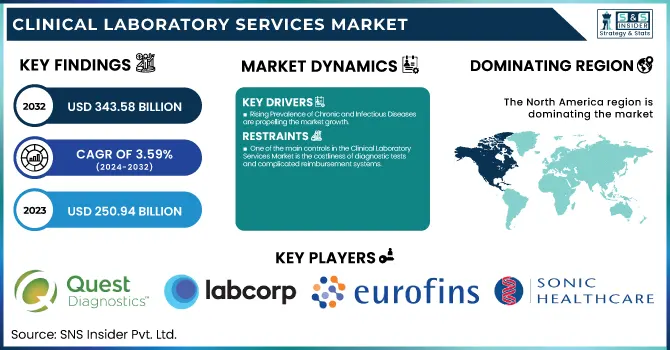

The Clinical Laboratory Services Market was valued at USD 250.94 billion in 2023 and is expected to reach USD 343.58 billion by 2032, growing at a CAGR of 3.59% from 2024-2032.

To Get more information on Clinical Laboratory Services Market - Request Free Sample Report

The Clinical Laboratory Services Market report offers insights into changing trends in laboratory service models, including the shift between in-house and outsourcing diagnostic operations. It analyzes the growing investments in laboratory automation and digital pathology, focusing on AI-based diagnostics and robotic lab workflows. The report also addresses reimbursement and insurance coverage trends, evaluating the financial effect of policy changes on laboratory services. In addition, it explores R&D spend among top-performing laboratory service providers, highlighting improvements in precision diagnostics, biomarker investigation, and next-generation testing solutions, presenting an overview of how the market is changing in terms of efficiency and innovation.

The U.S. Clinical Laboratory Services Market was valued at USD 69.16 billion in 2023 and is expected to reach USD 95.15 billion by 2032, growing at a CAGR of 3.65% from 2024-2032. The United States is the leader in North America's Clinical Laboratory Services Market with its highly developed healthcare infrastructure, excessive healthcare expenditure, and extensive availability of leading market players such as Quest Diagnostics, Labcorp, and Mayo Clinic Laboratories. The nation holds a high percentage of diagnostic testing stimulated by an increasing need for customized medicine, prevention care, and sophisticated laboratory automation. Moreover, positive reimbursement policies and growing investments in digital pathology and AI-based diagnostics further cement the U.S.'s position of strength in the region.

Drivers

Rising Prevalence of Chronic and Infectious Diseases are propelling the market growth.

The growing number of chronic conditions like diabetes, cardiovascular diseases, and cancer is fueling the demand for sophisticated diagnostic procedures. The Centers for Disease Control and Prevention (CDC) states that almost 6 out of every 10 adults in the U.S. have a chronic disease, requiring repeated laboratory testing to monitor and manage the disease. Moreover, the escalating prevalence of infectious diseases such as COVID-19, influenza, and tuberculosis has tremendously boosted demand for PCR tests, blood examination, and microbiological testing. Recent advancements also involve the application of liquid biopsy tests for oncology diagnosis and the growing usage of next-generation sequencing (NGS) for clinical diagnostics. The increasing growth of geriatric populations worldwide, which needs regular health monitoring, also accelerates market growth. As a result, laboratories are enriching their performance with automated testing platforms and artificial intelligence-based pathology solutions.

Increasing Adoption of Laboratory Automation and Digital Pathology accelerating the market growth.

Implementation of automation and digital pathology within clinical laboratories is revolutionizing diagnostic service efficiency and accuracy. Automated technologies, such as robotic handling of samples, AI-based imaging, and high-throughput analyzers, hugely decrease turnaround time and human mistakes. As per a 2023 report by the College of American Pathologists (CAP), more than 65% of North American laboratories have incorporated at least some level of automation to deal with rising sample volumes. Some of the recent innovations involve AI-enabled diagnostic algorithms, cloud-based laboratory information management systems (LIMS), and remote digital pathology solutions, which enable real-time consultation among pathologists across the globe. In addition, firms such as Quest Diagnostics and Labcorp are spending extensively on AI-enabled workflows to maximize test accuracy and reduce complexity. This technological advancement is enhancing the efficiency, scalability, and reach of clinical lab services globally.

