Cheese Packaging Market Report Scope & Overview:

The Cheese Packaging Market, valued at USD 3.59 billion in 2023, is anticipated to reach USD 5.36 billion by 2032, growing at a CAGR of 4.60% from 2024 to 2032.

Get E-PDF Sample Report on Cheese Packaging Market - Request Sample Report

The cheese packaging market is growing steadily due to rising global cheese consumption, increasing demand for convenience foods, and the expansion of modern retail and e-commerce channels. Consumers today prefer ready-to-use, portion-controlled, and resealable packaging formats that maintain freshness and reduce food waste, which is driving innovations such as vacuum packs, modified atmosphere packaging (MAP), and flexible pouches. At the same time, sustainability concerns are pushing manufacturers toward recyclable, biodegradable, and fiber-based materials, aligning with stricter food safety and environmental regulations. Premiumization in the dairy sector and the popularity of artisanal cheeses are also fueling the need for attractive, high-quality packaging that enhances product appeal and brand differentiation. Together, these factors are creating strong growth momentum in the cheese packaging market worldwide.

Market Size and Forecast:

-

Cheese Packaging Market Size in 2024: USD 3.75 Billion

-

Cheese Packaging Market Size by 2032: USD 5.36 Billion

-

CAGR: 4.55% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Cheese Packaging Market Key Players

-

Rising consumer demand for longer shelf life and freshness, driving innovation in packaging materials and technology.

-

Growing focus on sustainable and eco-friendly packaging solutions due to environmental concerns and regulatory pressures.

-

Increasing popularity of ready-to-eat and convenience cheese products boosting demand for flexible and portion-controlled packaging formats.

-

Adoption of smart packaging with freshness indicators, tamper-evident seals, and other safety features to enhance consumer confidence.

-

Global expansion of dairy consumption, particularly in emerging regions, fueling market growth.

-

Advancements in barrier films and vacuum-sealing technologies to maintain product quality during transportation and storage.

-

Rising demand for attractive and premium packaging designs to influence purchase decisions and brand perception.

-

Increasing use of modified atmosphere packaging (MAP) to extend shelf life and preserve flavor and texture of cheese products.

Cheese Packaging Market Growth Drivers

-

The demand for packaging packs is increasing

The demand for packaging packs is increasing as consumers seek greater convenience, safety, and product freshness in their daily purchases. Modern lifestyles, characterized by busy schedules and a preference for on-the-go food options, are driving the need for easy-to-use, portion-controlled, and resealable packs. At the same time, retailers and manufacturers are relying on advanced packaging to extend shelf life, protect products during transportation, and ensure compliance with strict food safety regulations. The rise of e-commerce and modern retail formats has further boosted demand for durable and attractive packaging that enhances product visibility while maintaining quality. Additionally, growing awareness of sustainability is encouraging the use of recyclable and eco-friendly packaging solutions, making packaging packs a critical element in balancing consumer preferences with environmental responsibility.

Cheese Packaging Market Restraints

-

The cost of raw materials is increasing

The cost of raw materials is increasing due to factors such as supply chain disruptions, rising energy prices, and fluctuating availability of essential inputs like plastics, paper, and aluminum. Global inflationary pressures and geopolitical tensions have further contributed to higher transportation and production costs, which directly impact raw material pricing. In the packaging industry, this escalation affects manufacturers who rely heavily on polymers, films, coatings, and other specialized materials to produce durable and sustainable solutions. As demand for eco-friendly alternatives grows, the cost of sourcing bio-based and recyclable materials also adds to overall expenses. These rising costs not only squeeze profit margins for producers but also create pricing challenges across the supply chain, ultimately influencing the affordability of end products for consumers.

Cheese Packaging Market Opportunities

-

Growth in demand for convenience foods

The growth in demand for convenience foods is being driven by changing lifestyles, urbanization, and the increasing preference for ready-to-eat, ready-to-cook, and on-the-go meal options. Busy work schedules and rising participation of women in the workforce have reduced the time available for traditional meal preparation, pushing consumers toward packaged and processed food products that offer speed and ease of consumption. In addition, expanding retail networks, quick-service restaurants, and e-commerce platforms have made convenience foods more accessible than ever before. Younger generations, particularly millennials and Gen Z, are also driving this trend as they seek variety, portability, and innovative flavors in their diets. This shift is not only boosting the food processing industry but also increasing demand for advanced packaging solutions that can preserve freshness, extend shelf life, and enhance product safety.

Cheese Packaging Market Segment Analysis

By Material

Plastic is the leading material in the cheese packaging market in 2024, accounting for nearly 44% of the total share. Its dominance comes from its versatility, lightweight nature, and excellent barrier properties that protect cheese from oxygen, moisture, and external contamination. In addition, plastic is cost-effective and easily adaptable to different packaging formats such as trays, wraps, and pouches, making it the most preferred material for both manufacturers and consumers.

By Packaging Format

Trays and flow wraps dominate the packaging format segment, holding over 38% of the market share in 2024. These formats are widely used for sliced, shredded, and block cheeses because they ensure product freshness, allow easy portioning, and are convenient for display in retail outlets. Their popularity also stems from their ability to combine visibility and protection, making them the preferred packaging choice for both premium and regular cheese products.

