Chlorine Dioxide Market Report Scope & Overview:

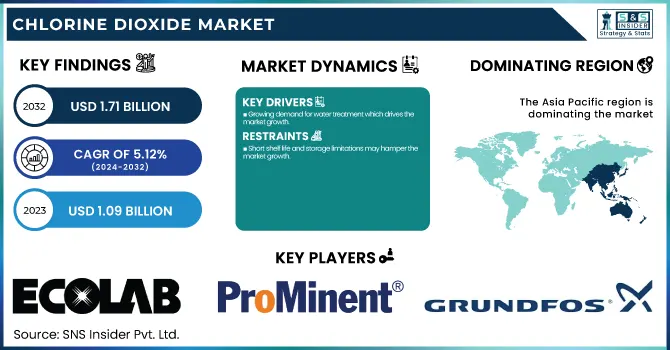

The Chlorine Dioxide Market size was USD 1.09 Billion in 2023 and is expected to reach USD 1.71 Billion by 2032 and grow at a CAGR of 5.12 % over the forecast period of 2024-2032. The chlorine dioxide market report provides a comprehensive analysis of production capacity and utilization by country, highlighting key manufacturing hubs and industry efficiency. It examines feedstock price trends, regulatory impacts across major regions, and environmental metrics, including emissions and waste management practices. The report also explores innovation in chlorine dioxide generation, R&D advancements, and emerging sustainability initiatives. Additionally, it assesses the adoption of digital monitoring and automation technologies, offering insights into efficiency improvements and regulatory adherence. This report delivers precise, data-driven insights to help stakeholders navigate market dynamics effectively.

To Get more information onChlorine Dioxide Market - Request Free Sample Report

Chlorine Dioxide Market Dynamics

Drivers

-

Growing demand for water treatment which drives the market growth.

One of the major factors shifting the demand for chlorine dioxide market is the increasing requirement of water treatment. The growing prevalence of waterborne illnesses, the rise of industrial effluents, and the depletion of freshwater resources have created an urgent need for effective water disinfection solutions. Chlorine dioxide is a common addition to municipal water treatment plants due to its strong disinfection properties in eliminating bacteria, viruses, and protozoa while not producing harmful disinfection byproducts such as trihalomethanes (THMs). Furthermore, high-purity water is required in industries such as pharmaceuticals, food & beverage, and power generation, which also enhances the demand for chlorine dioxide in industrial water treatment applications. Agencies like the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) are also implementing increasingly stringent regulations, again driving the use of chlorine dioxide as a safer alternative to conventional chlorine disinfectants. As the world population grows and urbanization increases so does the demand for safe and clean water, fostering the growth of the global chlorine dioxide market.

Restraint

-

Short shelf life and storage limitations may hamper the market growth.

The limited shelf life and storage capabilities of chlorine dioxide are likely to restrict the market growth over the forecast period. Chlorine dioxide is the definition of an unstable disinfectant, making it impossible for its active state to be packaged and held in storage for safe, widespread use without losing potency over time, unlike traditional disinfectants like chlorine or hydrogen peroxide. They have to produce it at the site with equipment, which leads to high operating expenses and technical proficiency. This restriction provides less flexibility to those industries and municipalities where bulk use of disinfectant is required for efficient and speedy treatment of water and sanitization. Moreover, chlorine dioxide in a concentrated form is dangerous to transport, therefore limiting it from general public use. These aspects formulate logistical hurdles, especially in areas where the capacity for onsite generation is limited, henceforth delaying market growth.

Opportunity

-

Increasing use in the food & beverage industry creates an opportunity in the market.

Food manufacturers are now increasingly opting for chlorine dioxide as a reliable disinfectant due to the increasing concerns regarding food and its safety and strong stringent regulations imposed by agencies like the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). It has a broad application for sanitation of food processing equipment, surface disinfection, and microbial safety of food-related water. Chlorine dioxide does not create these harmful byproducts associated with traditional chlorine-based disinfectants, including trihalomethanes (THMs) and chloramines, making it a safer and more environmentally conscious alternative. Moreover, using it for washing fruit, vegetables, poultry, and seafood minimizes bacterial contamination, thus prolonging shelf life. The growing trend of packaged and processed food items and the increase in the beverage industry across the globe will increase the demand for effective and residue-free disinfectant solutions, thus creating lucrative opportunities for the market of chlorine dioxide.

