Ceramic Membranes Market Report Scope & Overview

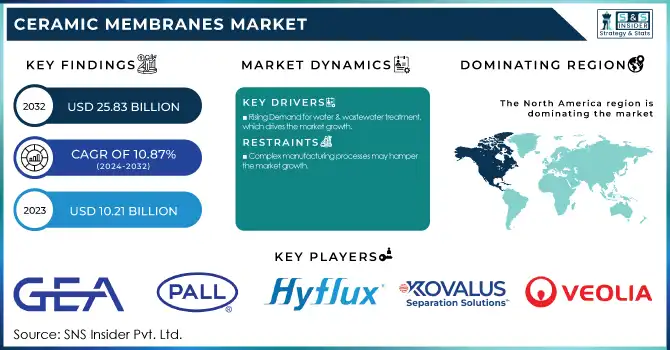

The Ceramic Membranes Market size was USD 10.21 Billion in 2023 and is expected to reach USD 25.83 Billion by 2032 and grow at a CAGR of 10.87% over the forecast period of 2024-2032. The ceramic membranes market report provides a comprehensive analysis of key industry metrics, including production capacity, feedstock pricing, regulatory impact, environmental performance, innovation trends, and adoption rates across various regions. In 2023, China, Germany, and the U.S. led ceramic membrane production, with utilization rates highest in wastewater treatment and food & beverage applications. The report explores feedstock price fluctuations, highlighting rising alumina costs in China due to energy tariffs, while Europe witnessed price stabilization supported by government subsidies. Regulatory frameworks such as the EPA’s water reuse policies in the U.S., the EU Green Deal, and China's Water Pollution Prevention Action Plan have accelerated the adoption of ceramic membranes, particularly in zero-liquid discharge (ZLD) systems.

To Get more information on Ceramic Membranes Market - Request Free Sample Report

Ceramic Membranes Market Dynamics

Drivers

-

Rising Demand for water & wastewater treatment, which drives the market growth.

Increasing demand for efficient and sustainable solutions for water treatment drives the ceramic membranes market. Stringent regulatory measures, such as the EPA, Clean Water Act (U.S.), the EU Water Framework Directive, and the China Water Pollution Prevention Action Plan, are enforcing stricter discharge limits and encouraging the application of advanced filtration technologies. Ceramic membranes have high durability, chemical resistance, and longer operational life than polymeric membranes and, therefore, are gaining traction in industries such as municipal water treatment, pharmaceuticals, food & beverage, and oil & gas. Furthermore, the increasing number of industrial wastewater management processes being adopted in the region adopting zero liquid discharge (ZLD) systems are positively impacting the growth of the ceramic membrane market in Asia-Pacific and North America. The global water crisis due to scarce water resources and concerns over industrial wastewater pollution is expected to expedite market growth, with governments and private sectors investing in advanced membrane technologies to ensure sustainable water reuse and compliance with environmental regulations.

Restraint

-

Complex manufacturing processes may hamper the market growth.

They require material selection, shaping, high-temperature sintering, and modification of the surface for high efficiency. Compared to polymeric membranes that are mass-manufactured at low cost, ceramic membranes are more costly to manufacture as their fabricating requires sophisticated manufacturing technologies and unique raw materials like alumina, zirconia, and titania. Moreover, the sintering method conducts a high-temperature process (usually above 1,200°C), which not only results in high energy consumption and production cost but also suffers from the scalability issue. Combined with the tightly controlled range of pore size and membrane uniformity, this makes large-scale production a difficult task. As a result, there is a high capital expenditure and longer production cycles that limit market growth, particularly in cost-sensitive sectors and developing regions where price is critical.

Opportunity

Advancements in hybrid and graphene-enhanced membranes create an opportunity in the market.

Membranes that are enhanced with graphene-based materials have higher permeation, better fouling resistance, and mechanical strength, which is the right choice for high-purity biopharmaceuticals, semiconductors, and desalination plants. Hybrid ceramic–polymer membranes merge the structural strength of ceramics and polymer flexibility to provide cost-effective production yet simultaneously high filtration efficacies. These developments are broadening fields of application, particularly in developing countries, where cost-effectiveness and energy efficiency are very important. Moreover, the innovation proliferation, fueled by rising R&D investments from leading companies, including Japan, Germany, and the U.S., will offer continued growth opportunities in the market.