Restraint

One of the main controls in the Clinical Laboratory Services Market is the costliness of diagnostic tests and complicated reimbursement systems.

Sophisticated diagnostic methods, including next-generation sequencing (NGS), molecular diagnostics, and personalized medicine testing, involve huge investments in cutting-edge equipment, highly trained staff, and quality assurance measures. These are usually transferred to patients, rendering tests inaccessible to many, particularly in areas where insurance coverage is minimal. Furthermore, slow reimbursements and repeated alterations in insurance policies cause laboratories financial stress. For instance, in the United States, Medicare reimbursement reductions under the Protecting Access to Medicare Act (PAMA) have cut deeply into payments for numerous standard tests. These economic burdens slow down market growth and uptake of innovative diagnostics, especially in small and mid-sized labs with fewer resources.

Opportunities

The increased need for genomic testing and personalized medicine represents a large opportunity within the Clinical Laboratory Services Market.

Developments in genomics, proteomics, and biomarker discovery are propelling the use of targeted therapies that demand thorough laboratory testing. The incorporation of next-generation sequencing (NGS), liquid biopsy, and pharmacogenomic testing is transforming disease diagnosis and treatment planning. For example, genetic tests focused on oncology, including BRCA mutations in breast cancer and EGFR mutations in lung cancer, are becoming routine in clinical settings. Moreover, regulatory bodies such as the FDA are promoting the use of companion diagnostics, further stimulating market growth. With growing healthcare investments and collaboration among biopharma and diagnostic firms, the market is observing a rise in genomic testing services, which generates new revenue streams for laboratory service providers.

Challenges

One of the biggest issues in the Clinical Laboratory Services Market is compliance with regulations and data privacy.

Laboratories are required to follow strict rules, such as the Clinical Laboratory Improvement Amendments (CLIA), HIPAA (Health Insurance Portability and Accountability Act), and GDPR (General Data Protection Regulation) for protection of patient data. Following fluctuating guidelines, accreditation criteria, and quality control practices creates operational challenges, particularly for independent and small laboratories. Moreover, the growing reliance on digital pathology, artificial intelligence, and cloud-based lab systems invites potential cybersecurity threats and unauthorized access to sensitive patient information. Data breaches can result in legal consequences, financial penalties, and erosion of patients' and providers' trust. Managing such intricate regulatory environments along with keeping testing accuracy and efficiency high is a major hindrance to market growth.

By Test Type

The Clinical Chemistry segment dominated the Clinical Laboratory Services Market with 55.46% market share because it has broad usage in routine diagnostic testing, management of chronic diseases, and preventive healthcare programs. Clinical chemistry tests such as blood glucose, lipid panels, liver function tests, and kidney function tests are necessary for diagnosing and monitoring diseases like diabetes, cardiovascular diseases, and renal diseases. The increasing incidence of chronic diseases worldwide, combined with a growing population and greater focus on early disease detection, has greatly increased demand for these tests. Moreover, the incorporation of automated analyzers and point-of-care testing (POCT) solutions has improved testing efficiency, lowering turnaround time and facilitating high-throughput analysis. The common availability of clinical chemistry tests at hospitals, diagnostic centers, and independent labs also solidified its market leading position.

By Service Provider

The Hospital-Based Laboratories segment dominated the Clinical Laboratory Services Market with a 54.12% market share in 2023 because it is part of healthcare facilities, allowing for smooth diagnostics and treatment planning. These labs are critical to performing urgent and complex testing that supports real-time clinical decision-making, especially in emergency care, surgical interventions, and inpatient monitoring. High patient traffic in hospitals, combined with the necessity of specialized test services, has fueled demand for in-house laboratory facilities. Moreover, the growth in laboratory automation and central hospital networks has improved efficiency, accuracy, and accessibility of test services. Favorable reimbursement policies and government funding of hospital labs support the dominance of the segment by enabling affordability and mass adoption of clinical test services in hospitals.

