Get more information on Clinical Trial Imaging Market - Request Sample Report

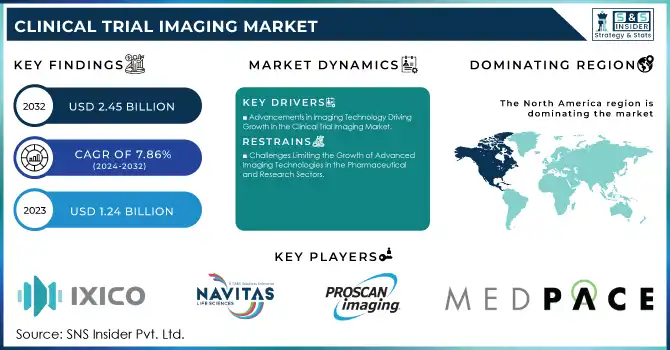

The Clinical Trial Imaging Market size was valued at USD 1.24 billion in 2023 and is expected to reach USD 2.45 billion by 2032, growing at a CAGR of 7.86% over the forecast period 2024-2032.

The Clinical Trial Imaging market plays a vital role in advancing drug development and medical research, offering critical insights into disease progression, therapeutic efficacy, and patient safety. Imaging technologies such as Magnetic Resonance Imaging (MRI), Computed Tomography (CT), Positron Emission Tomography (PET), and Ultrasound have become indispensable tools in clinical trials. These modalities provide both qualitative and quantitative data, ensuring precise monitoring of trial endpoints and enhancing regulatory compliance.

Technological advancements, particularly artificial intelligence (AI) integration, have revolutionized clinical trial imaging by increasing accuracy and efficiency. For example, AI-powered tools like Zircaix by Telix Pharmaceuticals have shown high precision in differentiating between benign and malignant kidney tumors during trials, reducing unnecessary interventions. In phase three trials, Zircaix demonstrated exceptional diagnostic accuracy across a cohort of over 300 patients, showcasing the transformative potential of AI in clinical imaging.

Imaging biomarkers are gaining prominence as reliable indicators of therapeutic outcomes. In oncology trials, PET imaging biomarkers have improved the precision of cancer therapy response assessments, with studies indicating a 20-30% increase in accurate patient stratification. Similarly, cardiovascular trials increasingly rely on advanced imaging to evaluate plaque stability, which is crucial for predicting cardiovascular event risks.

Regulatory frameworks also contribute significantly to the market’s evolution. The FDA’s imaging endpoint process guidelines provide clear standards for data consistency, enhancing confidence in imaging-based trial results. Furthermore, the shift towards decentralized trials has driven the adoption of teleimaging and remote monitoring technologies, which surged during the COVID-19 pandemic. Recent reports highlight a 30% rise in the utilization of teleimaging tools, ensuring the continuity of trials in challenging circumstances.

Collaborations between pharmaceutical companies and specialized imaging vendors have streamlined clinical workflows while developing hybrid imaging systems has expanded diagnostic capabilities. For instance, the combination of PET and CT in hybrid systems enables comprehensive disease assessment, enhancing trial accuracy and efficiency.

Drivers

Advancements in Imaging Technology Driving Growth in the Clinical Trial Imaging Market

The increasing complexity of clinical trials, particularly in areas such as oncology, neurology, and cardiology. These trials demand sophisticated imaging techniques, like MRI and PET, to provide non-invasive, high-resolution insights into disease progression and treatment effectiveness. Another major factor is the rising use of imaging biomarkers as surrogate endpoints. These biomarkers are critical in early-phase trials, enabling the evaluation of therapeutic responses, reducing dependence on invasive procedures, and accelerating the drug development process. For instance, imaging biomarkers have been particularly impactful in Alzheimer’s research, where detecting subtle changes in brain structure and volume is essential.

Technological advancements, including developing portable imaging devices, are also contributing to market expansion. These innovations support decentralized clinical trials, enhancing accessibility and encouraging greater patient participation, aligning with the trend toward patient-centered trial designs. Regulatory bodies are playing an influential role by promoting the standardization of imaging protocols and ensuring uniformity and reliability in data collection across global studies. Additionally, adopting cloud-based platforms for imaging data management has streamlined collaboration and enabled faster decision-making among researchers. Finally, strategic partnerships between pharmaceutical companies and imaging solution providers drive innovation, resulting in advanced and tailored imaging technologies designed to meet the unique demands of clinical trials. These combined factors are propelling the Clinical Trial Imaging market forward.

