Chrome Plating Market Report Scope & Overview:

Get E-PDF Sample Report on Chrome Plating Market - Request Sample Report

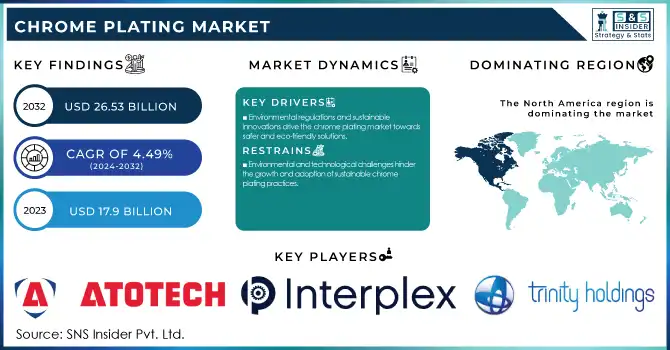

The Chrome Plating Market size was valued at USD 17.9 billion in 2023 and is expected to reach USD 26.53 billion by 2032, growing at a CAGR of 4.49% over the forecast period 2024-2032.

Rising demand for chrome-plated components in several prominent industries is envisaged to drive the chrome plating market growth over the next few years. In the automotive sector, chrome plating is widely utilized in bumpers, wheels, and trim, among others meaning some of the main sources of demand. Given the decorativeness of chrome platinizing in combination with durability and corrosion resistance, it contributes to the reliability of the installation of automotive components. With the growth of the automotive industry in developing countries and expansion in the scope of chrome-plated parts being used in automobiles, the chrome plating market is anticipated to grow over the forecast years. In addition, the performance characteristics of chrome plating, such as wear resistance and stability at high temperatures encourage growth in the aerospace and defense industry.

By 2024, the automotive industry is expected to manufacture more than 30 million vehicles per year, which will drive up the demand for chrome-plated parts such as bumpers, wheels, and trim. Aerospace and defense remain those with a long-standing requirement for chrome plating for high-performance components, such as landing gear, supported by national defense budgets that approach USD 786 billion in 2024 in the U.S.

An industry mainly focused on chrome plating is manufacturing, construction, and electronics because of its various surface properties, improving hardness, reducing friction, and applying corrosion resistance. Such properties are critical for industrial machinery components, tools, and consumer electronics. With the growth of industrial automation and an increasing demand for specialty materials, chrome plating will remain an essential process for maintaining long-lasting durability and efficiency. Moreover, the increasing use of decorative chrome plating in consumer goods and textile-based products further accelerates the growth of the market.

Chrome Plating Market Dynamics

Key Drivers:

-

Environmental regulations and sustainable innovations drive the chrome plating market towards safer and eco-friendly solutions.

Improvement of chrome plating technologies due to the increasing pressure of industry to become more environmentally friendly. Existing chrome plating has long been vilified for being loaded with toxic stuff, although technology has undergone major advancements since the advent of “green” or trivalent chrome plating, which is far less toxic than the traditional hexavalent chrome. These are not only increasingly environmentally safe innovations but also comply with stringent international environment specs and caps like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and EPA (Environmental Protection Agency). The demand for these environmentally beneficial plating techniques as well as coatings is mainly driven by automotive, aerospace, and manufacturing industries wishing to adhere to environmental regulations whilst offering quality products. With the rise of environmental rules, there has been a growing trend towards trivalent chrome plating. For Instance, California, will ban hexavalent chromium in decorative plating by 2027 and in aerospace by 2039. While this move increases chemical costs by USD 1,000 per week, it represents a drastic decrease in the impact on the environment. Hexavalent chrome emissions are 500 times deadlier than diesel fumes, and this has been a significant driving factor in industries switching to safer options.

-

Rising industrialization and urbanization in developing regions drive the growing demand for chrome plating applications.

The rapid urbanization in Asia-Pacific, Latin America, and the Middle East has significantly driven the demand for infrastructural or industrial applications, thereby raising the requirement for durable and high-quality materials. The chrome-plated layer delivers key characteristics such as hardness, wear resistance, and corrosion protection, justifying its common use in heavy equipment, construction equipments, and industrial tools. With the growth in manufacturing capabilities in these regions wherein chrome plays a pivotal role in enhancing the lifespan and efficiency of equipment, this trend is supporting the growth of the industry further. This is another factor that is propelling the chrome plating market due to the increase in industrialization and urbanization in this part of the globe, which is expected to be the primary growth factor of the market in the coming years. Rapid industrial growth in the developing regions is propelling the chrome plating market. Infrastructure investments are projected to reach USD 16 trillion by 2030, with the Asia-Pacific construction sector growing at 7-8% per year. For instance, the industrial growth rate is forecasted to be 5.9% annually through 2028 in India, and 6.5% in Vietnam. The Middle East is pouring USD 2 trillion into infrastructure, led by objectives such as Saudi Vision 2030.

