Clinical Microbiology Market Report Scope & Overview:

Get More Information on Clinical Microbiology Market - Request Sample Report

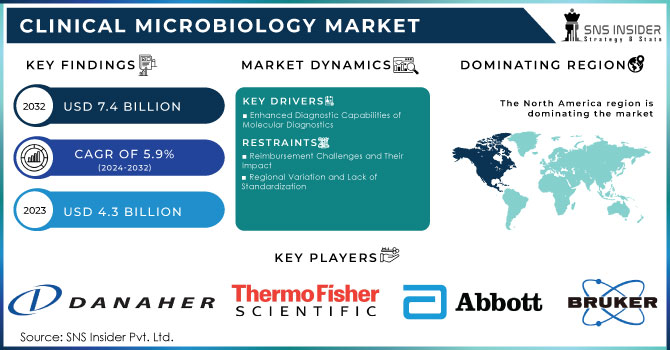

The Clinical Microbiology Market was valued at USD 4.3 billion in 2023 and is expected to reach USD 7.4 billion by 2032 and grow at a CAGR of 5.9% over the forecast period 2024-2032.

Robust Growth in Clinical Microbiology Market Fueled by Technological Advancements and Increased Demand

Innovative Diagnostic Solutions Drive Market Expansion and Investment

The clinical microbiology market is experiencing robust growth driven by several critical factors. Rapid technological advancements have significantly improved microbial identification and antibiotic susceptibility testing. This growth is further supported by increased funding and public-private partnerships in the healthcare sector, spurring advancements in testing technologies. The escalating need for rapid diagnostic tests has intensified research and development in novel automated culture media and microbiology equipment. Additionally, the growing role of clinical microbiology in the biotechnology industries and heightened awareness of Healthcare-Associated Infections (HAIs) have amplified the emphasis on infection control, driving the demand for microbiology testing.

A significant driver of market expansion is the increasing demand for laboratory services to detect pathogen-based diseases and implement control measures to prevent the spread of infectious diseases. The rising geriatric population and expanding targeted disease conditions are expected to fuel market growth. For instance, the World Health Organization reported in April 2023 that approximately 10.6 million people were diagnosed with tuberculosis in 2021, with 1.6 million fatalities, underscoring the urgent need for effective diagnostic solutions.

The pandemic accelerated the development of testing technologies, including Reverse Transcription-Polymerase Chain Reaction (RT-PCR), Loop-mediated Isothermal Amplification (LAMP), and Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR)-based assays. Emergency Use Authorizations (EUA) for rapid antigen tests, such as Abbott BinaxNOW and Quidel Sofia SARS antigen tests, highlighted their crucial role in virus screening and boosted market growth.

Technological advancements have led to the development of advanced automated microbial identification and susceptibility testing systems, which provide faster and more accurate results compared to traditional methods. For example, bioMérieux's VITEK MS system and BD Phoenix Automated Microbiology System represent significant innovations, offering rapid and precise microbial identification and susceptibility testing.

Increased prevalence of HAIs, which result in approximately 1.7 million infections and 99,000 deaths annually in the U.S. according to the CDC, emphasizes the growing importance of infection management. The heightened awareness of infection control drives demand for clinical microbiology testing, aiding in the identification and prevention of infectious agents and reducing the incidence of HAIs. As technology continues to advance and new products are introduced, the clinical microbiology market is expected to grow substantially, reflecting the increasing need for effective and efficient diagnostic solutions.

Regulatory bodies, including the FDA, the European Medicines Agency (EMA), and various regional authorities, enforce stringent guidelines on the development, manufacturing, and marketing of clinical microbiology products. The regulatory landscape for clinical microbiology is dynamic, with ongoing updates to guidelines and policies. This evolving environment presents challenges for companies, as they must continuously adapt to maintain compliance. However, these regulations also create opportunities for companies that innovate and develop products meeting these stringent requirements. Such advancements can provide a competitive edge and potentially set new standards for diagnosing and treating infectious diseases.

Traditionally, clinical microbiology has relied on laboratory-based testing methods to diagnose infectious diseases. However, the market is experiencing a shift with the emergence of alternative solutions like point-of-care testing (POCT) and self-testing kits. These new options offer customers a broader range of testing services, reflecting a change in how diagnostic services are accessed and utilized.

