Child Resistant Packaging Market Key Insights:

Get More Information on Child Resistant Packaging Market - Request Sample Report

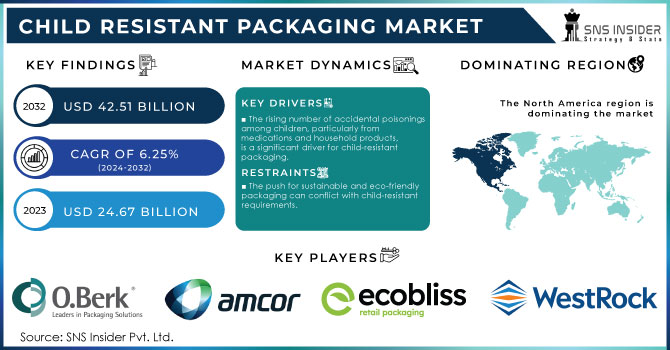

The Child Resistant Packaging Market Size was valued at USD 24.67 billion in 2023 and is expected to reach USD 42.51 billion by 2032 and grow at a CAGR of 6.25% over the forecast period 2024-2032.

Child-resistant packaging plays a critical role in preventing accidental poisonings and ensuring the safety of children in households. As per the Centers for Disease Control and Prevention (CDC), approximately 300 children aged 0-5 are treated in emergency departments every day due to unintentional poisonings, with many incidents involving medications and household products. This staggering statistic underscores the importance of effective packaging solutions designed to keep potentially harmful substances out of reach from curious young hands. The Consumer Product Safety Commission (CPSC) highlights that child-resistant packaging can significantly reduce the risk of these incidents, emphasizing the necessity for regulations that mandate child-resistant designs for various consumer products.

A key piece of legislation, the Poison Prevention Packaging Act of 1970, established requirements for child-resistant packaging in the United States. This legislation has led to a marked increase in the use of such packaging across industries, particularly for over-the-counter and prescription medications. The act mandates that products be packaged in a manner that is difficult for children to open but can still be managed by adults. A study published in the Journal of Pediatrics found that the effectiveness of child-resistant packaging can prevent around 85% of accidental poisonings. However, it is crucial to recognize that the design must also cater to adults, as many struggle with opening such packages. Research indicates that nearly 40% of adults find certain child-resistant packaging challenging, which could lead to improper medication storage or disposal.

The challenge of balancing child safety with adult accessibility has prompted further innovations in packaging design. The current trend is toward creating user-friendly child-resistant packaging that employs mechanisms allowing adults to open containers easily while remaining secure from children. The importance of compliance with packaging regulations is paramount, as countries with stringent rules on child-resistant packaging report up to a 70% reduction in pediatric poisoning incidents. This has catalyzed global manufacturers to prioritize safety in their packaging solutions.

In addition to safety, environmental considerations are also becoming a focal point in child-resistant packaging design. With approximately 30% of plastic packaging recycled in the United States, the environmental impact of non-recyclable child-resistant designs is raising concerns among consumers and manufacturers alike. The shift toward sustainable packaging solutions is critical, as companies aim to balance safety, functionality, and environmental responsibility.

The child-resistant packaging market is evolving, driven by consumer awareness and regulatory pressures. A study from the American Academy of Pediatrics indicates that while parents recognize the importance of child-resistant packaging, many do not always utilize it consistently. Approximately 66% of parents admit to not always using child-resistant containers for medications, pointing to an ongoing need for education and awareness campaigns.

Market Dynamics

Drivers

-

The rising number of accidental poisonings among children, particularly from medications and household products, is a significant driver for child-resistant packaging.

The increasing incidence of accidental poisonings among children is a critical driver for the demand for child-resistant packaging, especially concerning medications and household products. According to the Centers for Disease Control and Prevention (CDC), nearly 300 children aged 0-5 are treated in emergency rooms daily due to unintentional poisonings, highlighting the urgent need for effective safety measures. Many of these incidents involve easily accessible medications and toxic household chemicals, prompting manufacturers to prioritize the development of child-resistant packaging solutions. This packaging is designed to prevent young children from opening containers that may contain harmful substances, thereby significantly reducing the risk of ingestion and potential poisoning. Parents and caregivers are increasingly aware of these risks, leading to a growing demand for products that prioritize child safety. Additionally, regulatory requirements, such as the Poison Prevention Packaging Act, reinforce the necessity for such protective measures. By providing child-resistant packaging, manufacturers not only comply with legal mandates but also cater to the rising consumer preference for safety features in products. This trend is expected to continue, driving innovation and growth within the child-resistant packaging market.

