Clinical Diagnostics Market Size:

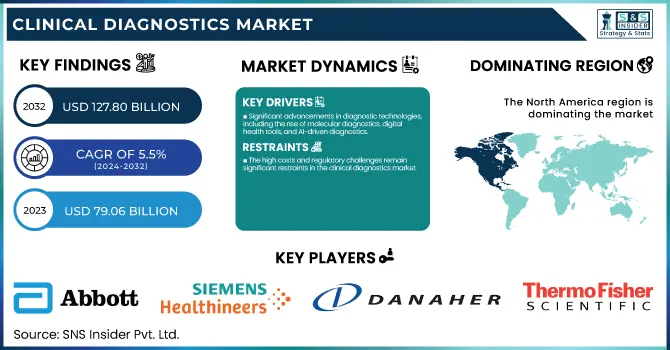

The Clinical Diagnostics Market size was estimated at USD 79.06 billion in 2023 and is expected to reach USD 127.80 billion by 2032 with a growing CAGR of 5.5% during the forecast period of 2024-2032. This report identifies regulatory and compliance trends, with a focus on the changing standards for diagnostic precision, data privacy, and new test technology approval. The research examines emerging trends in personalized and precision medicine, with a focus on the move toward customized diagnostic solutions and the incorporation of genomics and biomarker-based testing. In addition, it analyzes trends in digital and remote diagnostics, such as the growth of telemedicine, AI-based diagnostic equipment, and home testing kits, which are increasing accessibility and efficiency. The report also explores investment and M&A activity in the clinical diagnostics market, highlighting higher funding in cutting-edge diagnostic startups and consolidation of major players to fuel technological innovation and increase market share.

To Get more information on Clinical Diagnostics Market - Request Free Sample Report

Clinical Diagnostics Market Dynamics:

Drivers

-

Significant advancements in diagnostic technologies, including the rise of molecular diagnostics, digital health tools, and AI-driven diagnostics.

These technologies are enhancing diagnostic precision and accelerating testing procedures, resulting in higher demand for sophisticated diagnostic products. Moreover, the increasing global incidence of chronic diseases, including diabetes, cardiovascular diseases, and infectious diseases, has greatly increased the demand for diagnostic solutions. For instance, the rising number of cancer patients globally, which is projected to hit 22 million by 2030, as estimated by the World Health Organization (WHO), has boosted demand for diagnostic tests. Additionally, the move towards personalized medicine, in which diagnostics play an important role in customizing treatments, is driving market growth. Additional investments in healthcare from governments, together with the growth of the healthcare services base within emerging economies, are also driving the need for clinical diagnostics.

Restraints

-

The high costs and regulatory challenges remain significant restraints in the clinical diagnostics market.

The cost of diagnostic devices, reagents, and high-end test kits can be exorbitant, especially for smaller medical facilities in low-income countries. For instance, diagnostic testing for orphan diseases and genetic testing are commonly priced beyond the reach of most patients, thus restricting their availability. Additionally, regulatory requirements for introducing new diagnostic products, including FDA clearances and CE marking, pose entry barriers and slow down product availability. Such regulations guarantee product safety and effectiveness but raise costs and prolong development times for firms. Smaller firms consequently could find it difficult to penetrate the market or get innovative products to market on a competitive basis.

Opportunities

-

The clinical diagnostics market presents numerous opportunities, particularly through the growing emphasis on personalized medicine.

Diagnostic tests that examine genetic data are facilitating more accurate and targeted treatment options, presenting substantial growth opportunities for diagnostic firms. The increasing application of genomic testing in cancer treatment and the diagnosis of orphan diseases is especially fueling this trend. Additionally, the increasing demand for diagnostic tests, fueled by an aging population, increased health consciousness, and government initiatives to improve healthcare infrastructure, also supports the market's potential for growth.

Challenges

-

The handling of patient data, especially with the increasing integration of digital diagnostics and AI-based tools.