Challenges

Supply chain disruptions and raw material price volatility may create a challenge for the market.

The market for ceramic membranes has witnessed numerous challenges posed by reliance on various raw materials, such as alumina, zirconia, and titania. Prices of raw materials have continued to fluctuate. Additionally, uncertainties in the supply chain may create an obstacle for the ceramic membranes market during the forecast period. These materials have faced availability and pricing challenges driven by geopolitical tensions, trade restrictions, and rising energy costs. USA, Russia, China, etc. those nations are exporting the products of zirconia and alumina, but China is the main supplier. Therefore, the Chinese establishment resorted to export controls, making manufacturers around the world suffer from supply shortages and increased costs. Such challenges put pressure on profit margins for ceramic membrane manufacturers and hinder the adoption of this technology at scale for end-users in water treatment, pharmaceuticals, and food & beverages industries. Addressing these challenges will require more diversified sourcing strategies, investment in local production facilities, and innovations in alternative materials to safeguard the market.

Ceramic Membranes Market Segmentation Analysis

By Technology

Microfiltration held the largest market share, around 30% in 2023. Microfiltration is an efficient necessary separation blocking bacteria, suspended solids, and larger contaminants, which holds importance in drinking water treatment, dairy industry processes (like milk clarification), and biopharmaceutical sterilization, among others. Moreover, high regulation requirements regarding water quality and the need for food safety, including EPA(U.S.), EU Drinking Water Directive, and WHO guidelines, have driven the demand. Its low operational cost and energy consumption are what make microfiltration a preferred technology for industrial applications over ultrafiltration and nanofiltration. Microfiltration maintains its market leadership as the adoption of sustainable and energy-efficient filtration solutions continues to grow.

By Application

Water & Wastewater Treatment held the largest market share, around 46% in 2023. It is primarily due to the increasing demand for filtration products, which provides high durability, and the high performance as it purified water. These factors, in synchronization with stringent regulations on water quality and industrial discharge across the globe (such as the U.S. Clean Water Act, EU Water Framework Directive, and China Water Pollution Prevention Plan), are leading to the growing adoption of advanced filtration technologies. Compared to membranes made from polymeric materials, ceramic membranes demonstrate higher filtration efficiency, greater resistance to chemicals, and enhanced operating life making them well-suited for municipal water treatment, seawater desalination plants and industrial wastewater recycling. Furthermore, increasing emphasis on zero liquid discharge (ZLD) systems and sustainable water management practices is stimulating the market expansion.

Ceramic Membranes Market Regional Outlook

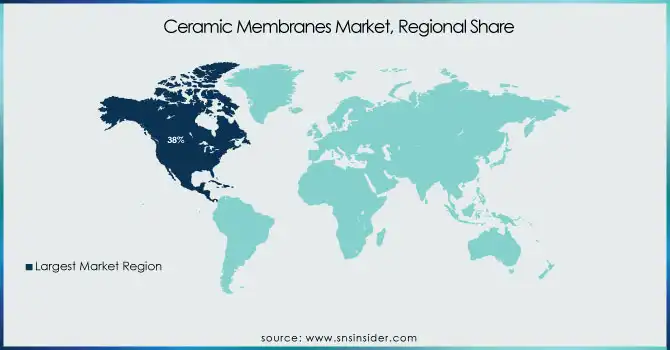

North America held the largest market share, around 38% in 2023. It is due to stringent environmental regulations, high investments in treatment infrastructure, and developed industrial applications. Stringent water quality standards set by U.S. Environmental Protection Agency (EPA) and the Clean Water Act in Canada are resulting in demand for advanced high-performance filtration technologies. Furthermore, increasing industrial wastewater discharge from industries such as pharmaceuticals, food & beverage, chemicals, etc. is driving the adoption of ceramic membranes to achieve effective purification and wastewater recycling. High research and development spending and technology advancement in the area resulting in innovative hybrid membranes and graphene-based ceramic solutions are a few of the key factors contributing to the growth of the market in this business segmentation. In addition, the U.S. Infrastructure Investment and Jobs Act, which is a government funding program for sustainable water management projects, is also driving market growth. North America has been the largest market segment for ceramic membranes, driven by a long-established industrial background, relatively high penetration of advanced filtration technologies, and robust regulatory support.