Restraints

Challenges Limiting the Growth of Advanced Imaging Technologies in the Pharmaceutical and Research Sectors

High costs associated with advanced imaging technologies, specialized equipment, and skilled personnel pose a major barrier, particularly for smaller pharmaceutical companies and research institutions. Regulatory compliance is another challenge, as imaging protocols must meet varying standards across regions, which can cause delays and increase costs, especially in multi-country studies. Additionally, managing and integrating the large volumes of data generated by imaging modalities requires sophisticated and costly data management systems. Finally, patient variability, such as differences in anatomy, age, and disease stage, can affect the consistency and accuracy of imaging results, complicating data interpretation and limiting the generalizability of findings. These factors continue to restrict the market’s full potential.

By Modality

In 2023, Magnetic Resonance Imaging (MRI) was the dominant modality due to its broad application across multiple therapeutic areas. MRI is highly valued for its ability to produce high-resolution images of soft tissues without the need for ionizing radiation, making it indispensable in the diagnosis of conditions related to neurovascular diseases, cardiovascular diseases, and oncology. MRI held a significant share of the market, representing approximately 40% of the overall imaging modalities segment.

The fastest-growing modality was Optical Coherence Tomography (OCT), largely driven by its increasing use in ophthalmology, particularly in retinal imaging. OCT’s high-resolution cross-sectional imaging capabilities make it a critical tool in diagnosing eye diseases such as diabetic retinopathy, macular degeneration, and glaucoma. Technological advancements and the rising prevalence of ophthalmic conditions have contributed to the rapid growth of OCT. It has gained popularity for its non-invasive nature and precision in monitoring retinal health.

By Therapeutic Area

In 2023, oncology emerged as the dominant therapeutic area, driven by the increasing global burden of cancer. Imaging technologies like CT scans and MRI play a crucial role in diagnosing and staging cancers, as well as monitoring treatment responses. The oncology segment represented the largest portion of the market, accounting for 45% of the market share, as imaging is integral in managing a wide range of cancers, from early detection to post-treatment evaluations.

The ophthalmology segment was the fastest-growing area, largely due to the aging population and the rising incidence of eye disorders such as macular degeneration, glaucoma, and diabetic retinopathy. Advances in imaging technologies, particularly OCT, have driven significant growth in this segment. The increasing demand for precise and non-invasive diagnostic tools in eye care has contributed to the rapid expansion of the ophthalmology market, making it a key focus area for technological development and investment.

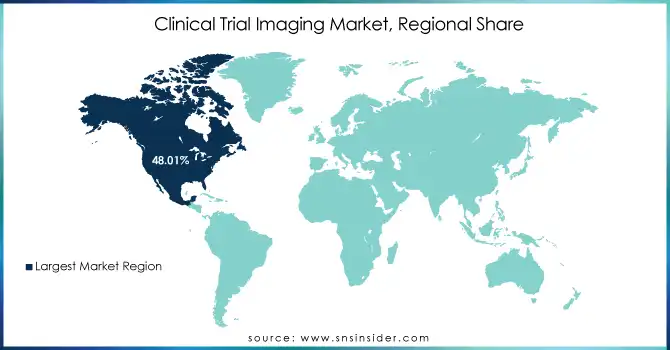

North America held 48.01% of the market share, primarily due to the presence of leading pharmaceutical companies, research institutions, and clinical trial organizations. The U.S. and Canada are at the forefront of integrating innovative imaging solutions, such as MRI, CT scans, and OCT, into clinical trials. Additionally, strong healthcare infrastructure, favorable regulatory environments, and high investments in medical research further support the region's dominance.

Europe followed closely, with countries like Germany, the UK, and France contributing to the region's growth. The increasing focus on personalized medicine and the growing number of clinical trials in oncology, neurology, and cardiovascular diseases are key factors propelling the demand for clinical trial imaging services in Europe. Moreover, the region benefits from strong collaboration between healthcare providers, regulatory bodies, and research organizations, fostering growth in clinical trials.

Asia-Pacific is emerging as the fastest-growing region for the clinical trial imaging market. The rapid expansion of healthcare infrastructure, with increasing clinical trial activity, especially in China and India, is driving the market forward. The rising prevalence of chronic diseases, coupled with advancements in imaging technologies, further accelerates market growth in this region.