Market Dynamics

Drivers

-

Enhanced Diagnostic Capabilities of Molecular Diagnostics

Molecular diagnostics have revolutionized the field of disease diagnosis by offering significantly enhanced capabilities compared to traditional methods. One of the most notable advantages is the quicker turnaround time provided by these techniques. This rapid turnaround is crucial for timely patient care, as early diagnosis and treatment can often improve outcomes. For instance, in infectious diseases, rapid identification of the causative pathogen allows for targeted antibiotic therapy, reducing the risk of antibiotic resistance and improving patient recovery.

Moreover, molecular diagnostics offer higher sample processing capacities, enabling the simultaneous analysis of multiple samples. This efficiency is particularly beneficial in high-throughput laboratories, such as those processing large numbers of clinical specimens. For example, in public health surveillance programs, molecular diagnostics can be used to screen thousands of samples for emerging infectious diseases, allowing for early detection and containment of outbreaks.

Another significant advantage of molecular diagnostics is their multiplex reaction capabilities. This means multiple targets can be simultaneously analyzed in a single reaction, saving time and resources. For example, in respiratory infections, a single multiplex assay can detect a wide range of viruses and bacteria, providing a comprehensive assessment of the patient's condition.

Restraints

-

Reimbursement Challenges and Their Impact

The clinical microbiology market is hindered by various reimbursement constraints, particularly in emerging economies. Limited reimbursement for laboratory tests, especially in outpatient settings, significantly impacts patient and healthcare professional preferences. This financial limitation restricts the adoption of higher-priced clinical microbiology products, impeding market growth.

-

Regional Variation and Lack of Standardization

Reimbursement policies for laboratory tests vary significantly across regions, especially in countries with decentralized healthcare systems. This lack of standardization creates challenges for manufacturers and healthcare providers, as it can lead to uncertainties in reimbursement rates and processes.

Key Segmentation

By Product

In 2023, the reagents segment led the clinical microbiology market, holding a dominant share of 72.2%. This prominence is primarily due to the ongoing development and commercialization of advanced reagents tailored for clinical microbiology. The rising incidence of chronic diseases such as cancer, diabetes, and cardiovascular conditions worldwide underscores the need for precise detection and monitoring. Reagents play a crucial role in identifying biomarkers, specific molecules, or genetic variations associated with these conditions through diagnostic methods like imaging, blood tests, and genetic analysis. The market's expansion is further supported by the availability of sophisticated reagents that enhance the ease, accuracy, and speed of testing. This trend is anticipated to continue, driving sustained growth in the reagents segment.

The laboratory instruments segment is projected to exhibit the fastest growth rate from 2024 to 2032. The surge in demand for laboratory equipment, which includes essential tools such as incubators, gram stainers, bacterial colony counters, autoclave sterilizers, and petri dish fillers, is fueling this rapid expansion. These instruments are pivotal in various applications across drug development, microbiology labs, biotechnology, and research institutions, where they are used for conducting experiments and analyzing samples.

By Disease

In 2023, the respiratory diseases segment led the market with a 28.7% share, driven by the increasing incidence of infectious diseases like tuberculosis. According to the WHO’s Global Tuberculosis Report 2022, there were 10.6 million global tuberculosis cases, with only 6.4 million diagnosed, highlighting a significant gap that boosts the demand for respiratory disease testing. This surge in respiratory conditions underscores the growing importance of clinical microbiology for accurate diagnosis and personalized treatment. Additionally, rising air pollution, which contributes to lung diseases such as Chronic Obstructive Pulmonary Disease (COPD), is fueling the growth of this segment. The bloodstream infection (BSI) segment is anticipated to experience the highest growth rate from 2024 to 2032. The global rise in BSI cases is a major public health concern, influenced by factors such as the increasing prevalence of antibiotic-resistant bacteria, more invasive medical procedures, a growing elderly population, and higher rates of chronic diseases.

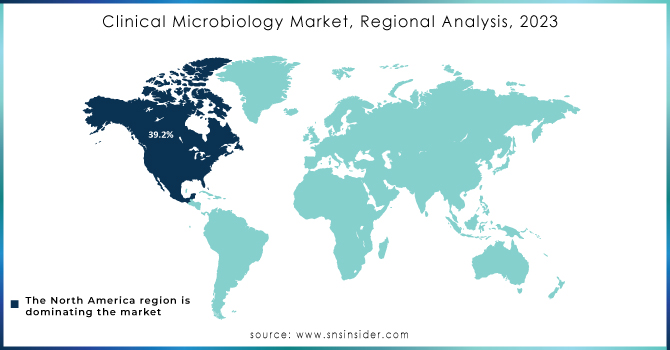

Regional Analysis

In 2023, North America led the clinical microbiology market, commanding a revenue share of 39.2%. The U.S. market is experiencing strong growth due to the high prevalence of infectious diseases and the challenges posed by emerging pathogens. There is a notable shift towards molecular diagnostics, emphasizing rapid and accurate testing methods. Major players like bioMérieux, B.D., and Danaher Corporation are actively investing in research and development to enhance sensitivity, and specificity, and reduce turnaround times in microbiological testing.

