Central Lab Market Size & Overview:

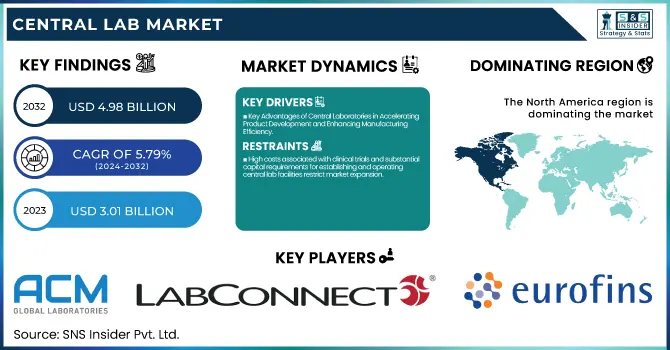

The Central Lab Market Size was valued at USD 3.01 billion in 2023 and is expected to reach USD 4.98 billion by 2032, growing at a CAGR of 5.79% over the forecast period 2024-2032.

Get More Information on Central Lab Market - Request Sample Report

The central lab market is expanding at a robust growth rate, as high investments in R&D, which are accompanied by the increasing interest of the sponsor and investigator in low-cost research, are increasing the demand for central laboratory services. Additionally, outsourcing trends of laboratory services in the pharmaceutical and biotech sectors are playing an important role in market expansion since it reduces the total research cost and enables researchers to focus on trial management. Increased diagnostics intensity-from increased interest and efforts paid to diagnostics since the novel coronavirus-presents high funds for novel diagnostics and improves central lab support requirements by clinical research.

The most critical market trends facilitating expansions, as in 2021, Bio-Techne Corporation launched a new R&D and manufacturing center focused on immunoassay in the U.S. for the production of next-generation test kits for infectious diseases. Partnerships are also growing in the market; for instance, in 2023, Cerba Research teamed with Teddy Clinical Research Laboratory in China to leverage the companies' respective strengths in the development of vaccines, immuno-oncology, and cell and gene therapies. This has supported specialty lab solutions by small and medium-scale companies, as a response to the preference among consumers.

Automation and cutting-edge equipment are enhancing the efficiency of labs, while the China Association of Clinical Laboratory Practice Expo in 2023 supports industry development through collaboration across borders and innovation in new in-vitro diagnostics. However, the logistical and sample handling sectors require careful maintenance to meet the stringent demands for temperature control and sample stability in preserving data integrity.

Central labs are also in demand with the ever-increasing demand for new treatments and personalized medicine, especially in biotechnology-based therapies such as cell and gene therapy. Government support for establishing central labs and adopting SOPs for sample stability will also underpin the market's future. These factors, coupled with the use of automated processes, give central labs an important position in modern clinical trials because they provide thorough and relatively inexpensive solutions to testing biological specimens and reporting results.

Central Lab Market Dynamics

Drivers

- Key Advantages of Central Laboratories in Accelerating Product Development and Enhancing Manufacturing Efficiency

The new accelerated product development speeds up performance through the provision of an essential early central lab conducting preclinical well-designed in the needs to API and can increase products in production getting them in the markets faster. Secondly, cost-cutting handling and transportation of APIs is due to the central facility and can decrease reagents' utilization and waste from production to reduce the final overall costs.

These labs also improve manufacturing flexibility, as they have dispersed the production of APIs across several central locations; this allows companies to bring new products into the market without waiting for enough capacity at one location. This decentralized model decreases the time-to-market for new ranges, allowing companies the prime initiative.

Central laboratories further enhance the effectiveness of resources and the quality of products. Positioning manufacturing closer to key markets reduces carbon emissions and packaging waste, thereby helping organizations achieve sustainability objectives. Central headquarters have more control and better quality of products and compliance with regulatory obligations. Such advantages- faster time-to-market with products, economies of scale, greater flexibility, and improved sustainability are significant push factors for central laboratories in the pharmaceutical industry.

Restraints

- High costs associated with clinical trials and substantial capital requirements for establishing and operating central lab facilities restrict market expansion.

- Limited medical infrastructure and regulatory challenges in the healthcare industry pose ongoing obstacles to the growth of the central laboratory services industry.

Central Lab Market Segmentation Insights

By Services

The pharmaceutical companies segment held the highest market share at 45.05% in 2023. Central laboratory service providers are of great importance to pharmaceutical companies as they enable them to assess the effectiveness of new drug products. The various tests for investigational drug evaluations that are offered by these providers include biochemistry, hematology, histopathology, immunology, endocrinology, microbiology, real-time PCR, and clinical pathology. Preclinical and clinical trial support from leading service providers like Covance, Celerion, Altasciences, NorthEast BioAnalytical Laboratories LLC, and Shanghai Medicilon is being availed to advance the pharmaceutical companies' trials. Market players are also developing partnerships with pharmaceutical companies to gain complementary services and geographic value. For instance, in April 2023, Sygnature Discovery entered into a partnership with Daewoong Pharmaceutical to speed up global drug development innovations.

