Ceramic Matrix Composites Market Size:

Get More Information on Ceramic Matrix Composites Market- Request Sample Report

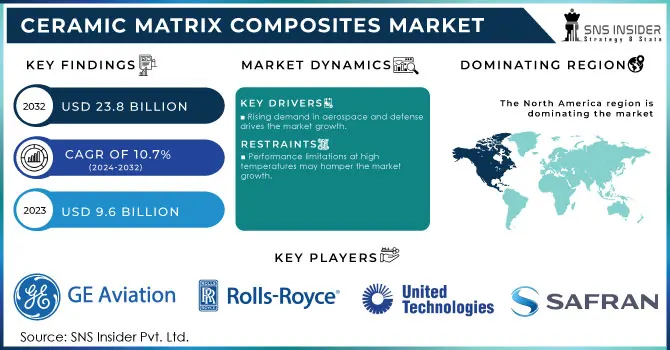

The Ceramic Matrix Composites Market Size was valued at USD 9.6 Billion in 2023. It is expected to grow to USD 23.8 Billion by 2032 and grow at a CAGR of 10.7% over the forecast period of 2024-2032.

Ceramic matrix composites are being rapidly established as a critical technology within the energy sector, specifically as it relates to gas turbines and nuclear reactors. Its combination of unique features, including exceptional high-temperature resistance and corrosion stability, makes CMC ideally suited for the industrial environment, as it permits new and renovated machinery and structural features to operate in conditions that are characterized by both high-temperature outputs and corrosive environments. In gas turbines, for example, CMC permits substantially increased operational temperatures, making it possible to increase performance and efficiency while also minimizing emissions. In the case of nuclear reactors, the unique features of CMC make it substantially more compatible with the industry’s ongoing zeal for preventative controls and continuous safety. The importance of working with composite materials has become realized as a development force.

In 2023, the U.S. Department of Energy (DOE) reported a projected investment of USD 8 billion in advanced manufacturing technologies, including Ceramic Matrix Composites, to enhance the efficiency and performance of energy systems, particularly in gas turbines and nuclear energy applications.

The current generation of industries is characterized by the increasing need for the use of high-performance materials. Many companies are hoping to improve the work of their processes, and durable certain products to enhance weight reduction. Ceramic matrix composites are becoming one of the central materials choices for many companies because of a unique combination of lightweight, high strength, and resistance to heat and corrosion. The superior combination of these characteristics makes this material quite perfect for some of the most technologically advanced applications, such as hypersonic vehicles and space shuttle systems.

In 2023, the National Aeronautics and Space Administration (NASA) announced a USD 1.2 billion investment in advanced materials research, including Ceramic Matrix Composites, aimed at developing next-generation aerospace technologies.

Drivers

-

Rising demand in aerospace and defense drives the market growth.

One of the most significant drivers of market growth for ceramic matrix composites is the increasing demand in the defense and aerospace sectors. Since these industries put a premium on performance, efficiency, and, most of all, safety, CMCs have become the material of choice due to their distinct properties. The ability to face critical temperatures and harsh environmental conditions makes CMCs ideally suited for the most critical parts of a wide variety of aircraft and missiles, such as turbine blades, thermal protection systems, and structural components. In addition, as the aforementioned industries look for ways to increase fuel efficiency and reduce harmful emissions, they promote lightweight materials such as CMCs. In turn, the defense sector is expending considerable funds on CMCs due to its stringent performance requirements and emphasis on next-generation aircraft and advanced military technologies. This combination of factors creates the conditions for the most market growth and helps establish the CMC as a critical enabler of advancements in aerospace and defense technologies of the future.

The U.S. Department of Defense allocated approximately USD 1.5 billion specifically for the development and integration of advanced materials, including Ceramic Matrix Composites, into military aircraft and defense systems. This investment reflects the increasing emphasis on enhancing the performance, durability, and efficiency of defense technologies, highlighting the critical role that CMCs play in meeting the rigorous demands of modern aerospace and defense applications.

Restraint

-

Performance limitations at high temperatures may hamper the market growth.