By Distribution Channel

Hypermarkets and supermarkets are the dominant distribution channels for cheese packaging, capturing more than 50% of the market share in 2024. These large retail chains offer consumers a wide variety of cheese products in different packaging formats, supported by advanced cold chain infrastructure that maintains quality and safety. Their convenience, competitive pricing, and broad product assortment make them the primary point of sale for packaged cheese globally, far surpassing smaller retail formats and e-commerce.

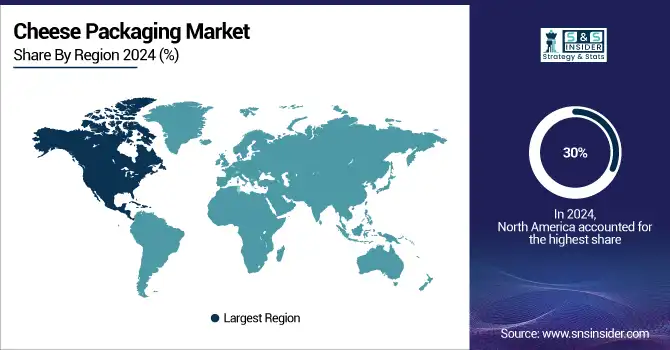

Cheese Packaging Market Regional Analysis

North America Cheese Packaging Market Insights

The North American region, which accounts for 30% of the worldwide market share in cheese packaging, is the 2nd largest region on the Global Cheese Packaging Market. Factors like the rising demand for convenience foods in North America, growing disposable incomes and increased consumer interest in higher quality cheese products are making a contribution to this market.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Asia Pacific Cheese Packaging Market Insights

The Asian region accounts for 20% of the global market share in cheese packaging, making it one of the world's 3rd largest regions. In the Asia Pacific region, which is being driven by factors like an increasing Middle Class and a developing Urbanisation as well as growth in disposable incomes, market size is expected to expand at fastest rates over the next few years.

Europe Cheese Packaging Market Insights

The Europe Cheese Packaging Market is witnessing steady growth in 2024, driven by increasing digitalization in HR processes, rising adoption of cloud-based solutions, and growing emphasis on employee engagement and performance management. Key markets such as the U.K., Germany, and France are investing in AI-enabled analytics, learning management systems, and recruitment automation. Moreover, the focus on diversity, equity, and inclusion (DEI) initiatives, along with regulatory compliance in labor practices, is further propelling the demand for integrated talent management solutions across the region.

Latin America (LATAM) & Middle East & Africa (MEA) Cheese Packaging Market Insights

The Latin America and Middle East & Africa (MEA) Cheese Packaging Market is witnessing steady growth in 2024, driven by rising consumer demand for packaged and convenience cheese products. In countries like Brazil, Mexico, the UAE, and Saudi Arabia, increasing urbanization, supermarket expansion, and growing foodservice sectors are boosting adoption of innovative packaging solutions such as vacuum-sealed packs, modified-atmosphere packaging (MAP), and sustainable materials. Rising awareness of food safety, hygiene, and extended shelf-life requirements is further fueling market growth across these regions.

Middle East & Africa (MEA) Cheese Packaging Market Insights

The MEA Cheese Packaging Market is gaining momentum in 2024, driven by rapid economic diversification, workforce modernization, and rising adoption of cloud and AI-powered HR technologies. Countries such as the UAE, Saudi Arabia, and South Africa are increasingly investing in digital solutions for recruitment, performance management, and learning & development. Regional focus on talent retention, upskilling, and workforce planning, along with initiatives to attract global talent, is further enhancing the demand for comprehensive Cheese Packaging across both public and private sector organizations.

Cheese Packaging Market Competitive Landscape

BelGioioso Cheese, Inc.

BelGioioso Cheese is a U.S.-based cheese manufacturer specializing in Italian-style cheeses and specialty products.

-

In January 2024, BelGioioso launched a line of sustainable cheese packaging using biodegradable films and recyclable materials. The initiative aims to reduce environmental impact while maintaining product freshness and quality.

Saputo Inc.

Saputo Inc. is a global dairy company producing a wide range of cheese, dairy, and specialty products.

-

In March 2024, Saputo introduced modified-atmosphere packaging (MAP) for its sliced and shredded cheese products in North America. This innovation extends shelf life by up to 30% and enhances product safety during distribution and retail display.

Cheese Packaging Market Key Players

-

Amcor Plc

-

Sonoco Products Company

-

ProAmpac

-

Arla Foods

-

Mondi Group

-

Stora Enso

-

Britannia Industries

-

Tetra Pak International S.A.

-

Huhtamaki Oyj

-

Winpak Ltd.

-

Constantia Flexibles

-

Bemis Company, Inc.

-

Klöckner Pentaplast

-

Coveris Holdings S.A.

-

Sigma Plastics Group

-

Scholle IPN

| Report Attributes | Details |

| Market Size in 2024 | US$ 3.75 Bn |

| Market Size by 2032 | US$ 5.36 Bn |

| CAGR | CAGR of 4.55% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Plastic, Aluminum, Glass, Paper) • by Packaging Format (Pouches, Boxes, Containers, Lids & Foil, Cups, Trays & Flow Wraps, Others) • by Distribution Channel (Retail Stores, E-commerce, Convenient Stores, Hypermarkets/ Supermarkets, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Berry Global Inc, Amcor Plc, Sonoco Products Company, Sealed Air, ProAmpac, Arla Foods, Mondi, Stora enso, Lactalis International, Britannia Industries |