Restrain:

-

Environmental and technological challenges hinder the growth and adoption of sustainable chrome plating practices.

Traditional chrome plating techniques, especially by using hexavalent chromium, are dangerous to health and the environment. Hexavalent chromium is toxic, resulting in increased regulations and expensive waste retention systems. Although the industry is migrating towards more environmentally friendly solutions, the market growth is being hindered by the problem relating to effective management of environmental risks. Limited resources of skilled labor and advanced technologies for chrome plating are different challenges. In some areas, chrome plating is a manual process so a lack of skilled labor means that lead times may also be affected. Although promising technologies such as trivalent chromium and automated plating systems are on the rise, many of them involve a higher upfront cost that smaller firms may be unable to afford. This slows the rate at which the industry can adopt more sustainable practices.

Chrome Plating Market Segments Analysis

By Type

In 2023, Decorative Chrome Plating accounted for a 68% market share, driven by applications majorly, in automotive, consumer goods, and fashion. Decorative chrome plating is important because it gives some products a shiny, mirror-like finish and corrosion resistance to various products. It is often used in automotive trim, jewelry, appliances, and home decor, where aesthetics is everything. Decorative chrome plating remains an area of high demand, especially in consumer-led sectors such as automotive, electronics, and luxury goods.

Hard Chrome Plating is expected to grow fastest on CAGR during the period 2024-2032. Hard chrome plating finds application in many industrial machinery, aerospace, automotive engines, and heavy-duty equipment components that are under high stress and need to resist abrasion and corrosion. There is an increasing demand for hard chrome plating as industries such as manufacturing, aerospace, and automotive push for parts that are more durable and efficient. Further growth is further aided by technological advances in hard chrome plating processes trivalent chromium alternatives and increasingly ‘green’ processes. Over the forecast years, the rising focus and demand for high-performance, durable components, and machinery will positively boost the hard chrome plating market.

By Application

In 2023, the Automotive industry held a market share of 43% in the chrome plating market. This explains the overwhelming dominance of chrome plating for functional and decorative automotive propulsion applications. A chrome plate adds a shiny, long-lasting finish that makes parts such as bumpers, grills, wheels, door handles, and trim pieces more attractive on cars. Chrome plating not only looks good but provides valuable protective capabilities like resistance to corrosion, wear, and scratching which is essential for all parts in a harsh environment. With increasing demand for luxury as well as mass-market vehicles, the activity in the automotive sector remains lucrative across North America, Europe, and Asia-Pacific regions. In addition, the adoption of vehicle customization and the requirement for performance-enhancing automotive parts for racing and commercial vehicles continue to sustain the need for such components with chrome plating.

Metal Finishing is expected to be the fastest-growing CAGR during 2024-2032. The growth is mainly attributed to the rising requirement for engineered, long-lasting components in multiple industries such as electronics, aeronautics, fabrication, and construction. Chrome plating is an important metal finishing process, as it increases the hardness of metal surfaces, reduces friction, and offers excellent protection against corrosion. With manufacturing and heavy machinery industries expanding, and an ever-greater demand for stiff, static components that can resist wear and tear, chrome-plating becomes an essentially critical process for machinery and equipment components and many others. Moreover, the increasing automation of manufacturing processes and the ongoing demand for high-precision components have made metal finishing more critical than ever. It performs better, with fewer maintenance costs, therefore increasing the life of machine parts, tools, or components chrome plating. In addition to this, due to rapid industrialization, urbanization, and developing economies, metal-finishing applications will be the fastest-growing segment in the chrome plating market.

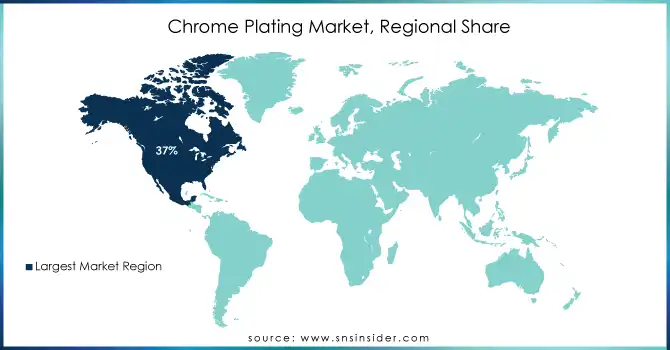

Chrome Plating Market Regional Overview

In 2023, North America accounted for 37% share, dominating the chrome plating market. This is partly due to the presence of major sectors like automotive, aerospace, and manufacturing that utilize chrome plating which is essential. For example, the US continues to be the single largest market for automobile chrome-plated parts, and manufacturers such as General Motors, Ford, and Chrysler extensively use chrome plating to finish vehicle components such as bumpers, grills, and wheels.