As more devices gather patient data, the risk of privacy violation and data misuse increases. Regulations are strengthening data protection laws, but businesses are still struggling with secure systems against complex rules like GDPR in the European Union or HIPAA in the United States. Another challenge comes from connecting new diagnostic technologies with existing health IT systems. Interoperability problems between various diagnostic platforms and electronic health record (EHR) systems can lead to inefficiencies and hamper the adoption of advanced diagnostic technologies. The slow pace of integration may slow down the large-scale deployment of innovative diagnostic solutions, undermining their impact.

Clinical Diagnostics Market Segmentation Analysis:

By Test

In 2023, the segment of Infectious Disease Testing was the market leader in the clinical diagnostics market and held a 30.6% market share. This is largely due to the rise in the incidence of infectious diseases like influenza, tuberculosis, HIV, and new viral infections that have increased the need for accurate and timely diagnostic services. Governments and healthcare institutions worldwide have been spending a lot on disease surveillance and early detection initiatives, further increasing the demand for infectious disease testing. Moreover, increased focus on pandemic preparedness, combined with improved molecular diagnostics and rapid testing technologies, has cemented this segment's market dominance. The large-scale use of point-of-care (POC) testing and home-based diagnostic kits has also helped it continue to grow.

In contrast, the Complete Blood Count (CBC) segment is anticipated to be the clinical diagnostics market's fastest-growing throughout the forecast period. CBC testing is a component of standard medical check-ups and helps in diagnosing and tracking a broad variety of conditions such as infections, anemia, and blood diseases. The growing incidence of chronic conditions, the increasing geriatric population, and increasing awareness about preventive healthcare are some of the primary drivers for the growth in demand for CBC testing. Additionally, development in automated hematology analyzers and artificial intelligence-based diagnostic solutions is improving test efficiency and precision, further boosting the growth of the segment. With its imperative position in everyday and emergency care facilities, CBC testing is anticipated to see ongoing growth in the future.

By Product

The reagents segment led the clinical diagnostics market in 2023 with the highest market share and highest overall market revenue. This is supported by the intrinsic role of reagents in virtually all diagnostic tests. Reagents are instrumental in facilitating chemical reactions that are fundamental to the identification of diseases, the quantitation of biomarkers, and everyday tests like urine and blood analyses. Because of their repeated application in different diagnostic procedures, reagents are a must-have in clinical laboratories, hospitals, and diagnostic centers. Their sustained demand is driven by the increasing number of diagnostic tests performed worldwide, especially in the aftermath of heightened awareness of health issues and the increased emphasis on preventive care.

The Instruments segment is likely to witness the most rapid growth in the years to come. This expansion is attributed to continuous innovations in diagnostic technology, such as the creation of automated systems, AI-driven diagnostic equipment, and advanced testing instruments. These advancements are enhancing the speed, accuracy, and efficiency of diagnostic procedures, fueling their use in hospital and point-of-care applications. With healthcare providers looking to streamline operations, minimize human error, and improve patient care, demand for state-of-the-art diagnostic equipment is likely to grow. This trend is expected to further fuel the growth of the instruments segment, which will emerge as the fastest-growing segment in the clinical diagnostics market.

By End User

Hospital Laboratory in 2023 led the market for clinical diagnostics, holding a large share of the market because they play a vital role in performing a large number of diagnostic tests. Hospitals usually have established infrastructure, such as advanced diagnostic equipment and qualified staff, which makes them the central point for a large variety of diagnostic services. The large patient pool and the intricacy of tests conducted in hospitals are added factors to the market dominance of hospital laboratories. The segment is supported by the continued need for routine and specialty diagnostic tests, thus making it a focal point in the clinical diagnostics market.

In contrast, the Point-of-Care Testing (POCT) segment is poised to witness the most rapid expansion in the coming future. This is fueled by the growing demand for immediate, on-site testing, which enables quicker diagnosis and treatment planning, especially in emergency cases. The efficiency and convenience of POCT are improving patient care, minimizing waiting times, and making it more accessible, particularly in rural or underprivileged communities. Moreover, POCT technology has evolved to be more advanced, providing more precise and reliable test results for many medical conditions. With healthcare systems working towards relieving the pressure on centralized laboratories and delivering better patient outcomes, the point-of-care testing market is destined to grow very rapidly and continue molding the future of clinical diagnostics.