Challenges

-

High Initial investment in on-site generation systems may create a challenge for the market.

This has traditional disinfectants can be stable with wide range and can be transported and used in bulk at different locations, chlorine dioxide a highly unstable material needs to be generated at the place of use requiring special personnel and infrastructure. On-site generation systems involve high initial investments for sophisticated dosing systems, reactors, and safety systems, limiting their applicability to small-scale industries, small-scale municipal water treatment plants with limited budgets, and the developing world. The financial burden is compounded further by the costs involved in training personnel, upkeep, and stringent regulatory compliance. Consequently, a lot of potential users choose to make use of other disinfecting techniques like chlorine or ultraviolet (UV) therapy depending on just cheaper expenditure and much easier treatment. Solving this problem will need technology development to enable affordable and scalable systems for chlorine dioxide generation that could be integrated into more types of industries.

Chlorine Dioxide Market Segmentation Analysis

By Form

The gas segment held the largest market share around 44% in 2023. They are extensively used in residential, commercial, and industrial construction. As one of the most important components of high-end performance paints and coatings, Chlorine Dioxide can be used to create durable, corrosion-resistant, and high-adhesion high-performance paints and coatings based on metal, concrete, wood surfaces, etc. As the demand for sustainable and durable coating continues to grow, the construction industry is also leveraging Chlorine Dioxide-based formulations to improve the performance life of buildings and civil infrastructure. Moreover, strict environmental regulations have driven the development of low-VOC and high-performance coatings, which in turn, is stimulating the need for Chlorine Dioxide.

By End User

Industrial held the largest market share around 35% in 2023. The industrial segment is the major market for chlorine dioxide as this product is extensively used in different applications such as water treatment, pulp & paper, oil & gas, food & beverage processing, and healthcare. In industrial applications, large-scale disinfection where chlorine dioxide is ideally suited due to its high efficiency, very limited cancerous byproduct production, and biofilm removal capability. Chlorine dioxide is commonly used to bleach pulp in the pulp & paper industry as it is a better alternative to conventional chlorine-based chemicals owing to its low environmental pollution potential. Likewise, its role in oil & gas industry is for pipeline disinfection, and against microbes in drilling fluids and water injection systems. Chlorine Dioxide is widely used in food & beverage industry, which includes surface disinfection, cleaning of equipment, and microbial control in processing facilities.

Chlorine Dioxide Market Regional Outlook

Asia Pacific held the largest market share around 42% in 2023. It is because of the growing industrialization, widening water treatment infrastructure, and increasing demand from major end-use industries such as pulp & paper, food & beverage, oil & gas, and healthcare. Due to rising concerns over high water pollution and government regulations surrounding the supply of clean water, countries such as China India, and Japan have made significant investments in municipal water treatment plants. On the flip side, the world's largest pulp & paper industry in China and Indonesia's high utilization of chlorine dioxide for bleaching applications will also boost the market growth. Growing food processing and healthcare sectors in the region have led to rapid expansion of the growing demand for effective disinfection and microbial control solutions. In addition, various government schemes supporting safe drinking water especially India-Jal Jeevan Mission and China-Five Year Plans for Water Conservation have been contributing to the usage of chlorine dioxide for municipal and industrial water treatment. Asia Pacific has also managed to dominate the chlorine dioxide market due to factors, such as the availability of cheap raw materials, an increase in population, urbanization, and stringent environmental regulations.