In Europe, the market is also expanding, driven by increasing demand for advanced diagnostic solutions. Favorable government initiatives and the growth of independent diagnostic centers are expected to further boost market development. The UK is a significant contributor to this growth, with rising infectious disease rates and a focus on diagnostic accuracy driving demand for clinical microbiology products and services. France is set to experience growth as innovative diagnostic methods, including molecular diagnostics and automation, become more prevalent. Germany's market is also poised for significant growth, supported by a USD 2.60 million government grant awarded in May 2022 to develop novel diagnostic and therapeutic approaches for urinary tract infections (UTIs).

In the Asia Pacific region, the clinical microbiology market is projected to have the highest CAGR, fueled by advancements in healthcare and innovative medical technologies. China's market growth is driven by increased awareness of infectious diseases, higher healthcare spending, and advancements in diagnostic technologies. Japan is also witnessing rapid growth, with rising demand for diagnostic services driven by an aging population, increasing infectious disease prevalence, and a focus on early diagnosis and treatment. India presents substantial growth potential due to rising healthcare expenditures and growing awareness of clinical microbiology's role in disease management and prevention.

Need any customization research on Clinical Microbiology Market - Enquiry Now

Key Players

-

Hardy Diagnostics (HardyCHROM, Hardy Diagnostics Culture Media)

-

Bruker (MALDI Biotyper, Microflex LT/SH)

-

Danaher (Cepheid, Inc.) (GeneXpert Systems, XpertCarba-R)

-

bioMerieux SA (VITEK 2 System, BIOFIRE FilmArray)

-

Abbott (Alinity M System, Panbio COVID-19 Ag Rapid Test)

-

F. Hoffmann-La Roche Ltd. (cobas 6800/8800 Systems, Elecsys SARS-CoV-2)

-

BD (BD Phoenix, BD MAX System)

-

Bio-Rad Laboratories, Inc. (Biolog Microbial ID, Hercules)

-

Hologic, Inc. (Panther System)

-

Arrow Diagnostics Srl (DIA-CT)

-

Shimadzu Corporation (Nexera)

-

Cole-Parmer Instrument Company, LLC

-

Thermo Fisher Scientific Inc. (KingFisher Flex, TaqMan Assays)

-

Agilent Technologies, Inc.

-

Neogen Corporation (Reveal), and others.

Recent Developments

-

January 2024: BioMérieux acquired LUMED, a software company, to enhance antimicrobial stewardship and improve infection control programs. This strategic acquisition aims to bolster BioMérieux’s capabilities in managing and controlling infections through advanced software solutions.

-

February 2024: Becton, Dickinson, and Company (US) partnered with Camtech Health (Singapore) to improve cervical cancer screening. The collaboration introduces an innovative solution allowing women in Singapore to collect samples privately at home, enhancing accessibility and convenience for cervical cancer diagnostics.

-

December 2023: F. Hoffmann-La Roche Ltd. (Switzerland) finalized an agreement to acquire LumiraDx's Point of Care technology. This acquisition consolidates multiple diagnostic modalities into a single platform, underscoring Roche’s dedication to advancing point-of-care diagnostics and expanding its capabilities to meet evolving healthcare needs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.3 Billion |

| Market Size by 2032 | US$ 7.4 billion |

| CAGR | CAGR of 5.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Laboratory Instruments, Automated Culture System, Reagents) • By Disease (Respiratory Diseases, Bloodstream Infections, Gastrointestinal Diseases, Sexually Transmitted Diseases, Urinary Tract Infections, Periodontal Diseases, Other Diseases) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bruker, Danaher (Cepheid, Inc.), bioMerieux SA, Danaher (Cepheid, Inc.), Abbott, F. Hoffmann-La Roche Ltd., BD, Bio-Rad Laboratories, Inc., Hologic, Inc., Arrow Diagnostics Srl, Shimadzu Corporation, and others. |

| Key Drivers | • Enhanced Diagnostic Capabilities of Molecular Diagnostics |

| Restraints | • Reimbursement Challenges and Their Impact • Regional Variation and Lack of Standardization |