-

The growth of online shopping and home delivery services has increased the need for child-resistant packaging

The growth of online shopping and home delivery services has significantly heightened the need for child-resistant packaging, as more products are shipped directly to consumers’ homes. With the convenience of e-commerce, parents often receive medications, cleaning supplies, and other household items without the immediate oversight that in-store shopping provides. This shift in purchasing behavior increases the likelihood of children accessing potentially harmful substances, making effective child-resistant packaging essential for preventing accidental poisonings. Studies show that children are naturally curious, and items that are readily available can pose serious safety risks. As a result, manufacturers are under increasing pressure to develop packaging solutions that are not only secure but also compliant with safety regulations like the Poison Prevention Packaging Act. Additionally, consumer awareness of safety features in packaging has risen, prompting families to seek out products that prioritize child safety. By implementing child-resistant designs, companies can reassure parents and caregivers that their products are safe, thereby boosting consumer confidence in online shopping. As the e-commerce sector continues to expand, the demand for robust child-resistant packaging will likely grow, underscoring its vital role in ensuring household safety.

Restraints

-

The push for sustainable and eco-friendly packaging can conflict with child-resistant requirements.

The push for sustainable and eco-friendly packaging increasingly conflicts with the requirements for child-resistant packaging, creating significant challenges in the market. According to a report from the World Economic Forum, plastic waste has become a pressing environmental concern, with over 300 Billion tons of plastic produced annually, of which only 9% is recycled. This statistic underscores the impact of conventional packaging, including child-resistant designs, which often rely on materials that are not easily recyclable. Furthermore, a recent report from Greenpeace revealed that plastic recycling rates continue to decline, with only 5% of plastic waste recycled in the U.S. in 2021, exacerbating the plastic pollution crisis. This situation highlights the challenge for manufacturers who strive to meet the dual demands of child safety and environmental responsibility. While many consumers prefer sustainable packaging, the complex multi-material designs necessary for child-resistant features complicate recycling processes. This is particularly important as 70% of consumers now seek eco-friendly products, indicating a shift in purchasing behavior towards more sustainable options. However, child-resistant packaging often utilizes non-recyclable materials, leading to a conflict between safety and sustainability goals. As businesses work to align their practices with consumer preferences and regulatory pressures, finding solutions that satisfy both child safety and eco-friendly requirements remains a significant hurdle in the packaging industry.

Segmentation Analysis

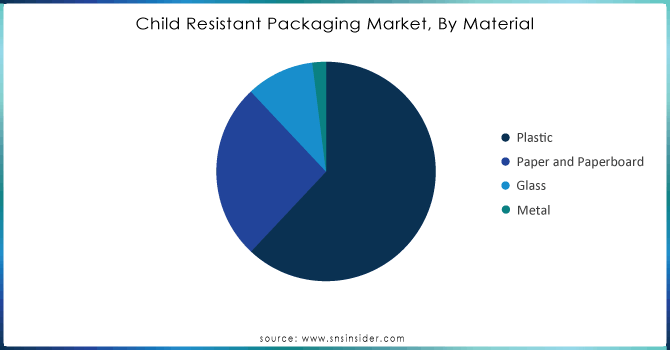

By Material

In the child-resistant packaging market, plastic dominates with a 62% revenue share in 2023, driven by several key factors. Its versatility and customization enable the creation of various child-resistant designs using materials like polyethylene (PE) and polypropylene (PP). Plastic is also cost-effective, allowing manufacturers to add safety features without raising prices significantly. Additionally, its lightweight and durable nature provides safety for households with children. Supported by regulatory bodies such as the U.S. Consumer Product Safety Commission (CPSC), plastic meets strict safety standards while catering to the growing demand for convenience in online shopping. Several companies have launched innovative child-resistant packaging solutions to cater to this growing market. For example, AptarGroup, a leader in dispensing and sealing solutions, recently introduced a new line of child-resistant closures designed for pharmaceutical applications. These closures feature a dual-action mechanism that requires simultaneous pushing and turning, ensuring that only adults can easily access the contents. Amcor, a global packaging company, launched a new range of child-resistant flexible pouches aimed at the cannabis industry. These pouches utilize sustainable materials while incorporating robust child-resistant features, addressing both safety and environmental concerns.

Need Any Customization Research On Child Resistant Packaging Market - Inquiry Now

By End User

In the child-resistant packaging market, the pharmaceutical sector accounted for around 55% of revenue in 2023, driven by several critical factors. Stringent safety regulations from bodies like the U.S. Food and Drug Administration (FDA) and the U.S. Consumer Product Safety Commission (CPSC) mandate child-resistant packaging for many medications, fueling demand for innovative solutions. The rise in accidental poisonings among children has heightened awareness and urgency for enhanced safety measures, prompting pharmaceutical companies to prioritize child-resistant designs. Additionally, ongoing technological advancements in packaging have led to the development of user-friendly options that are effective yet accessible for adults. The diversity of pharmaceutical products, including tablets, capsules, and liquids, necessitates customized child-resistant solutions tailored to various forms and delivery methods, further contributing to the sector’s dominance in the market. Overall, these elements underscore the pharmaceutical industry's critical role in driving growth within the child-resistant packaging market.

