTMS offers robust features for managing complex, multi-site clinical trials, which is crucial for organizations conducting numerous studies simultaneously. Moreover, enterprises already have a stronghold in the segment, primarily due to government support in promoting clinical research. As an example, in January 2023, the Canadian government announced the rollout of training platforms, a clinical trial consortium, and research, investing about USD 60 million to support different designs and stages of clinical trials. This investment exemplifies the urgent demand for advanced CTMS software that can manage high-volume and intricate trials. Moreover, the enterprise segment's leadership is reinforced by the increasing complexity of clinical trials, especially in the field of precision medicine. As trials grow increasingly complex, organizations need a CTMS capable of handling multiple data types, maintaining compliance, and integrating functionality between sites and stakeholders.

By Component

In 2023, software segment was the dominant segment with a 55% revenue share. This dominance is ascribed to the increasing digitization of clinical trials and the rising demand for effective data management solution for clinical data conversion. CTMS software becomes an essential tool between the operations of a trial as it helps in many processes starting from patient recruitment, data analysis, and data reporting. The software segment is significantly aided by government initiatives. Union Budget 2023 has provided for a larger allocation of INR 3.41 billion to the Ayushman Bharat Digital Mission in India, an increase of 70.52% allocation from the previous year. This significant digital health infrastructure investment demonstrates the need for strong software implementation to oversee healthcare data and clinical trials. Furthermore, the software segment's leadership is reinforced by the rapid adoption of electronic health records (EHRs) in healthcare settings. The widespread adoption of EHRs provides a solid foundation for the integration of CTMS software, improving data interoperability and helping to optimize clinical trial processes.

By Delivery Mode

The CTMS market was led by Web & cloud-based segment, as it accounted for 69% of revenue share in 2023. The growing need for flexible, scalable, and cost-effective CTMS solutions can be associated with this large market share. The advantages of web and cloud-based systems is allowing for remote access, constant updates of data and cost saving on infrastructure. This high segment is supported by government initiatives aimed at promoting digital health solutions. For example, the e-Sanjeevani platform in India is a national digital solution that has conducted around 90 million teleconsultations and added around 0.2 million providers to the system. This successful implementation of cloud-based healthcare services demonstrates the growing acceptance and reliability of web and cloud-based solutions in the healthcare sector.

By End-user

In 2023, the CRO (Contract Research Organization) segment held the highest market share of 39%. This growth is driven by due to the growing preference for pharmaceutical and biotechnology firms to outsource their clinical trials to CROs. The advantages of CROs such as industry-specific expertise, global reach, and cost-effective strategies to conduct clinical trials are key reasons many sponsors prefer to work with CROs. Explanations such as government incentives for conducting clinical research have been instrumental in strengthening the CRO segment. As an example, in May 2023, the UK Government announced a USD 132.21 million investment to fast-track clinical trials, to allow improved access to the use of essential technologies in clinical trials encompassing CTMS solutions. This long-term investment will help accelerate clinical research and adoption of next generation CTMS by CROs and other research organizations. In addition, the increasing complexity of clinical trials, especially in precision medicine and rare disease spaces, has accelerated the demand for specialized CRO services. As a result, CROs have been adopting more advanced CTMS capabilities to accommodate these complex trial designs, support regulatory compliance, and drive operational efficiencies.

Regional Insights

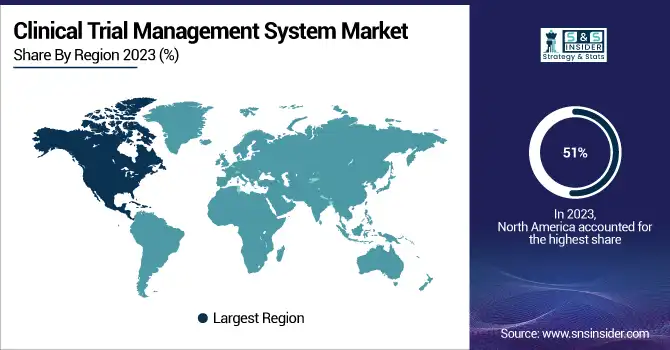

North America dominated the market with largest revenue share 51% of the Clinical Trial Management System (CTMS) market in 2023. This dominance is driven by the high concentration of advanced research institutions in the region, leading universities, and an ecosystem with a high concentration of pharmaceutical and medical device companies. These CTMS Market growth factors also contribute to North America' CTMS Market prominent position over the globe with established Healthcare Infrastructure with the use of Advanced Technology.

In the years to come, the Asia-Pacific region is expected to grow at the highest compound annual growth rate (CAGR) in the CTMS market throughout the forecast period. The expected escalation is due to the high investments in healthcare infrastructure, rise in clinical trial activities and rising awareness regarding CTMS benefits in developing nations such as China and India. One such example is the National Health Stack initiative by the Government of India which seeks to create a digital health framework in the country and can result in quicker adoption of CTMS in India. Similarly, China's commitment to healthcare reforms and innovation is expected to contribute significantly to the region's market expansion.

Need any customization research on Clinical Trial Management System Market - Enquiry Now

Clinical Trial Management System Market Key Players

Key Service Providers/Manufacturers

-

Medidata Solutions (Medidata Rave CTMS, Medidata Cloud)

-

Oracle Corporation (Oracle CTMS, Siebel Clinical)

-

Veeva Systems (Veeva Vault CTMS, Veeva SiteVault)

-

Parexel International (Parexel MyTrials, ClinPhone CTMS)

-

IBM Watson Health (IBM Clinical Development, Merge CTMS)

-

BioClinica (BioClinica CTMS, Trident IRT)

-

eClinicalWorks (eClinicalWorks CTMS, eClinicalWorks Research)

-

MedNet Solutions (iMedNet CTMS, MedNet eClinical)

-

Deloitte Life Sciences & Healthcare (ClinAxys CTMS, Deloitte ConvergeHEALTH)

-

MasterControl (MasterControl CTMS, MasterControl Clinical Excellence)

Key Users

-

Pfizer

-

Novartis

-

Johnson & Johnson

-

AstraZeneca

-

Roche

-

Bristol-Myers Squibb

-

Sanofi

-

GlaxoSmithKline (GSK)

-

Eli Lilly and Company

-

Merck & Co.

Recent Developments in the Clinical Trial Management System Market

-

In May 2024, EDETEK launched Version 5.1 of its CONFORM™ eClinical platform with a complete and integrated suite of tools that support trial management.

-

In March 2024, Oracle Corporation Japan revealed that ONO Pharmaceutical Co., Ltd. had adopted Oracle’s CTMS Cloud Service to enhance its clinical trial operations as part of its digital transformation strategy.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.8 Billion |

| Market Size by 2032 | USD 5.93 Billion |

| CAGR | CAGR of 14.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution Type (Enterprise, Site) • By Delivery Mode (Web & Cloud Based, On Premise) • By Component (Software, Services) • By End-user (Pharmaceutical and Biotechnology Firms, Medical Device Firms, CROs & Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medidata Solutions, Oracle Corporation, Veeva Systems, Parexel International, IBM Watson Health, BioClinica, eClinicalWorks, MedNet Solutions, Deloitte Life Sciences & Healthcare, MasterControl |