The biotechnology companies segment is expected to grow at the highest rate with a CAGR of 7.10% over the forecasting period. An accelerated pace of activities in developing biological therapies is a major driver as the U.S. By 2025, the FDA will also approve 10 to 20 cell and gene therapy products annually. Such services surrounding cell and gene therapy like Contract Development and Manufacturing, Analytical testing, and regulatory consulting will grow exponentially due to a rise in demand. Particularly, Pace Analytical has recently expanded its capability to contribute to gene therapy initiatives through its investment in advanced analytical equipment, such as capillary electrophoresis, UPLC large-molecule time-of-flight mass spectrometry, and microplate readers.

By End-use

Biomarker services held a market share of 38.42% in the year 2023. Biomarkers are essential to clinical development programs. Through biomarkers, insights into novel diagnostic pathways can be gained, and a more in-depth understanding of the mechanism of disease can be attained to develop better therapeutics. Biomarker studies make it possible to diagnose deadly diseases at an early stage, measure the risks for side effects from investigative therapy, and monitor disease progress during clinical trials. The key players in the biomarker market are expanding their biomarker service offerings to enhance their market positions. For example, Unilabs partnered with Ambry Genetics in January 2023 to upgrade the genetic testing services offered for biopharmaceutical firms conducting clinical trials across Europe, Latin America, and the Middle East.

The genetic services segment is expected to grow at the fastest rate in the biomarkers market during the forecast period, which is estimated at a CAGR of 7.67%. This growth is based on the increasing role of genetic analysis in clinical studies, as understanding genetic factors supports the development of targeted therapies for various conditions, including cancer and inherited diseases. In addition, genetic differences in drug metabolism pathways influence patient responses to treatments. Increased research activities in genetic testing are expected to raise demand for central lab genetic services in the next years. For instance, the Cystic Fibrosis Foundation Therapeutics Lab launched plans in December 2022 to accelerate the discovery and development of genetic-based treatments for patients with cystic fibrosis.

Central Lab Market Regional Analysis

Central laboratory share was 41.18% in North America during 2023, since the demand for molecular testing, being accurate, sensitive, and specific, is growing significantly. There will be an enormous increase in clinical studies related to advanced diagnostic instruments and drugs in places with high infection rates caused by infectious diseases such as STIs and tuberculosis. Such facts are that the CDC calculates more than 20 million new STI cases are established annually in the U.S., with annual costs in the range of USD 10–17 billion. Key players in the field are also expanding their development pipeline in the region for clinical purposes; for instance, LabCorp announced a spin-off company in July of 2022 to leverage its CRO capabilities and improve its services. For that reason, the market growth trend will be positive in the North American region.

During the forecasted period, growth of 7.74% will emerge from the Asia Pacific. The clinical testing and services market in China and India developed due to growing reasons related to urbanization and the corresponding increase in income due to such urbanization as well as increased healthcare awareness accompanied by education at an upsurge stage. Some countries like Australia, China, Korea, and Taiwan have established diagnostic test coverage and reimbursement systems related to the healthcare sector. Government support is increasing market potential. For instance, in September 2019, the South Korean Ministry of Food and Drug Safety unveiled a five-year plan to improve the handling of clinical trials; the plan will improve clinical trials by 2023. The positive environment is causing an increase in the rate of growth of the market for central laboratories in Asia Pacific.

Need Any Customization Research On Central Lab Market - Inquiry Now

Key Players in Central Lab Market

-

ACM Global Laboratories

-

Labconnect

-

Medicover Integrated Clinical Services (MICS) (Synevo Central Labs)

-

Versiti (Cenetron)

-

A.P. Møller Holding A/S (Unilabs)

-

Ampersand Capital Partners (Pacific Biomarkers)

-

Cirion Biopharma Research Inc.

Recent Developments in Central Lab Market

In June 2023, Versiti announced its acquisition of Quantigen, an Indiana-based company, to broaden its clinical trial and service capabilities.

In May 2023, LabConnect formed a strategic alliance with Labor Dr. Wisplinghoff to deliver customized, high-quality central lab services across Europe.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.01 billion |

| Market Size by 2032 | US$ 4.98 billion |

| CAGR | CAGR of 5.79% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Services (Genetic Services, Biomarker Services, Microbiology Services, Anatomic Pathology/Histology, Specimen Management & Storage, Special Chemistry Services, Others) • By End-use (Pharmaceutical companies, Biotechnology Companies, Academic and Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ACM Global Laboratories, Labconnect, Cerba Research, Eurofins Scientific, Medicover Integrated Clinical Services (Synevo Central Labs), Versiti (Cenetron), A.P. Møller Holding A/S (Unilabs), Ampersand Capital Partners (Pacific Biomarkers), Lambda Therapeutics Research Ltd, and Cirion Biopharma Research Inc. |

| Key Drivers | • Key Advantages of Central Laboratories in Accelerating Product Development and Enhancing Manufacturing Efficiency |

| Restraints | • High costs associated with clinical trials and substantial capital requirements for establishing and operating central lab facilities restrict market expansion. • Limited medical infrastructure and regulatory challenges in the healthcare sector pose ongoing obstacles to the growth of the central laboratory services industry. |