Regional Analysis

In 2023, North America emerged as the leading region in the child-resistant packaging market, capturing about 34% of global revenue. This significant share is driven by several key factors, including strict regulatory frameworks, increasing safety awareness, and ongoing innovation in packaging solutions. The region boasts some of the most comprehensive child safety regulations, particularly in the pharmaceutical and consumer goods sectors. Regulatory agencies like the U.S. Consumer Product Safety Commission (CPSC) enforce stringent requirements for child-resistant packaging, while the Food and Drug Administration (FDA) mandates such features for many prescription and over-the-counter medications, thereby fueling demand for compliant solutions. The rising incidents of accidental poisonings among children have heightened awareness around child safety, prompting manufacturers to prioritize child-resistant designs. Furthermore, North American companies lead the way in developing innovative, user-friendly packaging that balances safety and convenience. Advanced technologies, including smart closures and tamper-evident features, are increasingly popular, reflecting consumer demand for effective safety measures. Additionally, the diverse end-user segments, especially in pharmaceuticals, household products, and food and beverages, contribute to market growth, as does the surge in e-commerce and home delivery services that emphasize the need for secure packaging to protect children.

In 2023, the Asia-Pacific region emerged as the fastest-growing market for child-resistant packaging, driven by stringent regulatory standards, heightened awareness of child safety, and rapid industrialization. Countries like India, China, and Australia are enforcing stricter regulations to reduce accidental poisonings, prompting manufacturers to adopt compliant packaging solutions. The expanding pharmaceutical sector, fueled by rising healthcare demands, also necessitates child-resistant options for various medications. Furthermore, companies are investing in innovative solutions, such as smart closures and tamper-evident features, to ensure packaging is both secure for children and user-friendly for adults, while the growth of e-commerce highlights the need for effective safety measures.

Key Players

Some of the major key players in Child Resistant Packaging Market who provide the product and offering:

-

O.Berk Company, LLC (Child-resistant closures and containers)

-

Sun Grown Packaging (Child-resistant cannabis packaging solutions)

-

MJS Packaging (Child-resistant bottles and jars)

-

Kaufman Container (Child-resistant dispensing containers)

-

Amcor plc (Child-resistant flexible packaging)

-

Ecobliss B.V. (Child-resistant blisters and pouches)

-

Global Closure System (Child-resistant caps and closures)

-

WestRock Company (Child-resistant folding cartons)

-

Syntegon Technology GmbH (Child-resistant packaging systems)

-

WINPAK LTD (Child-resistant bags and pouches)

-

ABC Packaging Direct (Child-resistant bottle and jar packaging)

-

Carow Packaging Inc (Child-resistant food packaging)

-

Colbert Packaging (Child-resistant pharmaceutical packaging)

-

Comar (Child-resistant dispensing closures)

-

Constantia Flexibles (Child-resistant flexible film solutions)

-

Gerresheimer AG (Child-resistant glass containers)

-

LA Packaging (Child-resistant packaging for various applications)

-

Mold-Rite Plastics (Child-resistant plastic closures)

-

Origin Pharma Packaging (Child-resistant pharmaceutical packaging solutions)

-

Parkway Plastics Inc (Child-resistant packaging for healthcare products)

-

Others

Recent Developments

-

On April 5, 2024, Procter & Gamble recalled more than 8 Billion bags of Tide, Gain, Ace, and Ariel laundry detergent packets in the U.S. and Canada due to defects in their child-resistant packaging, which can split open near the zipper track. While no injuries have been reported, the company advises consumers to keep the affected products away from children and to reach out for a full refund and replacement of the packaging.

-

On 2 October, 2024 SGD Pharma is set to showcase its innovative siliconized molded glass vials at CPHI 2024, making it the only global supplier offering this technology to pharmaceutical standards. Designed to protect sensitive and viscous drug products, these vials reduce interactions with glass and maintain the integrity of their contents, available in clear and amber glass sizes ranging from 3ml to 500ml for various drug delivery methods.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 24.67 Billion |

| Market Size by 2032 | USD 42.51 Billion |

| CAGR | CAGR of 6.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material( Plastic, Paper and Paperboard, Glass, Metal) • By Packaging Type( Caps and Closure, Bags, Pouches, Clamshells, Blisters, Cartons, Containers) • By End User (Pharmaceuticals, Food and Beverage, Personal and Healthcare, Automotive, Chemical, Industrial, Household) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | O.Berk Company, LLC, Sun Grown Packaging, MJS Packaging, Kaufman Container, Amcor plc, Ecobliss B.V., Global Closure System, WestRock Company, Syntegon Technology GmbH, WINPAK LTD, ABC Packaging Direct, Carow Packaging Inc, Colbert Packaging, Comar, Constantia Flexibles, Gerresheimer AG, LA Packaging, Mold-Rite Plastics, Origin Pharma Packaging, and Parkway Plastics Inc. |

| Key Drivers | • The rising number of accidental poisonings among children, particularly from medications and household products, is a significant driver for child-resistant packaging. • The growth of online shopping and home delivery services has increased the need for child-resistant packaging |

| RESTRAINTS | • The push for sustainable and eco-friendly packaging can conflict with child-resistant requirements. |