One of the most significant restraints impeding the growth of the ceramic matrix composites market is the performance limits at high temperatures. While these materials are specifically designed for being used in extreme thermal environments, they may still exhibit performance issues under certain conditions. For instance, prolonged exposure to temperatures that exceed the specified maximum may create problems such as thermal shock, microcracking, and deterioration of mechanical properties. As a result, the components made of CMCs cannot be trusted to be reliable and safe in critical applications, including aerospace and defense. If industries tend to require materials capable of maintaining their integrity and functionality under extreme conditions, any issues related to the high-temperature performance of CMCs may make manufacturers reluctant to expand their use of these materials for advanced applications. As such, the concerns related to high-temperature performance may restrict market adoption and growth, particularly in such performance-sensitive sectors as TRS. This means that CMCs may fail to penetrate the markets that require extreme thermal performance.

Market segmentation

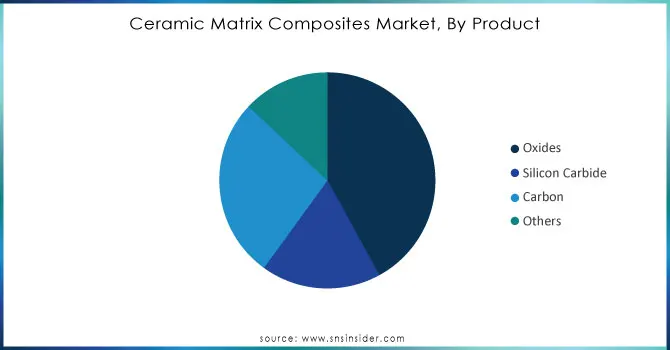

By Product

Oxide products held the largest market share around 42% in 2023. This is due to their wide application and advantageous properties. The oxide-based CMCs, such as alumina and zirconia composites, have excellent thermal stability, corrosion resistance, and mechanical strength, which are necessary for industries operating in high-temperature conditions, such as aerospace, automotive, and energy. For example, oxide CMCs are widely used in thermal barrier coatings to protect from extreme temperature the components in gas turbines and jet engines. Moreover, owing to the industry's increasing demand for lightweight materials aimed at reducing fuel consumption, the oxide CMCs are widely used in the aerospace and defense sectors. Hence, the CMCs based on oxides are the most demanded as they demonstrate excellent performance in harsh conditions, and with the help of developing production facilities, they will maintain the leading position in the market.

|

Product Type |

Key Specifications |

|---|---|

|

Silicon Carbide (SiC) Matrix Composites |

High thermal conductivity, and excellent oxidation resistance, are used in aerospace and nuclear reactors. |

|

Carbon/Carbon (C/C) Composites |

Exceptional thermal shock resistance, lightweight, used in brake systems and rocket nozzles. |

|

Oxide-Oxide Composites |

High resistance to oxidation and corrosion, suitable for aerospace turbine components, operating at 1,000°C+. |

|

Silicon Nitride (Si3N4) Composites |

Superior wear resistance, and low thermal expansion, ideal for automotive and high-temperature industrial applications. |

|

Alumina (Al2O3) Matrix Composites |

Excellent mechanical properties, and high hardness, are used in cutting tools and biomedical implants. |

Need Any Customization Research On Ceramic Matrix Composites Market - Inquiry Now

By Application

Aerospace held the largest market share around 43% in 2023. The aerospace industry is the key end-use sector contributing to the growth of the ceramic matrix composites market. The primary reason is the necessity for high-performing materials that can withstand extreme conditions and, at the same time, enhance efficiency. CMCs are increasingly popular among the aerospace segment for components, including turbine blades, thermal protection systems, and structural parts, among others. They provide multiple advantages in the sector due to their being lightweight; thus, the final product has higher fuel efficiency and lower emissions a crucial competitive factor for the aerospace industry. Moreover, CMCs offer better thermal and mechanical resistance, which allows them to operate in harsh environments. For example, new spaceships are created with the utilization of the tested compositions and successfully reach the orbit several times on one engine due to the thermal and mechanical strength characteristic of CMC.