Asia held a significant market share in the market. It is owing to the rapid pace of industrialization, increasing freshwater scarcity levels, and stringent environmental regulations in countries such as China, India, and Japan. For instance, countries such as China through its Water Pollution Prevention Action Plan and India through its National Water Policy are introducing stringent wastewater treatment laws which is in turn propelling the market for advanced filtration technologies in the region. Moreover, the rising requirement for potable water, increasing investments in desalination projects, and implementation of zero liquid discharge (ZLD) systems have positively influenced the market growth. Another important factor is the booming industries such as food & beverage, pharmaceuticals and chemicals that will ultimately lead to the demand of a filtration method that can provide high-purity water.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

GEA Group Aktiengesellschaft (Membrane Filtration Systems, Dairy Membrane Plants)

-

Pall Corporation (Microza Membranes, Pall SepraSol Plus Liquid/Gas Coalescers)

-

Hyflux Ltd (Kristal Membrane Modules, PoroCep Membrane Bioreactor)

-

Kovalus Separation Solutions (Ceramic Membrane Filtration Units, Crossflow Filtration Systems)

-

Nanostone (CM-151 Membrane, CM-700 Membrane)

-

Veolia (Ceramic Membrane Ultrafiltration, AnoxKaldnes MBBR)

-

TAMI Industries (Inside CéRAM Membranes, Multi-Channel Ceramic Membranes)

-

METAWATER Co., Ltd. (Ceramic Flat Sheet Membrane, Ceramic Hollow Fiber Membrane)

-

ITN Nanovation AG (CeraNovis Membranes, NanoCeram Filtration Systems)

-

SIVA Unit (Ceramic Membrane Modules, Industrial Filtration Systems)

-

Atech Innovations gmbh (Ceramic Membrane Elements, Tubular Membrane Modules)

-

LiqTech Holding A/S (SiC Ceramic Membranes, CoMem Industrial Modules)

-

Qua Group LLC (CeraQ* Ceramic Filters, EnviQ Membrane Bioreactors)

-

TORAY INDUSTRIES, INC. (Ceramic UF Membranes, TORAYFIL* Hollow Fiber Membranes)

-

KERAFOL Ceramic Films GmbH & Co. KG (Ceramic Membrane Discs, Flat Sheet Membranes)

-

Aquatech International LLC (Ceramic Membrane Systems, AquaEZ Membrane Solutions)

-

Paul Rauschert GmbH & Co. KG (Ceramic Filter Elements, Membrane Filtration Units)

-

HYDRASYST (Ceramic Membrane Filtration Systems, HYDRAcap Modules)

-

Membratec SA (Ceramic Membrane Plants, Membrane Filtration Solutions)

-

Mantec Filtration (Star-Sep Ceramic Membranes, Porous Ceramic Filters)

Recent Development:

-

In 2024, Pall Corporation expanded its product line by launching a new series of ceramic membranes designed to improve filtration efficiency in the food and beverage industry. The new membranes offer enhanced durability, higher permeability, and improved fouling resistance, making them ideal for dairy processing, beverage clarification, and industrial filtration applications.

-

In 2023, TAMI Industries invested in research and development to create innovative ceramic membrane solutions specifically for the pharmaceutical sector. These new solutions focus on enhancing separation processes, offering improved efficiency and reliability for pharmaceutical production.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.21 Billion |

| Market Size by 2032 | USD 25.83 Billion |

| CAGR | CAGR of 10.87% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Ultrafiltration, Microfiltration, Nanofiltration, Others) • By Application (Water & Wastewater Treatment, Pharmaceuticals, Food & Beverage, Chemical Processing, Biotechnology, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GEA Group Aktiengesellschaft, Pall Corporation, Hyflux Ltd, Kovalus Separation Solutions, Nanostone, Veolia, TAMI Industries, METAWATER Co., Ltd., ITN Nanovation AG, SIVA Unit, Atech Innovations gmbh, LiqTech Holding A/S, Qua Group LLC, TORAY INDUSTRIES, INC., KERAFOL Ceramic Films GmbH & Co. KG, Aquatech International LLC, Paul Rauschert GmbH & Co. KG, HYDRASYST, Membratec SA, Mantec Filtration |