The Stand-Alone Laboratories segment will see the fastest growth in the forecast year with 4.06% CAGR throughout the forecast year on account of increasing demand for independent diagnosis services, spurred by cost-savings, ease of access, and focus on high-tech testing. As more patients opt for outpatient-focused, convenient diagnosis services, stand-alone laboratories are increasing their array of tests, such as genetic testing, molecular diagnostic testing, and personalized medicine. In addition, strategic partnerships with healthcare networks, payers, and telehealth companies are expanding their reach. Digital pathology adoption, AI-based diagnostics, and home sample collection services are also fueling growth further. Further, growing healthcare consumerism and pressure for quicker turnaround times are making stand-alone laboratories an attractive alternative to hospital-based testing, driving them to expand across the developed as well as emerging economies.

By Application

The Bioanalytical & Lab Chemistry Services segment dominated the Clinical Laboratory Services Market with 51.68% market share in 2023 because it plays a central role in pharmaceutical research, clinical diagnostics, and therapeutic drug monitoring. These services are crucial for the analysis of biological samples, the detection of biomarkers, and the measurement of drug efficacy and safety, making them indispensable for drug development, personalized medicine, and disease diagnosis. The increasing incidence of chronic diseases, such as cardiovascular diseases, diabetes, and cancer, has fueled the need for accurate bioanalytical testing. Moreover, strict regulatory needs from organizations like the FDA and EMA demand thorough bioanalytical studies to ensure compliance. The increasing use of high-throughput screening, mass spectrometry, and chromatography technologies has further increased the dominance of this segment, providing accurate and efficient laboratory-based chemical and biological analysis.

The Toxicology Testing Services segment is experience to register the fastest growth in the forecast years ahead, led by the growing prevalence of drug abuse, boosting workplace drug testing, and concerns regarding environmental pollutants and food safety. With the liberalization of cannabis and the stringent regulation of drug testing, toxicology testing has emerged as a prerequisite for employment screening, forensic analysis, and clinical diagnosis. Also, growth in pharmaceuticals and biotechnology R&D has amplified demand for toxicological tests for new drug products to certify safety and compliance with regulations. Technical advances in liquid chromatography-mass spectrometry (LC-MS) and new-generation toxicology tests have enhanced test sensitivity and specificity, further enhancing adoption. Further, increased government efforts to stem opioid abuse and track exposure to harmful chemicals are driving growth in this segment worldwide.

North America dominated the clinical laboratory services market with a 38.11% market share in 2023 mainly because of its highly developed healthcare infrastructure, high rate of adoption of sophisticated diagnostic technologies, and the availability of leading market players such as Quest Diagnostics, Labcorp, and Mayo Clinic Laboratories. The region is assisted by robust government support, positive reimbursement policies, and high healthcare expenditure, which fuels demand for routine and specialized diagnostic testing. In addition, the rise in chronic disease, cancer, and infectious disease prevalence requires sophisticated laboratory services. The expanding use of artificial intelligence (AI), digital pathology, and automation in the laboratory further asserts the region's leadership by enhancing efficiency and accuracy in diagnostics.

Asia Pacific is experiencing the fastest expansion in the clinical laboratory services market with 4.21% CAGR throughout the forecast period due to the rapid urbanization, growing healthcare expenditure, and developing awareness of early disease detection. China, India, and Japan are considerably developing diagnostic testing infrastructure with the rising burden of infectious and chronic diseases. Moreover, initiatives by governments to enhance healthcare infrastructure and growth in private diagnostic labs are driving the market. Rising emphasis on precision medicine, genetic testing, and digital healthcare solutions in the region is further driving demand for lab services. Lower labor cost, high number of patients, and increasing outsource trend in laboratory services are also making the Asia Pacific market a good expansion place for clinical laboratories.

