Chelating Agents Market Size & Overview:

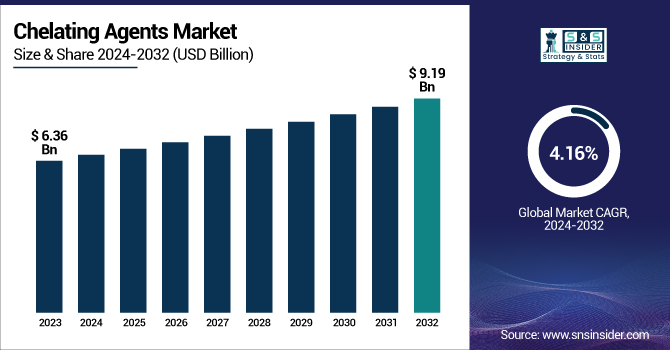

The Chelating Agents Market size was USD 6.36 billion in 2023 and is expected to reach USD 9.19 billion by 2032 and grow at a CAGR of 4.16% over the forecast period of 2024-2032.

To Get more information on Chelating Agents Market - Request Free Sample Report

This report provides a comprehensive chelating agents market analysis, concentrating on several major industry trends and statistical insights. It examines production capacity and utilization rates across regions, along with raw material price fluctuations affecting manufacturing costs. The market report also highlights the regulatory impact, showcasing the environmental and safety policies, which are further influencing market dynamics.

Moreover, it also assesses the sustainability metrics, highlighting the shift toward biodegradable and eco-friendly chelating agents. Innovation and R&D chelating agents market trends are also analyzed, which highlights the new product development and technological advancements. Furthermore, the report evaluates market adoption trends across several major industries including pulp & paper, water treatment, and pharmaceuticals, further identifying high-growth segments. These insights also help stakeholders understand market shifts and strategic opportunities in the evolving chelating agents landscape.

The U.S. held the largest share in the chelating agents market, and was valued at USD 1.319 billion, accounting for 74% of the total global market. This dominance is propelled by the country’s well-established industries, such as industrial and household cleaning, water treatment, pulp & paper, and agrochemicals, all of which are heavily relying on the chelating agents for improved efficiency and performance.

In Addition, strict environmental regulations by the EPA (Environmental Protection Agency) have also boosted the adoption of biodegradable and eco-friendly chelating agents, further driving the market demand. The presence of leading manufacturers and strong R&D investments in advanced formulations have also contributed to market expansion. Moreover, the surge in consumer awareness and industrial advancements in sustainable chemical solutions continue to propel market growth, making the U.S. the dominant nation in the global chelating agents market.

Market Dynamics:

Drivers:

-

Surging Demand for Biodegradable and Sustainable Chelating Agents Propels Market Expansion Globally

The increasing shift toward biodegradable and eco-friendly chelating agents is a key driver in the market, fueled by stringent environmental regulations and the need for sustainable alternatives. Governments worldwide, particularly in North America and Europe, are imposing strict limitations on traditional chelating agents like EDTA and NTA due to their persistence in the environment. Industries including household cleaning, water treatment, and agrochemicals are increasingly adopting biodegradable alternatives including MGDA (Methylglycinediacetic Acid) and GLDA (Glutamic Acid Diacetic Acid).

Moreover, surging consumer awareness related to the eco-friendly formulations in detergents and personal care products has further accelerated market growth. The push toward sustainability is also driving R&D investments by key manufacturers, leading to innovation in green chelating agents, which makes them highly cost-effective and efficient in different industrial applications.

Restraints:

-

Strict Environmental Regulations That Restrict Conventional Chelating Agents’ Use is Hampering Market Expansion

The regulatory landscape plays a significant role in shaping the chelating agents market, particularly with restrictions on non-biodegradable variants including EDTA and phosphates. Agencies including the EPA (Environmental Protection Agency), ECHA (European Chemicals Agency), and REACH regulations have imposed strict guidelines on the use of these chemicals owing to their negative impact on water bodies and ecosystems. These restrictions have led to higher compliance costs for manufacturers and end-users, particularly in the water treatment and detergent industries.