Need any customization research on Clinical Trial Imaging Market - Enquiry Now

NeuroVision, IXI-Connect, Imaging Biomarkers

Navitas Life Sciences

Navitas Clinical Trial Imaging Services

ProScan Clinical Imaging Services, Oncology Imaging Solutions

Radiant Sage LLC

Radiant Sage Imaging Solutions

Medpace Imaging Services

Biomedical Systems Corp

Cardiac Imaging, Neuroimaging Solutions

Cardiovascular Imaging Technologies

Cardiovascular Imaging Solutions

Intrinsic Imaging

Intrinsic Imaging Services

BioTelemetry

BioTelemetry Imaging Services

ICON Plc

ICON Imaging Services

Clario

Clario Imaging Services

Resonance Health Ltd.

Ferriscan, Cardiac T2 MRI, OsteoDetect

In Oct 2024, Rivanna launched a trial for its AI-powered Accuro XV imaging system, supported by a USD 30 million grant from the US Biomedical Advanced Research and Development Authority (BARDA). This funding will aid in advancing the system's capabilities for clinical use.

In Oct 2024, NUCLIDIUM announced the successful imaging of the first patient in its Phase 1 study, which is evaluating a 61Cu-based radiotracer in patients with PSMA-positive prostate cancer. This milestone marks a significant advancement in the development of targeted imaging agents for prostate cancer diagnosis and treatment.

In Sept 2024, Yunu expanded its offering to provide free access to its platform for all clinical trials conducted by the Children's Oncology Group. This extension supports the organization's ongoing efforts to enhance research and treatment options in pediatric cancer care.

In April 2024, Qureight secured USD 8.5 million in funding to enhance clinical trial imaging and accelerate drug development. The company aims to improve drug response analysis and identify new endpoints through advanced imaging analysis and data curation.

In May 2024, Clario partnered with Emsere, a reputable medical equipment supplier, to enhance its ophthalmic medical imaging capabilities for clinical trials. This strategic collaboration offers a comprehensive, end-to-end solution, streamlining the execution of ophthalmic imaging in clinical trials.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.24 billion |

| Market Size by 2032 | USD 2.45 billion |

| CAGR | CAGR of 7.86% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Modality (Computed Tomography Scan, Magnetic Resonance Imaging, X-ray, Ultrasound, Optical Coherence Tomography (OCT), and Other Modalities) • By Therapeutic Area (Neurovascular Diseases, Cardiovascular Diseases, Orthopedics & MSK Disorders, Oncology, Ophthalmology, Nephrology, and Other Therapeutic Areas) • By Services (Clinical Trial Design and Consultation Services, Reading and Analytical Services, Operational Imaging Services, System and Technology Support Services, Project and Data Management) • By End Use (Biotechnology and Pharmaceutical companies, Medical Devices Manufacturers, Academic and Government Research Institutes, Contract Research Organizations (CROs), Other End Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IXICO plc, Navitas Life Sciences, ProScan Imaging, Radiant Sage LLC, Medpace, Biomedical Systems Corp, Cardiovascular Imaging Technologies, Intrinsic Imaging, BioTelemetry, ICON Plc, Clario, Resonance Health Ltd. |

| Key Drivers | • Advancements in Imaging Technology Driving Growth in the Clinical Trial Imaging Market |

| Restraints | • Challenges Limiting the Growth of Advanced Imaging Technologies in the Pharmaceutical and Research Sectors |

Ans: The Clinical Trial Imaging Market Size was valued at US$ 1.24 Mn in 2023.

Services, Software are the sub segments of Clinical Trial Imaging market.

Key drivers of the Clinical Trial Imaging Market is the pharmaceutical and biotechnology industries are seeing rapid growth, and CROs are becoming more prevalent.

A clinical trial is an important part of the process of developing a pharmacological treatment. Clinical preliminary imaging advances has supported the decrease of medication preliminary expenses. Clinical imaging is a significant piece of the clinical advancement of new life science drugs.

Ans: The Clinical Trial Imaging Market is to grow at a CAGR of 7.86% over the forecast period 2024-2032.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends (2023), by Region

5.3 Device Volume, by Region (2020-2032)

5.4 Healthcare Spending, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Clinical Trial Imaging Market Segmentation, by Modality

7.1 Chapter Overview

7.2 Computed Tomography Scan

7.2.1 Computed Tomography Scan Market Trends Analysis (2020-2032)

7.2.2 Computed Tomography Scan Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Magnetic Resonance Imaging

7.3.1 Magnetic Resonance Imaging Market Trends Analysis (2020-2032)

7.3.2 Magnetic Resonance Imaging Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 X-Ray

7.4.1 X-Ray Market Trends Analysis (2020-2032)

7.4.2 X-Ray Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Ultrasound

7.5.1 Ultrasound Market Trends Analysis (2020-2032)

7.5.2 Ultrasound Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Optical Coherence Tomography (OCT)

7.6.1 Optical Coherence Tomography (OCT) Market Trends Analysis (2020-2032)

7.6.2Optical Coherence Tomography (OCT) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Other Modalities