Get Customized Report as per Your Business Requirement - Enquiry Now

Quest Diagnostics (Comprehensive Health Profiles, Blueprint for Wellness)

Labcorp (Pixel by Labcorp, Women's Health Blood Test)

Mayo Clinic Laboratories (Neurology Testing, Cardiovascular Diagnostics)

BioReference Laboratories (OncoReveal Dx, Scarlet Health)

Sonic Healthcare (Clinical Pathology Services, Genetic Testing)

ARUP Laboratories (Pediatric Testing, Infectious Disease Diagnostics)

Eurofins Scientific (Clinical Diagnostics, Genomic Services)

Synlab Group (Specialty Testing, Preventive Check-Ups)

Unilabs (Radiology Services, Pathology Testing)

Cerba Healthcare (Clinical Trials Services, Veterinary Diagnostics)

ACM Global Laboratories (Central Laboratory Services, Toxicology Testing)

Medicover (Preventive Health Packages, Diagnostic Imaging)

Genova Diagnostics (GI Effects Comprehensive Profile, NutrEval FMV)

Healius Limited (Pathology Services, Imaging Services)

Australian Clinical Labs (COVID-19 Testing, Women's Health Diagnostics)

Bio-Rad Laboratories (Quality Control Products, Immunohematology Testing)

Thermo Fisher Scientific (Clinical Chemistry Analyzers, Molecular Diagnostic Assays)

Agilent Technologies (Pathology Solutions, Genomics Services)

Tecan Group Ltd. (Automated Liquid Handling Systems, Microplate Readers)

DiaSorin (LIAISON XL Analyzer, Molecular Diagnostic Kits)

Suppliers (These suppliers provide essential laboratory equipment, reagents, and consumables, including diagnostic kits, assay reagents, analytical instruments, and automation solutions, enabling clinical laboratories to perform high-quality diagnostic testing and research efficiently.) in Clinical Laboratory Services Market

Merck KGaA

Thermo Fisher Scientific

Danaher Corporation

Agilent Technologies

Bio-Rad Laboratories

Siemens Healthineers

PerkinElmer, Inc.

Roche Diagnostics

Beckman Coulter (Danaher Corporation)

BD (Becton, Dickinson and Company)

January, 2025 – Quest Diagnostics, a preeminent diagnostic information services provider, has officially closed the acquisition of certain University Hospitals assets, a respected nonprofit health system and academic medical center in the United States. The transaction's financial terms are not disclosed.

March, 2024 – Labcorp, a world leader in laboratory testing, has signed an agreement with OPKO Health, Inc. to buy certain assets of BioReference Health, an OPKO Health subsidiary. The deal is expected to improve Labcorp's diagnostic capability and service offering.

January, 2023 – Helix, the leader in population genomics and viral surveillance, and Mayo Clinic Laboratories have established a strategic alliance. The joint effort will give biopharma customers an expansive combined laboratory portfolio to assist research and development teams across the lifecycle of drug development.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 250.94 Billion |

| Market Size by 2032 | US$ 343.58 Billion |

| CAGR | CAGR of 3.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Test Type (Genetic Testing, Clinical Chemistry, Medical Microbiology Testing, Hematology Testing, Immunology Testing, Cytology Testing, Drug of Abuse Testing, Other Esoteric Tests) • By Service Provider (Hospital-Based Laboratories, Stand-Alone Laboratories, Clinic-Based Laboratories) • By Application (Bioanalytical & Lab Chemistry Services, Toxicology Testing Services, Cell & Gene Therapy Related Services, Preclinical & Clinical Trial Related Services, Drug Discovery & Development Related Services, Other Clinical Laboratory Services) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Quest Diagnostics, Labcorp, Mayo Clinic Laboratories, BioReference Laboratories, Sonic Healthcare, ARUP Laboratories, Eurofins Scientific, Synlab Group, Unilabs, Cerba Healthcare, ACM Global Laboratories, Medicover, Genova Diagnostics, Healius Limited, Australian Clinical Labs, Bio-Rad Laboratories, Thermo Fisher Scientific, Agilent Technologies, Tecan Group Ltd., DiaSorin, and other players. |

Ans: The Clinical Laboratory Services Market is expected to grow at a CAGR of 3.59% from 2024-2032.