North America, due to its aerospace industry around Boeing and Lockheed Martin, the aerospace industry shows a significant dependency on chrome plating as they are durable and corrosion-resistant -this characteristic makes a chrome plating surface especially attractive considering that they frequently are used in critical aerospace components- North America is a stronghold for the market, as the high-quality standards and regulations and strong industrial base of the region help in continuing the high share of North America in the global market.

Asia Pacific would acquire the fastest growing CAGR during 2024-2032 owing to rapid industrialization, urbanization, and considerable growth of the manufacturing and automotive sectors. Take, for example, China and India, which are experiencing huge growth in vehicle production and demand. China is the world's largest automotive market and chrome plating demand can be attributed to the automotive market, especially for vehicle parts like Chrome trims and bumpers.

India is witnessing exponential growth in its automotive sector by manufacturers such as Tata Motors and Mahindra & Mahindra, driving demand for chrome-plated components. Apart from automotive, manufacturing, and industrial sectors countries such as South Korea and Japan also act as a strong bargain where chrome plating ensures better functioning and endurance of the tools, machinery, and components. The Asia Pacific chrome plating market is growing rapidly as the region witnesses an increasing industrial base, consumption of several commodity components of quality products, and capabilities of production in countries such as China, India, and Japan.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

Some of the major players in the Chrome Plating Market are:

-

J and N Metal Products (US) (Hard Chrome Coating, Wear-Resistant Coating)

-

AI ASHRAFI Group (Decorative Chrome Plating, Anti-Corrosion Coating)

-

Sharretts Plating (Electroless Nickel Chrome, Trivalent Chrome Coating)

-

Al Asriah Metal Coating L.L.C. (Decorative Chrome Plating, Metal Protective Coating)

-

Peninsula Metal Finishing (US) (Decorative Chrome Coating, Zinc-Nickel Chrome Plating)

-

Pioneer Metal Finishing (Hard Chrome Plating, Anodizing Coating)

-

Allied Finishing (Decorative Chrome Coating, Automotive Chrome Plating)

-

Atotech Deutschl (Germany) (Trivalent Chrome Plating, Functional Chrome Plating)

-

Interplex Industries (Decorative Chrome Plating, High-Precision Chrome Coating)

-

Kuntz Electroplating (Automotive Chrome Plating, Heavy Equipment Chrome Coating)

-

Trinity Holdings (Industrial Chrome Plating, Custom Chrome Coatings)

-

Roy Metal Finishing (Automotive Chrome Coating, Aerospace Chrome Coating)

-

Bajaj Electroplaters (Decorative Chrome Coating, Industrial Chrome Coating)

-

Al Wadi Metal (Decorative Chrome Coating, Anti-Corrosion Coating)

-

Certified Metal Finishing Inc. (Precision Chrome Coating, Trivalent Chrome Plating)

-

Milwaukee Plating Company (Decorative Chrome Plating, Aerospace Chrome Coating)

-

Multi-Flex Plating (Functional Chrome Coating, Zinc-Nickel Chrome Coating)

-

Ultra Plating Corp. (Automotive Chrome Plating, Industrial Hard Chrome)

-

Alcaro & Alcaro Plating Co. Inc. (Decorative Chrome Coating, Precision Chrome Coating)

-

ChromeTech Coatings (Laser-Assisted Chrome Plating, Pulse Chrome Coating)

Some of the Raw Material Suppliers for companies:

-

Elementis

-

LANXESS

-

BASF

-

Dow Chemical

-

Evonik Industries

-

Merck Group

-

3M

-

Henkel

-

Clariant

-

Honeywell

RECENT TRENDS

-

In October 2023, Interplex launched Ennovi, a new business focused on providing advanced electrification solutions for electric vehicles, including battery, power, and signal interconnect systems.

-

In October 2023, Atotech showcased its innovative surface finishing solutions at Surface Finishing Mexico 2023, focusing on eco-friendly zinc, zinc-nickel, and electroless nickel plating.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 17.9 Billion |

| Market Size by 2032 | USD 26.53 Billion |

| CAGR | CAGR of 4.49% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hard Chrome Plating, Decorative Chrome Plating) • By Application (Automotive, Aerospace & Defense, Metal Finishing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | J & N Metal Products, AI ASHRAFI Group, Sharretts Plating, Al Asriah Metal Coating L.L.C., Peninsula Metal Finishing, Pioneer Metal Finishing, Allied Finishing, Atotech Deutschland, Interplex Industries, Kuntz Electroplating, Trinity Holdings, Roy Metal Finishing, Bajaj Electroplaters, Al Wadi Metal, Certified Metal Finishing Inc., Milwaukee Plating Company, Multi-Flex Plating, Ultra Plating Corp., Alcaro & Alcaro Plating Co. Inc., ChromeTech Coatings. |

| Key Drivers | • Environmental regulations and sustainable innovations drive the chrome plating market towards safer and eco-friendly solutions. • Rising industrialization and urbanization in developing regions drive the growing demand for chrome plating applications. |

| Restraints | • Environmental and technological challenges hinder the growth and adoption of sustainable chrome plating practices. |