Get More Information on Chlor-Alkali Market - Request Sample Report

The Chlor-Alkali Market size was valued at USD 62.33 Billion in 2023. It is estimated to reach USD 81.33 Billion by 2032, growing at a CAGR of 3.03% during 2024-2032.

The chlor-alkali market is a critical segment of the chemical industry, focusing primarily on the production of chlorine, sodium hydroxide (commonly known as caustic soda), and soda ash. The chlor-alkali process has extensive applications across multiple industries, underscoring its importance for economic growth and daily life. Chlorine is a highly versatile chemical widely used in the production of disinfectants, water treatment solutions, and a diverse range of organic and inorganic chemicals. Data extracted from 46 intervention groups revealed significant variability in the adoption of point-of-use (POU) chlorine products, a key application of chlor-alkali technology. The studies indicated a lack of consensus on how to define household water treatment adoption, though the most common indicator was the proportion of stored water samples with free chlorine residual levels exceeding 0.1 or 0.2 mg/L. Adoption rates for chlorine POU products varied widely, ranging from 1.5% to 100%. The sample size-weighted median adoption rate was 47%, while the unweighted median was slightly higher at 58%.

The growth of the chlor-alkali market is primarily driven by the rising demand for chlorine and caustic soda across various end-use industries. The water treatment sector is a major consumer of chlorine, essential for ensuring safe drinking water by eliminating harmful pathogens. The construction and building materials industry also heavily relies on chlor-alkali products, particularly in glass manufacturing, which is experiencing increased demand due to urbanization and infrastructure development. Moreover, the pulp and paper industry utilize chlorine and sodium hydroxide for bleaching processes, improving the quality of paper products. The ongoing expansion of the chemical industry, particularly in emerging economies, further boosts the demand for chlor-alkali products. As industries continue to grow, the need for effective chemical solutions intensifies, reinforcing the significance of the chlor-alkali market.

Drivers

High demand from chemical manufacturing for chlorine and caustic soda fuels the market growth.

The chemical manufacturing sector has a high demand for chlorine and caustic soda, thereby driving growth in the chlor-alkali market. Chlorine is one of the primary raw materials required in manufacturing certain chemicals and products used in most of the applications across industries, particularly polyvinyl chloride (PVC). This is a common material used in construction industries for pipes, cables, and other equipment since it is durable and cost-effective. For instance, the growing global PVC market, influenced by increased urbanization and subsequent infrastructure development, goes in parallel with growing chlorine demand. Other chlorine applications include the preparation of end-use chemicals such as solvents, disinfectants, and a wide array of intermediates for the production of other chemicals like pharmaceuticals and agrochemicals—pointing out the huge significance of chlorine in the production of these chemicals. Apart from chlorine, caustic soda itself is rather essential in alumina extraction, paper and pulp manufacturing, and textile processing. With growing alumina demand due to increasing demand in the aluminum industry, wide increases in the consumption of caustic soda have been noted. Moreover, with the increasing demand for packaging materials, the advancement of the paper industry steadily raised the use of caustic soda due to its application in paper pulping and bleaching processes. The growth prospects of the chlor-alkali market are bright at the moment, with the chemical manufacturing sector constantly broadening its base and diversifying into newer areas of application, more so in emerging economies.

The chlor-alkali sector embraces sustainable innovations with membrane technology and renewable energy investment.

With a growing focus on sustainability, significant funds are being allocated to eco-friendly production methods in the Chlor-Alkali sector. As environmental laws become stricter globally, chlor-alkali companies are starting to implement sustainable measures to reduce their environmental impact and meet international standards. A significant advancement has been the substitution of mercury cell technology with membrane cell technology in chlorine production. These membrane cells provide an eco-friendlier and energy-saving option. It decreases mercury emissions by roughly 99% and energy consumption by 25-30%. This action is aligned with worldwide efforts to protect human health and the environment from mercury pollution as defined in the Minamata Convention. Moreover, companies are investing in renewable energy sources for their electrolysis operations, reducing both carbon footprints and operational expenses. For instance, European chlor-alkali producers are exploring the possibility of using sustainable electricity to reduce greenhouse gas emissions and comply with the environmental policy regulations of the European Union. The sector is working on green chemistry solutions to utilize saltwater instead of mined salt in producing chlor-alkali products, preserving resources and lessening environmental harm.

Restraints

Stringent environmental regulations, requiring costly technology upgrades.

One of the main limitations on the Chlor-Alkali Market is the strict environmental regulations, which require costly technology upgrades and adherence to rules. Efforts such as the Minamata Convention are pushing for a worldwide elimination of mercury cell technology, requiring expensive upgrades to more eco-friendly options like membrane cells. Legislation on water pollution and greenhouse gas emissions mandates manufacturers to adopt sophisticated emission control and wastewater treatment procedures. Although necessary for meeting regulations and environmental standards, enhancements in these specific areas can lead to higher operational expenses and create a financial burden, particularly for smaller businesses with restricted funding. As a result, this will affect the company's profits and present various obstacles for market competitors in maintaining competitive prices due to ongoing investments in compliance technologies.

By Product

Caustic Soda, also known as sodium hydroxide, held a major market share of over 48% in 2023. Its wide application in chemical manufacturing, pulp and paper processing, and water treatment makes it integral to various industries. Its important role in the production of detergents, soaps, and rayon is due to its high alkaline nature. Big corporations such as Olin Corporation and Occidental Chemical Corporation depend on caustic soda for their chemical processing requirements in large-scale operations. Caustic Soda continues to be dominant due to its strong demand in various industries such as textiles and aluminum, supported by widespread industrial dependence and diverse uses.

Chlorine segment is expected to the fastest-growing during 2024-2032 due to the increasing demand in pharmaceuticals, water disinfection, and PVC production. The disinfectant qualities are crucial in water treatment plants, and its application in PVC manufacturing aids in the expansion of the construction and automotive industries. Westlake Chemical Corporation and Formosa Plastics Corporation utilize chlorine to manufacture polyvinyl chloride (PVC) for long-lasting and eco-friendly construction materials. Chlorine's market is growing rapidly due to its expanding use in pharmaceuticals and public health, boosted by global advancements in health and infrastructure.

By Technology

Membrane cell dominated in 2023 with a 56% market share in the chlor-alkali market due to its energy efficiency and lower environmental impact. In contrast to the diaphragm and mercury techniques, membrane cells utilize ion-exchange membranes that only permit sodium ions to move across, successfully dividing chlorine and sodium hydroxide. This technology provides excellent purity in the final products and minimizes contamination, making it perfect for applications with strict quality requirements. Industries such as Dow Chemical and Olin Corporation utilize membrane cell technology for producing chlorine and caustic soda used in PVC manufacturing, water treatment, and chemical processing.

Diaphragm cell is anticipated to become the fastest-growing segment in the chlor-alkali market during 2024-2032. It utilizes a permeable membrane to divide the anode and cathode sections, allowing the creation of chlorine gas and caustic soda without requiring mercury. This technique requires less energy compared to methods using mercury, but usually results in less pure caustic soda because of the mixture of brine. Occidental Chemical Corporation and Tata Chemicals utilize diaphragm cell technology to fulfill needs in industries such as textiles, soap, and paper production, where caustic soda and chlorine are vital.

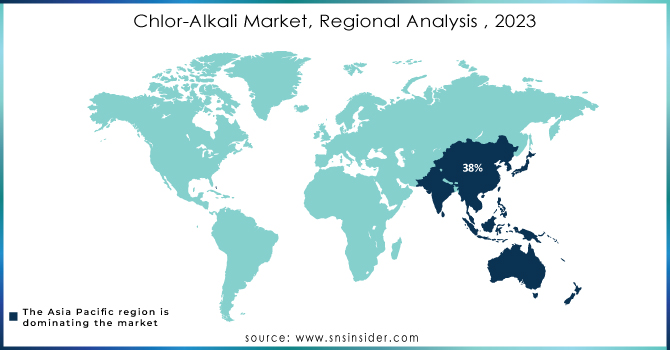

In 2023, the Asia-Pacific region dominated the market with a share of 55% in the, owing to the rapidly growing consumer base, the rising middle class, and high demand for new innovative flavors and fragrances. High population growth, coupled with economic development in this region, results in increased disposable income and thereby fuels higher consumption of processed foods and beverages, personal care, and other FMCG products. For instance, countries like China and India have consumed large volumes of flavored beverages and snacks, thus largely contributing to regional dominance. Growing demand for premium and customized fragrance products in emerging markets has also underpinned growth.

North America is anticipated to become the fastest-growing market during 2024-2032 because of its increasing use in water treatment, pulp and paper, and textiles industries. Heightened regulations for water quality and environmental control have increased the need for chlorine-based products. Occidental Petroleum Corporation and Olin Corporation have established a significant presence in this area, propelling growth through their emphasis on sustainable production methods. The increasing focus on environmentally friendly production technologies and advancements in chlor-alkali derivatives in North America is contributing to its role as a significant growth area, particularly due to the growing use of chlor-alkali products in energy storage applications.

Key Players

The key players in the Chlor-Alkali Market are:

Tata Chemicals Ltd (Sodium Carbonate, Caustic Soda)

Olin Corporation (Chlorine, Sodium Hydroxide)

Axiall Corporation (Chlorine, Caustic Soda)

Tronox Limited (Sodium Chloride, Sodium Hydroxide)

Solvay SA (Soda Ash, Caustic Soda)

Akzo Nobel NV (Chlorine, Sodium Bicarbonate)

Covestro AG (Chlorine, Polycarbonate)

Bayer AG (Chlorine, Sodium Hydroxide)

Xinjiang Zhongtai Chemical Co. Ltd (Caustic Soda, Chlorine)

Tosoh Corporation (Sodium Chloride, Caustic Soda)

Dow Chemical Company (Chlorine, Sodium Hydroxide)

Westlake Chemical Corporation (Caustic Soda, Chlorine)

Formosa Plastics Corporation (Chlorine, Sodium Hydroxide)

INOVYN (INEOS Group) (Chlorine, Sodium Hydroxide)

Chemical Company of Canada (Sodium Bicarbonate, Calcium Chloride)

KEM ONE (Chlorine, Caustic Soda)

SABIC (Chlorine, Sodium Hydroxide)

Shandong Jinling Chemical (Chlorine, Sodium Bicarbonate)

Koch Industries (Caustic Soda, Chlorine)

Nippon Soda Co., Ltd. (Sodium Hydroxide, Chlorine)

February 2024: INEOS Inovyn has developed a set of Ultra Low Carbon products, ULC Chlor-Alkali with emissions reductions up to 70%, setting new standards in sustainability powered by renewable energy.

April 2024: Nuberg EPC has commissioned largest Chlor-Alkali project of India for Mundra Petrochemical Ltd.(Adani Enterprises), fully NaOH based having149017230 TPD capacity.

Feb 2024: Launch of Ultra Low Carbon Chlor-Alkali range by INEOS Inovyn – 70% lower CO2 footprint.

November 2023: Brenntag has purchased Old World Specialty Chemicals and Old-World Logistics, adding distribution network access in North America along with additional terminal capabilities.

December 2023: Asahi Kasei announced that it will launch a demonstration trial in Europe for a rental service of chloralkali electrolysis cells with Nobian GmbH and LOGISTEED Europe B.V. With its headquarters located in the State of North Rhine-Westphalia, Germany, Nobian is one of the top chloralkali companies in Europe.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 62.33 Billion |

| Market Size by 2032 | US$ 81.33 Billion |

| CAGR | CAGR of 3.03% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Caustic soda, Soda ash, Chlorine) •By Production Process (Membrane cell process, Diaphragm cell process, Mercury cell process) •By Application (Organic chemicals, Food processing, Paper & pulp, Water treatment, Textiles, Soaps & detergents, Alumina, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Tata Chemicals Ltd, Olin Corporation, Axiall Corporation, Tronox Limited, Solvay SA, Akzo Nobel NV, Covestro AG, Bayer AG, Xinjiang Zhongtai Chemical Co. Ltd, Tosoh Corporation, and other players. |

| Key Drivers | •High demand from chemical manufacturing for chlorine and caustic soda •Focus on sustainability, driving investments in eco-friendly production processes. |

| RESTRAINTS | •Stringent environmental regulations, requiring costly technology upgrades. |

Ans: The Asia Pacific region dominated the Chlor-Alkali Market holding the largest market share of about 38% during the forecast period.

Ans: Stringent environmental regulations, requiring costly technology upgrades hamper the demand for the Chlor-Alkali market

Ans: Expansion projects like India's largest chlor-alkali facility by Nuberg EPC and increased focus on sustainable practices, creating demand for greener technologies are the driving factors that fuel the demand for the Chlor-Alkali market

Ans: Chlor-Alkali Market size was USD 54.9 billion in 2023 and is expected to reach USD 96.8 billion by 2032.

Ans. The Compound Annual Growth rate for the Chlor-Alkali Marketover the forecast period is 6.5%

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Chlor-Alkali Production Volume by Region

5.2 Consumption Patterns, by Region (2023)

5.3 Pricing Trends

5.4 Supply Chain Analysis

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Chlor-Alkali Market Segmentation, by Product

7.1 Chapter Overview

7.2 Caustic Soda

7.2.1 Caustic Soda Market Trends Analysis (2020-2032)

7.2.2 Caustic Soda Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Soda Ash

7.3.1 Soda Ash Market Trends Analysis (2020-2032)

7.3.2 Soda Ash Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Chlorine

7.4.1 Chlorine Market Trends Analysis (2020-2032)

7.4.2 Chlorine Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Chlor-Alkali Market Segmentation, by Technology

8.1 Chapter Overview

8.2 Membrane Cell

8.2.1 Membrane Cell Market Trends Analysis (2020-2032)

8.2.2 Membrane Cell Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Diaphragm Cell

8.3.1 Diaphragm Cell Market Trends Analysis (2020-2032)

8.3.2 Diaphragm Cell Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Others

8.4.1 Others Market Trends Analysis (2020-2032)

8.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Chlor-Alkali Market Segmentation, by Application

9.1 Chapter Overview

9.2 Chemical Manufacturing

9.2.1 Chemical Manufacturing Market Trends Analysis (2020-2032)

9.2.2 Chemical Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Pulp & Paper

9.3.1 Pulp & Paper Market Trends Analysis (2020-2032)

9.3.2 Pulp & Paper Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Textiles

9.4.1 Textiles Market Trends Analysis (2020-2032)

9.4.2 Textiles Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Metallurgy

9.5.1 Metallurgy Market Trends Analysis (2020-2032)

9.5.2 Metallurgy Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Construction

9.6.1 Construction Market Trends Analysis (2020-2032)

9.6.2 Construction Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Chlor-Alkali Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.4 North America Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.5 North America Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.6.2 USA Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.6.3 USA Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.7.2 Canada Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.7.3 Canada Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.2.8.2 Mexico Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.8.3 Mexico Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Chlor-Alkali Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.6.2 Poland Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.6.3 Poland Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.7.2 Romania Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.7.3 Romania Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Chlor-Alkali Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.4 Western Europe Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.5 Western Europe Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.6.2 Germany Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.6.3 Germany Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.7.2 France Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.7.3 France Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.8.2 UK Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.8.3 UK Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.9.2 Italy Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.9.3 Italy Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.10.2 Spain Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.10.3 Spain Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.13.2 Austria Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.13.3 Austria Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Chlor-Alkali Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.4 Asia Pacific Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.5 Asia Pacific Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.6.2 China Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.6.3 China Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.7.2 India Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.7.3 India Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.8.2 Japan Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.8.3 Japan Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.9.2 South Korea Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.9.3 South Korea Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.10.2 Vietnam Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.10.3 Vietnam Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.11.2 Singapore Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.11.3 Singapore Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.12.2 Australia Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.12.3 Australia Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Chlor-Alkali Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.4 Middle East Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.5 Middle East Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.6.2 UAE Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.6.3 UAE Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Chlor-Alkali Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.4 Africa Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.5 Africa Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Chlor-Alkali Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.4 Latin America Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.5 Latin America Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.6.2 Brazil Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.6.3 Brazil Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.7.2 Argentina Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.7.3 Argentina Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.8.2 Colombia Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.8.3 Colombia Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Chlor-Alkali Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Chlor-Alkali Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Chlor-Alkali Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Tata Chemicals Ltd

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Olin Corporation

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Axiall Corporation

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Tronox Limited

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Solvay SA

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Akzo Nobel NV

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Covestro AG

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Bayer AG

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Dow Chemical Company

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Westlake Chemical Corporation

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product

Caustic Soda

Soda Ash

Chlorine

By Technology

Membrane Cell

Diaphragm Cell

Others

By Application

Chemical Manufacturing

Pulp and Paper

Textiles

Metallurgy

Construction

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Sulfur Bentonite Market size was valued at USD 144.8 million in 2023. It is anticipated to reach USD 224.4 million by the year 2032 with a projected CAGR of 5.0% during the forecast period of 2024-2032.

The Blowing Agent Market Size was valued at USD 1.62 Billion in 2023 and is expected to reach USD 2.60 Billion by 2032, growing at a CAGR of 5.41% over the forecast period of 2024-2032.

Understand growth drivers, applications, and key players in the global fatty amines market, with insights into demand trends and industry forecasts.

The Acrylic Adhesives Market Size was valued at USD 14.4 billion in 2023 and is expected to reach USD 24.1 billion by 2032 and grow at a CAGR of 6.0% over the forecast period 2024-2032.

Composites Market Size was USD 104.6 Billion in 2023 and is expected to reach USD 231.2 Billion by 2032, growing at a CAGR of 9.2% from 2024 to 2032.

The Grinding Fluids Market Size was valued at USD 690.40 Million in 2023 and is expected to reach USD 954.36 Million by 2032, at a CAGR of 3.67% from 2024-2032.

Hi! Click one of our member below to chat on Phone