Ans: The Clinical Laboratory Services Market was USD 250.94 billion in 2023 and is expected to reach USD 343.58 billion by 2032.

Ans: Rising Prevalence of Chronic and Infectious Diseases are propelling the market growth.

Ans: The “Clinical Chemistry” segment dominated the Clinical Laboratory Services Market.

Ans: North America dominated the Clinical Laboratory Services Market in 2023.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Trends in Outsourcing vs. In-House Laboratory Services (2023-2032)

5.2 Investment Trends in Laboratory Automation & Digital Pathology (2023-2032)

5.3 Reimbursement & Insurance Coverage Trends (2023-2032).

5.4 R&D Expenditure by Leading Laboratory Service Providers (2023-2032)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Clinical Laboratory Services Market Segmentation, By Test Type

7.1 Chapter Overview

7.2 Genetic Testing

7.2.1 Genetic Testing Market Trends Analysis (2020-2032)

7.2.2 Genetic Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Clinical Chemistry

7.3.1 Clinical Chemistry Market Trends Analysis (2020-2032)

7.3.2 Clinical Chemistry Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Medical Microbiology Testing

7.4.1 Medical Microbiology Testing Market Trends Analysis (2020-2032)

7.4.2 Medical Microbiology Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Hematology Testing

7.5.1 Hematology Testing Market Trends Analysis (2020-2032)

7.5.2 Hematology Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Immunology Testing

7.6.1 Immunology Testing Market Trends Analysis (2020-2032)

7.6.2 Immunology Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Cytology Testing

7.7.1 Cytology Testing Market Trends Analysis (2020-2032)

7.7.2 Cytology Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Drug of Abuse Testing

7.6.1 Drug of Abuse Testing Market Trends Analysis (2020-2032)

7.6.2 Drug of Abuse Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Other Esoteric Tests

7.6.1 Other Esoteric Tests Market Trends Analysis (2020-2032)

7.6.2 Other Esoteric Tests Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Clinical Laboratory Services Market Segmentation, By Service Provider

8.1 Chapter Overview

8.2 Hospital-Based Laboratories

8.2.1 Hospital-Based Laboratories Market Trends Analysis (2020-2032)

8.2.2 Hospital-Based Laboratories Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Stand-Alone Laboratories

8.3.1 Stand-Alone Laboratories Market Trends Analysis (2020-2032)

8.3.2 Stand-Alone Laboratories Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Clinic-Based Laboratories

8.4.1 Clinic-Based Laboratories Market Trends Analysis (2020-2032)

8.4.2 Clinic-Based Laboratories Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Clinical Laboratory Services Market Segmentation, By Application

9.1 Chapter Overview

9.2 Bioanalytical & Lab Chemistry Services

9.2.1 Bioanalytical & Lab Chemistry Services Market Trends Analysis (2020-2032)

9.2.2 Bioanalytical & Lab Chemistry Services Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Toxicology Testing Services

9.3.1 Toxicology Testing Services Market Trends Analysis (2020-2032)

9.3.2 Toxicology Testing Services Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Cell & Gene Therapy Related Services

9.4.1 Cell & Gene Therapy Related Services Market Trends Analysis (2020-2032)

9.4.2 Cell & Gene Therapy Related Services Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Preclinical & Clinical Trial Related Services

9.5.1 Preclinical & Clinical Trial Related Services Market Trends Analysis (2020-2032)

9.5.2 Preclinical & Clinical Trial Related Services Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Drug Discovery & Development Related Services