7.7.1 Other Modalities Market Trends Analysis (2020-2032)

7.7.2 Other Modalities Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Clinical Trial Imaging Market Segmentation, By Therapeutic Area

8.1 Chapter Overview

8.2 Neurovascular Diseases

8.2.1 Neurovascular Diseases Market Trends Analysis (2020-2032)

8.2.2 Neurovascular Diseases Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Cardiovascular Diseases

8.3.1 Cardiovascular Diseases Market Trends Analysis (2020-2032)

8.3.2 Cardiovascular Diseases Market Size Estimates And Forecasts To 2032 (USD Billion)

8.4 Orthopedics & MSK Disorders

8.4.1 Orthopedics & MSK Disorders Market Trends Analysis (2020-2032)

8.4.2 Orthopedics & MSK Disorders Market Size Estimates And Forecasts To 2032 (USD Billion)

8.5 Oncology

8.5.1 Oncology Market Trends Analysis (2020-2032)

8.5.2 Oncology Market Size Estimates And Forecasts To 2032 (USD Billion)

8.6 Ophthalmology

8.6.1 Ophthalmology Market Trends Analysis (2020-2032)

8.6.2 Ophthalmology Market Size Estimates And Forecasts To 2032 (USD Billion)

8.7 Nephrology

8.7.1 Nephrology Market Trends Analysis (2020-2032)

8.7.2 Nephrology Market Size Estimates And Forecasts To 2032 (USD Billion)

8.8 Other Therapeutic Areas

8.8.1 Other Therapeutic Areas Market Trends Analysis (2020-2032)

8.8.2 Other Therapeutic Areas Market Size Estimates And Forecasts To 2032 (USD Billion)

9. Clinical Trial Imaging Market Segmentation, by Services

9.1 Chapter Overview

9.2 Clinical Trial Design and Consultation Services

9.2.1 Clinical Trial Design and Consultation Services Market Trends Analysis (2020-2032)

9.2.2 Clinical Trial Design and Consultation Services Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Reading and Analytical Services

9.3.1 Reading and Analytical Services Market Trends Analysis (2020-2032)

9.3.2 Reading and Analytical Services Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Operational Imaging Services

9.4.1 Operational Imaging Services Market Trends Analysis (2020-2032)

9.4.2 Operational Imaging Services Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 System and Technology Support Services

9.5.1 System and Technology Support Services Market Trends Analysis (2020-2032)

9.5.2 System and Technology Support Services Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Project and Data Management

9.6.1 Project and Data Management Market Trends Analysis (2020-2032)

9.6.2 Project and Data Management Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Clinical Trial Imaging Market Segmentation, By End Use

10.1 Chapter Overview

10.2 Biotechnology and Pharmaceutical Companies

10.2.1 Biotechnology and Pharmaceutical Companies Market Trends Analysis (2020-2032)

10.2.2 Biotechnology and Pharmaceutical Companies Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Medical Devices Manufacturers

10.3.1 Medical Devices Manufacturers Market Trends Analysis (2020-2032)

10.3.2 Medical Devices Manufacturers Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Academic and Government Research Institutes

10.4.1 Academic and Government Research Institutes Market Trends Analysis (2020-2032)

10.4.2 Academic and Government Research Institutes Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Contract Research Organizations (CROs)