Furthermore, the increased availability of cost-effective synthetic alternatives has made it challenging for traditional chelating agents to maintain their market position. The transition toward sustainable and biodegradable chelating agents requires significant investment in research and reformulation, creating financial and operational hurdles for manufacturers and suppliers.

Opportunities:

-

Surging Demand for Chelating Agents in Pharmaceutical and Personal Care sectors Creates Growth Opportunities

The growing applications of chelating agents in personal care and pharmaceutical products present substantial market growth opportunities. Chelating agents play a critical role in drug formulation, improving bioavailability, and stabilizing active ingredients in the pharmaceutical applications. The surging pharmaceutical sector, especially in the Asia Pacific and North America, has raised the demand for specialty chelating agents, which are used in dietary supplements and intravenous medications.

Moreover, the personal care industry is witnessing a surge in demand for chelating agents in skincare, haircare, and cosmetic formulations, where they prevent discoloration and improve product stability. With the surging focus on clean-label and natural formulations, the companies are heavily investing in the biodegradable chelating agents, which align with consumer preferences. This growing demand from high-growth industries is projected to further boost innovations and market penetration during the forecast period.

Challenges:

-

High Production Costs and Volatility in Raw Material Price Can Challenge Profitability and Market Expansion

The high production costs and fluctuating raw material prices pose significant challenges for the chelating agents market growth. The manufacturing of biodegradable chelating agents incliding GLDA, MGDA, and IDS (Iminodisuccinic Acid) requires advanced processing techniques, leading to higher production costs compared to traditional synthetic variants. Additionally, the volatile prices of key raw materials, including amines, carboxylic acids, and phosphonates, directly impact profit margins.

The dependency on petroleum-based feedstocks makes pricing susceptible to global crude oil fluctuations, further complicating cost structures. Moreover, supply chain disruptions and increased logistics expenses due to geopolitical tensions and trade restrictions have exacerbated pricing pressures. These factors create challenges for manufacturers in maintaining competitive pricing while ensuring compliance with strict environmental regulations, ultimately affecting market growth and profitability.

Segmentation Analysis:

By Product

Aminopolycarboxylate held the largest share in the chelating agents market, which was around 64%, in 2023 owing to a wide range of applications, strong metal-binding properties, and higher industrial usage. Aminopolycarboxylates, as EDTA (Ethylenediaminetetraacetic acid), DTPA (Diethylenetriaminepentaacetic acid), and NTA (Nitrilotriacetic acid), are an important class of metal-chelating agents, which are largely used in water treatment, detergents, pulp & paper, and chemical processing owing to their excellent property of chelating and removing metal ions. In such a, the largest consumer is the water treatment industry, where such chelating agents are used to inhibit scale formation and metal precipitation that helps in better efficiency of the industrial process.

The pulp & paper sector also uses a chain of large aminopolycarboxylates to optimize bleaching and the quality of products. They can achieve benefits at some considerable cost, efficiency, and extensive regulatory approval in all designs, and with increasing climate & ecological concerns, are keeping in top output of the market.

By Application

The Pulp & Paper segment held the largest market share at around 27% in 2023. It is due to its extensive use in improving bleaching efficiency, preventing metal ion interference, and enhancing paper quality. Chelating agents, particularly aminopolycarboxylates including EDTA and DTPA, play a crucial role in the bleaching process by sequestering metal ions, such as iron, manganese, and calcium, which can degrade pulp quality and increase chemical consumption. With the growing demand for high-quality paper products, including packaging materials and specialty papers, the adoption of chelating agents has increased significantly.

Additionally, the shift toward sustainable and eco-friendly paper production has further driven the use of biodegradable chelating agents to comply with stringent environmental regulations. The growth of the e-commerce industry and rising demand for paper-based packaging have also contributed to the segment’s dominant position in the market.

Regional Insights:

Asia Pacific held the largest market share, around 42%, in 2023. It is due to the booming industrial sector, high end-use industries demand, and rapid urbanization. The high share of chelating agent consumption is majorly due to the growth in the pulp & paper, textile, water treatment, and agrochemical industries of the region. Paper, industrial cleaning, and agriculture are some of the booming sectors for producing countries including China, India, and Japan resulting in the growing demand for chelating agents including EDTA, DTPA, and biodegradable alternatives.