9.6.1 Drug Discovery & Development Related Services Market Trends Analysis (2020-2032)

9.6.2 Drug Discovery & Development Related Services Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Other Clinical Laboratory Services

9.7.1 Other Clinical Laboratory Services Market Trends Analysis (2020-2032)

9.7.2 Other Clinical Laboratory Services Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Clinical Laboratory Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.2.4 North America Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.2.5 North America Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.2.6.2 USA Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.2.6.3 USA Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.2.7.2 Canada Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.2.7.3 Canada Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.2.8.3 Mexico Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Clinical Laboratory Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.3.1.6.3 Poland Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.3.1.7.3 Romania Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Clinical Laboratory Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.3.2.5 Western Europe Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.3.2.6.3 Germany Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.7.2 France Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.3.2.7.3 France Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.3.2.8.3 UK Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.3.2.9.3 Italy Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.3.2.10.3 Spain Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.3.2.13.3 Austria Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Clinical Laboratory Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.4.5 Asia Pacific Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.4.6.2 China Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.4.6.3 China Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.4.7.2 India Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.4.7.3 India Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.4.8.2 Japan Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.4.8.3 Japan Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.4.9.3 South Korea Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.4.10.3 Vietnam Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.4.11.3 Singapore Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.4.12.2 Australia Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.4.12.3 Australia Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Clinical Laboratory Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.5.1.5 Middle East Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.5.1.6.3 UAE Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Clinical Laboratory Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.2.4 Africa Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.5.2.5 Africa Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Clinical Laboratory Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.6.4 Latin America Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.6.5 Latin America Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.6.6.3 Brazil Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.6.7.3 Argentina Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.6.8.3 Colombia Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Clinical Laboratory Services Market Estimates and Forecasts, by Test Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Clinical Laboratory Services Market Estimates and Forecasts, by Service Provider (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Clinical Laboratory Services Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Quest Diagnostics

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Labcorp

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Mayo Clinic Laboratories

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 BioReference Laboratories

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Sonic Healthcare

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 ARUP Laboratories

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Eurofins Scientific

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Synlab Group

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Unilabs

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Cerba Healthcare

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Test Type

Genetic Testing

Clinical Chemistry

Routine Chemistry Testing

Therapeutic Drug Monitoring Testing

Endocrinology Chemistry Testing

Specialized Chemistry Testing

Other Clinical Chemistry Testing

Medical Microbiology Testing

Infectious Disease Testing

Transplant Diagnostic Testing

Other Microbiology Testing

Hematology Testing

Immunology Testing

Cytology Testing

Drug of Abuse Testing

Other Esoteric Tests

By Service Provider

Hospital-Based Laboratories

Stand-Alone Laboratories

Clinic-Based Laboratories

By Application

Bioanalytical & Lab Chemistry Services

Toxicology Testing Services

Cell & Gene Therapy Related Services

Preclinical & Clinical Trial Related Services

Drug Discovery & Development Related Services

Other Clinical Laboratory Services

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Physiotherapy Equipment Market Size was valued at USD 20.9 billion in 2023, is projected to grow at a CAGR of 6.9% to reach USD 38.2 billion by 2032.

Dermatology CRO Market was valued at USD 4.8 Billion in 2023 and is expected to reach USD 8.6 Billion by 2032, growing at a CAGR of 6.7% over the forecast period 2024-2032.

Ophthalmology PACS Market was valued at USD 156.39 billion in 2023 and is expected to reach USD 311.31 billion by 2032, growing at a CAGR of 8.02% from 2024-2032.

The Microbial Identification Market Size was valued at USD 3.6 Billion in 2023 and is expected to reach USD 9.77 Billion by 2032, growing at a CAGR of 11.5 % over the forecast period 2024-2032.

The Healthcare Biometrics Market Size was valued at USD 8.2 billion in 2023 and is expected to reach USD 48.9 billion by 2032, growing at a 22% CAGR.

The Lab Automation Market size was estimated at USD 7.31 billion in 2023 and is expected to reach USD 13.05 billion by 2032, with a growing CAGR of 6.65% during the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone