Chitosan Market Report Scope & Overview:

The Chitosan Market Size was valued at USD 12.7 billion in 2023 and is expected to reach USD 71.5 billion by 2032 and grow at a CAGR of 21.2% over the forecast period 2024-2032.

Get More Information on Chitosan Market - Request Sample Report

The chitosan market has witnessed significant growth due to increasing demand for sustainable and biodegradable materials across various industries. Chitosan, derived from chitin, is renowned for its biocompatibility, non-toxicity, and potential in food and pharmaceutical applications. Factors such as rising environmental concerns and regulatory pressures to reduce plastic usage have propelled interest in natural polymers like chitosan. As industries strive for sustainability, innovative applications of chitosan have emerged, reflecting its versatility and efficacy in various sectors, including textiles, food packaging, and agriculture.

In recent developments, a fire-retardant coating for wood has been created using chitosan and itaconate, enhancing fire safety while remaining eco-friendly. This innovative product addresses the growing demand for safer building materials and demonstrates the potential of chitosan to provide protective properties without harmful additives. The advancement highlights chitosan's role as a key ingredient in developing sustainable solutions that align with modern construction standards. The launch of this fire-retardant coating in September 2024 illustrates the ongoing trend of leveraging natural materials to meet stringent safety regulations while contributing to environmental sustainability.

Another notable innovation is the functionalization of chitosan to create a biobased flocculant, which enhances water treatment processes. This treatment, developed by Fraunhofer Gesellschaft in May 2024, has the potential to significantly improve the efficiency of wastewater treatment by promoting the aggregation of particles, making them easier to remove. This advancement is particularly important as industries and municipalities seek sustainable alternatives to conventional chemical flocculants, which can have negative environmental impacts. The focus on using chitosan for water treatment underscores its multifunctionality and aligns with global efforts to adopt eco-friendly solutions in industrial processes.

Cuantec, a leading firm in chitosan production, commenced operations in Scotland in May 2024, establishing a facility dedicated to producing high-quality chitosan for various applications. This strategic move not only enhances the local economy but also strengthens the supply chain for chitosan-based products. By increasing production capabilities, the company aims to meet the growing demand for chitosan in sectors such as cosmetics, agriculture, and food processing. The establishment of this production facility illustrates the rising interest in chitosan as a sustainable alternative in various industries, further highlighting its market potential.

Additionally, research published in August 2023 demonstrated the impact of chitosan on recycled paper's properties, showing that it significantly enhances packaging performance. This finding is crucial as the packaging industry seeks to improve the sustainability of materials while maintaining functionality. The incorporation of chitosan not only improves the barrier properties of recycled paper but also aligns with the industry's goals of reducing plastic waste. As manufacturers increasingly adopt environmentally friendly practices, the role of chitosan in enhancing the functionality of recycled materials is becoming more prominent, driving further research and development in this area.

The chitosan market is evolving rapidly, driven by innovations and a growing focus on sustainability. The versatility of chitosan across various applications, from enhancing fire safety in construction to improving water treatment and packaging properties, illustrates its potential to contribute significantly to environmental goals. As more companies invest in chitosan-based solutions, the market is poised for continued growth, responding to global demands for sustainable and biodegradable materials that meet regulatory standards and consumer preferences.

Chitosan Market Dynamics:

Drivers:

- Growing environmental awareness is driving demand for biodegradable materials, with consumers seeking eco-friendly alternatives to conventional plastics, thus boosting the chitosan market.

The growing awareness of environmental issues has led to an increased demand for biodegradable materials in various industries. Consumers are seeking eco-friendly alternatives to conventional plastic products, propelling the market for natural polymers like chitosan. The shift towards sustainability is influencing purchasing decisions across sectors such as packaging, agriculture, and cosmetics. Chitosan, a biopolymer derived from chitin, is biodegradable and offers an attractive alternative to synthetic polymers. As industries strive to minimize their environmental footprint, they are actively exploring the use of biodegradable materials for packaging solutions and product formulations. For instance, in the food sector, chitosan films and coatings are increasingly used for preserving food and enhancing shelf life, thus reducing food waste. Similarly, in agriculture, chitosan is gaining popularity as a natural pesticide and soil conditioner, helping to promote sustainable farming practices. This trend is further supported by regulatory changes aimed at reducing plastic waste, with many governments implementing bans on single-use plastics. The combination of consumer preference for eco-friendly products and government initiatives is driving significant growth in the chitosan market. As industries adapt to these changes, the demand for chitosan is expected to rise, fostering innovation and expansion across various applications.

- Chitosan's versatility has spurred innovations across industries, with companies creating new formulations and applications that enhance its market appeal and expand its usage.

The versatility of chitosan has led to numerous innovations across various industries. Companies are developing new formulations and applications, enhancing its market appeal and broadening its usage. Recent advancements in chitosan technology have unlocked new potential applications, particularly in healthcare, food, and environmental sectors. In the pharmaceutical industry, chitosan is increasingly used in drug delivery systems due to its biocompatibility and ability to enhance the bioavailability of drugs. Researchers are exploring its potential in targeted drug delivery and as a carrier for vaccines, making it an attractive choice for innovative healthcare solutions. Moreover, the food industry is seeing chitosan utilized as a natural preservative and functional ingredient that improves food safety and quality. Innovations like chitosan-based edible coatings are enhancing the freshness and shelf life of perishable products. Environmental applications are also on the rise, with chitosan being used in water treatment processes to remove contaminants effectively. Its ability to flocculate particles makes it an eco-friendly alternative to traditional chemical coagulants. These innovations not only enhance the functionality of chitosan but also contribute to its increasing demand as industries look for sustainable and effective solutions.

Restraint:

- Chitosan production relies on the availability and cost of chitin from crustacean shells, which can limit market growth.

The production of chitosan is heavily dependent on the availability and cost of raw materials, primarily chitin sourced from crustacean shells. This limitation can hinder market growth. Chitosan is derived from chitin, which is abundantly found in the shells of crustaceans such as shrimp and crabs. However, the supply of these raw materials can be inconsistent due to fluctuations in seafood production, environmental regulations, and sustainability concerns surrounding marine harvesting. As the seafood industry faces challenges such as overfishing and climate change, the availability of chitin may be further affected. This situation can lead to price volatility in chitosan production, making it difficult for manufacturers to maintain competitive pricing. Consequently, the high cost of chitosan can deter potential users in industries that are sensitive to price fluctuations, such as food packaging and agriculture. Additionally, companies may seek alternative materials that offer similar benefits without the associated costs, which could limit the growth of the chitosan market. Efforts to cultivate sustainable sources of chitin or explore alternative methods of production, such as utilizing fungi or agricultural waste, are being researched but have yet to become commercially viable. Until these challenges are addressed, the high cost and limited availability of raw materials remain significant restraints on the chitosan market.

Opportunity:

- The growing focus on sustainability presents a substantial opportunity for chitosan as industries pursue eco-friendly alternatives, likely fueling innovation and growth.

With increasing global emphasis on sustainability, there is a significant opportunity for chitosan as industries seek eco-friendly alternatives. This trend is expected to drive innovation and expansion. The global push towards sustainability presents a significant opportunity for chitosan-based products across various sectors. Governments and consumers are increasingly prioritizing environmentally friendly practices, which is encouraging companies to adopt more sustainable materials. In the packaging industry, for example, chitosan's biodegradable properties make it an attractive alternative to conventional plastics. As businesses face pressure to reduce their environmental impact, they are exploring chitosan for packaging solutions that meet consumer demand for sustainability. The agricultural sector is also recognizing the benefits of chitosan in promoting eco-friendly practices, such as organic farming and the reduction of chemical inputs. By leveraging its natural pest control and soil enhancement properties, farmers can adopt more sustainable methods that align with consumer preferences for organic produce. Furthermore, the cosmetics industry is beginning to integrate chitosan in formulations due to its natural origins and skin-friendly characteristics. As awareness of sustainability continues to grow, the demand for chitosan is likely to increase, providing ample opportunities for manufacturers to innovate and expand their product offerings.

Challenge:

- The chitosan market faces competition from the established synthetic polymer industry, which offers cost-effective alternatives, potentially limiting its growth.

The chitosan market faces challenges from the well-established synthetic polymer industry, which offers cost-effective and versatile materials. This competition may hinder the growth of chitosan in various applications. Synthetic polymers dominate many industries due to their low cost, high availability, and versatile properties. These materials, including polyethylene and polypropylene, are often favored for their performance characteristics and ease of processing. As a result, industries may be hesitant to switch to chitosan, especially when cost considerations are a priority. While chitosan has unique advantages, such as biodegradability and non-toxicity, its price and processing complexity can limit its adoption in price-sensitive applications. For example, in the packaging sector, companies may opt for cheaper synthetic options, which can offer similar performance without the environmental benefits of chitosan. Additionally, the widespread use of synthetic polymers in established supply chains and manufacturing processes can create barriers for chitosan to penetrate these markets. To overcome this challenge, manufacturers need to emphasize the long-term benefits of using chitosan, including its positive environmental impact and compliance with evolving regulations on plastic waste. By demonstrating the value of chitosan as a sustainable alternative, companies can enhance their competitiveness against synthetic polymers and expand their market share.

Chitosan Market Segmentation Outlook

By Grade

In 2023, the Food Grade segment dominated the chitosan market, holding an estimated market share of approximately 40%. This significant share can be attributed to the increasing demand for natural and biodegradable preservatives in the food industry. Food Grade chitosan is widely used for enhancing food safety, quality, and shelf life due to its antimicrobial properties. For instance, it is often incorporated into edible coatings for fruits and vegetables, helping to extend their freshness and reduce spoilage during transport and storage. Moreover, as consumer preferences shift towards clean-label products, manufacturers are increasingly turning to Food Grade chitosan as a natural alternative to synthetic preservatives, further driving its adoption in food processing and packaging applications. This growing trend underscores the pivotal role of Food Grade chitosan in meeting the industry's sustainability and safety standards.

By Source

In 2023, the Shrimp segment dominated the chitosan market, accounting for an estimated market share of approximately 55%. This predominance is largely due to the abundant availability of shrimp shells, which are a rich source of chitin, the primary raw material for chitosan production. The shrimp industry generates substantial amounts of waste in the form of shells, leading to a sustainable and cost-effective source for chitosan extraction. For example, several companies are leveraging shrimp shell waste to produce chitosan for various applications, including food preservation and biodegradable packaging. Additionally, the high demand for shrimp in global markets ensures a steady supply of this resource, further solidifying the Shrimp segment's leading position in the chitosan market. The growing focus on utilizing marine waste effectively for sustainable products has also contributed to the increased utilization of shrimp as a source for chitosan, aligning with the global push towards environmentally friendly practices.

By Application

In 2023, the Water Treatment segment dominated the chitosan market, holding an estimated market share of approximately 35%. This dominance can be attributed to chitosan's effective flocculating and coagulating properties, which make it an excellent choice for removing impurities from water and wastewater. Chitosan is increasingly used in municipal water treatment facilities as well as industrial processes to effectively reduce turbidity and contaminants. For instance, numerous studies have highlighted the successful application of chitosan in treating water contaminated with heavy metals and organic pollutants, significantly improving water quality. Additionally, its biodegradability and non-toxic nature further enhance its appeal over traditional chemical coagulants, aligning with the growing global emphasis on sustainable and environmentally friendly water treatment solutions. The rising awareness of water pollution and the need for cleaner water sources are driving the adoption of chitosan in this application, making it a key player in the water treatment industry.

Chitosan Market Regional Analysis

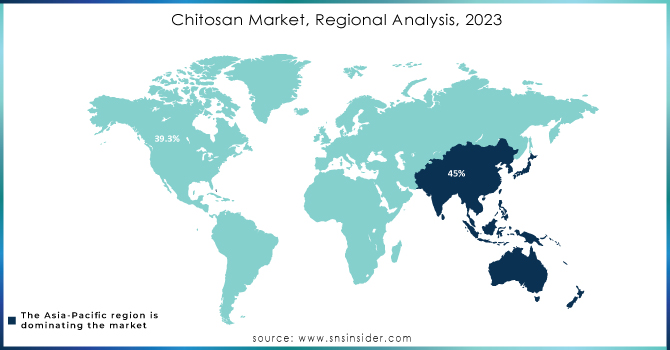

In 2023, the Asia-Pacific region dominated the chitosan market, holding an estimated market share of approximately 45%. This leadership is primarily driven by the high production and consumption of chitosan in countries like China, Japan, and India, where there is significant demand for applications in food preservation, water treatment, and agriculture. For instance, China has emerged as a major player in chitosan production, utilizing abundant shrimp and crab shell waste to extract chitosan for various industrial applications. Additionally, the region’s booming aquaculture industry has resulted in a continuous supply of raw materials, further supporting the growth of the chitosan market. The increasing awareness of environmental sustainability and the rising need for biodegradable alternatives in packaging and agricultural practices are also propelling the demand for chitosan in the Asia-Pacific region.

Moreover, in 2023, the North American region emerged as the fastest-growing area in the chitosan market, with a CAGR of around 12% during the forecast period. This rapid growth is driven by the increasing focus on sustainable and natural products in various sectors, including food, pharmaceuticals, and personal care. The rising trend of using biodegradable materials is leading to a higher demand for chitosan, particularly in applications such as food coatings and water treatment. For example, in the food industry, companies are increasingly adopting chitosan-based preservatives to meet consumer preferences for clean-label products. Moreover, regulatory pressures and initiatives aimed at reducing plastic waste are further motivating industries in North America to explore eco-friendly alternatives, contributing to the rapid growth of the chitosan market in the region.

Need any customization research on Chitosan Market - Enquiry Now

Key Players in Chitosan Market

-

Biothera (Biothera Chitosan, Biothera Chitosan Capsules)

-

Chitinor AS (Chitosan Powder, Chitosan Flakes)

-

FMC Corporation (ChitoClear, ChitoGluco)

-

Giant Biogene International Inc. (Giant Chitosan Powder, Chitosan Capsules)

-

Golden Shell Pharmaceutical Co., Ltd. (Chitosan Granules, Chitosan Tablets)

-

Hangzhou Dadi Biology Engineering Co., Ltd. (Chitosan Hydrochloride, Chitosan Oligosaccharides)

-

Heppe Medical Chitosan GmbH (Heppe Chitosan, Heppe Chitosan Derivatives)

-

KitoZyme S.A. (KitoZyme Chitosan, KitoZyme Chitosan Gel)

-

Meron Biopolymers (Meron Chitosan, Meron Chitosan Solution)

-

Taj Pharmaceuticals Ltd. (Taj Chitosan Tablets, Taj Chitosan Powder)

-

AquaChit (AquaChit Powder, AquaChit Granules)

-

Aldevron (Aldevron Chitosan, Aldevron Chitosan Solution)

-

Chitosan Solutions (Chitosan Solution, Chitosan Gel)

-

Kawasaki Kasei Chemicals Ltd. (Kawasaki Chitosan, Kawasaki Chitosan Fiber)

-

Nippon Chitin Chemical Co., Ltd. (Nippon Chitosan Powder, Nippon Chitosan Oligosaccharides)

-

Pioneer Industries (Pioneer Chitosan, Pioneer Chitosan Granules)

-

Primex EHF (Primex Chitosan, Primex Chitosan Flakes)

-

Sambavanam Agencies (Sambavanam Chitosan Powder, Sambavanam Chitosan Capsules)

-

Tianjin Daguangming Biological Products Co., Ltd. (Daguangming Chitosan, Daguangming Chitosan Oligosaccharides)

-

Zhangzhou City Sannong Chitosan Co., Ltd. (Sannong Chitosan Powder, Sannong Chitosan Capsules)

Recent Developments

July 2023: Axio Biosolutions Pvt. Ltd. received FDA 510(k) clearance for its Axiostat Gauze, a chitosan-based hemostatic product designed to control severe bleeding. CE certified and used by military forces worldwide, it employs advanced biomaterial technology.

May 2023: FMC Corporation partnered with Syngenta Crop Protection to launch a new weed control solution for rice, featuring the novel active ingredient Tetflupyrolimet developed by FMC.

March 2023: Meron Group launched new dessert premixes for the HoReCA sector, offering ready-to-use formulations and specialized blends.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 12.7 Billion |

| Market Size by 2032 | US$ 71.5 Billion |

| CAGR | CAGR of 21.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (Industrial Grade, Food Grade, Pharmaceutical Grade) •By Source (Shrimp, Squid, Crab, Krill, Others) •By Application (Water Treatment, Food & Beverages, Cosmetics, Medical & Pharmaceuticals, Agrochemicals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | KitoZyme S.A., FMC Corporation, Golden Shell Pharmaceutical Co., Ltd., Heppe Medical Chitosan GmbH, Chitinor AS, Meron Biopolymers, Taj Pharmaceuticals Ltd., Biothera, Hangzhou Dadi Biology Engineering Co., Ltd., Giant Biogene International Inc. and other key players |

| Key Drivers | • Growing environmental awareness is driving demand for biodegradable materials, with consumers seeking eco-friendly alternatives to conventional plastics, thus boosting the chitosan market • Chitosan's versatility has spurred innovations across industries, with companies creating new formulations and applications that enhance its market appeal and expand its usage |

| Restraints | • Chitosan production relies on the availability and cost of chitin from crustacean shells, which can limit market growth |