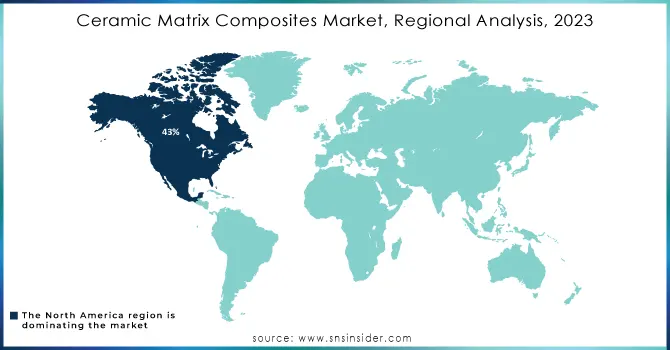

Regional Analysis

North America region held the highest market share around 43% in 2023. In North America CMC is actively utilized in the US in a multitude of advanced applications such as turbine engines, thermal protection systems, and structural components. Large aerospace manufacturers such as Boeing and Lockheed Martin produce some of the most advanced aircraft in which the reliance on R&D and material improvement cannot be overstated. Moreover, CMC increases fuel efficiency, and therefore governmental initiatives and funding contributing to the growth of advanced manufacturing technologies in the region is a critical driver for CMC consumption. NASA is one example of a government organization that invests in the development of CMC for space exploration purposes. Lastly, North America is a highly developed market in terms of the production of CMC and the presence of larger producers allows for the heightened consumption of the product. Overall, the unique combination of industry demand, government incentive for growth, and the strong presence of ceramic material manufacturers contributes to high market share in North America.

Key Players

-

General Electric Aviation (CMC Turbine Blades)

-

Rolls-Royce plc (Ceramic Matrix Composite Engine Components)

-

3M Company (Nextel Ceramic Fibers)

-

COI Ceramics Inc. (SiC/SiC Composites)

-

United Technologies Corporation (Pratt & Whitney CMC Turbine Components)

-

Safran S.A. (CMC Turbofan Engine Parts)

-

SGL Carbon (SIGRASIC C/SiC Composites)

-

Ultramet (UHT CMC Components)

-

Applied Thin Films Inc. (Thin Film CMC Coatings)

-

Saint-Gobain Ceramics (Hexoloy SiC CMC Components)

-

CeramTec GmbH (BIOLOX CMC Implants)

-

Lancer Systems (CMC Structural Components)

-

Kyocera Corporation (Kyocera Advanced Ceramics)

-

Schunk Carbon Technology (CMC Brake Discs)

-

CoorsTek Inc. (Ceramic Composite Armor)

-

Morgan Advanced Materials (Technical Ceramic Composites)

-

Pyromeral Systems (PyroKarb CMC Solutions)

-

Rauschert GmbH (High-Temperature CMCs)

-

Hitco Carbon Composites Inc. (SiC CMC Solutions)

-

Fiber Materials Inc. (Carbon-Carbon Composite Structures)

Key Users

-

Boeing

-

Airbus

-

Lockheed Martin

-

NASA

-

United States Department of Defense

-

Raytheon Technologies

-

General Electric

-

Rolls-Royce

-

Safran

Recent Development:

-

In 2023, CoorsTek Inc. significantly expanded its production capacity for ceramic composite armor to address the growing demand for advanced protective solutions in both military vehicles and personal protection.

-

In 2023, Rauschert GmbH developed high-temperature ceramic matrix composites (CMCs) specifically tailored for power generation applications, addressing the need for materials that can withstand extreme temperatures and harsh operating conditions.

-

In 2022, Fiber Materials Inc. expanded its Carbon-Carbon composite structures specifically designed for hypersonic vehicles, targeting applications that demand extreme heat tolerance and structural integrity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 9.6 Billion |

| Market Size by 2032 | US$ 23.8 Billion |

| CAGR | CAGR of10.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • Segmentation By Product (Oxides, Silicon Carbide, Carbon, Others) •By Application (Aerospace, Defense, Energy & Power, Electrical & Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | General Electric Aviation, Rolls-Royce plc, 3M Company, COI Ceramics Inc., United Technologies Corporation, Safran S.A., SGL Carbon, Ultramet, Applied Thin Films Inc., Saint-Gobain Ceramics, CeramTec GmbH, Lancer Systems, Kyocera Corporation, Schunk Carbon Technology, CoorsTek Inc., Morgan Advanced Materials, Pyromeral Systems, Rauschert GmbH, Hitco Carbon Composites Inc., Fiber Materials Inc. and others |

| Key Drivers | •Growing demand in aerospace and defense drives the market growth. |

| Restraints | • Performance Limitations at High Temperatures may hamper the market growth. |