Moreover, the growing environmental regulations in countries including China, directed toward the minimization of water pollution and better handling of industrial waste, are incentivizing the use of green chelating agents. The increase in urban population, rise of manufacturing industries, and growing investments in water treatment projects are boosting the domination of Asia Pacific in the market.

North America held a significant chelating agents market share owing to its robust industrial base, coupled with stringent environmental regulations and increasing demand for sustainable formulations. Demand for chelating agents including EDTA, DTPA, and biodegradable chelating agents has been dominated by the region due to a strong presence in industries including water treatment, pulp & paper, household and industrial cleaning, and pharmaceuticals.

In the U.S. and Canada, companies including the Environmental Protection Agency (EPA) have implemented strict policies that strongly support the use of environmentally friendly and biodegradable chelating agents to reduce ecotoxicity. The other factors aiding the market growth include high demand for premium cleaning products and advanced industrial solutions in the region. A strong presence in North America is expected to continue due to the expansion of the pharmaceutical and personal care sectors and rising investments in water treatment infrastructure.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Trilon, Lutensit)

-

Dow Inc. (Versene, Violet)

-

Nouryon (Dissolvine, Ferrazone)

-

Kemira Oyj (KemEcal, KemGuard)

-

Mitsubishi Chemical Holdings Corporation (Aminotron, Aminotron Plus)

-

Lanxess AG (Baypure, Bayhibit)

-

Hexion Inc. (EpiKure, EpiRez)

-

Archer Daniels Midland Company (ADM) (Citric Acid, Sodium Citrate)

-

Ascend Performance Materials (FlexaTrac-NTA, FlexaTrac-DTA)

-

MilliporeSigma (Chelex 100 Resin, Calcium Disodium EDTA)

-

Nippon Shokubai Co., Ltd. (Acrylic Acid, Acrylates)

-

Tate & Lyle PLC (Tate & Lyle Citric Acid, Tate & Lyle Sodium Citrate)

-

Shandong IRO Chelating Chemical Co., Ltd. (EDTA-2Na, EDTA-4Na)

-

New Alliance Fine Chem Pvt. Ltd. (Zinc EDTA, Calcium DTPA)

-

Starco Arochem Pvt. Ltd. (Ecoquest CL 100, Starcochel FS 1030)

-

Adinath Auxi Chem Pvt. Ltd. (ADILON SAM, ADILON SPIN)

-

American International Ingredients, Inc. (EDTA, Sodium Citrate)

-

Merck KGaA (EDTA Disodium Salt, EDTA Tetrasodium Salt

-

Nagase & Co., Ltd. (Nagase Chelate, Nagase Chelate II)

-

Zhonglan Industry Co., Ltd. (EDTA-2K, EDTA-4K)

Recent Development:

-

In January 2023, Nouryon strengthened its presence in the agricultural sector by acquiring ADOB, a Polish provider of chelated micronutrients and specialty agricultural solutions.

-

In October 2023, Sasol Chemicals partnered with Solugen to explore the commercialization of sustainable solutions for home and personal care products, emphasizing chelating agents with enhanced environmental profiles.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.36 Billion |

| Market Size by 2032 | USD 9.19 Billion |

| CAGR | CAGR of 4.16% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Sodium gluconate, Organophosphonates, Aminopolycarboxylate, Others) •By Application (Household & industrial cleaning, Pulp & Paper, Chemical processing, Water treatment, Agrochemicals, Consumer Products, Pharmaceutical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Dow Inc., Nouryon, Kemira Oyj, Mitsubishi Chemical Holdings Corporation, Lanxess AG, Hexion Inc., Archer Daniels Midland Company (ADM), Ascend Performance Materials, MilliporeSigma, Nippon Shokubai Co., Ltd., Tate & Lyle PLC, Shandong IRO Chelating Chemical Co., Ltd., New Alliance Fine Chem Pvt. Ltd., Starco Arochem Pvt. Ltd., Adinath Auxi Chem Pvt. Ltd., American International Ingredients, Inc., Merck KGaA, Nagase & Co., Ltd., Zhonglan Industry Co., Ltd. |