10.5.1 Contract Research Organizations (CROs) Market Trends Analysis (2020-2032)

10.5.2 Contract Research Organizations (CROs) Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Other End Users

10.6.1 Other End Users Market Trends Analysis (2020-2032)

10.6.2 Other End Users Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Clinical Trial Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.2.4 North America Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.2.5 North America Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.2.6 North America Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.2.7.2 USA Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.2.7.3 USA Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.2.7.4 USA Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.2.8.2 Canada Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.2.8.3 Canada Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.2.8.4 Canada Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.2.9.2 Mexico Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.2.9.3 Mexico Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.2.9.4 Mexico Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Clinical Trial Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.3.1.7.2 Poland Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.3.1.7.3 Poland Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.3.1.7.4 Poland Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.3.1.8.2 Romania Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.3.1.8.3 Romania Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.3.1.8.4 Romania Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Clinical Trial Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.3.2.4 Western Europe Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.3.2.5 Western Europe Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.3.2.6 Western Europe Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.3.2.7.2 Germany Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.3.2.7.3 Germany Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.3.2.7.4 Germany Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.3.2.8.2 France Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.3.2.8.3 France Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.3.2.8.4 France Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.3.2.9.2 UK Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.3.2.9.3 UK Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.3.2.9.4 UK Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.3.2.10.2 Italy Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.3.2.10.3 Italy Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.3.2.10.4 Italy Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.3.2.11.2 Spain Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.3.2.11.3 Spain Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.3.2.11.4 Spain Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.3.2.14.2 Austria Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.3.2.14.3 Austria Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.3.2.14.4 Austria Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Clinical Trial Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.4.4 Asia Pacific Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.4.5 Asia Pacific Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.4.6 Asia Pacific Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.4.7.2 China Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.4.7.3 China Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.4.7.4 China Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.4.8.2 India Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.4.8.3 India Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.4.8.4 India Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.4.9.2 Japan Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.4.9.3 Japan Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.4.9.4 Japan Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.4.10.2 South Korea Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.4.10.3 South Korea Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.4.10.4 South Korea Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.4.11.2 Vietnam Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.4.11.3 Vietnam Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.4.11.4 Vietnam Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.4.12.2 Singapore Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.4.12.3 Singapore Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.4.12.4 Singapore Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.4.13.2 Australia Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.4.13.3 Australia Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.4.13.4 Australia Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Clinical Trial Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.5.1.4 Middle East Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.5.1.5 Middle East Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.5.1.6 Middle East Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.5.1.7.2 UAE Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.5.1.7.3 UAE Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.5.1.7.4 UAE Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Clinical Trial Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.5.2.4 Africa Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.5.2.5 Africa Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.5.2.6 Africa Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Clinical Trial Imaging Market Estimates and Forecasts, By End Use(2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Clinical Trial Imaging Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.6.4 Latin America Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.6.5 Latin America Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.6.6 Latin America Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.6.7.2 Brazil Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.6.7.3 Brazil Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.6.7.4 Brazil Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.6.8.2 Argentina Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.6.8.3 Argentina Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.6.8.4 Argentina Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.6.9.2 Colombia Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.6.9.3 Colombia Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.6.9.4 Colombia Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Clinical Trial Imaging Market Estimates and Forecasts, by Modality (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Clinical Trial Imaging Market Estimates and Forecasts, By Therapeutic Area (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Clinical Trial Imaging Market Estimates and Forecasts, by Services (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Clinical Trial Imaging Market Estimates and Forecasts, By End Use (2020-2032) (USD Billion)

12. Company Profiles

12.1 IXICO plc

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Navitas Life Sciences

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Resonance Health Ltd.

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Cardiovascular Imaging Technologies

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 BioTelemetry

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Resonance Health Ltd.

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Clario

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Biomedical Systems Corp

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 ICON Plc

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Intrinsic Imaging

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Modality

Computed Tomography Scan

Magnetic Resonance Imaging

X-Ray

Ultrasound

Optical Coherence Tomography (OCT)

Other Modalities

By Therapeutic Area

Neurovascular Diseases

Cardiovascular Diseases

Orthopedics & MSK Disorders

Oncology

Ophthalmology

Nephrology

Other Therapeutic Areas

By Services

Clinical Trial Design and Consultation Services

Reading and Analytical Services

Operational Imaging Services

System and Technology Support Services

Project and Data Management

By End Use

Biotechnology and Pharmaceutical companies

Medical Devices Manufacturers

Academic and Government Research Institutes

Contract Research Organizations (CROs)

Other End Users

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Clinical Trial Management System Market Size was valued at USD 1.80 Billion in 2023 and is expected to reach USD 5.93 Billion by 2032, growing at a CAGR of 14.18% over the forecast period 2024-2032.

The Regenerative Medicine Market size was estimated at USD 32.50 billion in 2023, expected to reach USD 235.98 billion in 2032 and grow at a CAGR of 24.66%.

Prepacked Chromatography Columns Market valued at USD 307.78 Million in 2023, projected to reach USD 612.41 Million by 2032, with a 7.96% CAGR from 2024-2032.

The Fluorescent In Situ Hybridization Probe Market was valued at USD 892.21 million in 2023 and is expected to reach USD 1733.96 million by 2032, growing at a CAGR of 7.69% over the forecast period of 2024-2032.

The Monkeypox Testing Market Size was valued at USD 1.73 billion in 2023 and is expected to reach USD 2.58 billion by 2032 and grow at a CAGR of 4.55% over the forecast period 2024-2032.

The Diabetes Drug Market Size was valued at USD 79.4 billion in 2023 and is expected to reach USD 145.0 billion by 2032, growing at a CAGR of 6.9%.

Hi! Click one of our member below to chat on Phone