Clinical Diagnostics Market Regional Insights:

North America led the market with the highest share in 2023 and most developed, led by a well-established healthcare infrastructure, increased healthcare expenditure, and a huge focus on research and development. The United States, specifically, led the region owing to its extensive use of advanced diagnostic technologies, such as molecular diagnostics and point-of-care testing. The rising incidence of chronic and infectious diseases, coupled with the demand for personalized medicine, also fueled the growth of the market. Moreover, government programs, including the Affordable Care Act, expanded access to healthcare services, which helped drive diagnostic testing. North America's market expansion was also fueled by a large number of diagnostic product launches and partnerships among major industry players.

In Asia Pacific, the clinical diagnostics market is growing at a fast pace with the development of better healthcare infrastructure, rising government expenditure on healthcare, and growing awareness regarding early detection of diseases. China, India, and Japan are witnessing tremendous growth in the adoption of diagnostic technology, with a trend towards molecular and genetic testing. The growth in Asia Pacific's healthcare market is fueled by the aging population, chronic disease incidence, and the need for point-of-care solutions. In addition, increased disposable incomes and improved access to healthcare in emerging markets are also fueling demand for diagnostics. Consequently, the region is expected to experience one of the fastest growth rates in the clinical diagnostics market over the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players and Their Offering Products:

-

Abbott – Architect, Alinity

-

bioMérieux SA – VITEK 2, VIDAS

-

QuidelOrtho Corporation – Sofia, QuickVue

-

Siemens Healthineers AG – ADVIA, Atellica

-

Bio-Rad Laboratories, Inc. – Unity, Droplet Digital PCR

-

Qiagen – QIAamp, Rotor-Gene

-

Sysmex Corporation – Sysmex XN-series, HemoCue

-

Charles River Laboratories – In Vitro Diagnostic Testing Solutions

-

Quest Diagnostics Incorporated – Quest Diagnostics Lab Testing

-

Agilent Technologies, Inc. – Agilent SureSelect, Bioanalyzer

-

Danaher Corporation – Beckman Coulter, Cepheid

-

F. Hoffmann-La Roche Ltd. – Cobas, Elecsys

-

Thermo Fisher Scientific – Thermo Scientific, Ion Torrent

-

Becton, Dickinson and Company – BD Veritor, BD Vacutainer

Recent Developments:

-

In Dec 2024, Roche received CE mark approval for its cobas Mass Spec solution, featuring the cobas i 601 analyzer and Ionify reagent pack for steroid hormone assays. The solution will offer over 60 analytes, including tests for steroid hormones, vitamin D metabolites, and drugs of abuse.

-

In Nov 2024, Amprion was honored with the 2024 BioTech Breakthrough Award for 'Clinical Diagnostics Solution of the Year' for its innovative SAAmplify-ɑSYN assay, which helped in diagnosing various neurodegenerative conditions.

-

In Oct 2024, Eurofins Scientific announced an agreement to acquire SYNLAB’s clinical diagnostics operations in Spain. This acquisition, focused on expanding Eurofins' presence in specialized and molecular clinical diagnostics, is pending regulatory approval and is expected to close in 2025.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 79.06 billion |

|

Market Size by 2032 |

USD 127.80 Billion |

|

CAGR |

CAGR of 5.5% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Test [Lipid Panel, Liver Panel, Renal Panel, Complete Blood Count, Electrolyte Testing, Infectious Disease Testing, Other Tests] |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Cosmos Biomedical Ltd., Microm U.K. Ltd., CooperSurgical, Inc., FUJIFILM Irvine Scientific, Cryolab Ltd., Vitrolife AB, European Sperm Bank, Bloom IVF Centre, Merck KGaA, Ferring B.V., Hamilton Thorne, Inc., Nikon Corporation, Nidacon International AB, Laboratoire CCD, Esco Micro Pte. Ltd. |