North America held a significant market share in 2023. It is due to stringent environmental and safety standards along with high consumption of chlorine dioxide for water treatment applications across the region coupled with robust industrial demand. This need for chlorine dioxide in municipal water treatment plants is also due to stringent water quality standards imposed by the U.S. Environmental Protection Agency (EPA) and the Canadian Environmental Protection Act (CEPA). Moreover, the booming food & beverage, pharmaceutical, and healthcare industries in the region need chlorine dioxide for disinfection, sterilization, and microbial control. The U.S. and Canada pulp & paper industry also holds a significant share of the market, as chlorine dioxide is extensively used as a bleaching agent. In addition, chlorine dioxide is used as a biofilm killer in pipelines and fracking in the U.S. oil & gas sector. Further boost to market growth has been given by rising waterborne diseases and biofilm contamination in industrial & commercial applications. North America continues to be one of the key regions in the global chlorine dioxide market due to the ever-evolving technology and is home to a few of the global key players who are investing in innovative systems for chlorine dioxide generation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Ecolab Inc. (OXON Chlorine Dioxide Generators, Purate Technology)

-

ProMinent GmbH (Bello Zon CDLb Chlorine Dioxide System, Chlorine Dioxide Generator CDV)

-

Grundfos Holding A/S (Oxiperm Pro Chlorine Dioxide Generator, Selcoperm Electrochlorination Systems)

-

Evoqua Water Technologies LLC (DIOX Chlorine Dioxide Generators, Millennium III Chlorine Dioxide Generators)

-

The Chemours Company (Vanchem Chlorine Dioxide, Anthium Dioxide)

-

CDG Environmental LLC (ClO2 Chlorine Dioxide Generators, ClO2 Precursor Chemicals)

-

The Sabre Companies LLC (Sabre Oxidant Solutions, Sabre Chlorine Dioxide Generators)

-

AquaPulse Systems (AquaPulse Chlorine Dioxide Generators, AquaPulse Disinfection Systems)

-

TECME SRL (Tecme Chlorine Dioxide Generators, Tecme Disinfection Systems)

-

Accepta Ltd. (Accepta 8501 Chlorine Dioxide Solution, Accepta 8601 Chlorine Dioxide Tablets)

-

Scotmas Group (Scotmas Chlorine Dioxide Generators, Scotmas Aquadose Systems)

-

Bio-Cide International (Oxine Chlorine Dioxide, MB-10 Tablets)

-

Dioxide Pacific (Dioxide Pacific Chlorine Dioxide Generators, Dioxide Pacific Precursor Chemicals)

-

HES Water Engineers (India) Pvt. Ltd. (HES Chlorine Dioxide Generators, HES Water Treatment Systems)

-

Superior Plus Corp. (Superior Chlorine Dioxide Solutions, Superior Disinfection Systems)

-

Iotronic Elektrogerätebau GmbH (Iotronic Chlorine Dioxide Generators, Iotronic Dosing Systems)

-

Vasu Chemicals LLP (Vasu Chlorine Dioxide Generators, Vasu Water Treatment Chemicals)

-

LANXESS AG (LANXESS Chlorine Dioxide Solutions, LANXESS Disinfection Products)

-

BASF SE (BASF Chlorine Dioxide Solutions, BASF Water Treatment Chemicals)

-

Tristel (Tristel Fuse for Surfaces, Tristel Duo for Ultrasound)

Recent Development:

-

In 2024, Ecolab expanded its portfolio by introducing a new line of chlorine dioxide-based disinfectants tailored for the food and beverage industry, enhancing microbial control in processing environments.

-

In 2024, ProMinent launched the upgraded Bello Zon CDLb Chlorine Dioxide System, featuring enhanced safety protocols and real-time monitoring capabilities for municipal water treatment applications.

-

In 2024, Evoqua introduced the DIOX-3000 series, a new range of chlorine dioxide generators optimized for large-scale wastewater treatment, offering higher output and improved automation features.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.09 Billion |

| Market Size by 2032 | USD 1.71 Billion |

| CAGR | CAGR of 5.12% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form (Gas, Liquid, Solid), • By End-User (Paper & Pulp, Industrial, Food & Beverages, Oil & Gas, Medical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ecolab Inc., ProMinent GmbH, Grundfos Holding A/S, Evoqua Water Technologies LLC, The Chemours Company, CDG Environmental LLC, The Sabre Companies LLC, AquaPulse Systems, TECME SRL, Accepta Ltd., Scotmas Group, Bio-Cide International, Dioxide Pacific, HES Water Engineers (India) Pvt. Ltd., Superior Plus Corp., Iotronic Elektrogerätebau GmbH, Vasu Chemicals LLP, LANXESS AG, BASF SE, Tristel. |